Banks in Trouble: The 25 Largest U.S. Banks Are Seeing the Largest Fall in Deposits in 38 Years With No Signs of Letting Up

BanksterCrime:

By Pam Martens and Russ Martens: August 7, 2023 ~

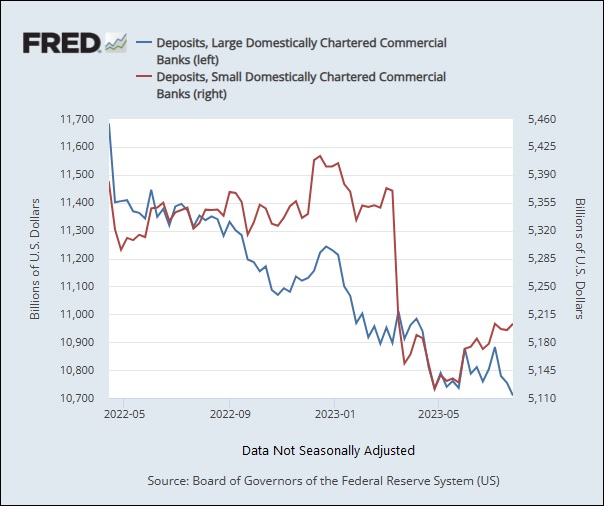

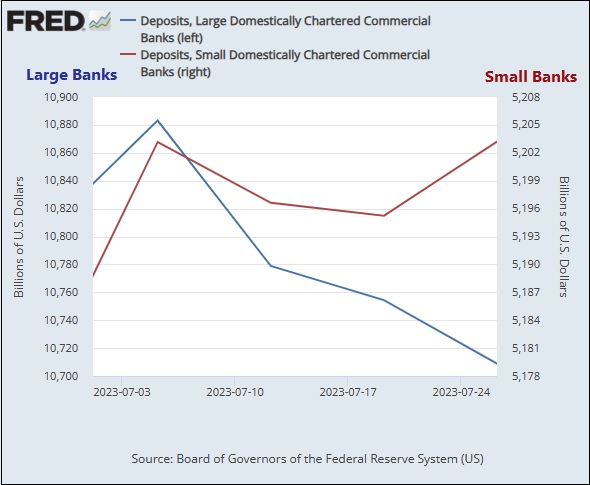

Deposits at the 25-largest domestically-chartered U.S. commercial banks peaked at $11.680 trillion on April 13, 2022, according to the updated H.8 data maintained at the Federal Reserve Economic Database (FRED). As of the most current H.8 data for the week ending on Wednesday, July 26, 2023, deposits stood at $10.709 trillion at those 25 commercial banks, a dollar decline of $970 billion and a percentage decline of 8.3 percent.

Equally noteworthy, the decline shows no signs of letting up. According to the FRED data, between July 5 and the most current reading on July 26, the 25 largest U.S. banks shed $174 billion in deposits.

Despite all of the misleading news reports about depositors seeking out the perceived safety of the largest banks since the banking crisis in the spring, it’s actually been the smaller banks that have staged a comeback on growing deposits since the week of April 26. (See chart above.)

As of March 31 of this year, according to FDIC data, there were a total of 4,096 commercial banks in the U.S., meaning that if you segregate the 25 largest banks, that leaves 4,071 falling into the H.8 category of small, domestically chartered commercial banks.

This breakdown does not give the American people a quick pulse beat on the dangers lurking in the U.S. banking system – a system that imploded in 2008 and was on its way to imploding again this spring until the Fed stepped in with another bailout program. In the span of seven weeks this spring, running from March 10 to May 1, the second, third, and fourth largest bank failures in U.S. history occurred. In order of size, those were: First Republic Bank (May 1), Silicon Valley Bank (March 10) and Signature Bank (March 12). The largest bank failure in U.S. history, Washington Mutual, occurred in 2008 during the financial crisis.

Because there are only four domestically-chartered commercial banks in the U.S. with more than $1 trillion in deposits – JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup’s Citibank – it behooves Americans to closely monitor what is happening at these four banks, which hold such a highly concentrated share of the banking system’s deposits and assets. That is especially true given that one of those four banks, Citigroup, blew itself up in 2008 and received the largest Fed and Treasury bailout in U.S. banking history.

Given this history, it would make far more sense for the Fed to provide this deposit data in the following breakdowns: deposits at mega banks with more than $1 trillion in deposits; deposits at large banks with $200 billion to $1 trillion in deposits; and deposits at small and medium banks with less than $200 billion in deposits.

Monitoring what is going on at these four behemoth banks should make nightly network news and the front pages of newspapers – but rarely does. This lack of media attention allows a five-count felon bank like JPMorgan Chase to continue its serial crimes while simultaneously getting bigger. JPMorgan Chase was allowed by federal regulators to gobble up the failed First Republic Bank this year, despite the fact that JPMorgan Chase is currently being credibly charged in federal court by the Attorney General of the U.S. Virgin Islands with “actively participating” in Jeffrey Epstein’s sex-trafficking of underage girls for more than a decade.

