If the Christian wants to know God’s will, he turns to the Bible. If the Christian wants to discern right from wrong, he turns to the Bible….

Heading into a global recession first and then a US recession to follow.

Consider the macro context here: Nine major economies are either in a recession or on the verge of it. This includes Germany, UK, Italy, Mexico, Brazil, Argentina, Singapore, South Korea, Russia. Everything else is slowing down hard. Yields are plummeting for a reason and once again the world is looking to central banks to bail everyone out and for stimulus programs to be launched to rescue a global economy that hasn’t been able to do without in 10 years. US consumers are holding the US economy up is the consensus as they keep spending for now, but already we saw a dip in confidence. Why? Trade tensions, political tensions, and yes, concerns that the longest business cycle may come to an end. Add scary stock market headlines and before you know it the consumer is holding back.

And hence confidence must be maintained under all circumstances. This has been the game for 10 years and hence any market drops that would add pressure to confidence must be averted. Do you really think it’s an accident we see intervention always at the point of serious trouble?

Retail sales dropped hard in December as markets plummeted. It’s no coincidence. Hence any prolonged malaise must avert.

As Mohamed El-Erian pointed out so clearly this week:

“We may end up in a situation where people read these alarmist headlines, they get concerned, they stop spending. As they stop spending, companies stop investing. And then we get a major slowdown:”

Alarmist headlines? How about headlines that point out reality? But the larger point is clear: Lose the consumer and a recession is unfolding perhaps more quickly than anyone can imagine. After all, nobody on the planet called for a 1.5% US 10 year yield in 2019 or a German 10-year bund at -0.72%.

And nobody in 2018 called for a renewed global easing cycle to go in full swing in 2019. But these are now a reality. And this reality reveals a larger truth:

Without intervention, without stimulus, without artificial help markets fall apart. If the Fed doesn’t cut rates in September markets plunge. Plain fact. If the ECB doesn’t cut rates and outline a new QE program Europe is heading fully into recession. If China or Switzerland or others don’t interfere in their currency markets things fall apart. These actions are taken out of desperation and make for an unspoken admission:

Markets can’t be left on their own. Economies can’t be left on their own. We must always intervene. Our market system no longer functions without intervention, be it a central bank or fiscally driven.

It is no accident that Blackrock is lobbying for the ECB to buy stocks directly, it is no accident that they are lobbying for “helicopter” money to bail out the system in the full recognition that the central bank intervention gig is reaching a point of no return, a loss of efficacy.

2019 should be known as the year when central banks began to choke at the absurdity of the market structure they have imposed on the world. 10 years of intervention with little growth to show for except rampant debt expansion, ever-expanding wealth inequality and absolutely no admission of failure. The Fed’s spectacular policy error and failure to recognize the impending shift in the global economy that was well advertised in advance makes them just as guilty as everyone else that failed to see what was happening. Again. Always chasing reality. Never admitting mistakes. Why? Because CONfidence must be maintained. If the supposed stewards of the economy don’t know what they’re doing why should anyone have confidence in their ability to prevent what the bond market signaling? Best keep pretending we know what we’re doing.

And it is precise because of deteriorating confidence and data that President Trump spectacularly choked this week. Having threatened to raise tariffs further on China with markets all-time highs in July it suddenly blew up in his face as markets sold off hard and recession risk exploded to the upside with yield curves inverting. Quick to try to repair the damage he suddenly announced a delay in tariffs only to see the resulting rally falter and the $DJIA drop 800 points in one day. No wonder he called the big bank CEOs. Not the kind of headlines you want to see if you’re running for re-election. Hence the aftermarket close tweets to suddenly say nice things about President Xi and to sheepishly suggest a face to face meeting, all are a classic attempts at jawboning and this weekend’s announcement to give Huawei reprieve is part of the same strategy.

Bring trade hope back, bring optimism back. How long markets will fall for this remains to be seen. Strategically this public capitulation, however, gives the Chinese the upper hand in the trade war negotiations. They sense weakness, the weakness that’s obvious to everyone. Trump can’t afford a recession in 2020 nor deteriorating economic sentiment. How will the Chinese take advantage of this? This remains to be seen, but the longer there is no resolution the higher the risk of a global recession.

Don’t expect Trump to be beneath agreeing to a shoddy marketing deal, as long as it serves the larger purpose, and therein lies the risk forbears: Get a surprise truce, or even a shoddy deal and a massive relief rally, spurring confidence back up, can certainly ensure into Q4 and push the global recession another year or 2 further into the future.

See massive rate cuts and stimulus announcements and asset prices can once again race to the upside at least in the short term. That is the bull case. Intervention. Because this is what it takes.

