Greed is a strong and selfish desire to have more of something, most often money or power. There are many warnings in the Bible about giving in to greed and longing for riches. Jesus warned, “Watch out! Be on your guard against all kinds of greed; a man’s life does not consist in the abundance of his possessions” (Luke 12:15). “Do not store up for yourselves treasures on earth, where moth and rust destroy and where thieves break in and steal… You cannot serve both God and money” (Matthew 6:19, 24b). Did Jesus pursue the acquisition of money? No. On the contrary, He became poor for our sake (2 Corinthians 8:9) and had “no place to lay his head” (Matthew 8:20). Neither did Jesus pursue power. Rather, He instructed, “Whoever wants to become great among you must be your servant, and whoever wants to be first must be slave of all. For even the Son of Man did not come to be served, but to serve, and to give his life as a ransom for many” (Mark 10:43–45).

Pretend you’d never heard of the Rapture and I was telling you all about the Last Days. I tell you about the horrors of the Tribulation, all the death and destruction that will take place as foretold in the Book of Revelation; the plagues, pestilence, famine, drought, economic and social upheaval on a scale never seen in history. A third of the earth’s population will be wiped out, then later another fourth! I briefly chronicle the rise of the antichrist and false prophet and finally, the Battle of Armageddon, earth’s worst and bloodiest war. Then I say, “But comfort one another, cause when it’s all over, we’ll be caught up to meet the Lord in the air.”

You’d think I was nuts! There’s no comfort in knowing you’ve got to pass through all of that to get to the Rapture. The only comfort you could gain was by hoping the Last Days were a long way off and that the return of Jesus was nowhere near.

But that isn’t close to what Scripture tells us our attitude should be. We ought to hope and looking forward to the Rapture. The comfort of the Blessed Hope (Rapture) comes from knowing it comes before the hour of trial coming upon the whole Earth.

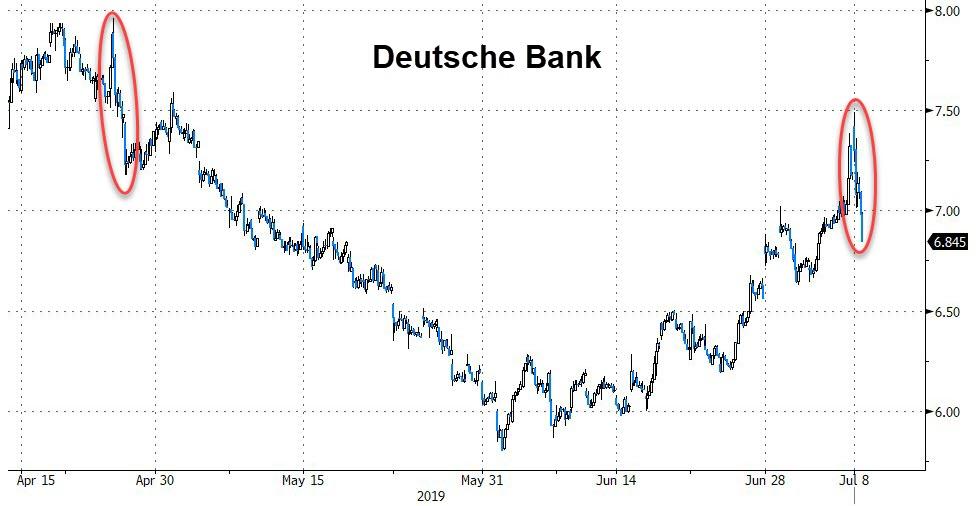

Update (9 am ET): Deutsche Bank shares have continued to sell off ahead of the US market open. They were recently off 5% at a new session low, as the bank’s shareholders have apparently realized that DB won’t be able to return to profitability with no revenue.

At times when public institutions – including banks, the media, government departments, and professions – command widespread trust, we rarely question how they achieve this. And yet at the heart of successful liberal democracies lies a remarkable collective leap of faith: that when public officials, reporters, experts, and politicians share a piece of information, they are presumed to be doing so in an honest fashion. Not anymore!

Some readers might have dismissed warnings of “Lehman-style” scenes outside Deutsche Bank’s global offices as hysteria related to the bank’s restructuring. But the mass firings that will eventually cull some 18,000 employees, roughly 20% of the bank’s global workforce, have already begun.

After announcing the bank’s most radical restructuring plan in two decades, CEO Christian Sewing on Sunday revealed that the bank would immediately move ahead with the steep job cuts. On Monday, whole teams of equity traders in Tokyo and the bank’s other Asian offices were let go, the first step toward winding down the bank’s equities sales and trading operation. The bank is also planning cutbacks to its fixed income, and rates, trading business. Shares bounced in pre-market trading on Sunday, but have since turned lower; in recent trade, DB shares were off nearly 2%.

