Second Corinthians 9:6 says, “Remember this: whoever sows sparingly will reap sparingly, and whoever sows generously will reap generously.” The context is actually speaking about investing in our relationship with God, but it demonstrates how one must often sacrifice now to gain in the future. Similarly, Proverbs 3:9-10says, “Honor the Lord with your wealth, with the first fruits of all your crops; then your barns will be filled to overflowing, and your vats will brim over with new wine.”

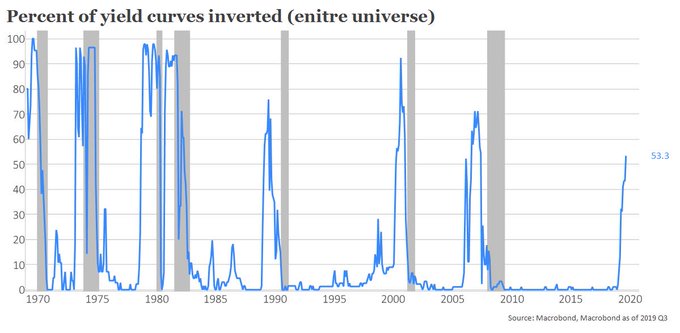

In a quiet end to an extremely tumultuous week (pending one or more shocking Trump tweets) there were no overnight trade war tape bombs from China, no additional curve inversions even as more than half of the world’s yield curves are now inverted…

Jeffrey Kleintop✔@JeffreyKleintop

Percentage of yield curves inverted around the world now over 50%

834:13 PM – Aug 15, 2019Twitter Ads info and privacy59 people are talking about this

… and so US equity futures surged and European stocks and most Asian shares posted modest gains on Friday, while Treasuries pared some of their recent blistering advances, taking advantage of the rare moment of quiet, as expectations grew of further stimulus by central banks, offsetting worries about slowing economic growth which intensified this week as the US 2s10s yield curve inverted for the first time since 2007.

S&P 500 futures pushed above prior day’s highs amid renewed trade optimism after U.S. President Donald Trump said a call is planned very soon with Chinese leader Xi Jinping.

MSCI’s All Country World Index was up 0.2% on the day, although it was set for its third straight losing week, down 2.2%.