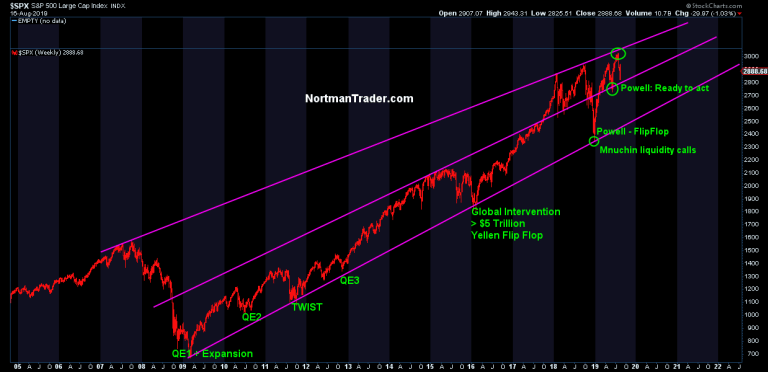

And it is absolutely necessary here as the 2019 uptrend has been broken:

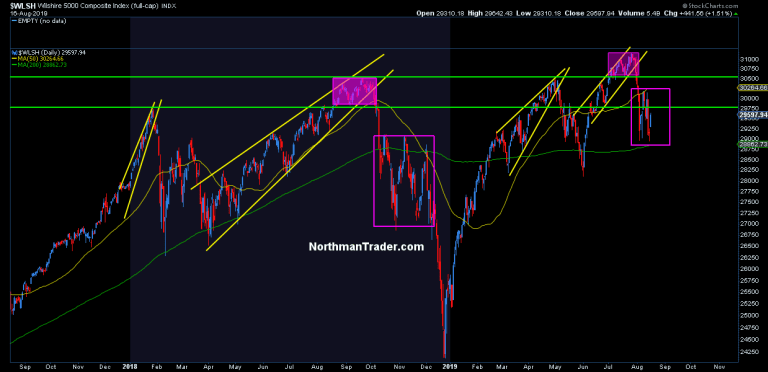

and as markets have once again rejected new highs and dropped below previous highs:

And here’s the problem in all this. When central banks have normalized and had plenty of ammunition they have efficacy. But they haven’t normalized and when the business cycle turns in earnest a couple of rate cuts are not enough. Far from it. In 2000 and 2007 it took 500bp+in rate cuts to stop the bleeding. And Blackrock I suspect knows this, hence the call for helicopter money.

How do you introduce helicopter money with the US already running a trillion-dollar deficit? With a political system that’s entirely broken at this point? Beats me.

And so the parade to maintain confidence continues. The daily headlines, the jawboning, the ever more dovish central bankers. Next week we get to hear from them all at Jackson Hole, and in September we get showered with more announcements of rate cuts and stimulus.

For the Fed, the choice is clear: Blow the market valuation wall beyond its historic limits or risk a massive sell-off by disappointing and ruin confidence. For the ECB the choice is also clear: Cut rates from negative to more negative and re-introduce more QE or risk immediate recession. Happy retirement Mario Draghi. The central banker who never raised rates and never did anything but print money. Congrats.

For Donald Trump, the choice is also clear: Insist on the trade war with no real solution in sight and risk blowing his re-election chances or cave. That he is willing to cave and bow to market pressure he has already shown this week.

For bulls, there is no choice but hope intervention works again because without intervention natural price equilibrium is much lower. And so the bull case is once again dependent on central bank intervention to bring about multiple expansion. No intervention, no bull case. That’s the state of markets.

And so the next few weeks are an important journey of price discovery in the context of markets that have just broken their 2019 uptrend and face lots of overhead resistance. Last week gave us short term oversold readings, but no true fear bottom.

Welcome to the battle for CONfidence. Source

The Bible records two instances of Jesus cleansing the temple of money changers and those selling sacrificial animals. Jesus’ first encounter with money changers was at the beginning of His three-year ministry (John 2:14–16). He made a whip of cords and drove them out. The second time He confronted the money changers was the week before His trial and crucifixion. Seeing that the money changers had come back, He again drove them out, saying, “It is written, ‘My house will be called a house of prayer,’ but you are making it ‘a den of robbers’” (Matthew 21:13).

Because Jewish law required a temple tax of a half-shekel (Exodus 30:11–16), Jews and visitors from other nations came to pay their taxes when they offered their sacrifices. But foreign coins with the likeness of pagan emperors would not be accepted in God’s temple. So money changers exchanged those foreign coins for Jewish money, but they did so at an exorbitant profit. Rather than provide this service as a business in another part of town, they exploited the religious zeal of the visitors to Jerusalem and did their business on temple grounds. Because they determined their own exchange rate, money changers easily took advantage of the poor and the foreigners pouring into Jerusalem for Passover.

StevieRay Hansen

Editor, Bankster Crime

The people spreading concrete information on the dangers of globalism are accomplishing far more than those sitting around buying bitcoin or passing around Q-cult nonsense.

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers

“Have I, therefore, become your enemy by telling you the truth?”

![]()