This Is Not Sustainable, Were Watching What the World Is Now Calling the Great Reset

(Reality–New World Order Pukes ) Our President Knows the End Is Near With the Current Financial Apparatus… The U.S. government…

![]()

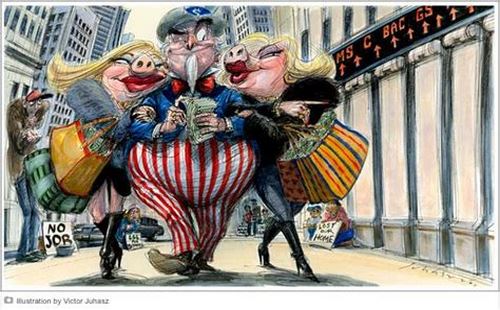

America’s Coming Double Dip

www.zerohedge.com Soaring financial markets are blithely indifferent to lingering vulnerabilities in the US economy. But the impact of consumers’ fear of…

![]()

S&P Jumps Above Record High After $9 Trillion Global Liquidity Tsunami

$9 trillion in additional global liquidity (from $79 to almost $88 trillion since the March lows)… Are we Drowning in…

![]()

Who Is The Next Wirecard?

Now that the multi-year saga of German fintech megafraud Wirecard is finally over, the pain is only just starting for…

![]()

Soaring Food & Energy Costs Spark Rebound In Producer Prices

Producer Prices rebounded MoM in May with headline Final Demand PPI rising 0.4% (against +0.1% exp) but it left PPI YoY…

![]()

Wall Street Caught Short Again As “Money Printer Go BRRRRRR To 11”

With US stocks soaring to start the week on the combination of Powell’s 60 Minutes affirmation that the Fed’s money printer go BRRRRR…

![]()

A Shift In The Global Financial Order Is Upon Us

The collapse in bond yields, exacerbated by the crash in oil prices, marks an end to the era of trust…

![]()

The World Has Gone Nuts High-Income Taxpayers Now Confronted At Home By IRS Agents

They perverted justice among themselves (v. 7): “You turn judgment to wormwood, that is, you make your administrations of justice…

![]()

The Next Ten Years In Oil Markets

An eventful 2019 wraps up a decade of turmoil in oil markets, in which Brent Crude prices fluctuated from as high as US$125 a…

![]()