This is where we stand as we enter Monday morning:

- European markets are firmer this morning, though the FTSE 100 significantly outperforms on a second-wave of UK election optimism.

- China State Council stated it will continue to suspend additional tariffs on US vehicles and auto parts due to the Phase One deal.

- China sources cited by CNBC’s Yoon note that the USD 40-50bln target on agricultural purchases is a “best case target”.

- Boeing (BA) is mulling cutting or stopping its 737 MAX production, via WSJ – Co. shares are down 2% pre-market

- USD remains subdued although Sterling and Euro were dented by the latest poor PMIs.

Now that “Phase one” of the US-China deal is in the history books, traders around the world are bracing for a full year of “Phase Two” optimism in continuation of the only thing that matters since the spring of 2018 (that, and central banks cutting like there’s a global crisis, of course). And after US cash markets hit a new all-time high on Friday, world stock markets rules to catch up with the US on Monday, trading at fresh all-time highs in what was another “sea of green” day.

Whether it was looking ahead to Phase Two optimism, or simply relishing the (non) deal that was China’s ridiculous promise to double US ag imports, Wall Street was quick to try and shape narratives as one of buying the rumor and then buying the news as well:

“We may have reached the point of ‘peak tariffs’ and this deal could be the start of a series of phased rollbacks, which could unlock further upside for equity markets, driven by an improvement in business confidence and a recovery in investment,” said Mark Haefele, CIO of UBS Global Wealth Management in a note to clients. We may have… but we haven’t, because as Morgan Stanley explained most supply chains are already in process of being moved while the “deal” will hardly inspire confidence among companies to spend more on CapEx.

For now, however, the optimism is working: European shares stormed out of the gate, and the pan-European STOXX 600 index was up by 1.1% hitting a new record high. Germany’s DAX rose as much as 0.5%, despite weakness in the Stoxx 600 Automobiles & Parts Index which underperformed the broader gauge. German auto stocks fell after China’s ambassador to Germany threatened retaliation if Germany excludes Huawei Technologies Co. as a supplier of 5G wireless equipment. Auto-parts stocks such as Valeo and Hella also underperformed after Morgan Stanley cut both stocks along with Schaeffler to underweight, saying that suppliers have failed to fully understand the size of structural changes ahead, which makes it tough to justify their re-rating against OEMs.

European markets also ignored the latest disappointing PMI print, indicating that Europe remains stuck in a manufacturing recession: German private sector activity shrank for the fourth month running in December as a downturn in manufacturing offset services sector growth in Europe’s largest economy. Across the border, French businesses grew at a steady pace in December despite a nationwide strike against pension reform, although activity in the manufacturing sector came unexpectedly close to stagnating. Overall, the Eurozone composite PMI was unchanged at 50.6, modestly missing the expectation of a rebound to 50.7, driven by continued manufacturing weakness which shrank from 46.9 to 45.9, well below the 46.9 expectation, while the Services PMI rose modestly from 51.9 to 52.4.

The weakness was largely due to another decline in both German and French mfg PMIs, both of which dropped, with the former now in contraction since March and the latter just one pension strike away from a sub-50 print.

Earlier in Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan to its highest level since April 18. It was last up 0.13%. Australia’s S&P/ASX 200 led the way as it jumped 1.63%, while shares in Taiwan added 0.22%. Japan’s Nikkei 225 succumbed to some profit-taking, falling 0.29% after surging 2.55% to a 14-month closing high on Friday.

