BanksterCrime:

Personal Consumption growth slowed (3 months ago) and so did Core PCE inflation (to 2%); Jobless claims fell (to 2023 lows) as the LEI continued to tumble, signaling recession in 1H24.

So, ‘goldilocks’, ‘soft landing’, ‘everything is awesome’, or ‘we are all going to hell’ – pick your own narrative… as economic data remains sluggish and financial conditions dramatically ‘loose’…

Source: Bloomberg

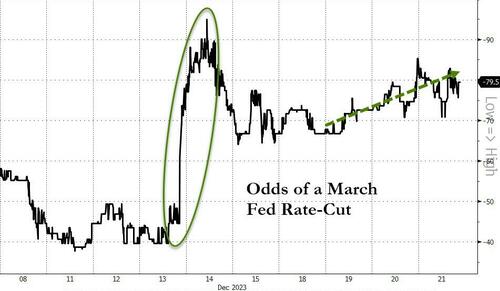

All of which prompted a dovish response in STIRs, with the odds of a March rate-cut higher still, now at 80%)…

Source: Bloomberg

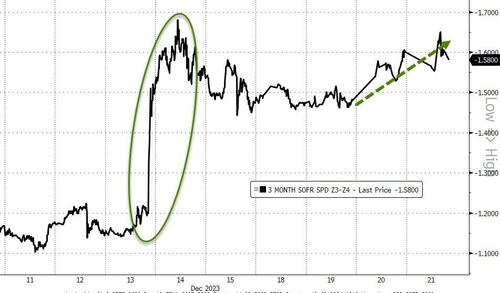

And expectations for the number of rate-cuts next year higher (now around 160bps)…

Source: Bloomberg

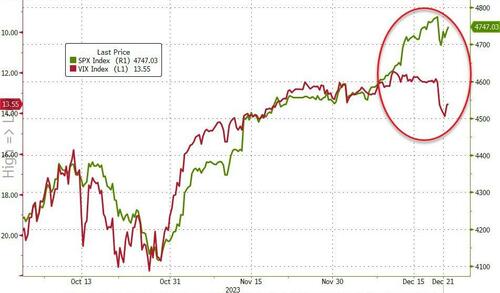

Echoing yesterday’s malarkey, 0-DTE traders pushed the markets around to the downside with an initial downswing around 1130ET and then again from around 1330ET. And then as the market refused to fold in the afternoon (like it did yesterday)…

…0-DTE call-buyers swamped it and sparked a surge higher in the main indices…

VIX spiked intraday back above 14.5, but then in the afternoon, vol-sellers re-appeared

But, the recent squeeze higher in stocks has not been backed by vol compression…

Small Caps were the best performer, up 1.5% on the day and The Dow was the laggard, though all the majors were green. However, as the chart shows, today’s recovery was considerably less of a gain than the losses yesterday afternoon – still down around 0.5% from the 1430ET raid plunge yesterday…

MAG7 stocks opened higher, traded down into the red briefly then recovered…

Source: Bloomberg

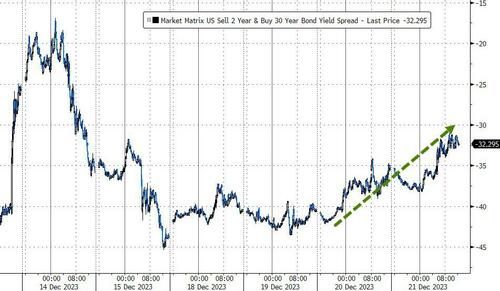

Treasury yields were higher across the curve but not significantly relative to recent chaos, with the long-end slightly lagging (30Y +4bps, 2Y +1.5bps)…

Source: Bloomberg

With the yield curve (2s30s) steepening

Source: Bloomberg

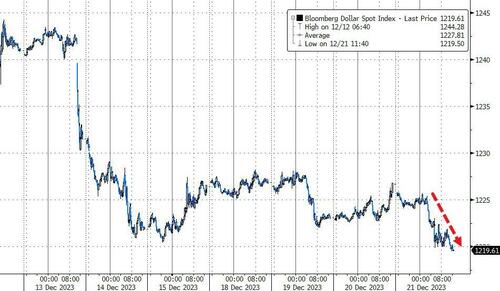

The Dollar dived, falling back below the post-Powell lows, back to its weakest since early August…

Source: Bloomberg

Bitcoin rallied back up to $44,000 once again and faded…

Source: Bloomberg

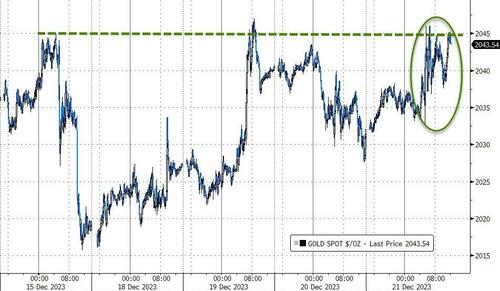

Gold jumped back up to recent highs…

Source: Bloomberg

Oil prices ended slightly lower, but well off their lows, with WTI just below $74…

Source: Bloomberg

Finally, the market seems very sure that this is not about to happen…

Source: Bloomberg

Do you feel lucky?

Treat your skin well. Our soaps are gentle and produce a smooth, creamy lather that is nourishing to your skin. They are handmade in small batches. We use only high-quality natural ingredients. No chemicals, no sodium laurel sulfate, no phthalates, no parabens, no detergents. GraniteRidgeSoapworks

Revelation: A Blueprint for the Great Tribulation

A Watchman Is Awakened

The Future Has Already Been Written

Will Putin Fulfill Biblical Prophecy and Attack Israel?

JPMorgan Chase As Bank of America, Wells Fargo and Citigroup Will Be Close Temporary Very Soon, Welcome to Fed Now CBDC

By StevieRay Hansen | December 21, 2023

Three Wall Street Mega Banks Hold $157.3 Trillion in Derivatives – That’s $56.7 Trillion More than the Entire World’s GDP Last Year

By StevieRay Hansen | December 20, 2023

David Webb Has an Incredible Bio, and Came From a Family Deeply Involved in Freemasonry. He Was a Successful Wall Street Manager for Years, and Now Lives in Switzerland Where He Owns Farmland. He Is Originally From Cleveland

By StevieRay Hansen | December 18, 2023

It Seems We Have Hit A Point Where A Wall Is In The Way Of “Kicking The Can” Much Further

By StevieRay Hansen | December 18, 2023

The New York Fed Has Extended Its Half Trillion Dollar Bailout Facility to a Sprawling Japanese Bank You’ve Never Heard Of

By StevieRay Hansen | December 15, 2023

Wall Street CEOs Want the Line Between a Federally-Insured Bank and a Wall Street Trading Casino Erased; Regulators Want Higher Capital to Prevent That

By StevieRay Hansen | December 14, 2023

![]()