Could the coronavirus act as a catalyst for a new global economic crisis? It certainly has that potential - but how would the crisis proceed?

In the December 2018 issue of our Q-Review, we laid out the likely scenarios of an approaching global economic collapse. But, like most things in life, such a dramatic event is unlikely to proceed in a linear fashion. There will be different stages within it.

In December 2019 we outlined these stages, which are likely five: the onset, counter-attack, flood, calamity, and recovery. Here, we briefly define the characteristics of each.

The onset

Currently, there seem to be two possible ignition points for the collapse: the credit market and the European banking sector.

At the onset, stresses that have been building in the credit markets since the summer of 2019 will explode, shrinking if not eliminating entirely the exits from many parts of that market. Downgrades of corporate debt in the U.S. and peripheral sovereign debt in the Eurozone will push large fixed-income investors, including pension funds, into higher-rated bonds, leading to large-scale selling of lower-rated bonds, forcing wider spreads and even more selling.

Panic will build first in the junk bond market, then in the “investment-grade” corporate bond market, and then rapidly metastasize to engulf the stock market. A frantic retreat to ‘safe-haven’ assets, including U.S. Treasuries, German Bunds, and U.K. Gilts as well as cash and precious metals will commence.

Cascading banking troubles in Europe will have the same destabilizing effects on the global stock and bond markets.

The counterattack

The second phase of the collapse will be the desperate efforts of authorities to stop the crisis by a counterattack.

These are likely to include the restarting and acceleration of QE-programs and other market support programs, gigantic fiscal stimulus, increasing trade protectionism and possibly even calls for direct debt monetization (see Q-Review 3/2019 for an explanation).

However, the plummeting yields on safe-haven bonds will make reflexive central bank QE-programs utterly ineffective, while any central bank stock purchase programs will provide little relief from the panic gripping investors. Central banks will also be unable to ameliorate a massive reduction in market liquidity.

Most of the governments of the Eurozone are too indebted to engage in any meaningful stimulus, especially when confronted with cascading bank problems and eventual failures. China will desperately try to enact even more fiscal stimulus, but due to the collapse of global economic demand and the probable implosion of the housing and financial system bubbles in China, such attempts will be wholly inadequate. The Chinese economy will slam to earth in a hard landing.

The flood

The crack-up in the credit and stock markets will be followed by a flood of corporate bankruptcies.

So-called “zombie” corporations, faced with collapsing economic demand and exploding interest rates—due to the banking crisis and crashing credit markets—will fail on a scale unseen in decades. The value of the holdings of pension funds, charitable endowments, trust funds, insurance company variable accounts, and stock and bond mutual funds will crash in short order. Even lowly money-market funds may be at risk, just as they were in the Financial Crisis.

If the European banking sector has not ‘cracked’ by this point, this tsunami of corporate bankruptcies will wash it over the edge. As Europe holds the largest concentration of Global Systemically Important Banks or G-SIBs, the European banking crisis will “go global” in an instant.

Massive global deflation will follow, led by an ugly chain of bank and corporate failures. Global liquidity will collapse. An utter economic crash will follow.

The calamity

Due to both crashing capital markets and banking sector bankruptcies, joblessness and poverty are likely to explode. Simultaneously, government tax revenues will collapse as incomes retreat and capital gains evaporate. As governments spending skyrockets in an orgy of Keynesian counter-cyclicality, national deficits will hit all-time highs on both an absolute and relative basis.

Governments will try to save critically-important banks, which will require large-scale funding in many countries—such as those in the Eurozone—can not afford and will not be able to finance in paralyzed capital markets. This economic reality makes depositor bail-ins the only if a politically-unpalatable option.

Confronted by new and harsh fiscal realities, pensions and other social security programs are likely to face serious cutbacks by desperate governments. An economic calamity sets in.

The recovery

We expect global depression to last 4-5 years. The initial collapse is likely to be over within three years.

The path to recovery will depend crucially on how far the ‘cleansing’ of the economy, markets, and the financial sector is allowed to go. If the banking sector implodes completely, the economic deficit will naturally be made much deeper leading to a systemic crisis.

However, if the essential functions of the banking sector are sustained, especially in Europe, we would avoid the deepest malaise. Moreover, if unsound banks and “zombie” corporations are allowed to go-under or are wound-down methodically, it will clear much of the malinvestment from the economy, creating the foundation for a strong and sustained recovery.

So, if we manage to return to the principles of the market economy including, most crucially, a return to undistorted price discovery in the capital markets, we are likely to see one of the most powerful recoveries in global economic history. It would be led by robotization and general technological innovation, which hard economic times tend to foster.