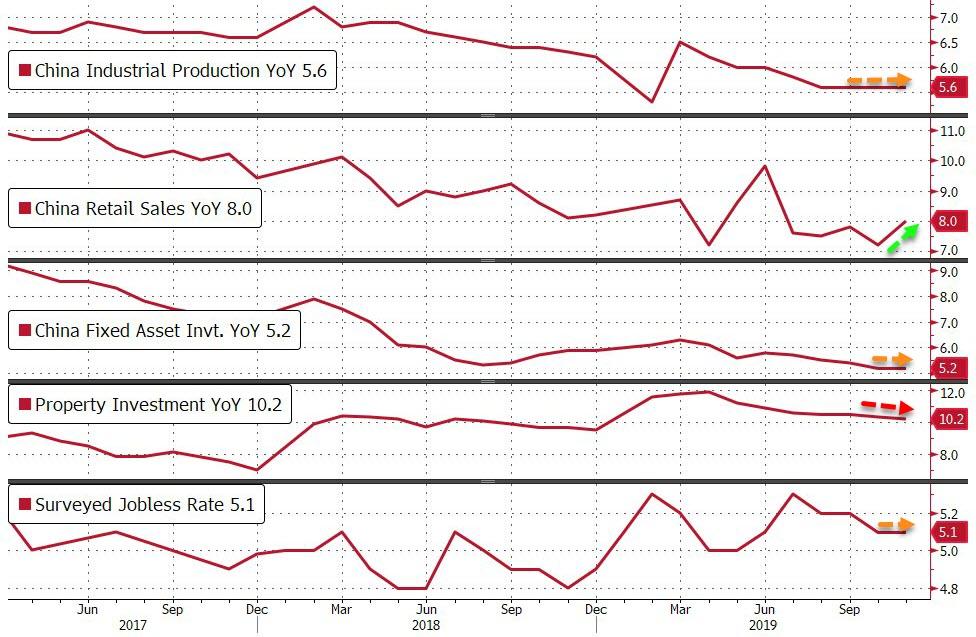

While everyone was busy ignoring the latest European economic data, markets were positively giddy at the all too credible rebound in Chinese data unveiled late on Sunday night which saw most indicators post a sharp and orchestrated rebound.

Chinese investors initially had a more tepid reaction to the trade news, with the blue-chip CSI300 index struggling to rise further after trade hopes fanned a near 2% rise on Friday. But after a lackluster morning session, the CSI300 index turned higher in the afternoon and was last up 0.3%, helped by the latest industrial output and retail sales data.

And so, thanks to China’s latest data dump, positive sentiment helped push MSCI’s All Country World Index up 0.15%, after hitting an all-time high on Friday when the trade deal was agreed.

Looking at the latest trade development, on Sunday, China State Council stated it will continue to suspend additional tariffs on US vehicles and auto parts due to the Phase One deal, whilst also suspending the additional 5-10% tariffs on some US goods planned to take effect on December 15th, according to CNBC’s Yoon. Meanwhile, China’s Foreign Ministry said that more trade information will be released in due course and working-level officials from both sides remain in contact.

China sources cited by CNBC’s Yoon note that the USD 40-50bln target on agricultural purchases is a “best case target”, and that the US would likely allow ‘best endeavor’ purchases; adds that general feeling on tariff rollback is an issue of linguistics. Additionally, CNBC’s Yoon adds, no Chinese confirmation regarding the hard targets for US agricultural purchases; although, China is likely to agree but cannot acknowledge this publicly due to a possible backlash.

In addition to the trade deal, markets were excited by the apparent end of the Brexit drama, if only for the time being. Ryan Felsman, the senior economist at CommSec in Sydney, said the trade deal and the receding risk of a disorderly Brexit after the British election produced a strong Conservative majority provided support for sentiment in Australia. A lower-than-expected Australian budget surplus due to a sluggish economy has also “built expectations by markets for further easing from the Reserve Bank (of Australia),” he said. He added that investors wanted more details and the reduction in U.S. tariffs may have disappointed some looking for more aggressive action.

“Certainly there were expectations perhaps that the rollback would be more significant than just 50%.”

In the US, S&P futures were back to record highs hit last week. U.S. shares struck a cautious note on Friday, paring initial gains to end barely higher as wary investors awaited signs of a concrete deal.

However, the news of a deal was still enough to send the S&P 500 to a record closing high of 3,168.8, up just 0.01%. The Nasdaq Composite added 0.2% to end at 8,734.88, also a record, and the Dow Jones Industrial Average rose 0.01% to 28,135.38.

In rates, U.S. Treasury yields moved modestly higher on Monday, after the sharp reversal on Friday, reflecting the more positive mood. Benchmark 10-year Treasury notes rose to 1.8452% compared with their U.S. close of 1.821% on Friday, and the two-year yield touched 1.6304% compared with a U.S. close of 1.604%.

