US equity futures were subdued and European stocks rebounded from an early selloff as markets tried to stem the Wednesday rout sparked after a range of Fed speakers urged further fiscal stimulus, even as investors braced for another staggering weekly jobless claims figure, the latest evidence of a slowing economic recovery from a pandemic-led recession.

The FAAMGs which led a Wall Street rally since April, again edged lower in premarket trading. A 2% slide put Tesla Inc on course for its third straight day of declines following an underwhelming “Battery Day” presentation by Chief Executive Officer Elon Musk. At the same time, big banks including Goldman Sachs, Wells Fargo and JPMorgan gained between 0.8% and 1.6%. Nikola which is set for one of its biggest weekly declines ever, tumbled another 7.8% as Wedbush downgraded the stock to “underperform”.

The S&P 500 is hovering just above correction territory on waning hopes of more fiscal stimulus – which prompted Goldman overnight to slash its Q4 GDP forecast from 6% to 3% – signs of choppy economic growth and a sell-off in heavyweight technology-related names. The Nasdaq entered correction territory earlier this month, but the blue-chip Dow has outperformed its peers on demand for value-linked stocks such as industrials.

The MSCI World index was down 0.5% in morning trading, its fifth day in the red out of the last six and hovering near a two-month low. “Optimism on the recovery, optimism on the virus, and bets on stimulus were keeping markets well bid, and on all three of these issues, there has been a degree of disappointment this month,” said John Velis, an FX and macro strategist at BNY Mellon.

Despite markets betting on more U.S. fiscal stimulus, political stalemate in Washington continues to frustrate efforts to prop up the world’s biggest economy, beset by one of the worst COVID-19 death rates globally.

“A U.S. fiscal deal was baked into markets and now what you are seeing is that the probability of a deal going through has simply reversed,” said Justin Onuekwusi, a London-based portfolio manager at Legal and General Investment Management. “We have heard this week how important a fiscal deal is to the Federal Reserve but from a political standpoint, focus has moved more towards the election and Supreme Court deliberations rather than the economy,” he added.

In Europe, the Stoxx 600 Index initially slipped as much as 0.8% by, but has since erased most of the losses with improving German business optimism and a strong take-up of the latest European Central Bank liquidity operation providing some relief. After a summer lull in much of Europe, the infection rate has begun to rise sharply, with a number of countries including Britain introducing tougher rules to help limit the spread of the virus.

Earlier in the session, the MSCI Asia Pacific Index dropped 1.7% overnight, while Japan’s Topix index closed 1.1% lower with Takakita and Niitaka falling the most. The Shanghai Composite Index retreated 1.7%, with Wuxi Commercial and Guangdong Guanhao High-Tech posting the biggest slides. MSCI’s Emerging Markets Index was down 1.8%.

In rates, the 10-year Treasury yield was at 0.664%, down 0.5bps. Futures volume stood around 80% of 20-day average level ahead of risk events including 7-year auction and another bevy of Fed speakers including Powell at 10am. Yields remain within a basis point of Wednesday’s closing levels, 10-year around 0.67% with bunds outperforming by 1.5bp on haven flows. The week’s Treasury auction cycle concludes with the sale of $50b in 7-year notes at 1pm ET; Wednesday’s 5-year offering drew a record low yield about a basis point lower than the WI yield at the bidding deadline. High-grade euro zone government bond yields fell across the board on an expectation that stimulus measures would be maintained, with the German 10-year down 2.2 basis points.

In FX, flows into the dollar helped it rise for a fifth straight day following yesterday’s warnings by Federal Reserve officials that more fiscal stimulus is needed to sustain the economic recovery. The Bloomberg Dollar Spot Index advanced a fifth consecutive day, the longest streak since March, and the greenback touched a two-month high versus the euro at 1.1635, as it remained bid in amid a risk-averse sentiment.