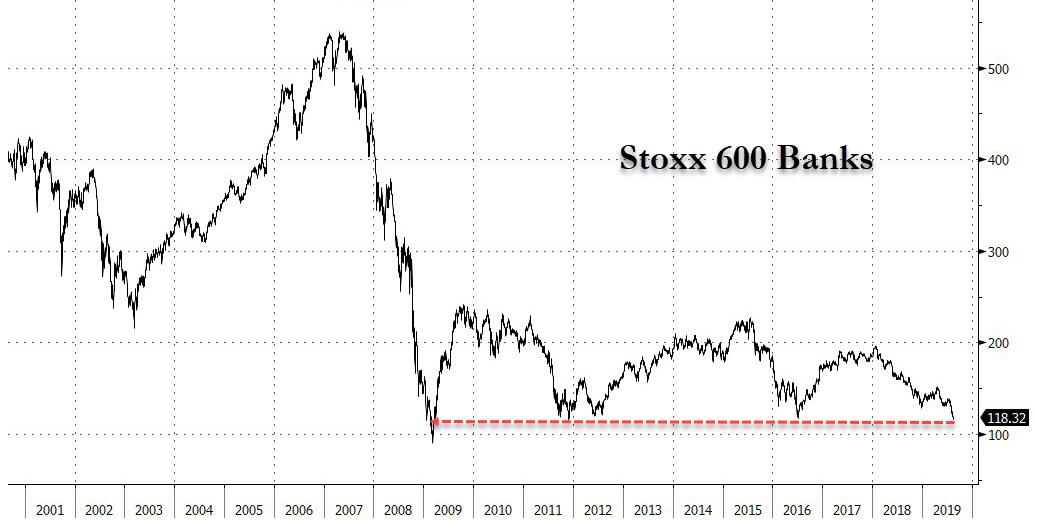

European shares rebounded from six-month lows, with the European Stoxx 600 index over 1% higher, drifting in low-volume trade in a morning devoid of fresh news flow or data. The Stoxx 600 Banks Index was one of Europe’s best-performing sectors today, gaining 1.1%, in contrast with other cyclical industries like autos and chemicals that lagged behind the broader market. Commerzbank was the biggest gainer in the index as the negative yield sentiment took a step back. The catalyst: the 10y Bund yield was slightly up Friday by 1bps as the benchmark’s bond is heading for the fifth weak of falling yields; somehow this was enough to launch a relief rally in Europe’s banks which have tumbled to near-record-low levels. Italian banks also among the top performers after the country’s market was closed for a holiday Thursday. The banks were also catching up on comments from ECB’s Olli Rehn about a potential “impactful and significant” stimulus package.

Think Bitcoin is the New Gold 2.0? Think Again

Some investors refer to bitcoin as “Gold 2.0”. Learn why that description may not be accurate. 2495046.2.1.AM.RTLAdvertisement: State Street Global Advisors

A technical glitch delayed the start of trading of the UK’s benchmark FTSE 100 and midcap stock indexes for almost two hours. It was the longest outage at one of the world’s top stock markets in eight years.

Earlier in the session, Asian shares were mostly higher, with Chinese stocks climbing and Korean shares dipping.

Treasuries drifted lower over Asia session and into the early European session, paring some Thursday’s rally. Yields were up 0.5bp to 3.2bp across the curve in a bear steepening move with 2s10s wider by ~1bp and 5s30s by ~2bp; 10-year yields ~1.54% are cheaper by 1.5bp but remain towards the richer end of 1.473% to 1.733% weekly range. In Europe, Bunds outperformed Treasuries, while gilts underperformed as money markets trim pricing on Bank of England easing; Chancellor Sajid Javid holds Brexit talks in Berlin later Friday.

To be sure, the bulk of the action this week was in the bond market, wherewith no trade war settlement in sight, investors hedged against a global slowdown by buying bonds. Yields on 30-year debt dropped to a record low 1.916% on Thursday, leaving them down 27 basis points for the week, the sharpest decline since mid-2012.

That means investors are willing to lend the government money for three decades for less than either the overnight rate or LIBOR. Which also means that all those who pegged their ARM mortgages to the 30Y instead of Libor are now winning.

Some analysts say the current bond market is a different beast than past markets and might not be sending a true recession signal: “The bond market may have got it wrong this time, but we would not dismiss the latest recession signals on grounds of distortions,” said Simon MacAdam, global economist at Capital Economics. “Rather, it is of some comfort for the world economy that unlike all previous U.S. yield curve inversions, the Fed has already begun loosening monetary policy this time.”

And so with the bond market screaming a recession is coming, the futures market is bracing for action from the Fed and the Fed Funds market now sees a one in three chance the Federal Reserve will cut rates by 50 basis points at its September meeting, and see rates reaching just 1% by the end of next year.

On Thursday, the ECB’s Olli Rehn flagged the need for even stronger easing in September. Markets currently anticipate a cut in the ECB’s deposit rate of at least 10 basis points and a resumption of bond buying, sending German 10-year bund yields to a record low of ‑0.71%.

“The underlying concern and drivers such as a recession and the expectation for an aggressive policy response, fueled by Rehn’s comments yesterday, has given the bond market another boost at already elevated levels,” said Commerzbank rates strategist Rainer Guntermann.

Meanwhile, Mexico overnight joined the global easing tide and became the latest country to surprise with a rate cut, the first in five years. Canada – whose yield curve inverted by the most in nearly two decades – is likely next to cut.