In FX, the Bloomberg Dollar Spot Index slipped and the euro held gains after data showed the euro-area economy is still struggling. EURUSD touched 1.1151 versus the dollar before paring gains after a slew of European PMIs. Treasuries halted their advance from Friday, while euro-area bonds were mostly higher. As noted above the latest Eurozone composite PMI stayed at 50.6 in December, slightly lower than the forecast of 50.7. The reading signals fourth-quarter output will be the weakest since the region exited a double-dip recession in the second half of 2013.

Sterling pared Asia session gains on profit-taking and after a flash indicator for all business activity dropped to the lowest since the aftermath of the 2016 Brexit referendum; manufacturing activity slipped to 47.4, a sharper downturn than the 49.2 reading predicted by economists.

In commodities, oil prices which had risen on Friday following the deal, climbed further on Monday. Brent crude rose 0.1% to $65.28 per barrel, and U.S. West Texas Intermediate crude was down 0.05% at $60.11 per barrel. Spot gold prices were down 0.06% at $1,474.64 per ounce.

Looking at today’s US calendar we get the November Markit PMI data, December Empire State manufacturing survey, NAHB housing market index, October net long-term TIC flows, total net TIC flows.

Market Snapshot

- S&P 500 futures up 0.3% to 3,181.25

- STOXX Europe 600 up 1% to 416.15

- MXAP down 0.1% to 168.88

- MXAPJ up 0.06% to 542.89

- Nikkei down 0.3% to 23,952.35

- Topix down 0.2% to 1,736.87

- Hang Seng Index down 0.7% to 27,508.09

- Shanghai Composite up 0.6% to 2,984.39

- Sensex down 0.1% to 40,950.83

- Australia S&P/ASX 200 up 1.6% to 6,849.71

- Kospi down 0.1% to 2,168.15

- German 10Y yield fell 1.5 bps to -0.304%

- Euro up 0.1% to $1.1133

- Italian 10Y yield rose 20.4 bps to 1.09%

- Spanish 10Y yield fell 0.7 bps to 0.406%

- Brent Futures up 0.1% to $65.33/bbl

- Gold spot up 0.1% to $1,477.23

- U.S. Dollar Index down 0.1% to 97.08

Top Overnight News

- China’s economy showed signs of stabilizing and regaining growth momentum in November; industrial output rose 6.2% from a year earlier, versus a median estimate of 5.0%. Retail sales expanded by 8.0%, compared to a projected 7.6% increase. Fixed-asset investment was unchanged at 5.2% in the first eleven months, the same as forecast

- President Recep Tayyip Erdogan warned that Turkey could shut down two of the most critical NATO installations on its territory if the U.S. imposes sanctions over its purchase of an advanced Russian missile-defense system

- Boris Johnson will appoint top ministers to his cabinet on Monday as he pushes ahead with Brexit, emboldened by the historic majority he won in last week’s British general election

- China’s economy showed signs of stabilizing and regaining growth momentum in November, adding to the good news for the nation’s outlook after a preliminary trade deal with the U.S. was reached last week. China steps up talks with U.S. on opening its companies’ books

- China’s ambassador to Germany threatened Berlin with retaliation if it excludes Huawei Technologies Co. as a supplier of 5G wireless equipment, citing the millions of vehicles German carmakers sell in China

- Australia’s Treasury lowered its forecast surplus for the 12 months through June 2020 to A$5 billion ($3.4 billion) from April’s budget estimate of A$7.1 billion as it scaled back estimated tax revenues, according to the Mid-Year Economic and Fiscal Outlook released in Canberra Monday. It also predicted narrower surpluses for the following three fiscal years

- Oil retreated from a three-month high as optimism the U.S.-China trade deal will spur demand for crude gave way to caution due to the agreement’s limited nature and lack of detail

- Hong Kong’s demonstrators clashed with police late Sunday as Chief Executive Carrie Lam visited Beijing where she’s expected to update Chinese President Xi Jinping and other senior officials on the violent protests that have gripped the city for the past six months. Chinese Premier Li Keqiang gives Hong Kong leader fresh boost after protests