For hundreds of years, modern societies have depended on something that is so ubiquitous, so ordinary, that we scarcely ever stop to notice it: trust. The fact that millions of people are able to believe the same things about reality is a remarkable achievement, but one that is more fragile than is often recognized.

At times when public institutions – including banks, the media, government departments, and professions – command widespread trust, we rarely question how they achieve this. And yet at the heart of successful liberal democracies lies a remarkable collective leap of faith: that when public officials, reporters, experts, and politicians share a piece of information, they are presumed to be doing so in an honest fashion. Not anymore!

Why we stopped trusting elites – podcast

The notion that public figures and professionals are basically trustworthy has been integral to the health of representative democracies. After all, the very core of liberal democracy is the idea that a small group of people – politicians – can represent millions of others. If this system is to work, there must be a basic modicum of trust that the small group will act on behalf of the much larger one, at least some of the time. As the past decade has made clear, nothing turns voters against liberalism more rapidly than the appearance of corruption: the suspicion, valid or otherwise, that politicians are exploiting their power for their own private interest.

Though DB didn’t disclose the regional breakdown of the job cuts, it’s widely believed that roughly 50% of the employees in its bloated investment bank will be let go. That would mean the bank’s offices in New York and London will be the hardest hit.

One Singapore-based employee whose team had not been hit by the cuts told the FT on Monday: “The mood is always depressed in Deutsche.”

This Novice trader made a FORTUNE by trading ONE Penny Stock Alert per Week

The FT said DB staff working in London will receive “notification risk” notices, effectively a warning that they might soon be fired, offered a ‘consultation session with HR, and then given the rest of the day off.

“People know the bank is not doing well…It’s not like a party…This is really sad what is going on right now in the bank, but I guess from top management’s point of view that is what is needed to be done,” said one Deutsche staff member in London who declined to be named.

As a reminder, here are the highlights of the “radical transformation” as published by the bank:

- Creating a fourth business division called the Corporate Bank which will be comprised of the Global Transaction Bank and the German commercial banking business.

- Exiting the Equities Sales & Trading business and reducing the amount of capital used by the Fixed-Income Sales & Trading business, in particular Rates.

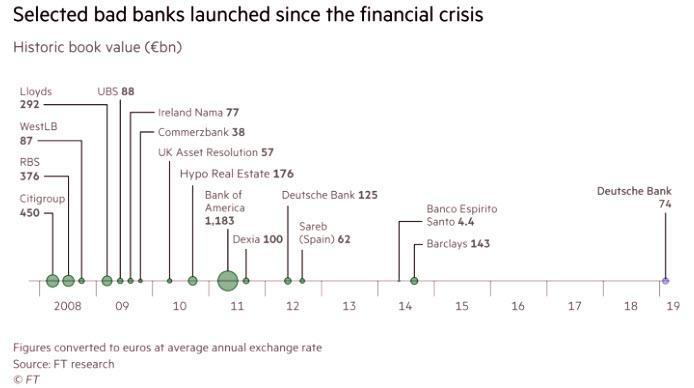

- Returning 5 billion euros of capital to shareholders starting in 2022, facilitated by a new Capital Release Unit (CRU) to which the bank plans initially to transfer approximately 288 billion euros or about 20% of Deutsche Bank’s leverage exposure, and 74 billion euros of risk-weighted assets (RWA) for wind-down or disposal.

- Funding the transformation through existing resources including maintaining a minimum Common Equity Tier 1 ratio of 12.5%. The bank expects to execute its restructuring without the need to raise additional capital.

- As a result, the bank’s leverage ratio is expected the increase to 4.5% in 2020 and approximately 5% from 2022.

- Reducing adjusted costs by 2022 by approximately 6 billion euros to 17 billion euros, a reduction by a quarter of the current cost base.

- Targeting a Return on Tangible Equity of 8% by 2020.

- Investing 13 billion euros in technology by 2022, to drive efficiency and further improve products and services.

The layoffs come as DB refocuses on its core European corporate business, while also planning to package some €74 billion in derivatives into a ‘bad bank’. Most of the job cuts will land outside Germany, partly because Germany’s powerful unions will shield employees from the axe. The bank has committed not to fire any German retail employees against their will until mid-2021, and since 2017 it has been reducing headcount through natural attrition.

One fund manager in Germany described CEO Sewing’s cuts as “a crash diet” to help the bank get back in shape, adding that the steps are long overdue.

“The announced measures are a crash diet,” said Alexandra Annecke, fund manager at Germany’s third-largest asset manager Union Investment.

As the cuts begin, one staffer warned: “it is going to be carnage” inside the bank’s London office on Monday.Business Finance

The pre-tribulation position advocates that the rapture will occur before the beginning of a seven-year tribulation period, while the second coming will occur at the end of it. Pre-tribulationists often describe the rapture as Jesus coming for the church and the second coming as Jesus coming with the church.

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers

“Have I therefore become your enemy by telling you the truth?”

![]()