Why is it so important to understand and embrace the concept of absolute truth in all areas of life (including faith and religion)? Simply because life has consequences for being wrong. Giving someone the wrong amount of a medication can kill them; having an investment manager make the wrong monetary decisions can impoverish a family; boarding the wrong plane will take you where you do not wish to go; and dealing with an unfaithful marriage partner can result in the destruction of a family and, potentially, disease.

As Christian apologist Ravi Zacharias puts it, “The fact is, the truth matters – especially when you’re on the receiving end of a lie.” And nowhere is this more important than in the area of faith and religion. Eternity is an awfully long time to be wrong.

New Report: The Rap Sheet For Wall Streets Biggest Banks Crime Spree

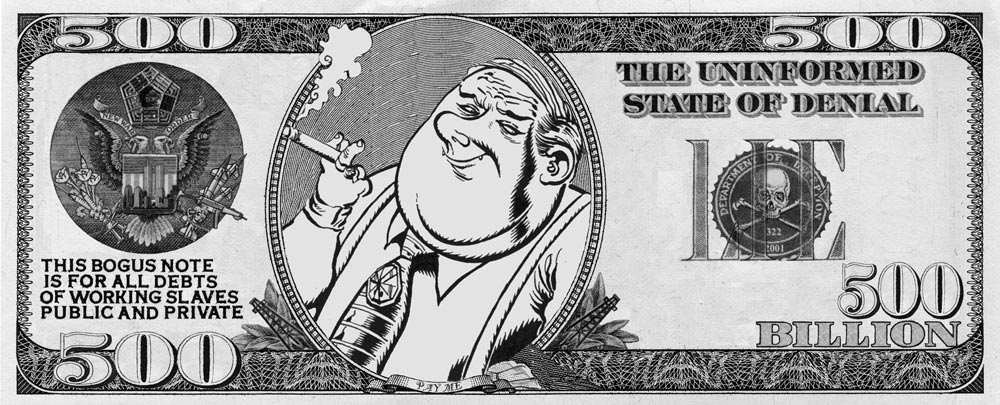

Over 350 Different Legal Actions (since 2008), Almost $200 Billion in Fines and Settlements, $8.2 Trillion in Bailouts (and the game continues into 2019), When does justice arrive?

Wall Street’s top financial executives from 2008 and after. Why no justice for these bankers? Could it be that money rules over all events within Capitalism?

Washington, D.C. – As the CEOs of Wall Street’s biggest megabanks appear before Congress, Better Markets is releasing a Report, “Wall Street’s Six Biggest Bailed-Out Banks: Their RAP Sheets & Ongoing Crime Spree.” On 10th April, a number of CEOs from leading banks testified in front of the House of Representatives Financial Services Committee. But this report from Better Markets was ignored by all! Interesting!

The Report, for the first time, details the Six Megabanks’ (1) taxpayer bailouts, (2) crime spree before, during and after the 2008 financial crisis, and (3) the fines and penalties involved.

An independent group of journalists have written a detailed report which exposes six criminal banks which now have a ‘rap’ sheet which proves their many crimes. This information needs to get out to every investor and voter who desires justice and honesty within global commerce. The report is comprehensive and documented. These are the six banks that should have their executives jailed for fraud and malfeasance IMO:

- Bank of America

- Citi

- Goldman Sachs

- JPMorgan Chase

- Morgan Stanley

- Wells Fargo

Our markets were corrupted (since 2008) with some $29 trillion of bogus money units created mostly by these six criminal banks. The bogus money units (we should call them counterfeit money units) ended up with a select few cronies which had personal connections with these six banks. And the corruption continues as I write this missive. SHOCKING! Yet few seem to care as of today! This could change, however, when the CRASH finally arrives.

Read the report above for your own enlightenment and understanding. The reports summary is as follows:

Of the more than $29 trillion in bailouts, just the six biggest banks in the country (the “Six Megabanks”) received more than $8.2 trillion in lifesaving support from American taxpayers during the 2008 financial crash, or nearly one-third of the total bailouts provided to the entire financial system. This was a massive transfer of wealth from Main Street to Wall Street to prevent the bankruptcy of just six banks, supposedly because they were vital to the economic security and prosperity of Main Street Americans.

One might think that receiving trillions of dollars of undeserved and lifesaving taxpayer bailouts would cause those financial institutions to reform their high-risk, destabilizing activities or, at a minimum, to rein in their predatory conduct and illegal practices. Think again. The banks showed no gratitude, no remorse, and no willingness to reform their activities. Worse, they also didn’t bother to end their systemic, widespread, and brazen illegal conduct.

The day of judgment will eventually come for those who continue with this financial corruption. And my sense is that this day of judgment is coming soon! Crime pays in the short-term but dire consequences arrive eventually! I am: https://kingdomecon.wordpress.com.

BankstersCrime

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers

![]()