In other overnight news, President Trump said Fed Chair Powell should be cutting rates because other countries are lowering rates and we want to remain even. Meanwhile, Fed’s Kashkari (Non-Voter, Dove) said the Fed will debate what to do on rates and that he is leaning towards further rate reduction, while he added that Fed officials are committed to ignoring politics and focusing on jobs. Kashkari also noted that he sees some cautious signs as well as some signs of optimism and that it is definitely a nervous time.

Additionally, Trump said he doesn’t think China will retaliate to an increase in tariffs and understands the September meeting between negotiators is still on, while he added that he has a call scheduled with Chinese President Xi and will be speaking to him soon. Trump also stated that US consumers may have to pay something at some point to cover the cost of tariffs on Chinese goods, that China very much wants to make a deal and he thinks the trade war will be fairly short.

In FX, the talk of ECB easing knocked the euro lower for a fourth day back to a two-week low of $1.1075 and away from a top of $1.1230 early in the week. It was last down 0.3% at $1.1078, helping lift the dollar index to 98.283 and off the week’s low of 97.033. Australia’s dollar rose for a second day as U.S. President Donald Trump said he had a phone call coming soon with China’s Xi Jinping, boosting optimism trade tensions between the two nations will ease. The pound headed for its first weekly gain against the euro for three months, as opposition lawmakers sought to find a way to stop a no-deal Brexit, while Chancellor of the Exchequer Sajid Javid will become the first senior member of Boris Johnson’s government to hold Brexit talks with EU leaders when he flies to Berlin today to speak to German finance minister Olaf Scholz.

In commodities, gold fell 0.7% to $1,512.7, just off a six-year peak. Oil prices surged. Brent crude futures added 2% to $59.48 a barrel, while U.S. crude rose 2% to $55.60 a barrel.

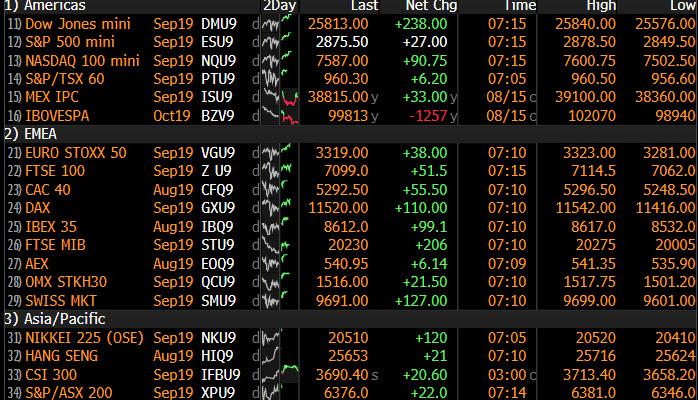

Market Snapshot

- S&P 500 futures up 0.9% to 2,872.75

- STOXX Europe 600 up 0.8% to 367.96

- MXAP up 0.3% to 150.51

- MXAPJ up 0.4% to 486.38

- Nikkei up 0.06% to 20,418.81

- Topix up 0.1% to 1,485.29

- Hang Seng Index up 0.9% to 25,734.22

- Shanghai Composite up 0.3% to 2,823.82

- Sensex up 0.3% to 37,409.18

- Australia S&P/ASX 200 down 0.04% to 6,405.53

- Kospi down 0.6% to 1,927.17

- German 10Y yield rose 0.6 bps to -0.707%

- Euro down 0.2% to $1.1086

- Italian 10Y yield fell 17.1 bps to 0.985%

- Spanish 10Y yield unchanged at 0.034%

- Brent futures up 1.5% to $59.09/bbl

- Gold spot down 0.7% to $1,512.71

- U.S. Dollar Index up 0.1% to 98.26

Top Overnight News

- The European Central Bank is throwing every tool it has at the sluggish euro-zone economy. Starting in September, it’ll make a generous funding offer to lenders in the region, returning to an approach it’s used twice before in the past five years. It’s also considering tweaking its interest-rate policy to limit the punitive side effect of its stimulus.

