Why is the love of money a root of all kinds of evil? To help us answer this, we must look at the passage in its greater context. Near the end of the letter (1 Timothy 6:2–10), Paul is exhorting Timothy regarding the need to “teach and urge these things” to his congregation, “these things” referring back to earlier material in the epistle. Paul then warns Timothy about false teachers who will seek to warp and pervert the content of sound doctrine for their own greedy gain (verses 3–5). Now notice what the apostle says at the end of verse 5: “Imagining that godliness is a means of gain.” These false teachers do what they do for the fame and notoriety they achieve, along with the financial rewards it brings.

Paul wants to steer Timothy away from that trap. In doing so, he tells him the real source of “great gain;” namely, godliness with true contentment (verse 6). Contentment, in a biblical sense, is the recognition that we come into the world with nothing and that everything we have is a gift from God’s hands (verses 7–8). Yet those who desire to be rich (i.e., those who have the “love of money”) are the ones who are led into temptation and fall into a snare (verse 9). Paul concludes the passage by telling Timothy that the love of money leads to all sorts of sin and evil.

Simple reflection on this principle will confirm that it is true. Greed causes people to do all sorts of things they wouldn’t normally do. Watch any number of TV courtroom dramas, and the crime under consideration is usually motivated by jealousy or greed, or both. The love of money is what motivates people to lie, steal, cheat, gamble, embezzle, and even murder. People who have a love for money lack the godliness and contentment that is true gain in God’s eyes.

But the Bible makes an even stronger statement about the love of money. What we have discussed thus far simply describes the horizontal level of the love of money. In other words, we have only mentioned how the love of money can lead one to commit greater sins against his fellow man. But the Bible makes quite clear that all sin is ultimately against God’s holy character (Psalm 51:5). We need to consider the vertical dimension to the love of money.

In the Sermon on the Mount, Jesus said, “No one can serve two masters, for either he will hate the one and love the other, or he will be devoted to the one and despise the other. You cannot serve God and money” (Matthew 6:24). This verse comes at the end of a passage in which Jesus tells us to “lay up treasures in heaven” (v. 19). Here, Jesus likens a “love of money” to idolatry. He refers to money as a “master” we serve at the expense of serving God. We are commanded by God to have “no other gods” before the only true and living God (Exodus 20:3; the first commandment). Anything that takes first place in our lives other than our Creator God is an idol and makes us guilty of breaking the first commandment.

Jesus had much to say about wealth. His most memorable conversation about money is His encounter with the rich young ruler (Matthew 19:16–30). The young man asks Jesus what he must do to obtain eternal life, and Jesus tells him to follow the commandments. When the man tells Jesus that he has done all that, Jesus tests his ability to obey the first commandment and tells him to sell all his possessions and give it to the poor and to follow Him. The young man couldn’t do this; his wealth had become an idol—it was his master!

After this encounter, Jesus turns to His disciples and says, “Truly, I say to you, only with difficulty will a rich person enter the kingdom of heaven. Again I tell you, it is easier for a camel to go through the eye of a needle than for a rich person to enter the kingdom of God” (Matthew 19:23–24). This is a hard saying, especially for 21st-century people living in North America. Jesus is saying that wealth is one of the biggest obstacles to coming to faith in Christ. The reason is obvious: wealth becomes a slave master in our lives and drives us to do all sorts of things that drive us further and further away from God. The good news is that what is impossible for man, entering into the Kingdom of God, is possible with God (Matthew 19:26). Source

Financial markets the world over are increasingly chaotic; either retreating or plunging. Our view remains that there’s a gigantic market crash in the coming future — one that has possibly started now.

Our reason for expecting a market crash is simple: Bubbles always burst.

In today’s hyper-interconnected world of global banking, if one domino falls, it will topple any number of others. The points of connectivity are so numerous and tangled that literally no human is able to predict with certainty what will happen. Which is why the action now occurring in the banking sector is beginning to smell like 2008 all over again.

