Less than a year after his finance ministry failed to broker a merger between Commerzbank and Deutsche Bank in a bid to rescue the flailing German lending giant (Deutsche) and create a new national champion (or so he hoped), German Finance Minister Olaf Scholz is embarking on a campaign to convince the European Union to finish work on a comprehensive banking union.

Many have argued that Europe’s lack of a comprehensive banking regulatory framework makes the system particularly vulnerable to chaos and infiltration by criminal groups (evidenced by the money-laundering scandal that has embroiled several northern European banking giants).

Olaf Scholz

And with Brexit finally nearing the end game, or so it appears, Scholz argues that Europe’s global position would be at risk if it doesn’t finish the integration of the eurozone’s financial sector, seeing as the EU is losing one of its main financial centers in London.

The plan to centralize oversight of eurozone banks was conceived years ago in response to the debt crisis that threatened to destabilize the entire continent earlier in the decade. Many have argued that the system would help avoid taxpayer bailouts with a new deposit guarantee scheme designed to help keep liquidity taps open. However, some have criticized the plan (especially within Germany) as a scheme to leave German taxpayers on the hook for mismanagement of foreign banks).

In a lengthy editorial published in the FT, Scholz argued that it’s time to end political divisions that have prevented the banking union from becoming viable. The project is critical to ensure EU banks can be safely wound down without a bailout. In the editorial, Scholz tries to link the timing to Brexit.

Then again, we can think of another reason why Germany would want to start to shore up government support for European banks.

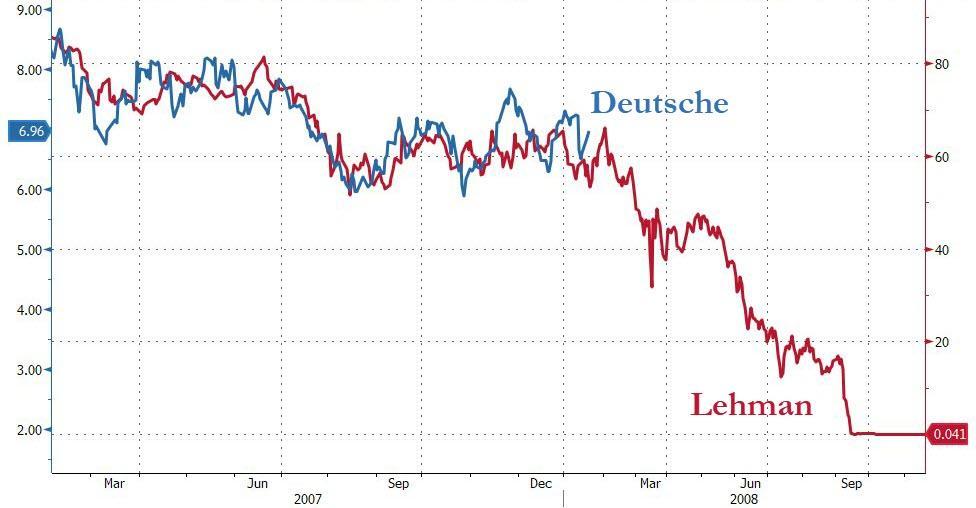

Enter Deutsche Bank, the struggling German lending giant with a derivatives exposure in the tens of trillions of dollars. DB is a bank that, thanks to years of mismanagement and hamfisted corporate crime, has become the largest domino in Europe’s extremely shaky financial system. DB has continued to lose a staggering amount of money every quarter while scrambling to cut expenses by drastically reducing staff.

Meanwhile, the bank’s persistent misfortune has sent its share-price consistently lower, on its way toward the big “0”.

As the FT explains, the most controversial component of Scholz’s plan is something that hasn’t even been embraced by his fellow Germans yet. It’s a deposit scheme intended to shield depositors during a banking collapse. At first brush, it sounds like something fastidious Germans would never consider.

While the policy probably faces an uphill climb, it has won the support of the new European Commission President Ursula von der Layen (though according to Reuters the plan hasn’t been formally discussed by the German government, and it’s unclear whether Chancellor Angela Merkel will support it).

According to the FT, Scholz’s plan has many safeguards to protect the people of Germany from being saddled with bailing out foreign banks from country’s with weaker financial systems. But these same safeguards might lead to diminished support in Italy.

Aside from the deposit scheme, Scholz’s plan also involves amending EU capital rules to remove incentives for banks to buy up large quantities of their home country’s sovereign debt, while also putting forth common EU rules for taxing companies on their profits.

Scholz also wants the EU to harmonize bank insolvency laws, arguing that the existing patchwork of national rules undermines EU attempts to make sure senior creditors share the costs of dealing with bank failures.

So far, the plan has received a “lukewarm reception,” according to another Reuters report. Both the ECB and the Commission, both under new leadership, reportedly said they support finishing the Continent’s banking union, but had some disagreements with Scholz’s plan, which they praised as a “very good starting basis” for further talks. Source

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The Birth Pains Are Growing Stronger….

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

My name is Steve Meyers and I need to share a vision and warning that the Lord showed me back in April 2007….

Many of you will ask why I waited so long to share the warning. I didn’t. I shared the story with everyone that would listen from pastors to friends to family to colleagues. Immediately following the initial vision, I called a close friend. I told him to sit down that I had something to tell him. I needed it documented as I knew this was supernatural and from God. As I witness events unfolding today, I need to share the vision again.

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user.

Tagged Under: #Fraud #Banks #Money #Corruption #Bankers,#Powerful Politicians, #Businessmen

![]()