- Japanese investors bought a record amount of U.S. agency bonds in June, data from Department of Treasury showed Thursday. Purchases worth $14.3b were the highest in data going back to 1977

- Labour Party leader Jeremy Corbyn’s appeal to other U.K. parties that he should become a caretaker prime minister to stop a no-deal Brexit looks to have already fallen flat, as even some in his own party apparently accepted an alternative plan was needed

- Japan’s 10-year bond yield slipped to its lowest since July 2016, intensifying scrutiny over the central bank’s yield- curve control policy amid a global debt rally. New Zealand’s benchmark rate also fell to a new record low

- The U.S. is gravely disappointed with the U.K. after a Gibraltar court allowed the release of an Iranian tanker suspected of hauling oil to Syria, and threatened sanctions against ports, banks and anyone else who does business with the ship or its crew, two administration officials said

- “I’m leaning towards the camp of yes, we need to give more stimulus to the economy, more support, we need to continue the expansion and not allow a recession to hit us,” Minneapolis Fed President Neel Kashkari told Minnesota Public Radio

- North Korea fired two unidentified projectiles on Friday into waters off its east coast between the Korean Peninsula and Japan, South Korea’s defense ministry said

Asian equity markets struggled for firm direction following the mixed lead from Wall St where most major indices eventually composed themselves after the recent sell-off but with price action tumultuous on continued US-China trade uncertainty. ASX 200 (Unch.) was subdued as upside in healthcare and financials counterbalanced weakness in commodities and telecoms, with a heavy slate of earnings adding to the mix. Nikkei 225 (Unch.) was restricted by an uneventful currency, while KOSPI (-0.6%) underperformed as it caught up to the recent rout on return from holiday and amid a deterioration in inter-Korean relations after North Korea fired 2 more projectiles and stated it has no intention to talk with South Korea again. Hang Seng (+0.9%) and Shanghai Comp. (+0.3%) were initially choppy amid conflicting rhetoric from both sides of the trade spat. In addition, policymakers later contributed to the outperformance in the mainland after the PBoC’s continued liquidity efforts resulted to a net weekly injection of CNY 300bln and with the NDRC announcing to roll out a plan to boost disposable incomes. Finally, 10yr JGBs initially edged higher to test the 155.00 level to the upside as 10yr yields fell to -0.25% which was the lowest since 2016, although prices then reversed in the aftermath of the BoJ’s Rinban operation in which it reduced purchases of 5yr-10yr bonds for the first time since December as speculated, to stem the decline in yields.

Top Asian News

- BOJ Steps in With Cut to Bond Purchases as Yields Keep Sliding

- Thailand Plans $10 Billion Economic Boost to Hit 3% Growth

- Modi’s Kashmir Move Faces UN Test After Top Court Skips Pleas

European equities are higher across the board [Eurostoxx 50 +1.1%] following on from a mixed Asia-Pac session, with Europe continuing to feel tailwind from ECB’s Rehn, who yesterday hinted to a preference for a bazooka of Central Bank stimulus (in the form of rate cuts and APP) whilst stating its better to overshoot with stimulus than undershoot. UK’s FTSE 100 (+0.4%) fails to benefit from the prospect of EU stimulus and also encountered technical problems which delayed the bourse’s open by just over 90 minutes. Sectors are all in positive territory, whilst some early outperformance was seen in the IT sectors in light of NVIDIA’s (+5.3% pre-market) earnings which beat on both top and bottom lines and supported the likes of fellow chip names [AMS (+3.2%), Infineon (+2.2% and STMicroelectronics (+1.2%)]. Meanwhile, the EU banks saw a sudden sharp decline, although the current yield environment is not attractive, some are citing a technical break below 80 in the Euro Stoxx Bank Index (SX7E). In terms of individual movers, Bayer (+2.3%) rose on the back of an upgrade at BAML, whilst Ryanair (-2.6%) shares were impacted by a double downgrade.