This time it looks like the trouble is likely to begin in Europe, where we’ve been tracking the woes of Deutsche Bank (DB) for a while. But in Italy, banks are carrying 18% non-performing loans and an additional double digit percentage of ‘marginally performing’ or impaired loans. Taken together, these loans represent more than 20% of Italy’s GDP, which is hugely problematic.

The Italian banking sector may have upwards of 25% to 30% bad or impaired loans on the books. That means the entire banking sector is kaput. Finis. Insolvent and ready for the restructuring vultures to take over.

List of US Banks in Financial Trouble

RELATED Fleet Bank History LEARN MORE →

Over the last few years, the financial markets in the United States hit some lows. Local and national banks started to close or merge with larger banks once the companies could no longer manage business logistically. The Federal Deposit Insurance Corporation is responsible for making sure that each deposited transaction and bank member. This government institution was established in 1933 after reexamining the events that led to the Great Depression four years earlier. The FDIC has a list of troubled banks that it updates periodically to ensure the awareness of these hurting establishments.

Georgia Banks

Founded in 2006, One Georgia Bank is an Atlanta-based establishment located in the heart of Midtown. Located in Stockbridge, High Trust Bank celebrated its 105th anniversary as a financial institution this year. However, Ameris Bank acquired both of these banks on July 15th, 2011 when the FDIC declared these banks as financial failures. Established in 2003, the Mountain Heritage Bank of Clayton, GA was shut down by the FDIC on June 24th, 2011. It later became acquired by the First American Bank and Trust Company. McIntosh State Bank of Jackson, GA. was shut down by the FDIC on June 17th, 2011 and became merged with the Hamilton State Bank. On May 20th, the First Georgia Banking Company and the Atlantic Southern Bank were both closed and CertusBank acquired both.

Florida Banks

The First Peoples Bank of St. Lucie, FL was founded in 1999. However, the bank was shut down on July 15th and later merged with the Premier American Bank. On June 17th, the First Commercial Bank of Tampa Bay was closed and the Stonegate Bank took over any remaining assets. The Coastal Bank of Cocoa Beach, FL was shut down on May 6th, 2011. The Florida Community Bank, a subsidiary Premier American Bank, acquired the Coastal Bank afterward.

VIDEO OF THE DAY

Brought to you by TechwallaBrought to you by Techwalla

Colorado Banks

On July 8th, the FDIC received two separate banks and later delegated control to two different companies. The Signature Bank of Windsor was acquired by the Points West Community Bank while the Colorado Capital Bank was taken over by the First-Citizens Bank and Trust Company.

Washington Banks

Columbia Bank and its subsidiary, Columbia State Bank, have acquired two Washington state banks for the month of May in 2011. The first institution, Summit Bank of Burlington, was closed on May 20th after 97 years of service. First Heritage Bank of Snohomish was closed on May 27th.

Arizona Banks

The Prescott, AZ branch of the Summit Bank was closed by regulators on July 15th, 2011. This particular branch later became transferred to the Foothills Bank. Earlier in the year, the Legacy Bank of Scottsdale was closed on January 7th. The Enterprise Bank & Trust assumed all remaining assets.

Illinois Banks

The First Chicago Bank & Trust, originally opened in 1903 under the First Chicago Bank name. The bank was placed on the failed list and shut down by officials on July 8th. The Northbrook Bank & Trust Company has assumed responsibility ever since. The Western Springs National Bank and Trust was closed on April 8th, 2011 and was later taken over by Heartland Bank and Trust Company.

