The world offers conflicting views of what being a man is all about. Some say that being a man requires grit, square-jawed determination, working knowledge of weaponry, and, preferably, rock-solid abs. Others say that manliness is about getting in touch with one’s feelings, caring for the less fortunate, and being sensitive. Still, others would include leadership skills, a good work ethic, physical stature, riches, or sexual prowess. Can these things truly define masculinity, or is there another standard?

To know what a true man is, you need to look no further than the life of Jesus Christ. As the Son of Man, Jesus is the epitome of manhood, the perfect example of what true maturity looks like. Jesus was full of the Holy Spirit and lived in complete dependence on and obedience to the will of God. Christ fully displayed the fruit of the Spirit (Galatians 5:22-23). A true man of God will show evidence of these works of the Spirit as well.

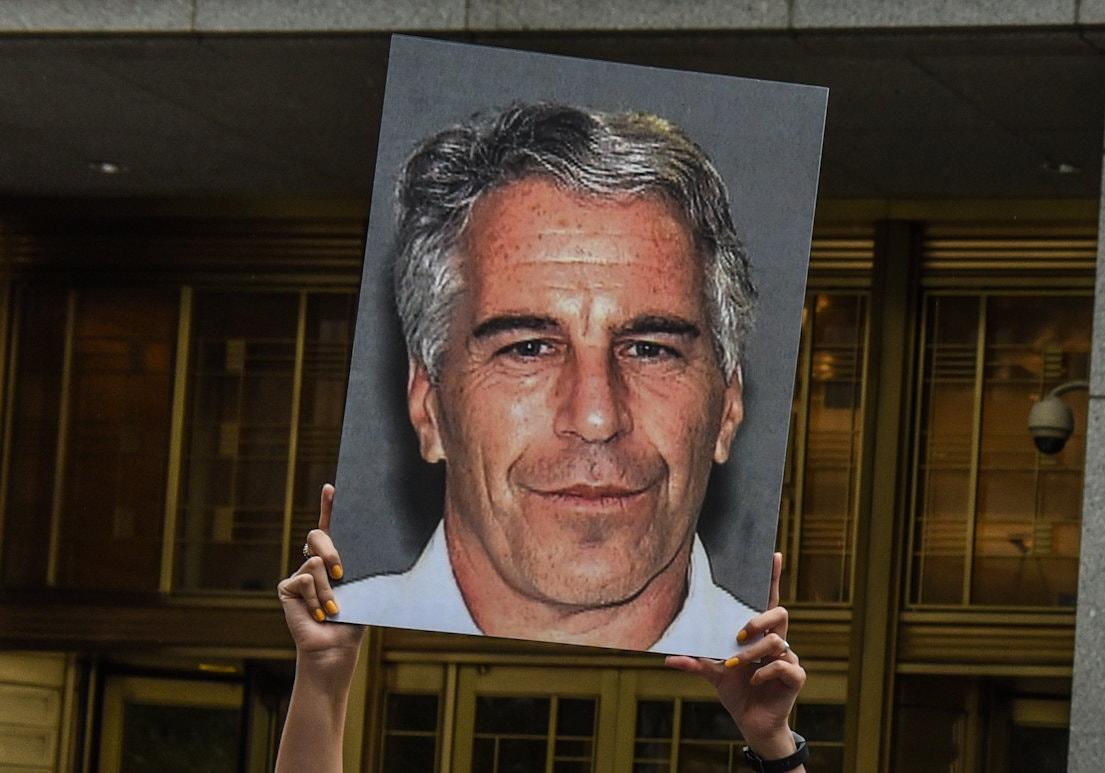

Jeffrey Epstein’s wealth has long been a topic of discussion since becoming known as a ‘billionaire pedophile’ and other similar monickers. Described by prosecutors this week as a “man of nearly infinite means,” a 2011 SEC filing has provided a window into the registered sex offender’s elite Wall Street links, according to the Financial Times.

Epstein, who caught a lucky break tutoring the son of Bear Stearns chairman Alan Greenberg before joining the firm, left the investment bank in 1981 to set up his own financial firm. While he reportedly managed money for billionaires for decades, most of Epstein’s dealings have been done in the shadows.