Top European News

- In Brave New World, U.K. Markets Don’t See Any BOE Hike, Forever

In FX, Sterling looks set to end the week on top of the G10 table after a run of firmer or better than expected UK data (average earnings, CPI and retail sales) and latest moves to block a no-deal Brexit. Cable has reclaimed 1.2100+ status and inched above yesterday’s high (1.2150) even though the Dollar is also generally bid after Thursday’s strong US data/survey releases, while Eur/Gbp has reversed sharply from ytd highs of 0.9325 through Fib support at 0.9160 and 0.9150 amidst all-round Euro weakness on the back of dovish ECB rhetoric and perhaps with some fix flow in the mix as well, as the cross probes 0.9125.

- EUR – As noted, the single currency remains under pressure following yesterday’s aggressive policy pronouncements from ECB’s Rehn who is advocating conventional easing and substantial bond-buying to be unveiled in September on the premise that too much is better than not enough in terms of stimulus. Hence, Eur/Usd is hovering just above the next sub-1.1100 target area or bidding zone between 1.1080-70 and at this stage expiry option interest at the big figure does not seem likely to factor (especially as there are less than 1 bn rolling off).

- DXY – The index is inching closer to nearest chart resistance above 98.000 in wake of the aforementioned bullish US macro updates, at 98.301 vs 98.371, with the Greenback also gleaning momentum at the expense of other majors in contrast to EM currencies that are clawing back losses amidst an improved risk environment overall.

- JPY/CHF/NZD – All on the back foot, with the Yen unable to breach 106.00 vs the Buck or threaten decent expiries below (1.1 bn from 105.80-70) and subsequently slipping to circa 106.50 as supply at 106.30 dried up, but holding in ahead of support via a Fib at 106.68 for now. Safe-haven unwinding is also weighing on the Franc that is hovering around 0.9800 and even lagging against the independently weak Euro, albeit still above 1.0900 and pivoting 1.0850. Elsewhere, the Kiwi has not derived any comfort from the upturn in risk sentiment after more deep RNBZ rate cut calls overnight (UBS looking for the OCR to hit 0.5% by February next year) and a sub-50 NZ manufacturing PMI, with Nzd/Usd closer to the base of 0.6450-25 parameters.

- CAD/NOK – A decent rebound in crude prices has helped the Loonie pare some losses relative to its US counterpart within a 1.3325-1.3290 band, while 1.2 bn expiries at 1.3340 are also providing support ahead of 1.3350, and Eur/Nok has reversed from 10.0320 towards 9.9600 with the aid of oil’s recovery and ECB/Norges Bank policy divergence after the latter kept a 25 bp hike on the agenda for this year, albeit not necessarily next month as previously inferred.

- EM – Regional currencies have extended their recoveries vs the Dollar as noted earlier, and irrespective of factors that would appear bearish or negative, like an unexpected 25 bp ease from Banxico and much weaker than forecast Turkish IP. However, Usd/Mxn and Usd/Try are both mid-range circa 19.5750 and 5.5500 respectively with the Peso and Lira getting traction from the wider pick-up in risk appetite.

