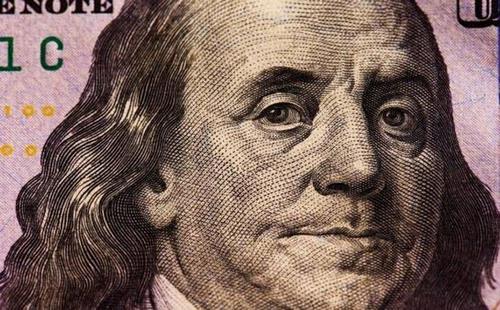

Fed Dramatically Speeds Up U.S. Payments With FedNow, but Downplays Any Tie to CBDCs–Don’t Trust The Fed’s

Some argue it would weaken crypto’s payments use case or form a bridge to a digital dollar. By Jack Schickler…

![]()

The Fed Has Just Declared War On Americans… Again!

And now the Fed wants to make us a cashless society! When every dollar is gone, that means no greenbacks…

![]()

“An Extremely Dangerous Game” – Central Bankers ‘Extend & Pretend’ Has Increased Risk Of “Catastrophic Collapse”

In recent weeks, there has been a lot of talk about the role of the world’s central bankers going forward. With that…

![]()

Central Banks Are Destroying What Was Left Of Free Markets

President Reagan memorably said that the nine words you don’t want to hear are “I’m from the government, and I’m…

![]()

No Financing And No Demand: Chinese Refiners Run Into Trouble

International banks are suspending credit lines for some independent oil refiners worried about the growing risk of defaults across industries…

![]()

Will The Coronavirus Outbreak Cause A Massive Stock Market Crash?

Could it be possible that this coronavirus outbreak will be the trigger that finally bursts the biggest stock market bubble…

![]()

Coronavirus Triggers “Biggest Shock” To Oil Markets Since Lehman Crisis

Update: The Telegraph’s Ambrose Evans-Pritchard warned that the collapse in Chinese oil consumption is “the biggest shock to oil markets since the Lehman…

![]()

STAGGERING GLOBAL DEBT OF $253 TRILLION IS A DISASTER WAITING TO HAPPEN

Global debt has reached a staggering $253 trillion. This is a disaster waiting to happen, as the world’s total debt…

![]()

Making A Fortune: 19 Million Public Employees Across America Cost Taxpayers Nearly $1 Trillion

For the first time in history, 19 million public employee salaries at every level of government across America have been…

![]()

Krieger: “It’s A Systemic Looting On A Massive Scale”

The United States has historically bragged about its free and transparent markets. But what the Fed is doing today is…

![]()