Amos: 11 “Behold, the days are coming,” says the Lord God, “That I will send a famine on the land, Not a famine of bread, Nor a thirst for water, But of hearing the words of the Lord. 12 They shall wander from sea to sea, And from north to east; They shall run to and fro, seeking the word of the Lord, But shall not find it. 13 “In that day the fair virgins And strong young men Shall faint from thirst.

Just what exactly is terrifying the Fed?

Over the last week, multiple Fed officials have surfaced to suggest the Fed needs to start cutting interest rates right now.

Indeed, on Thursday, John Williams, who runs the NY Fed (the branch in charge of market operations) suggested the Fed needs to cut rates to ZERO again.

This is happening at a time when economic data is rebounding, unemployment is below 4% and GDP growth is north of 3%.

So what exactly is going on? What does the Fed know that has it so terrified because it’s obviously not the US economy.

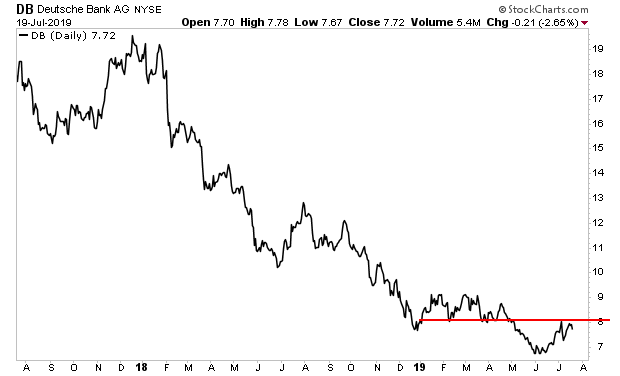

1) Deutsche Bank (DB) is imploding.

Sitting atop over $49 trillion in OCT derivatives, DB is like Lehman Brothers 2.0. And despite the best efforts of management and the authorities, the bank is imploding. DB shares were rejected by resistance last week, ending the “hope bounce” from recent moves to curtail the blow-up.

Is This What Has Got the Fed So Spooked?

2) China’s banking system is freezing.

China experienced its first financial institution failure in 21 years in June. Depositors and creditors lost 30% of their deposits in the process.

Put another way, nearly 30% of their money is GONE.

The Chinese banking authorities are attempting to piece the system back together, but it’s not working. The duress has yet to spill over into the Chinese stock market, but on Friday interbank lending in the mainland temporarily spiked to 1,000%, meaning a large bank was willing to pay ANYTHING in order to get access to capital.

This is EXTREMELY similar to what happened to the US credit markets n 2008.

And finally…

3) The Everything Bubble has burst.

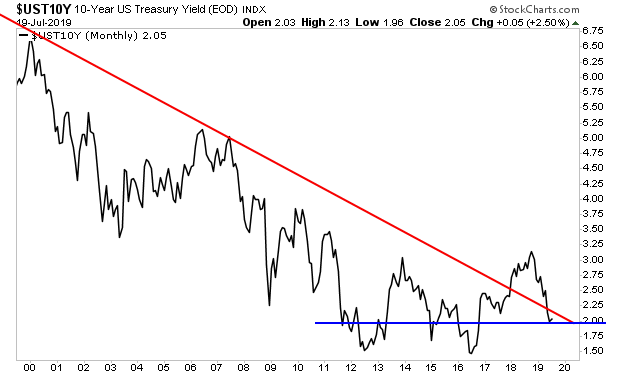

Treasuries are the bedrock of the current financial system and their yields represent the risk-free rate of return against which all risk assets are priced. So when the Fed created a bubble in these bonds, it created a bond in EVERYTHING.

The single most important bond in the world is the 10-Year US Treasury Bond. And thanks to the Fed’s tightening policy in 2018, it burst, with the yield on the 10-Year US Treasury breaking its 20-year downtrend.

The Fed is trying to get yields back into this downtrend. But it’s not going well. The yield temporarily broke back below the downtrend last month but is beginning to bounce again.

If the Fed cannot get this situation under control, there’s $555 trillion in derivatives at stake. Yes, TRILLION with a T.

Something BIG is coming and the Fed knows it.

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers #The Fed #Amos

“Have I therefore become your enemy by telling you the truth?”

![]()

Day-Traders Send US Producer Prices Soaring In July

US Producer prices were expected to rise MoM following four declines in the last five months and they did, rising 0.6% MoM (double the expected…

Read More