It’s always good to remember the Lord’s purpose for what He makes. Whether it’s the temple, the church, marriage, the family, or life itself, we should follow God’s design and seek to honor Him. Any twisting or perverting of God’s design for selfish purposes will draw the Lord’s righteous anger.

It’s amazing that the big banks continue to mislead and overcharge customers for a simple business, over and over. That business is foreign payments, sometimes known as foreign exchange. But first, let us understand the difference between payments and trading. Payments are when you want to send money to a friend in Germany, or pay an invoice from a company in Australia. You’re sending money. Conversely, if you are the recipient of a foreign inbound transfer, your foreign friend may send in their local currency and have your bank do the transfer, thus fleecing you out of as much as 8% of your money per whack.

Here’s the real shocker: This happens only in America. In New Zealand for example, when you open a new bank account they may ask you ‘what currency do you want it denominated in?’ The point is New Zealand is an export-driven economy with tasty Lamb meat and succulent Marlborough Wines that their economy depends on. There isn’t really much else going on in New Zealand in a country with 13 sheep for every 1 human. So Kiwis are above average foreign exchange traders, and many companies offer ancillary services and overlay services such as hedging, payments, and related services. But you won’t find such companies in the USA. That’s because the population is so brainwashed they have been led to believe the only currency in the world is the U.S. Dollar. I’m not here to tell you most Americans are stupid, I’m just stating the fact that in Europe you couldn’t rip off customers so badly. It’s only possible in America.

Another amazing fact is that the banks have paid out settlement after settlement to customers but continue the same abusive practices! Of course, if you look from their perspective, if you can make $10 Billion and pay out $500 Million in fines and fees then its good business.

There are companies out there such as DiscountCurrencyTransfers.com which offer a cheaper alternative to exchange foreign currency compared to the big banks, but generally, they are unknown.

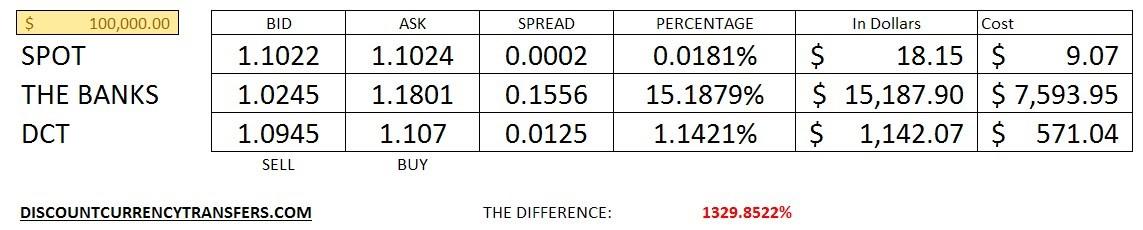

Take a look at this chart to fully understand what we are talking about:

This is assuming a default transfer value of $100,000. Quickly, let’s understand the differences between payments and trading. If you are margin trading foreign exchange, you’ll get near spot rates, as places like FX Trading Pro. But that’s margin trading, similar to stock trading. If you are sending money to another country, this is called ‘deliverables’ or ‘remittances’ – in which case you aren’t going to get spot rates.

But having said all that, look at the savings of using services like DiscountCurrencyTransfers.com compared to what the banks are charging.

On a $100,000 transaction, you’d be spending $7,593 on fees. What’s really insulting is that they will hide these fees from you. In fact, they will offer you to waive the $30 wire transfer fee if they do the FX conversion for you! Yes, please, I want to pay $7,593 and save $30. What planet do we live on?

Bottom line is that there are alternatives, but the banks continue to pillage and plunder like pirates in a modern world. You’d think that after all the abuses their abusive pricing practices would stop, but they won’t. Likely what will happen is a new industry of disruptive tech will grow this sector away from the banks and into more of a FinTech service, as we were promised with the Crypto revolution. Source

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers

“Have I, therefore, become your enemy by telling you the truth?”

![]()