In commodities, a positive session thus far for WTI and Brent futures as the benchmarks recover from yesterday’s losses with upside supported by constructive trade comments from US President Trump, who stated that a call is scheduled with his Chinese counterpart and the September meeting between the negotiators is still on. WTI reclaimed the 55/bbl handle during Asia-Pac hours whilst Brent prices moved north of 59/bbl in early EU trade; and both remain north of these marks. Looking ahead on the docket, OPEC is due to release its delayed Monthly Oil Market Report with a focus on any revisions to its global oil demand outlook following 2019 downgrades by both the EIA and IEA (to 1.1mln BPD and 1.0mln BPD respectively). Currently, OPEC estimates that oil demand will grow by 1.4mln BPD in both 2019 and 2020. On a weekly basis, both benchmarks are poised to post mild gains, albeit this is very much subject to macro-newsflow heading into the final settlement of the week. Elsewhere, gold prices are retreating closer to the 1500/oz level as the Dollar index continues to gain ground above 98.000, whilst profit-taking and an unwind in haven positions are contributing to the downside. Meanwhile, copper prices are little changed intraday and remain below the 2.60/lb level as a rise in Chinese refined copper output counterbalances some of the optimism from Trump’s latest China comments. Finally, Dalian iron ore futures are relatively flat as demand woes were neutralized by supply concerns after Brazil’s Vale halted operations at its Viga concentration plant, thus impacting some 330k tonnes of iron ore per month.

US Event Calendar

- 8:30 am: Housing Starts, est. 1.26m, prior 1.25m; Housing Starts MoM, est. 0.24%, prior -0.9%

- 8:30 am: Building Permits, est. 1.27m, prior 1.22m; Building Permits MoM, est. 3.08%, prior -6.1%

- 10 am: U. of Mich. Sentiment, est. 97, prior 98.4; Current Conditions, prior 110.7; Expectations, prior 90.5

DB’s Craig Nicol concludes the overnight wrap

After running to stand still recently, yesterday felt almost like a rare day of calm for risk assets although we still had the usual intraday swings to deal with. Indeed, it wasn’t like there wasn’t much newsflow to digest. We had more trade headlines, strong US data, and ECB stimulus talk. By the end of the play, the S&P 500 limped to a +0.25% gain while the DOW and NASDAQ ended +0.39% and -0.09%, respectively. Volumes were still above average and the VIX remained elevated around 21.18; however, it did feel a bit calmer certainly relative to recent days. That being said, Treasuries continued to rally with 2y, 10y and 30y yields ending -7.8bps, -5.1bps and -4.5bps lower, respectively. They did actually weaken a bit into the close as prior to that we saw 10y yields fall below 1.50% intraday. The moves also meant that the 2s10s slope ended slightly steeper at +2.3bps. So we’re still waiting for the first official negative print on a closing basis in this cycle. Cash HY credit spreads finished +3bps and +4bps wider in the US and Europe, respectively. US IG spreads also widened slightly, though they were impacted by the sharp move in GE’s benchmark 2035 bonds, which widened +45bps after reports circulated, accusing the company of “accounting fraud.” The company’s shares fell -11.30% for their worst day since April 2008.

Just on the trade headlines, they focused on China’s state council tariff committee saying that China “has no choice but to take necessary measures to retaliate” and that the US had violated the Xi-Trump consensus with the latest tariff announcement. The statement didn’t suggest what the countermeasures might be; however, Zhou Xiaoming – a former Ministry of Commerce official – suggested that the retaliation may not be limited to tariffs. President Trump also said that an agreement with China has to be on “our terms” while he also indicated that he has a call with Xi “very soon” and that “they would like to do something”.

Overnight most Asian markets are trading higher, with the Nikkei (+0.09%), Shanghai Comp (+0.69%) and the Hang Seng (+0.74%) all advancing. However, the Kospi (-0.70%), which is trading again after yesterday’s Liberation Day bank holiday, has fallen back as news has come through overnight from South Korea that North Korea fired two projectiles, the latest in a series of tests that North Korea has launched in recent weeks. Meanwhile, in Japan, 10y JGB yields fell to -0.257% in trading earlier for the first time since 2016, although at time of writing have risen to -0.241%. We’ve also heard overnight that the BoJ reduced their purchases of 5- to 10-year bonds by 30bn yen, the first reduction in their purchases of that maturity since December.