The Norway’s krone fell a sixth consecutive day against the euro, the longest streak since February, to reach more than a four-month low after the central bank said rate hikes remains years away; Governor Oystein Olsen also said current situation doesn’t warrant any further intervention in the Norwegian krone similar to what Norges Bank did earlier when the currency weakened. Australian and New Zealand dollars extended losses as a strengthening greenback combined with soft local rates and speculative client flows weigh on the currencies. The Swiss franc advanced against the euro even as the Swiss National Bank said it’s on alert and ready to “intervene more strongly”after an intense battle earlier this year in response to the franc’s advance to a five-year high against the euro. The pound was steady versus the dollar before U.K. Chancellor Rishi Sunak announces plans to protect jobs from coronavirus upheaval.

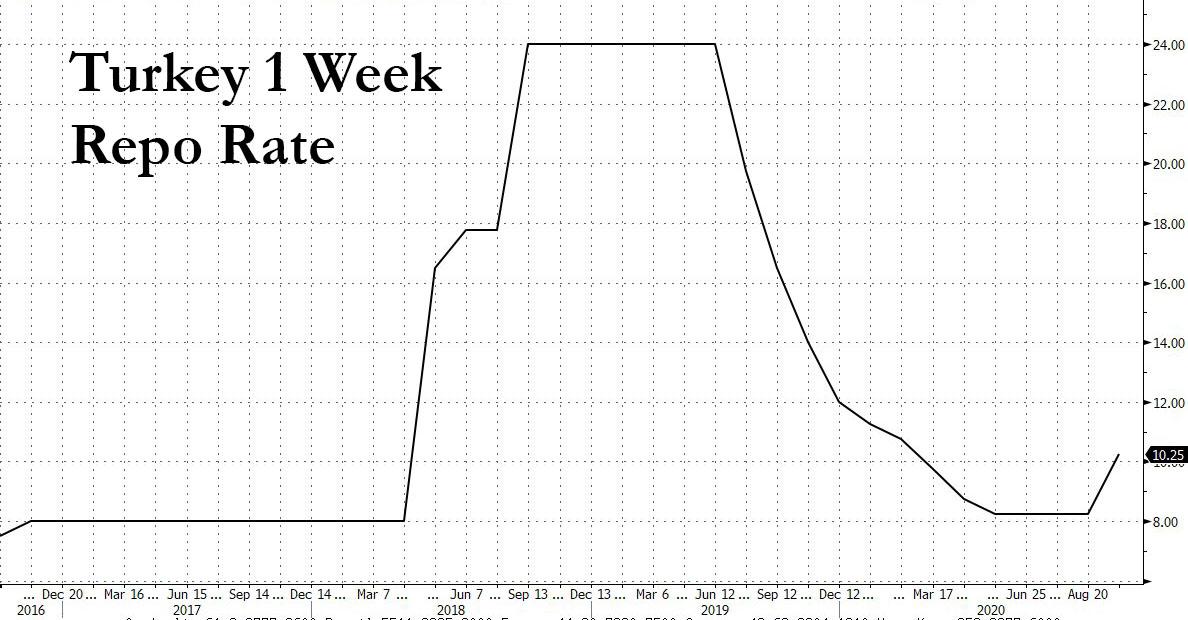

Elsewhere among regional rate-setters, the Swiss National Bank maintained its easy monetary policy, but turned less gloomy on the impact of the pandemic. In Britain, meanwhile, the finance minister launched a new jobs support scheme. In emerging markets, Turkey surprised markets with a hike in its policy rate by 200 basis points to 10.25%, sending the lira and bonds higher. Mexico is also set to decide on monetary policy later on Thursday.

In commodities, gold continued to drop tracking the rise in negative real rates.

With central bankers in focus globally, Federal Chair Jerome Powell will be watched later in the day when he delivers his third testimony for the week before the Senate Banking Committee, while other Fed officials are scheduled to speak at other events during the day. Investors are also waiting for weekly data due later on Thursday, which is expected to show U.S. jobless claims fell slightly but remained elevated, indicating the world’s largest economy is far from recovering. A similar picture was visible in Europe, where the European Central Bank’s latest Economic Bulletin said unemployment would continue to rise in the euro zone, with little growth in demand seen for consumer goods.