Asian equity markets traded mixed following relatively light newsflow over the weekend and last Friday’s flat performance on Wall St. where the major indices consolidated near-record levels after the confirmation of a US-China Phase One deal which officials plan to sign in early January, although some noted the deal was only limited and questions arose over the feasibility of China committing to as much as USD 50bln of US agriculture goods. ASX 200 (+1.6%) was lifted by outperformance in defensives and the top-weighted financials sector with sentiment buoyed after the world’s 2 largest economies averted the December 15th tariffs, while Nikkei 225 (-0.3%) was subdued by the recent pullback in USD/JPY and as the latest Japanese Manufacturing, PMI data remained in contraction territory. Hang Seng (-0.7%) and Shanghai Comp. (+0.6%) were constrained despite the phase one agreement confirmation and better than expected Chinese data in which Industrial Production and Retail Sales both topped estimates, as the stats bureau stated the economy still faces relatively big downward pressure and amid expectations for a reduced growth target for next year, while the mood in Hong Kong was also soured by a rise money market rates (Overnight HIBOR +57bps) and the resumption of violent protests over the weekend. Finally, 10yr JGBs were flat with prices hampered by last week’s resistance levels and with demand also subdued due to the absence of the BoJ in the market today.

Top Asian News

- Top Turkish Bankers Say They Were Fired on Orders of Regulators

- India Protests Spread as Anger Against Citizenship Law Grows

- Masayoshi Son’s Bankers Are Worried About Their Favorite Client

- Philippine Stocks Sink to Two-Month Low as Utilities Retreat

European equities kick-start the week on the front foot [Eurostoxx 50 +0.7%] following on from a relatively mixed APAC session, with traders citing an overall improvement in the trade environment as a reason for the advances. Cash Stoxx 600 (+1.1%) managed to notch intraday record highs, albeit the FTSE 100 (+2.1%) stands as the marked outperformer amid further post-election tailwinds on large-cap stocks, miners benefitting from rising copper prices and exporters taking advantage of a declining Sterling – Standard Chartered (+3.3%), RBS (+3.2%), Barclays (+3.5%), Glencore (+4.0%), BHP (+3.2%), Rio Tinto (+2.9%) and Antofagasta (+2.7%). DAX and other core European indices stalled gains amid disappointing December Flash PMIs. Sectors opened modestly in positive territory but have since gained traction, with cyclical Materials and Financials outperforming on the back of FTSE 100 gainers. In terms of other individual movers, Novartis (unch) opened lower after the Co. stated it will be dropping development of its asthma drug amid a string of disappointing trials. Meanwhile, Kerry Group (-3.5%) shares fell to the foot of the pan-European index after losing a USD 26bln deal to International Flavours and Fragrances for US-listed DuPont’s nutrition division (+1.9% pre-market). Last but not least, Sports Direct (+20%) soared on the back of a profit jump with group revenue increasing 14% YY which comes amid performance woes after the Co. acquired the troubled House of Fraser.

Top European News

- Euro-Area Economy Ends 2019 Still Struggling as Momentum Stalls

- Factory Woe Puts U.K. Economy on Brink of Contraction, PMI Shows

- German Factory Slump Deepens Again as Recovery Seems Elusive

- U.K. Rainmakers Eye Dealmaking Return Post Tory Election Win

In FX, Sterling’s post-UK election 2nd coming was already fading after a fleeting foray above 1.3400 vs the Dollar and test of resistance around the psychological 0.8300 level against the single currency when the preliminary PMIs for December confounded expectations for some improvement and missed consensus by quite a distance, especially in the manufacturing sector. Cable duly retreated towards 1.3325 and the cross rebounded to circa 0.8350 even though the earlier Eurozone flash surveys were also disappointing, and Germany’s manufacturing headline in particular. However, Eur/Usd remains depressed within a 1.1123-50 range and may struggle to pull away from decent option expiries between 1.1120-25 and 1.1100-10 (1.2 bn clips) rather than challenging slightly larger interest at 1.1150 (1.3 bn).