Sticking with Asia, we also heard yesterday that Hong Kong revised down their growth forecasts for this year, down to 0-1%, having been 2-3% previously, while also announcing stimulus measures. This morning, we’ll get Hong Kong’s final Q2 GDP print, which follows the advance estimate last month that showed GDP contracting by -0.3% qoq in Q2, with a YoY growth rate of +0.6%. Looking ahead, S&P 500 futures are currently up +0.58%.

In terms of that US data yesterday that we mentioned at the top, front and center was the July retail sales report, which was undoubtedly strong with above-market prints for the core (+0.9% mom vs. +0.5% expected) and control group (+1.0% mom vs. +0.4% expected) components. There was a small downward revision to the prior month; however, this was still the fifth straight monthly increase in retail sales, which underscores the solidity of consumer activity at the moment. In addition to that, both the August empire manufacturing (4.8 vs. 2.0 expected) and Philly Fed (16.8 vs. 9.5 expected) surveys surprised to the upside while jobless claims ticked up slightly to 220k but still remain historically low.

The flip side for risk was the upward revision to unit labor costs to +2.4% qoq, which points to some modest upside risk to core CPI over the next year. The other slightly negative print was missing for July industrial production (-0.2% mom vs +0.1% expected), and manufacturing production (-0.4% mom vs. -0.3% expected) albeit slightly offset by upward revisions to the prior. All in all, the general takeaway from the slew of data was that this might make it harder for the Fed to surprise with a more aggressive cut next month (50bps as opposed to 25bps) given the solid consumer data, resilient business sentiment especially in the face of the trade war escalation, and a firming of pricing pressure in the labor market. It’s worth noting that GDP trackers ticked higher yesterday, with the Atlanta Fed estimate now at 2.2% for the third quarter, up +0.3pp from its previous level.

Meanwhile, the ECB stimulus talk concerned comments from policymaker Rehn who said that ECB easing should include a “significant and impactful” stimulus package at its September meeting, in an interview with the WSJ. He went on to say that “when you’re working with financial markets, it’s often better to overshoot than undershoot.” That left the market pricing higher odds of a big QE announcement for the September ECB meeting. Bonds rallied across the continent, with 10y yields in Germany, France, and Italy dropping -6.2bps, -6.6bps, and -17.6bps. The euro weakened as much as -0.42% in response and ultimately closed -0.29% lower versus the dollar, though the pass-through to equities was not overly strong, as the STOXX 600 still closed -0.29% lower.

Across the pond, Fedspeak didn’t really move markets, though we did get confirmation that Chair Powell will speak at 3pm London time next Friday to kick off the Jackson Hole conference. The text of his speech will likely be released at the same time. There were also unsubstantiated reports that Powell is cracking down on Fed staff communicating with market participants and/or the media, though it’s hard to believe that they would change their communications policy without publicizing it. Separately, St. Louis Fed President Bullard spoke and sounded, at the margin, dovish. He said that the market’s inflation expectations were “not high enough to meet our target so that is something I will definitely take into account if it is sustained going forward”. Minneapolis Fed President Kashkari also said yesterday that “I’m leaning towards the camp of yes, we need to give more stimulus to the economy”.

In other news, the only other data worth flagging yesterday was in the UK where the July retail sales data was by and large surprisingly positive, with the core measure rising +0.2% mom versus expectations for a -0.2% mom decline. That took the year-on-year reading to +2.9% versus the expected +2.3%. As for other central banks, the global march toward more accommodation continued as the Norges Bank gave a surprisingly dovish statement, sending the krone -0.39% weaker versus the dollar. Mexico’s central bank also surprisingly cut interest rates by 25bps.

Finally to the day ahead, which is quiet for data this morning with only the June trade balance for the Euro Area due. Over in the US this afternoon, we’ll get July housing starts and building permits data before the preliminary University of Michigan consumer sentiment survey is released. It’s worth keeping an eye on the household inflation expectations component of this survey, which remains low despite a pickup last month and has been flagged as a concern by Fed officials. The only other release worth flagging is OPEC’s monthly oil market report. Business Finance Source

![]()