However, debt monetization, Modern Monetary Theory (“MMT”) and other money-conjuring schemes would corrupt the economy further making a sustained recovery impossible (see more from Q-Review 4/2019).

Moreover, with the governments and the central banks assuming a much bigger role in the economy and society in this darker scenario, some form of fascism (which is, by definition, the merger of state and corporate power) would be the likely end-result of these developments.

We can do nothing more than hope that wise, courageous and far-sighted political leadership will spare us from that horrible fate.

When?

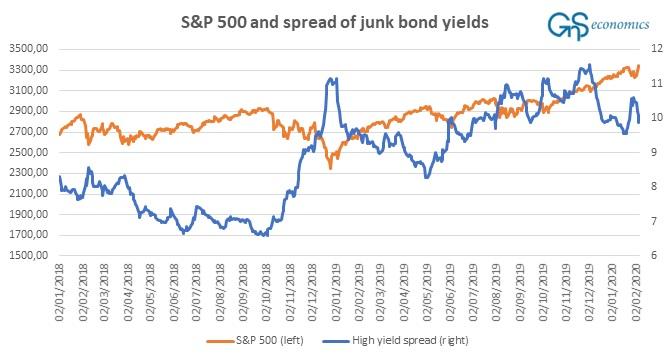

After the Fed launched its desperate repo-market bailout operations in September and October of last year, stresses in the credit markets eased-up and stock markets rallied. Following the coronavirus outbreak, junk bond yield-spreads shot-up, but they were quickly tamed by the massive support operations launched, once again, by major central banks (see Figure 1).

It’s truly interesting to see, how long the artificial liquidity can keep the stock markets up, when the economy slows.

Figure 1. The daily closing value of the S&P 500 index and the option-adjusted spread of the ICE BofAML US corporate C index over the spot Treasury curve. Source: GnS economicss, Fed St. Louis, Yahoo Finance

Now, everything depends on China and the impact of the coronavirus. How bad will the situation get? Do we anticipate a global pandemic, which at this point appears increasingly likely? Can China restore production quickly, which currently looks unlike?

The virus is so hazardous for the Chinese economy because the virus itself and the draconian measures adopted to contain it disrupt production and the incomes of millions of highly-indebted firms and households. The longer that this broad economic stress continues, the higher the likelihood of corporate defaults and bankruptcies.

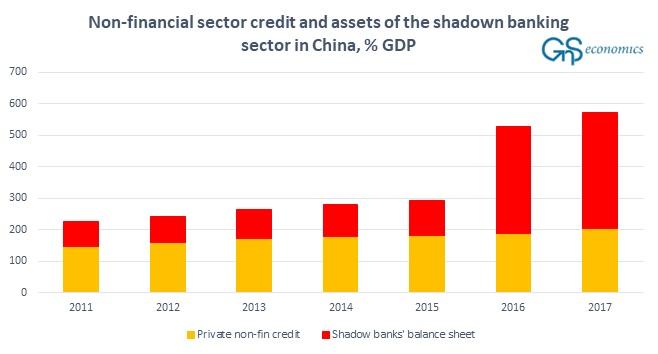

China’s banking system is extremely levered (see Figure 2). As we explained in Q-Review 4/2019, China’s banking system will be unable to cope with any longer slowing down of growth, not to speak of a recession.

Large-scale defaults and bankruptcies caused by the reasons just discussed would hit the Chinese banking sector especially hard. The virus can in this way easily act as a catalyst for a deep and severe banking crisis in China. It would guarantee a global recession.

Figure 2. The asset of the shadow banking sector and the credit issued to the non-financial sector in China. Source: GnS Economics, PBoC, BIS, Fed St. Louis

Most importantly, if the coronavirus pushes the Eurozone into a recession within the next few months, which seems very likely, our weak banking sector is unlikely to be able to cope with that (see Q-Review 4/2019 for a detailed explanation). And, that would imply the beginning of a global banking crisis, as explained above.

This is to say that by summer, we may be at the onset.

For more than a decade, the global economy has steadily grown quarter after quarter, but it looks like that streak is about to come to a very abrupt ending. The coronavirus outbreak in China has brought the Chinese economy to a virtual standstill, and as a result, critical supply chains are in a state of chaos all over the world. And since it doesn’t look like the Chinese economy will be able to return to normal for an extended period of time, it appears that a worldwide economic slowdown is imminent. I warned about this the other day, but now we have even a clearer picture of what is happening. According to Capital Economics in London, this coronavirus outbreak will cause the global economy to shrink this quarter, and that will be the very first time this has happened since 2009…

The economic casualties from China’s coronavirus epidemic are mounting as Asian and European auto plants run short of parts, free-spending Chinese tourists stay home and American companies brace for unpredictable turbulence.