A 2011 SEC filing reveals that Epstein’s privately held firm, the Financial Trust Company, took a 6.1% stake in Pennsylvania-based catalytic converter maker Environmental Solutions Worldwide (ESW) backed by Leon Black, the billionaire founder of Apollo Global Management.

ESW itself has a checkered past. In 2002, its then-chairman Bengt Odner was accused by the SEC of participating with others in a $15 million “pump and dump” scheme with ESW stock. The case was settled a year later according to FT, with Odner ordered to pay a $25,000 civil penalty. Of note, ESW accepted Epstein’s investment several years after he had registered as a sex offender in a controversial 2008 plea deal in Florida.

Epstein’s connection to Black doesn’t stop there – as the financier served as a director on the Leon Black Family Foundation for over a decade until 2012 according to IRS filings. A spokeswoman for the foundation claims that Epstein had resigned in July 2007 and that his name continued to appear on the IRS filings “due to a recording error” for five years. A 2015 document signed by Epstein provided to the Financial Times appears to confirm this.

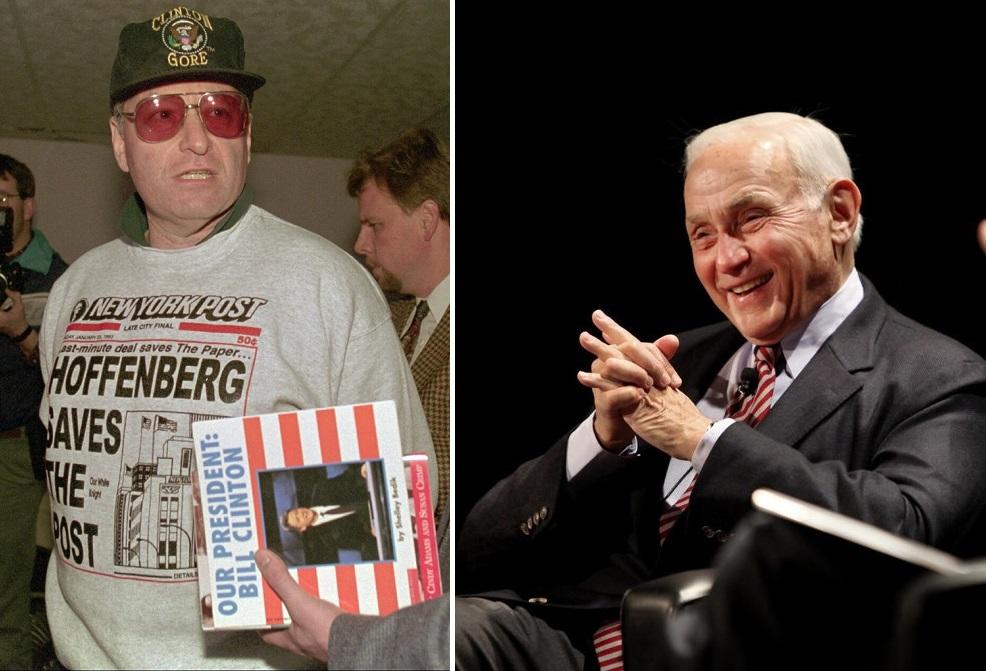

Epstein also built his wealth with Steven J. Hoffenberg and Leslie H. Wexner, the former of whom was convicted of running a giant Ponzi scheme, and the latter a clothing magnate.

Mr. Epstein’s wealth may have depended less on his math acumen than his connections to two men — Steven J. Hoffenberg, a onetime owner of The New York Post and a notorious fraudster later convicted of running a $460 million Ponzi scheme, and Leslie H. Wexner, the billionaire founder of retail chains including The Limited and the chief executive of the company that owns Victoria’s Secret.

Mr. Hoffenberg was Mr. Epstein’s partner in two ill-fated takeover bids in the 1980s, including one of Pan American World Airways, and would later claim that Mr. Epstein had been part of the scheme that landed him in jail — although Mr. Epstein was never charged. With Mr. Wexner, Mr. Epstein formed a financial and personal bond that baffled longtime associates of the wealthy retail magnate, who was his only publicly disclosed investor. –New York Times

“I think we both possess the skill of seeing patterns,” Wexner told Vanity Fair in 2003. “But Jeffrey sees patterns in politics and financial markets, and I see patterns in lifestyle and fashion trends.”