- NZD/CAD/AUD – All firmer vs their US counterpart that continues to flounder (DXY anchored around 97.000), with the Kiwi keeping tabs on the 0.6600 handle, Aussie hovering just under 0.6900 and Loonie pivoting 1.3150 in wake of some upbeat Chinese data overnight (ip and retail sales) and further reserved reflection on US-China trade deal Phase 1. Nzd/Usd and Aud/Usd have both regrouped after losing some ground on independent impulses via growth forecast downgrades from the NZIER and government respectively, while the former also took note of Westpac rolling its RBNZ rate cut prediction to August next year from February.

- NOK/SEK – The Scandi Crowns are both holding firm lines ahead of this week’s Norges Bank and Riksbank policy meetings, but Eur/Nok’s retreat is more technical after breaching the 100 DMA (10.0385) compared to Eur/Sek’s reversal through 10.4300 in anticipation of a 25 bp repo rate hike on Thursday.

- CHF/JPY – The safe-haven Franc and Yen are narrowly mixed against the Buck, with Usd/Chf nearer the bottom of a 0.9825-45 band in contrast to Usd/Jpy hovering just below 109.50 compared to 109.25 at one stage and flanked by expiries between 109.00-05 and 109.50 in 1bn.

In commodities, little to report on the commodities front – with WTI and Brent futures largely unchanged on the day, albeit in positive territory after a relatively flat APAC session. WTI futures trade on either side of USD 60/bbl whilst its Brent counterpart topped USD 65/bbl in recent trade with little by way of fresh fundamental catalysts, and with participants somewhat cautious of the US-China Phase One deal amid a lack of details and a paucity on China’s commitments. Elsewhere, gold prices remain choppy within a tight USD 5/oz range thus far, as traders and investors await further Phase One details. Copper meanwhile has resumed its upward trajectory with risk-sentiment a cited factor, although upside may be more due a receding USD and above-forecast China industrial production and retail sales. Finally, Dalian iron ore futures fell in excess of 1.5% after data showed weekly utilization rates at 163 mills across China slumped almost 66 – thus casting fresh doubts on demand for the base metal.

Receive a daily recap featuring a curated list of must-read stories.

- 8:30 am Empire Manufacturing, est. 4, prior 2.9

- 9:45 am: Markit US Composite PMI, prior 52

- Markit US Manufacturing PMI, est. 52.6, prior 52.6

- Markit US Services PMI, est. 52, prior 51.6

- 10 am NAHB Housing Market Index, est. 70, prior 70

- 4 pm: Net Long-term TIC Flows, prior $49.5b

DB’s Jim Reid concludes the overnight wrap

This is the last full week of the year and there are still a number of interesting events/data points to get through before the soporific Xmas week. I’m starting it a bit tired as for the second night in a row I fell asleep trying to finish “The Irishman” – the new Scorsese/De Niro et al film with de-aging technology used. It’s very very good but 3hr 30mins is a little tough to watch in one (or even two) sitting(s) after a day running after atrociously behaved children. We’ll be trying to finish tonight.

As for this week, today’s global flash PMIs stand out, along with the German IFO (Wednesday) and the BoE/BoJ meetings (Thursday). We don’t often mention the Swedish central bank decision as to the main highlight but on Thursday it’s expected that the Riksbank will end Sweden’s five-year experiment with negative rates and take them back to zero even though they haven’t met their inflation target. As concerns over the side effects of negative rates rise around the world, especially in Europe, a lot of attention will be placed on how the Swedish economy and banking system deals with this in the months ahead.

More on the week ahead below but after a lot of drama, we finally got a Phase One trade deal between the US and China, confirmed by both sides on Friday. The legal work, full details, and signing (probably in January) is still to come but it appears that agreement has been made. The immediate consequence is that the tariffs scheduled to have come into effect yesterday have now been suspended. Meanwhile, tariffs on $120bn of Chinese imports by the US will be halved from 15% to 7.5%, although 25% on a remaining $250bn worth will remain, and the fact sheet released by the US Trade Representative’s office said that China has committed “to import various U.S. goods and services over the next two years in a total amount that exceeds China’s annual level of imports for those goods and services in 2017 by no less than $200 billion.” Looking forward, President Trump tweeted that discussions on the Phase Two deal would begin “immediately”, as opposed to after next year’s presidential election. There will clearly be relief that it looks like a deal has been done but there are fewer tariff rollbacks than some had thought likely and Mr. Trump’s comments suggest phase two will be a live issue straight away. My base case was that this would wait until after next November’s election assuming he won. So it will be very interesting as to how much Trump keeps the negative China rhetoric alive in 2020 after the deal is eventually signed.

