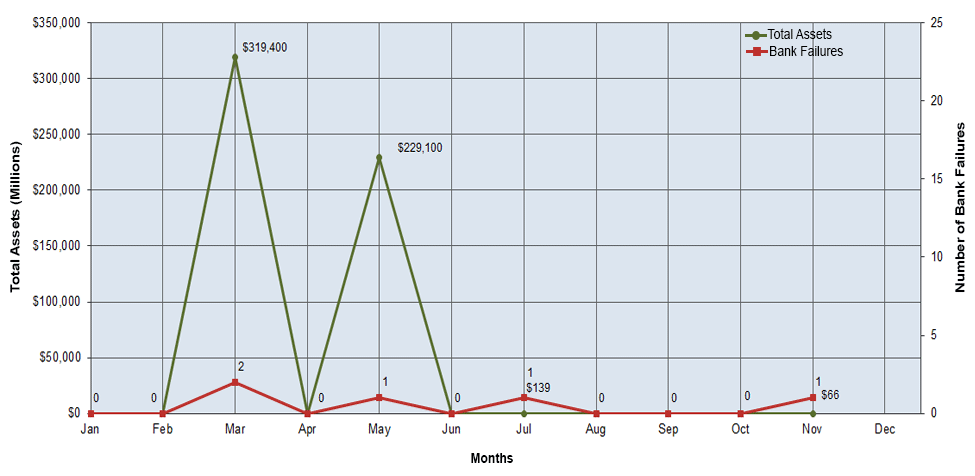

Over the course of five days in March 2023, three small-to-mid size U.S. banks failed, triggering a sharp decline in global bank stock prices and swift response by regulators to prevent potential global contagion. Silicon Valley Bank (SVB) failed when a bank run was triggered after it sold its Treasury bond portfolio at a large loss, causing depositor concerns about the bank’s liquidity. The bonds had lost significant value as market interest rates rose after the bank had shifted its portfolio to longer-maturity bonds. The bank’s clientele was primarily technology companies and wealthy individuals holding large deposits, but balances exceeding $250,000 were not insured by the Federal Deposit Insurance Corporation (FDIC). Silvergate Bank and Signature Bank, both with significant exposure to cryptocurrency, failed in the midst of turbulence in that market.

Bank Failures in Brief – 2023

In response to the bank failures, the three major U.S. federal bank regulators announced in a joint communiqué that extraordinary measures would be taken to ensure that all deposits at Silicon Valley Bank and Signature Bank would be honored.[1] The Federal Reserve established a Bank Term Funding Program (BTFP) to offer loans of up to one year to eligible depository institutions pledging qualifying assets as collateral.[2][3]

To prevent the situation from affecting more banks, global industry regulators, including the Federal Reserve, the Bank of Canada, Bank of England, Bank of Japan, European Central Bank, and Swiss National Bank intervened to provide extraordinary liquidity.[4][5][6]

By March 16, large interbank flows of funds were occurring to shore up bank balance sheets and some analysts were talking of a possibly broader U.S. banking crisis.[7] The Federal Reserve discount window liquidity facility had experienced approximately $150 billion in borrowing from various banks by March 16.[8]

Soon after the bank run at SVB, depositors quickly began withdrawing cash from San Francisco-based First Republic Bank (FRB), which focused on private banking to wealthy clientele. Like SVB, FRB had substantial uninsured deposits exceeding $250,000; such deposits constituted 68% of the bank’s total at year-end 2022, declining to 27% by the end of March, as $100 billion in uninsured deposits were withdrawn. Despite a $30 billion capital infusion from a group of major banks in March, FRB continued to destabilize and its stock price plummeted as the FDIC prepared to take it into receivership and find a buyer on April 29.[9][10] On May 1, the FDIC announced that First Republic had been closed and sold to JPMorgan Chase.[11][12]

![]()