Expected data include jobless claims and new home sales. Accenture, CarMax and Costco are reporting earnings.

Market Snapshot

- S&P 500 futures down 0.2% to 3,225.75

- STOXX Europe 600 down 0.2% to 358.46

- MXAP down 1.6% to 168.03

- MXAPJ down 1.9% to 546.00

- Nikkei down 1.1% to 23,087.82

- Topix down 1.1% to 1,626.44

- Hang Seng Index down 1.8% to 23,311.07

- Shanghai Composite down 1.7% to 3,223.18

- Sensex down 2.2% to 36,832.76

- Australia S&P/ASX 200 down 0.8% to 5,875.94

- Kospi down 2.6% to 2,272.70

- Brent futures down 0.8% to $41.44/bbl

- Gold spot down 0.4% to $1,855.30

- U.S. Dollar Index little changed at 94.43

- German 10Y yield fell 1.6 bps to -0.521%

- Euro down 0.03% to $1.1657

- Brent Futures down 0.8% to $41.44/bbl

- Italian 10Y yield fell 1.5 bps to 0.647%

- Spanish 10Y yield unchanged at 0.224%

Top Overnight News from Bloomberg

- The day after Bank of England Governor Andrew Bailey poured cold water on the chance of negative rates, betting against them via the options market exploded

- The Swiss National Bank is on alert and ready to “intervene more strongly”after an intense battle earlier this year in response to the franc’s advance to a five- year high against the euro

- Euro-zone banks took 174.5 billion euros ($203 billion) in another dose of ultra-cheap funding from the European Central Bank. The bids for the targeted loans, known as TLTROs, came from 388 banks, and the takeup was at the high end of economists’ expectations

- France introduced new measures to fight the rapid resurgence of the coronavirus pandemic in major cities, adding to risks weighing on an already slowing economic recovery

- U.K. Chancellor of the Exchequer Rishi Sunak will set out a new crisis plan to protect jobs and rescue businesses as the coronavirus outbreak forces the U.K. to return to emergency measures

- German companies are turning increasingly optimistic that government support and a reluctance to return to wide-scale lockdowns will carry the economy through the coronavirus pandemic. The Ifo institute’s business climate index rose to 93.4 in September from 92.5 in August. That was slightly lower than the median forecast of economists in a Bloomberg survey. A gauge of expectations also improved

Asian equity markets were lower on spill-over selling from peers on Wall St where the major indices were dragged by broad weakness across all sectors and hefty losses in the big tech names, while President Trump’s comments also spurred concerns of a contested election. This was after he stated that he thinks the 2020 election will end up at the Supreme Court which is why it is important to have nine justices and later refused to commit when questioned about a peaceful transition of power if he loses the election. ASX 200 (-0.8%) was dragged lower by underperformance in tech and miners, as well as losses in financials after Westpac agreed to pay a record AUD 1.3bln fine over anti-money laundering breaches, while Nikkei 225 (-1.1%) was also subdued as exporters suffered from the recent inflows into the currency and ill-effects of the JPY-risk dynamic. Hang Seng (-1.8%) and Shanghai Comp. (-1.7%) conformed to the broad downbeat tone after a tepid liquidity effort which resulted to a net daily injection of CNY 10bln and it refrained from 7-day reverse repos owing to the National Day Golden Week holiday which begins next Thursday. Furthermore, there was still no significant improvement in US-China related headlines as US Secretary of State Pompeo reiterated calls for US Governors to increase scrutiny on state pension funds’ investments into Chinese companies, while TikTok filed for a preliminary injunction against President Trump’s ban. Finally, 10yr JGBs were rangebound and failed to benefit from the risk averse tone after similar lacklustre trade in T-notes and with demand also hampered by weaker results at the 40yr JGB auction.