Staying with politics and as an additional word on the U.K. election result from the end of last week, I wonder if it marks a new chapter in populism. The victorious Conservative Party is traditionally a party of the better off with the Labour Party the party of the poorer and working-class communities. The problem is that the working class is generally in favor of Brexit and the Conservatives ruthlessly exploited this and they subsequently voted for them in waves in areas that haven’t for a century in some cases. To maintain this support the Tories will have to shape policy to help those left behind by globalization (mostly in the north of the country) and by definition reduce inequality. If you want to see a great graph look at the FT today where they show a scatter of the percentage of blue-collar jobs in a constituency against the vote swing in this election in favor of the Tories. There was a big correlation. Although politics isn’t often rational, it would make perfect sense if this election heralded a spending bias towards the poorer parts of the U.K. that voted for Brexit. In terms of the read-through to other countries, to arrest the rise of populism we’ve always thought mainstream parties will adopt more populist policies aimed at the so-called left-behinds. No-one has done this better in terms of winning an election than Mr. Trump in the US and Boris Johnson in the U.K. The confusing thing about the Trump presidency is that his tax cuts were biased towards the rich which is probably why the likes of Warren and Sanders remain in the Presidential race and populism is still alive there. As we said on Friday though, the U.K. election result may at the margin make Democratic voters conclude that a lurch too far to the left is dangerous in Anglo-Saxon countries. We will see. Nevertheless, the concluding remark is that the U.K results show that populism is far from dead – it’s just that mainstream parties can morph into populist parties if the will is there. To me, it seems that European mainstream parties have so far struggled with this. I wonder if lessons will be taken from this on the continent.

Overnight, we’ve seen a number of data releases from China that have surprised to the upside, something that will further boost sentiment after the reaching of a Phase One agreement with the US. November retail sales were up +8.0% YoY (vs. +7.6% expected), while industrial production was up +6.2% YoY (vs. +5.0% expected). That said, fixed-asset investment over the Jan-Nov period was only up +5.2% YoY, the joint weakest since at least 1998 where data became more readily available. Equity markets in Asia are treading water this morning though, with the Nikkei (+0.03%), the Shanghai Comp (+0.06%) and the Kospi (-0.05%) seeing little movement in either direction, though the Hang Seng is down -0.37%. S&P 500 futures are up +0.28% following another record high for the index on Friday.

In terms of a fuller rundown of the week ahead, for today’s PMIs, we’ll see manufacturing, services, and composite PMI data for France, Germany, the Euro Area, UK, and the US. So quite a collection to watch for, especially as the market expectation is that the global economy is steadily turning after recently bottoming out. In November, the PMIs showed some sign of this in the Euro Area with a 50.6 reading for the composite PMI, but which included both Germany (49.4) and Italy (49.6) in contractionary territory led by manufacturing.

With the Fed and the ECB have announced their policy decisions in the week just gone, attention will turn to central banks elsewhere over the week ahead. The major action takes place on Thursday, with the Bank of Japan, Bank of England, Riksbank, the Banco de Mexico, and Bank Indonesia all announcing policy decisions that day. As we said at the top the Riksbank might be the most interesting longer-term as they are expected to end a 5-year dalliance with negative rates. The rest of the world will be watching to see if the sky falls in or whether this helps persuade people that negative rates are part of the problem. My guess is the latter when the history books are written.

In terms of central bank speakers next week, there’s a conference being held at the ECB on Wednesday in honor of Benoît Cœuré, whose 8-year tenure on the ECB Executive Board concludes at the end of the month. Cœuré himself, along with ECB President Lagarde and the Fed’s Brainard will all be making remarks there. In the US, we’ll also hear tomorrow from New York Fed President Williams, Boston Fed President Rosengren, and Dallas Fed President Kaplan. Chicago Fed President Evans will also be speaking on Wednesday.