Billion Dollar Bank Failure – Guaranty Bank of Wisconsin Closed by Feds

May 5, 2017

For the second week in a row a billion dollar bank was closed by regulators. Last week it was First NBC Bank of New Orleans and today it was Guaranty Bank, Milwaukee, Wisconsin (doing business as Best Bank in Georgia and Michigan). Overwhelmed by bad loan, the Comptroller of the Currency shuttered Guaranty Bank and […]

Five Billion Dollar Bank Failure – First NBC Bank, New Orleans, Closed by Regulators

April 29, 2016

A very large bank failure occurred today when state regulators closed First NBC Bank, New Orleans, and appointed the FDIC as receiver. To prevent losses to depositors, the FDIC took a significant hit to its Deposit Insurance Fund and sold First NBC Bank to Whitney Bank, Gulfport, Mississippi. In terms of asset size the collapse of […]

Allied Bank, Mulberry, AK, Becomes Fifth Bank Failure of 2016

September 26, 2016

It’s been six years since a bank failed in the state of Arkansas but this trend ended on Friday when state regulators closed Allied Bank in Mulberry, Arkansas. The failure of Allied Bank apparently had no linkage to the health of the overall business environment in Arkansas. According to the Arkansas Banking Commissioner, Candace Franks, “This […]

The Woodbury Banking Company Closed by Regulators

August 19, 2016

The Woodbury Banking Company, a tiny bank located in Woodbury, Georgia, was closed today by Georgia state regulators. The FDIC, appointed as receiver, sold the bank to United Bank, Zebulon, Georgia, in order to protect depositors of the failed bank. Founded over a hundred years ago in 1902 The Woodbury Banking Company remained a very […]

First Cornerstone Bank, King of Prussia, PA – Largest Bank Failure of 2016

May 7, 2016

The largest banking failure of the year occurred when state regulators closed the First Cornerstone Bank, King of Prussia, PA. In order to protect depositors, the FDIC in its role as receiver, entered into a purchase and assumption agreement with First-Citizens Bank & Trust Company, Raleigh, North Carolina. First Cornerstone Bank was established in March […]

Trust Company Bank, Memphis, TN, Closed by Regulators

April 30, 2016

Trust Company Bank, Memphis, Tennessee, was closed by state regulators who appointed the FDIC as receiver. In order to protect depositors the FDIC sold the failed bank to The Bank of Fayette County, Piperton, Tennessee. Trust Company Bank is the second banking failure of the year. The last banking failure of 2016 occurred on […]

North Milwaukee State Bank, WI, First Bank Failure of 2016

March 11, 2016

The first bank failure of 2016 occurred today when regulators closed a small bank in Wisconsin. It has been almost six months since the last banking failure in the U.S. The last FDIC insured bank failure occurred on October 2, 2015 when regulators closed Hometown National Bank, Longview, WA. North Milwaukee State Bank, Milwaukee, Wisconsin, […]

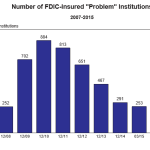

FDIC Insured Problem Banks at Lowest Level Since 2008

November 25, 2015

The number of banks on the FDIC Problem Bank List continues its steady decline since peaking at 888 banks in March 2011. According to the latest FDIC Quarterly Banking Profile the number of problem banks stood at 203 as of September 30, 2015, down by 25 banks since the previous quarter. The number of problem […]

Hometown National Bank, Longview, WA, Closed by Regulators

October 3, 2015

After almost three months since the last bank closing regulators closed two banks on the first Friday of October. The first bank failure occurred when The Bank of Georgia, Peachtree, GA, was closed, followed shortly thereafter by the failure of the Hometown National Bank, Longview, Washington. In order to protect depositors the FDIC sold the failed Hometown National […]

The Bank of Georgia Closed By Regulators – 7th Bank Failure of 2015

October 3, 2015

After almost a three month hiatus of bank failures, regulators closed The Bank of Georgia, Peachtree City, Georgia. Fulfilling one of its primary roles as guarantor of depositor funds, the FDIC sold the failed bank to Fidelity Bank, Atlanta, GA, which will assume all of the deposits of The Bank of Georgia. Established in February 2000 by […]