Top Asian News

- Israel Controversially Tightens Lockdown as Virus Cases Soar

- South Korea Says North Korea Killed its Citizen, Burned Body

- Early Pandemic Bets Paid Off Big for a Few Asia Hedge Funds

European equities are now mixed after opening lower across the board (Euro Stoxx 50 -0.2%) in a continuation of the losses seen on Wall Street yesterday and in APAC hours. That being said, European equity futures came off lows following the cash open and are now mixed on the day whilst futures across the pond have been contained within tight ranges ahead of a slew of Fed speakers scattered throughout the day; currently mixed as well. Back to Europe, broad-based losses are seen across major bourses, but Netherland’s AEX (-0.5%) modestly underperforms as the tech sector lags (in-fitting with Wall Street and APAC performance), with heavy-weight ASML (-2.2%) weighing on the index and broader sector. The energy sector also resides as one of the straddlers amid price action in the complex. Overall sectors are mostly lower and somewhat of a defensive bias. The sectoral breakdown paints a similar picture, but performance is similarly off lows, with Travel & Leisure towards the bottom of the pile, whilst real estate, particularly in the UK, are supported ahead of Chancellor Sunak’s unveiling of further supportive measures. In terms of individual movers, AA (+4.6%) is firmer after confirming that a consortium of Towerbrook Capital and Warburg Pincus has expressed strong interest in pursuing a possible cash offer for the Co. Elsewhere, Veolia (-1.3%) CEO said the group is to hold discussions with Engie (-1.0%) and did not rule out increasing its bid for Engie’s holding of Suez (-3.9%).

Top European News

- Norges Bank Surprises Market as Rate Hike Remains Years Away

- JPMorgan Joins Rivals in Pausing London Office Return Plans

- German Business Optimism Improves With Economy on Recovery Path

- Virus Forces Sunak to Spend More on Saving U.K. Jobs, Firms

In FX, the SNB and Norges Bank both maintained benchmark rates, as widely expected, but the reaction in respective currencies has been quite contrasting given relative stability in the Franc around 0.9250 vs the Dollar and 1.0775 against the Euro compared to Eur/Nok rallying further through 11.0000 towards 11.1750 at one stage. It seems that the former has acknowledged no change in the Swiss Central Bank’s valuation of the Chf and perhaps more regular updates on intervention, while the Krona is taking heed of the rate path projecting steady policy for the next couple of years against some expectation that a hike may come before the 4th quarter of 2022.

- USD – Demand for the Dollar has accelerated again, and this time mainly on safe-haven grounds after a sharp retreat in US stocks and knock-on declines in global amidst the ongoing recurrence of COVID-19. The DXY has duly extended gains to 94.558 and pull-backs are getting shallower and more fleeting with the latest bout of consolidation stopping well ahead of 94.000, at 94.235. However, some G10 rivals continue to display a degree of resilience and resistance for the index resides relatively close by around 94.632 (March 9 high).

- AUD/NZD – No respite for the beleaguered Aussie or Kiwi, as Aud/Usd straddles 0.7050 having let go of the 0.7100 handle and Nzd/Usd struggles to retain 0.6500+ status following NZ trade data for August showing a deficit vs surplus due to a marked slowdown in exports rather than moderately higher imports.

- GBP/JPY/EUR/CAD – Sterling continues to defy the odds and gravity, with Cable resisting pressure below 1.2700 and Eur/Gbp probing 0.9150 after the cross formed a near double top around 0.9220 on Tuesday and yesterday ahead of Chancellor Sunak’s mini budget and more commentary from BoE Governor Bailey. Meanwhile, support at 105.50 seems to have arrested the Yen’s reversal from circa 104.00 and Usd/Jpy may be kept in check by decent option expiry interest spanning 104.45-55 (1.1 bn) to 105.70-75 (1.4 bn) with even more rolling off at the 105.00 strike (1.7 bn). Similarly, after a rather non-descript German Ifo survey in terms of key metrics vs consensus and an even more forgettable monthly ECB report, the Euro could be contained by expiries between 1.1600-10 and 1.1700-10 (1.7 bn and 1.2 bn respectively), though veering towards the downside after a hefty TLTRO3 take up. Elsewhere, the Loonie has recoiled to sub-1.3400 in wake of Canadian PM Trudeau’s stark warning that an Autumn bout of the coronavirus could be significantly worse than the original one in Spring, as a 2nd wave is already spreading across the country’s 4 biggest provinces.