Staying with Europe, Wednesday sees the publication of the latest Ifo survey from Germany. Last month, the business climate indicator rose to its highest level since July, so it’ll be interesting to see if recent momentum is sustained, with the consensus looking for a modest increase to 95.5. Separately, Wednesday also sees the final release of the CPI and core CPI readings for the Euro Area in November, and on Friday there’ll be the advance December reading of the European Commission’s consumer confidence reading for the Euro Area.

From the US, we also have a number of key readings out this week. Alongside the PMIs, Tuesday sees the release of November’s industrial production figures, as well as housing starts and building permits data. Last month, building permits rose to their highest level since May 2007, so it’ll be interesting to see if this strength in the recent data is sustained. Friday sees the final Q3 US GDP reading where the component breakdown will influence Q4 thinking.

Recapping Friday and last week now. Global markets were buoyed by the combination of a Phase One deal between the US and China, along with signs of a resolution to the immediate Brexit impasse from the UK election. The S&P 500 ended the week up +0.73% (+0.01% Friday) at a new record high, while in Europe the STOXX 600 was up +1.15% (+1.09% Friday) at its highest level since April 2015. Bond yields ended the week slightly lower after a sizeable trading range, with 10yr Treasury yields down -1.4bps (-7.0bps Friday), and 10yr bund yields -0.3bps (-2.0bps Friday). The removal of downside risks to the global economy saw investors move into other risk assets, with Brent crude up +1.29% (+1.59% Friday) last week, while the spread of BTPs over bunds narrowed by -8.9bps.

Meanwhile, UK assets rallied on Friday as it emerged the Conservatives had won an 80-seat majority at the general election. Sterling ended the week up +1.45% (+1.29% Friday) at $1.3331, its highest level since March, while against the euro it was up +0.94% (+1.39% Friday) at its highest level since July 2016. UK equities also outperformed, with the FTSE 100 up +1.57% (+1.10% Friday), while the more domestically-focused FTSE 250 index was up +2.75% (+3.44% Friday). Banks, in particular, rose following the result, with Friday seeing big share price moves for Lloyds Banking Group (+5.25%), Barclays (+6.18%) and RBS (+8.39%). The other major rises were seen from the companies that had been floated as targets for nationalization by Labour. Centrica, the parent of British Gas, was up +10.51% on Friday, its best day since November 2008, while BT Group was up +6.54%, its best since November 2018.

Finally, in terms of data on Friday, US retail sales were weaker than expected, with a +0.2% (vs. +0.5% expected) increase in November, although the previous month was revised up a tenth to +0.4%. The year-on-year figure fell to +2.9%, its lowest since June. In spite of the figures, Fed Vice Chair Clarida said on Fox Business that “the U.S. consumer’s never been in better shape in my professional career.” Elsewhere, New York Fed President Williams also sounded a positive note on the outlook, saying that “we’ve got the economy on a very strong footing, sustainable footing, for good growth next year.” Source HNewsWire Bankster ZeroHedge

StevieRay Hansen

Editor, Bankster Crime

“debtors are hostage to their creditors.”

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The Birth Pains Are Growing Stronger….

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

My name is Steve Meyers and I need to share a vision and warning that the Lord showed me back in April 2007….

Many of you will ask why I waited so long to share the warning. I didn’t. I shared the story with everyone that would listen from pastors to friends to family to colleagues. Immediately following the initial vision, I called a close friend. I told him to sit down that I had something to tell him. I needed it documented as I knew this was supernatural and from God. As I witness events unfolding today, I need to share the vision again.

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user. Steve Meyers, StevieRay Hansen

People’s hearts are troubled, their minds are in a state of confusion, the Bible tells us a time of great delusion that will come upon the people, that time has arrived, the politicians must come up with more significant and more believable lies in order to bring on the antichrist, we have entered the doorstep Tribulation.

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

censored.news/

Tagged Under: #Fraud #Banks #Money #Corruption #Bankers,#Powerful Politicians, #Businessmen

![]()