I want you to imagine, for a moment, a future world in which everything we now know about functioning and surviving within the economy is completely upended. This world has gone fully digital, meaning people live within a cashless society where physical monetary interactions are abandoned or prohibited, replaced by CBDCs. All transactions are tracked and traced, nothing is private any longer unless you are operating as a criminal within a black market.

By extension, production is overtly suppressed and micromanaged. Small businesses are a thing of the past, and only a select group of major corporations working directly with government are allowed to operate. It’s not just that cash is outlawed and that everyone must rely on a digital ledger, the very data pathways and networks that we use to transfer funds are also controlled. Much like the SWIFT data network, the globalists have the ability to lock down internet payments, individual accounts and business accounts and deny people the ability to move funds from one place to another.

In the meantime, AI-based monitoring systems sift through millions of transactions every minute, searching for “anomalies.” The algorithm is designed to identify anyone who has found a way around the data tracking – People who want to remain anonymous.

The internet still exists, but it’s a shell of its former glory. The population uses it regularly to complete necessary tasks and to research information, but data providers are severely restricted. Cryptocurrencies are not an option as an alternative to the CBDCs because trading them online immediately sets off red flags for the AI-in-the-sky.

Only government approved websites are allowed to exist, with extensive rules limiting what they can do and what they can say. AI chatbots provide the public with most of their information, and the globalists control the parameters of the chatbots. People only ever hear the news that the elites want them to hear. All contrary data is eliminated. It’s not so much banned, rather, it is simply omitted from the record until the people who remember it are long gone.

It might sound like science fiction, but ALL of this technology already exists and is currently being tested by globalist institutions including the Bank for International Settlements and the IMF.

Not long ago during the covid pandemic scare, organizations like the World Economic Forum began widely promoting a concept called the “Great Reset.” It was an agenda sometimes whispered about in banker conferences as far back as 15 years ago, but now the Reset was being promoted openly in the media and at Davos. It’s a new economic paradigm, a revolution in which AI runs everything, humanity is relegated to a limited number of vital jobs, and a new brand of technological socialism rules our lives. Private property would be cast aside and the populace would live day-to-day within a “shared economy” in which no one owns anything and everything is borrowed from the collective system.

The Reset, or the 4th Industrial Revolution as they sometimes call it, would be the start of a new terrifying age of feudalism. It’s a return to the oligarch and peasant model, a return to enslavement. The average person would only be allowed to work as a means to survive, never to accumulate wealth for the future. And each peasant’s survival would be utterly dependent on their access to the system, which could be taken away with the push of a button.

The primary stepping stone to this dystopian nightmare would be a global digital currency system. Without a cashless society, the globalists would have no power to enforce the other elements of their Reset. But when and how will they implement this monstrosity, and why would anyone embrace it?

Globalists tend to operate in stages of incrementalism, but sometimes they exploit dramatic crisis events in order to frighten the population into compliance with policies that would have taken decades to institute otherwise. We saw this clearly with the pandemic; most of the Reset concepts were revealed to the public during this time, perhaps because the globalists thought they had it in the bag and there was nothing anyone could do to stop them. This even included consistent talk of cashless systems to “prevent the spread of covid on physical dollars.”

But, covid with its tiny Infection Fatality Rate failed to frighten people enough and the opportunity fell apart. Today, the question is when will they try again?

Most globalist organizations consistently mention the year 2030 as their timeline for finishing the numerous projects they have in place, including the “Great Reset” along with multiple climate and carbon taxation goals. The WEF calls it “a social contract to transform our world by 2030.” The UN simply calls it “Agenda 2030.”

This means the establishment wants to have their control grid in place within seven years or less. That would be impossible without a bone rattling crisis of epic proportions, but first they would have to introduce a number of future mechanisms as a trial run. That way, when disaster does occur the public will be acclimated to the solutions that the elites will ask them to adopt later.

In the case of digital currencies, crypto has already received wide exposure in popular media. Most people don’t own crypto and hardly anyone uses it, but they have all heard of it. CBDCs will likely ride the crypto wave and will be presented as a “safer and more stable” crypto option.

For now, Australia seems to be the primary guinea pig for fielding CBDCs to a large western population. Their pilot programs are set to finish this summer and international transactions have been accomplished using the eAUD unit. Though, they have not revealed when they might introduce the currency to Forex markets or the citizenry. The point is, the system exists, and can be copied and adopted by any other nations.

At bottom, globalists know that countries like America will not accept a fully cashless system without a complete collapse of their existing currency and economy. It’s just not going to happen otherwise, and I have doubts that many Americans will accept such a system even after a collapse. The majority of Americans, 59%, say they like to have cash with them for various purchases.

Though western consumers make payments more often with bank cards, they still enjoy having physical money when they want it. The implications of intricate digital surveillance of every single purchase and transfer of funds is not lost on a large portion of the population. People know that if they give the government a telescope into their wallets eventually that information will be used against them. Take away the option of anonymity and millions of people will resist, even if they have nothing in particular to hide.

Conversion to a cashless system would require calamity and force, a full spectrum crisis throughout the US and much of the western world in the next few years, along with another few years or more of reconstruction to bring in CBDC mechanisms. Small businesses would have to be removed from the picture, leaving only major corporations which could then refuse to accept cash as a means of payment from consumers. This would be one method of expediting the cashless system, along with outright government confiscation of physical paper.

That said, there is another rather blunt way to push Americans into CBDCs that the globalists seem to be expediting – The death of the dollar’s world reserve currency status. Only five years ago skeptics argued that the dollar would be king for many decades to come. Today, those same people are eerily quiet as the IMF announces their own global CBDC called the “UMU” and BRICs nations quickly move away from the Greenback in bilateral trade. If the US dollar loses a majority of its buying power through inflation and the loss of reserve status, it may be easier to convince the populace to abandon it for a digital replacement.

If we take the globalist timeline of 2030 as an effective limiter, this would mean another crisis even more pervasive than the covid pandemic would have to take place soon in order for the elites to get what they want. The longer they wait, the more people become educated on their agenda and the less likely it will be to succeed. Source: Zerohedge

Say hello to Granite Ridge Soap-works! Use our handmade soaps to take good care of your skin. Our premium natural ingredients work together to create a silky, creamy lather that hydrates your skin. Chemicals, such as sodium lauryl sulfate, phthalates, parabens, or detergents, are never used by us. To ensure quality, we make all of our soaps in modest quantities. Visit our Etsy store right away to give them a try and the attention your skin deserves. GraniteRidgeSoapworks: Because only the best will do for your skin.

Use the code HNEWS15 to receive 15% off your first purchase.

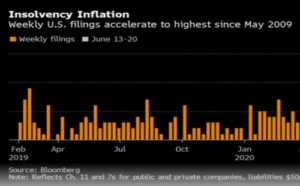

“Red Flags Galore”: Companies Sold A Mindblowing $113 Billion In Stock In Q2

When it comes to bearish market flow red flags, aggressive selling of stock by corporate insiders is traditionally viewed as the biggest red flag –…

Read More