That’s just the start of a financial hangover that is expected to linger for months even if the flulike illness is soon brought under control, economists and supply chain experts say. The Chinese epidemic’s aftereffects will likely cause the global economy to shrink this quarter for the first time since the depths of the 2009 financial crisis, according to Capital Economics in London.

And if the global economy shrinks for two quarters in a row, that will officially meet the definition of a “global recession”.

So here we are on the verge of the worst economic downturn in more than a decade, and even if this outbreak miraculously ended tomorrow it would still take quite an extended period of time for global supply chains to return to normal.

In particular, the auto industry has been hit extremely hard…

The ripple effects of China’s shutdown are spreading, with the auto industry especially hard hit. Nissan temporarily closed one of its factories in Japan after running short of Chinese components, one week after Hyundai in South Korea did the same. Fiat Chrysler warned that it may shutter one of its European plants. Some U.S. manufacturers could face parts shortages in one to two weeks.

“I worry that it’s going to be a bigger deal than most economists are treating it as right now,” said Mohamed El-Erian, chief economic adviser at Allianz, the German financial services company. “It will take time to restart all these economic engines.”

Of course, the global economy was already slowing down before this coronavirus outbreak started, but this has definitely helped to accelerate our problems.

One big red flag is the fact that Caterpillar’s sales are suddenly dropping. After “33 consecutive months of increases”, Caterpillar’s sales have now fallen for two months in a row. In fact, January’s enormous 7 percent decline caught many analysts completely off guard…

If Caterpillar is still the global industrial bellwether and leading manufacturing sector indicator it has been for the past century (and absent the Fed somehow printing buildings or excavating mines, it is), then the world is about to enter the worst manufacturing downturn since the financial crisis.

According to CAT’s latest retail sales data, in January the company posted a 7% drop in machine sales, the biggest drop since Jan 2017, and only the second consecutive negative print since December’s -5% drop following 33 consecutive months of increases.

Across the Atlantic, major supply chain headaches have contributed to stunning factory output declines throughout the eurozone.

Just check out these numbers…

Factory output fell by 4.1 percent in the final month of the year compared with the same month a year earlier, according to figures published by Eurostat on Wednesday. Germany was among the states which suffered the most, as production dropped by 7.2 percent. Italy was close behind on a 4.3 percent decrease while France was down 3.2 percent.

Those numbers absolutely scream “recession”, and they aren’t likely to get any better until this coronavirus outbreak is over.

So all eyes will continue to be on China, and right now activity in major Chinese cities is way, way below normal. The following comes from Zero Hedge…

Specifically, Morgan Stanley suggested that real time measurements of Chinese pollution levels would provide a “quick and dirty” (no pun intended) way of observing if any of China’s major metropolises had returned back to normal. What it found was that among some of the top Chinese cities including Guangzhou, Shanghai and Chengdu, a clear pattern was evident – air pollution was only 20-50% of the historical average. As Morgan Stanley concluded, “This could imply that human activities such as traffic and industrial production within/close to those cities are running 50-80% below their potential capacity.”

If the number of cases continues to rise at an exponential rate, there won’t be a “return to normal” any time in the foreseeable future.

So barring some sort of a miracle, we should all settle in for a very long global economic downturn.

But at least one small segment of the global economy is booming at the moment. Thanks to fears about the coronavirus, demand for private jets has absolutely skyrocketed…

Wealthy travelers and major corporate clients are rejecting commercial airline travel and looking to private jets as a way to isolate themselves from the deadly coronavirus outbreak.

The uptick in interest comes as more airlines cut scheduled flights to and from mainland China and Hong Kong in the wake of the spread of the disease that originated in the Chinese city of Wuhan.

The elite are going to do all that they can to insulate themselves from this virus, and considering how easily it spreads, it is hard to blame them.

As I discussed earlier this week, a prominent medical expert in Hong Kong is warning that 60 to 80 percent of the total world population could ultimately end up catching this virus. And if that were to happen, it would greatly escalate all of the other problems that we are currently facing.

I am still hoping that such a scenario is not going to happen.

I am still hoping that global authorities can get this horrible virus under control soon, but with each passing day it is becoming more difficult to be optimistic about this outbreak. Source: ZeroHedge http://themostimportantnews.com/

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

“Have I therefore become your enemy by telling you the truth?”

Oil Drop, global banking crisis, Coronavirus, Fraud, Banks, Money, Corruption, Bankers