Those around Wexner were mystified over Wexner’s affinity for Epstein.

“Everyone was mystified as to what his appeal was,” said Robert Morosky, a former vice chairman of The Limited. “I checked around and found out he was a private high school math teacher, and that was all I could find out. There was just nothing there.”

As the New York Times noted on Wednesday, Epstein’s “infinite means” may be a mirage, as while he is undoubtedly extremely rich, there is “little evidence that Mr. Epstein is a billionaire.”

While Epstein told potential clients he only accepted investments of $1 billion or more, his investment firm reported having $88 million in capital from his shareholders, and 20 employees according to a 2002 court filing – far fewer than figures being reported at the time.

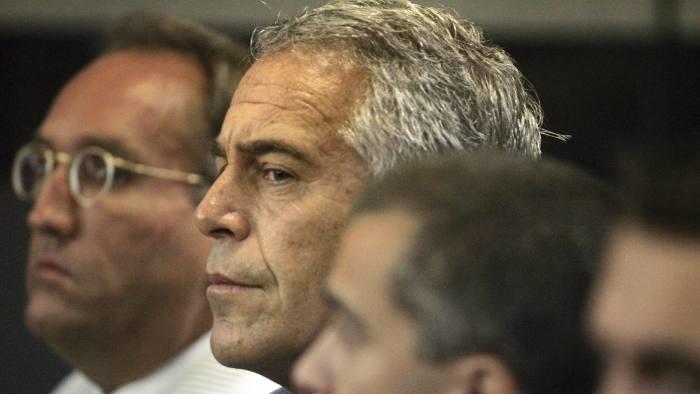

And while most of Epstein’s dealings are unknown, his Financial Trust Company also had a $121 million investment in DB Zwirn & Co, which shuttered its doors in 2008, and had a stake in Bear Stearns’s failed High-Grade Structured Credit Strategies Enhanced Leverage Fund – the collapse of which helped spark the global financial crisis.

Epstein was hit hard by the financial crisis a decade ago, while allegations of sexual abuse of teenage girls caused many associates – such as Wexner – to sever ties with him.

Bear Stearns — the bank that had given Mr. Epstein his start — was still among his investments when the crisis hit. According to a lawsuit he later filed against the bank, Mr. Epstein controlled about 176,000 shares of Bear Stearns, worth nearly $18 million, in August 2007.

Mr. Epstein sold 56,000 shares at $101 each that month. He sold the remaining 120,000 shares in March 2008 as the firm was collapsing — 20,000 at $35 and the rest at $3.04, losing big. He also lost about $50 million in one of Bear’s hedge funds.

By the time Bear Stearns came apart, Mr. Epstein was at the center of his first abuse case. He pleaded guilty to prostitution charges in 2008, receiving a jail sentence that allowed him to work at home during the day but also required him to register as a sex offender. –New York Times

In trying to determine what Epstein is actually worth, Bloomberg notes that “So little is known about Epstein’s current business or clients that the only things that can be valued with any certainty are his properties. The Manhattan mansion is estimated to be worth at least $77 million, according to a federal document submitted in advance of his bail hearing.”

He also has properties in New Mexico, Paris and the U.S. Virgin Islands, where he has a private island, and a Palm Beach estate with an assessed value of more than $12 million. He shuttles between them by private jet and has at least 15 cars, including seven Chevrolet Suburbans, according to federal authorities. –Bloomberg

Deutsche Bank, meanwhile, severed ties with Epstein earlier this year – right as federal prosecutors were preparing to charge him with operating a sex-trafficking ring of underage girls out of his sprawling homes in Manhattan and Palm Beach, according to Bloomberg, citing a person familiar with the situation. It is unknown how much money was involved or how long Epstein had been a client. Source

StevieRay HansenEditor, Bankster Crime

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers,#Powerful Politicians, #Businessmen

![]()