Futures Jump Ahead Of Tuesday Stimulus Deadline

Bulls will breathe a sigh of relief that on the 33-year-anniversary of Black Monday (when the Dow dropped 22.6% on…

![]()

The Next Ten Years In Oil Markets

An eventful 2019 wraps up a decade of turmoil in oil markets, in which Brent Crude prices fluctuated from as high as US$125 a…

![]()

We Are Entering the Time of “the Perfect Storm”, and Most People Have Absolutely No Idea What Is Ahead of Us.

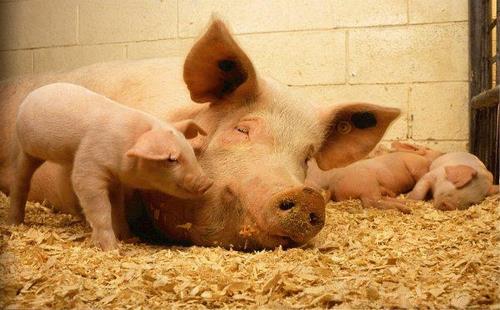

The global pig population is being absolutely decimated by a disease that does not have a cure. African Swine Fever, also…

![]()

Global Markets Hit All-Time High As Traders Brace For “Phase Two” Optimism

This is where we stand as we enter Monday morning: European markets are firmer this morning, though the FTSE 100…

![]()

“It’s About To Get Very Bad” – Repo Market Legend Predicts Market Crash In Days

For the past decade, the name of Zoltan Pozsar has been among the most admired and respected on Wall Street:…

![]()

The Danger Of Deeper OPEC+ Cuts

OPEC+ agreed to cut production by 500,000 bpd, sending oil prices higher on Friday. During mid-day trading, WTI was just shy…

![]()

Dalio & Tudor Jones Warn: “We Will Kill Each Other” If Our Broken Economic System Isn’t Fixed

Two hedge fund icons – Bridgewater founder Ray Dalio and Paul Tudor Jones – joined Yahoo Finance for the 2nd annual Greenwich…

![]()

The Food Shortage and the Coming Tribulation’s

There Are Not Enough Pigs in the World to Fill China’s Pork Hole… African swine fever has wiped out herds…

![]()

Its BS, Fracking Blows Up Investors Again: Phase 2 Of The Great American Shale Oil & Gas Bust

In 2019 through the third quarter, 32 oil and gas drillers have filed for bankruptcy, according to Haynes and Boone. Since…

![]()

“It’s As If JPMorgan And Goldman Vanished…”

The equity-ification of the bond market has been closely followed by Bloomberg News and other financial journalists. Unfortunately for the…

![]()