Premier Bank, Denver, CO, Becomes Sixth Bank Failure of 2015

July 11, 2015

After a hiatus of two months the sixth banking failure of 2015 occurred today when regulators closed Premier Bank, Denver, CO. The last banking failure occurred on May 8th when Edgebrook Bank, Chicago, IL, was closed. After being shut down by the Colorado Division of Banking, the FDIC was appointed as receiver and sold the […]

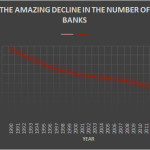

The Amazing Decline in the Number of Banks Has Resulted in Big Bank Domination

May 28, 2015

The number of banks operating in the United States has been in an amazing decline for the past 25 years. Many institutions disappeared after going bust during the savings and loan crisis of the early 1990’s while hundreds more collapsed during the financial panic and banking crisis that started in 2008. Since 2008 a total […]

Problem Banks Fall to Six Year Low

May 28, 2015

According to the latest FDIC Quarterly Banking Profile the number of problem banks has declined to a six year low. As of March 31, 2015, a total of 253 banks were still classified as problem banks by the FDIC, down from 291 at the end of 2014. During the first quarter of 2015 a total […]

Edgebrook Bank, IL, Closed by Regulators – Fifth Bank Failure of 2015

May 9, 2015

After over a two month hiatus with no bank closings, regulators swooped in to close the Edgebrook Bank, Chicago, Illinois. The last banking failure occurred on February 28, 2015 when regulators closed the Doral Bank, San Juan, Puerto Rico. After the Illinois Department of Financial & Professional Regulation closed Edgebrook Bank, the FDIC was appointed […]

Bank Failures Decline But Still Above Pre Banking Crisis Levels

March 4, 2015

Prior to the banking crisis that began in 2008 bank failures had been a rare occurrence with only 32 banking failures between 2000 to 2007. During 2008 the wheels began to fall off the financial system and bank failures increased dramatically as loan defaults soared. As the banking crisis worsened bank failures reached a peak […]

Yes – It Is Still Possible to Get High Interest Rates on Your Savings

March 4, 2015 By P

In 2007 it would have been inconceivable for anyone to imagine that savers would receive virtually zero percent return on their money. The entire concept of wealth creation is built not only upon savings but upon the magic of compound interest whereby your money works for you by earning more money. It wasn’t that long […]

Doral Bank Collapses After Years of Financial Losses – Largest Bank Failure Since 2010

February 28, 2015

The largest bank failure since 2010 left the FDIC on the hook for almost $1 billion in losses as the giant $5.9 billion asset Doral Bank, San Juan, Puerto Rico, was closed by bank regulators. Doral Bank has been a bank failure waiting to happen as years of losses and economic turmoil in Puerto Rico […]

Number of Problem Banks Declines for 15th Consecutive Quarter

February 26, 2015

According to the latest FDIC Quarterly Banking Profile the number of problem banks continued to decline for the quarter ending December 31, 2014. After reaching a peak of 888 at the end of the first quarter of 2011 the number of problem banks has declined for 15 consecutive quarters. The number of problem banks is […]

Capitol City Bank & Trust Co, Georgia, Collapses – Largest Bank Failure of 2015

February 13, 2015

The largest bank failure of the year occurred today as regulators closed down Capitol City Bank & Trust Company, Atlanta, Georgia. After shuttering the bank, the Georgia Department of Banking & Finance appointed the FDIC as receiver. To protect depositors the FDIC sold the failed bank under a purchase and assumption agreement to First-Citizens Bank […]

Highland Community Bank, IL, Second Bank Failure of 2015

January 23, 2015

The second bank failure of the year occurred in Illinois when state regulators closed Highland Community Bank, Chicago, IL. During 2014 Illinois had five banking failures, the most of any state. After closing Highland Community Bank, state regulators appointed the FDIC as receiver. To protect depositors the FDIC sold the failed bank to United Fidelity […] Source

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers

![]()