What could be more damaging to a mom and pop bank’s reputation, with more than 5,000 Chase Bank branches dotting the landscape across America, than credible charges from the Attorney General of the U.S. Virgin Islands that JPMorgan Chase sold out young girls as sex slaves for more than a decade in order to get wealthy client referrals from Jeffrey Epstein?

The Eleventh Circuit Court of Appeals called what the U.S. Department of Justice allowed to happen to these girls “beyond scandalous” and “a national disgrace.” And yet, the U.S. Department of Justice has left it to the Virgin Islands to bring civil charges while it remains missing in action on bringing criminal charges against JPMorgan Chase.

Allowing a bank with this serial history of outrageous crimes to get even bigger and more dangerous did not escape the attention of Senator Elizabeth Warren. On May 17, Warren sent a letter to federal regulators pointing out the problems with the JPMorgan Chase/First Republic deal. Warren wrote:

“…it resulted in a $13 billion cost to the Federal Deposit Insurance Fund – which will ultimately be passed on to ordinary bank consumers across the country – and made JPMorgan, the nation’s biggest bank, even bigger. JPMorgan will also record a $2.6 billion gain from the deal…”

Warren’s letter also noted the following:

“Under the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994, a bank holding company may not consummate a merger that would result in the bank holding more than 10% of the nation’s total deposits – a standard that JPMorgan already exceeds. However, because Riegle-Neal includes an exception for failed banks, the OCC has indicated that it did not need to take any action because the statute automatically provides a waiver. Separately, this merger required approval under the Bank Merger Act, which was granted by OCC. In its May 1 letter approving JPMorgan’s acquisition of First Republic, the OCC concluded that ‘The Transaction does not increase risk to the stability of the United States banking or financial system as it facilitates the orderly resolution of an insured depository institution in default,’ though it provides little detail about its analysis.”

There is a very compelling argument to be made that the JPMorgan Chase/First Republic Bank combination did, indeed, “increase risk to the stability of the United States banking or financial system,” because federal regulators had already assessed JPMorgan Chase to be the nation’s riskiest bank. (See Federal Data Show JPMorgan Chase Is, By Far, the Riskiest Bank in the U.S.)

“This Is a Fraud” – Wework Co-Founder Cashes out $700m as IPO Looms

Greed and a desire for riches are traps that bring ruin and destruction. “The love of money is a root…

![]()

Absolute Power Molests Absolutely Birth Pains

Generally speaking, the ungodly are those who do not know God through Jesus Christ. They have rejected God’s Son and…

![]()

Ray Dalio Warns A “New Paradigm” Is Coming: “Buy Gold, Sell Stocks”

The principle Jesus teaches in Luke 16:9 is that everything we own should be used to further God’s kingdom. We are God’s…

![]()

This Isn’t Normal: 20 Large Quakes Have Hit California Within The Last 24 Hours Birth Pains

Strange sounds in the sky, which some call “sky trumpets” or “sky quakes,” have been reported from around the world…

![]()

Bank Run: Deutsche Bank Clients Are Pulling $1 Billion A Day, Birth Pains

A bank run occurs when a large number of people withdraw their money from a bank because they believe the…

![]()

Banks rip off foreign payments customers over and over

It’s always good to remember the Lord’s purpose for what He makes. Whether it’s the temple, the church, marriage, the…

![]()

Waking into Our New Volatile Age of Oil Prices

The Bible has a lot to say on the subject of injustice. We know that God is in favor of…

![]()

Merrill Lynch Caught Criminally Manipulating Precious Metals Market “Thousands of Times” over 6 Years

The Bible explains the reason for the trouble. Humanity is sinful, not just in theory or in practice but by…

![]()

The collapse of the banking system

False apostles are motivated by their greed, lust, or power. Second Timothy 3:1–8 describes such teachers in more detail: “But mark this:…

![]()

Follow The Money- The Bankers Do, One Banker Arrested In This Sex Solicitation Sting…

The Banker,money whores, greedy,” Narcissists” they are involved in every illicit money transaction in the world, including selling children, check…

![]()

Beef in Bulk: Half, Quarter, or Eighth Cow Shipped to Your Door Anywhere within Texas Only

We do not mRNA vaccinate our cattle, nor will we ever!

Grass Fed, Grass Finished Beef!

Here is a discount code for HNewsWire readers to get 20 percent off first order:

HNEWS20

From Our Ranch to Your Table

Sources: WallStreet BanksterCrime

Revelation: A Blueprint for the Great Tribulation

A Watchman Is Awakened

Will Putin Fulfill Biblical Prophecy and Attack Israel?

Newsletter

Orphans

Editor's Bio