- SEK/EM – Rhetoric from Riksbank’s Skingsley underlining limited space to cut the Swedish repo rate and discounting Crown developments have not prevented the Sek depreciating to almost 10.6000 before bouncing vs the Eur, but the Try and Mxn will be hoping for more support from the CBRT and Banxico. On that note, the NBH has helped the Huf via a 15 bp hike in the 1 week deposit rate having left the benchmark on hold on Tuesday.

In commodities, WTI and Brent front month futures are essentially flat firmly off overnight lows and relatively contained in early European hours amid a lack of fresh fundamental catalysts ahead of a raft of Central Bank speakers. Complex-specific newsflow has also been light, although the Iraqi oil ministry denied earlier reports, citing the Iraqi oil minister, that OPEC+ agreed for Iraq to increase oil exports. Iraq added that it is fully committed to the supply deal. WTI resides just below USD 40.00bbl (vs. current range of 39.12-40.00) while its Brent counterpart trades towards the top end of today’s range around USD 41.75/bbl (vs. current range 41.27-84). Elsewhere, spot gold mirrors USD action and briefly dipped below USD 1850/oz, while spot silver remains on a downward trajectory and underperforms in the precious metal space as it probes USD 22/oz to the downside. In terms of base metals, LME copper prices are softer amid the firmer USD and broad losses across equities. Conversely, Shanghai steel futures rose almost 3% amid future demand speculation as prices flipped into backwardation.

US Event Calendar

- 8:30am: Initial Jobless Claims, est. 840,000, prior 860,000; Continuing Claims, est. 12.3m, prior 12.6m

- 9:45am: Bloomberg Consumer Comfort, prior 47.7

- 10am: New Home Sales, est. 890,000, prior 901,000; New Home Sales MoM, est. -1.22%, prior 13.9%

- 11am: Kansas City Fed Manf. Activity, est. 14, prior 14

Fed speakers:

- 8:50am: Fed’s Kaplan speaks at Texas Christian University

- 10am: Powell, Mnuchin Testify Before Senate Banking Committee

- 12pm: Fed’s Bullard Discusses Economy and Monetary Policy

- 1pm: Fed’s Evans Discusses the U.S. Economy and Monetary Policy

- 1pm: Fed’s Barkin Speaks to the Money Marketeers of NYU

- 2pm: Fed’s Barkin Takes Part in Virtual Discussion on Economy

- 2pm: Fed’s Williams Discusses Virus Impact on Communities of…

- 2pm: Fed-s Bostic Speaks to Bankers on Racism

DB’s Jim Reid concludes the overnight wrap

Yesterday marked 6 months since lockdown started here in the U.K. and with the tightening restrictions announced over the last 36 hours I suspect we’ll have at least another 6 months of similarly restrictive conditions. How time flies. On that you may be amused to know my wife and I had a relatively big row on Tuesday night which I can now mention as we kissed and made up last night. In it she said one of the most hurtful things I have ever had directed at me. She said, or rather shouted ……. “Why can’t you just go back to the office full time…”. It was a hammer blow. I just said “fine I will…” which given the new restrictions might end up being illegal had I followed through. You won’t be surprised to learn the argument was about kids and childcare.

So Covid-19 looks like remaining at the epicentre of our lives for months or even quarters to come. Indeed Europe saw further increases in cases yesterday, as yet more signs emerged of further restrictions heading into winter. US markets fell sharply after Europe went home as the continual negative blows finally took their toll.

The S&P 500 lost -2.37% with over 94% of stocks in the index lower yesterday and 23 of 24 industries down on the day. Consumer durables and apparel were the one exception (+2.69%) on the back of Nike (+8.76%), who was the top performer in the overall S&P after the company posted much stronger results than expected. Tech (-3.21%) and Energy (-4.55%) stocks lost further ground too, with the NASDAQ falling -3.02%. Tesla saw one of the larger declines in the index with a -10.34% dip as reports came through of a network outage on top of the “Battery Day” disappointments we discussed yesterday. The VIX volatility index rose 1.7pts to 28.6 in its second largest daily jump since 3 Sept, when the current market weakness began.

Receive a daily recap featuring a curated list of must-read stories.

Risk-off sentiment has continued this morning with the Nikkei (-0.77%), Hang Seng (-1.78%), Shanghai Comp (-1.46%), Kospi (-1.79%), Asx (-0.94%) and India’s Nifty (-1.26%) all down. European futures on the Stoxx 50 (-1.04%), FTSE 100 (-0.89%) and Dax (-1.01%) are also pointing to a weak open in the region. Meanwhile, futures on the S&P 500 and Nasdaq are trading broadly flat. In Fx, the US dollar index is up a further +0.09% this morning and on course for the strongest weekly performance since April. Elsewhere, crude oil prices are down c. -1%.

On the virus it’s beginning to feel a bit like March-lite. In France, it was announced by Health Minister Veran last night that the country would be divided into “zones” by alert level and they would empower local authorities to tighten restrictions before a state of emergency would be declared within them. Marseille, the second largest city in the country and the Carribbean Island of Guadeloupe are the only “maximum” level zones today. The minster also announced that bars and restaurants in the Paris region as well as other major cities will close at 10pm, similar to the rules recently laid out in the UK. Attendance at large public events will be cut down to 1,000 from 5,000, while small gatherings over 10 people are banned in those “maximum” level areas.

Meanwhile in Germany, the foreign minister Heiko Maas went into quarantine as a result of one of his security detail having the virus, even though an initial test on Maas came up negative. Germany also issued travel warnings to more parts of France. Elsewhere, China will ease restrictions on entry of some foreign nationals as the country said foreigners holding residence permits for work, personal matters and reunions will be allowed to enter China starting September 28.

In terms of case numbers, the UK reported a further 6,178 yesterday, which was the highest number since May 1, and sent the 7-day average above 4,500. That comes ahead of an announcement today from Chancellor Sunak in the House of Commons, who tweeted yesterday that he’d be speaking about “our plans to continue protecting jobs through the winter.” With the furlough scheme scheduled to conclude at the end of October, there have been reports that Sunak is looking at a German-style wage subsidy program, similar to the Kuzarbeit program, which would see the government top up the wages of part-time workers.

Over in the US, there was some positive news on the vaccine front, as Johnson & Johnson announced yesterday that they were launching their Phase 3 trial, which will involve a single vaccine dose given to up to 60,000 participants. This is different to a number of the other candidates, which involve a second dose, and Dr Fauci said in a statement that this “may be especially useful in controlling the pandemic if shown to be protective after a single dose.” J&J said that they anticipate the first batches could be available for emergency use authorisation in early 2021, should they be proven to be safe and effective. Meanwhile various media reports suggest that the UK government is considering carrying out the first studies that would deliberately expose healthy people to the coronavirus in a bid to accelerate the development of a vaccine. The report further added that a growing number of volunteers have signed up to take part in such studies should researchers decide to proceed. This could help AstraZeneca in speeding up its Phase 3 trials as they continue to remain on halt in the US. Bloomberg suggested this wouldn’t start until January though if it got the green light.

Late last night, aPresident Trump news conference signalled that he may try to veto any tightening of FDA rules surrounding the emergency clearance of a coronavirus vaccine. This may increase concerns that the vaccine is being politicised. On the other side, overnight we also heard from Dr. Anthony Fauci, the head of the National Institute of Allergy and Infectious Diseases, and Stephen Hahn, the commissioner of the FDA, who both said that drug companies still face hurdles to authorising a vaccine. Dr. Fauci said that he expected a vaccine to be authorized at the earliest by November, while Dr Hahn stressed that the FDA would soon issue a number of additional guidelines. Elsewhere, the president again criticised mail-in ballots and as we showed in yesterday’s CoTD (link here) the US public is also very distrustful of mail-in ballots.

From central bankers, it was the 2nd day out of 3 featuring a testimony from Fed Chair Powell, and he was again asked about how the Fed could further help Main Street. The Fed Chair noted that the central bank had “done basically all of the things that we can think of” and reiterated that the economy needed fiscal stimulus. We also heard from a bevy of other Fed governors who all sought to convey the importance of fiscal aid. The Fed’s Rogerson noted that the “toughest part” of the recovery is still ahead, and that he was less optimistic than peers due to a lack of fiscal help and a second Covid-19 wave. The Fed’s Evans noted that members were concerned that the fiscal stimulus which was embedded in the FOMC’s outlook would not come to fruition, saying that the estimated jobless numbers had factored in roughly $1 trillion of fiscal support. Fed Governor Quarles joined the refrain of the day in asking for more fiscal help. As we have noted, the Senate and House are clearly more focused on the election – and also now a supreme court seat – than getting an additional fiscal stimulus bill through in the short term. While the Fed member’s spoke throughout the New York afternoon, we saw a clear move out of risk assets and the dollar index rose to an 8-week high, finishing +0.43%, having risen every session this week.

On the other side of the Atlantic, the STOXX 600 continued to come back from Monday’s loses, gaining +0.55% before the US later slump. The index was up as much as +1.5% in early trading before a mix of deteriorating virus news flow from Europe and negative market sentiment from the US saw the index fall into the close. Over in the fixed income sphere, Italian sovereign debt continued to outperform following the country’s regional election results, and the yield on 30yr BTPs fell a further -1.9bps yesterday to an all-time low of 1.768%. Spreads also narrowed further, with those on both 10yr Italian and Spanish debt over bunds reaching their tightest levels since late February when investors began to realise the pandemic’s impact on Europe. In the US, 10yr rates were up modestly (+0.2bps) at 0.672%. However there was a decline in inflation expectations – especially given some of the Fed rhetoric – with breakevens down -1.9bps to 1.603%, their lowest closing level in 6 weeks. Between the decline in inflation expectations and the rally in the greenback discussed earlier gold had its worst day in over a month, falling -1.94% to close under $1900/oz for the first time since 23 July. With the precious metal falling, its more volatile peers silver (-6.64%) and platinum (-3.08%) saw deep losses as well.

In terms of yesterday’s data, the main highlight came from the flash PMI readings, where there were clear signs that the services sector in Europe was being affected by the second wave of Covid-19. The Euro Area services PMI fell to 47.6 (vs. 50.6 expected), so below the 50-mark that separates expansion from contraction, with both Germany (49.1) and France (48.5) underperforming expectations. The big question as we enter Q4 next week will be whether activity can avoid a decline in the face of a virus resurgence. Manufacturing was more positive however, and the Euro Area (53.7), French (50.9) and German (56.6) numbers were all in expansionary territory. PMI readings were comparatively better in the US, showing continued momentum in the recovery though they were slightly lower than in August. The composite reading was just 2 tenths lower at 54.4, as services were just under expectations at 54.6 after being 55.0 last month. The country’s manufacturing numbers were in line with expectations (53.5), and actually up 0.4 from last month.

To the day ahead now, and the data highlights include the German Ifo business climate indicator for September, French business confidence for September, while from the US we’ll get the weekly initial jobless claims, new home sales for August and the Kansas City Fed manufacturing index for September. From central banks, we’ll hear from Fed Chair Powell at the Senate Banking Committee, as well as the Fed’s Bullard, Evans, Barkin, Williams, Kaplan and Bostic. Otherwise, we’ll hear from Bank of England Governor Bailey, ECB chief economist Lane, and the ECB will release its latest Economic Bulletin. In addition, both the Turkish and Mexican central banks will be deciding on monetary policy. Source: ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()