Something fascinating took place on January 3: on that day AAPL slashed its revenue guidance, blamed China, and triggered a cascade of flash crashes across various carry currency pairs. More importantly, that day also saw the lowest stock print for AAPL since the summer of 2017 and triggered an unprecedented ramp in AAPL stock which since then is up a mindblowing 86%…

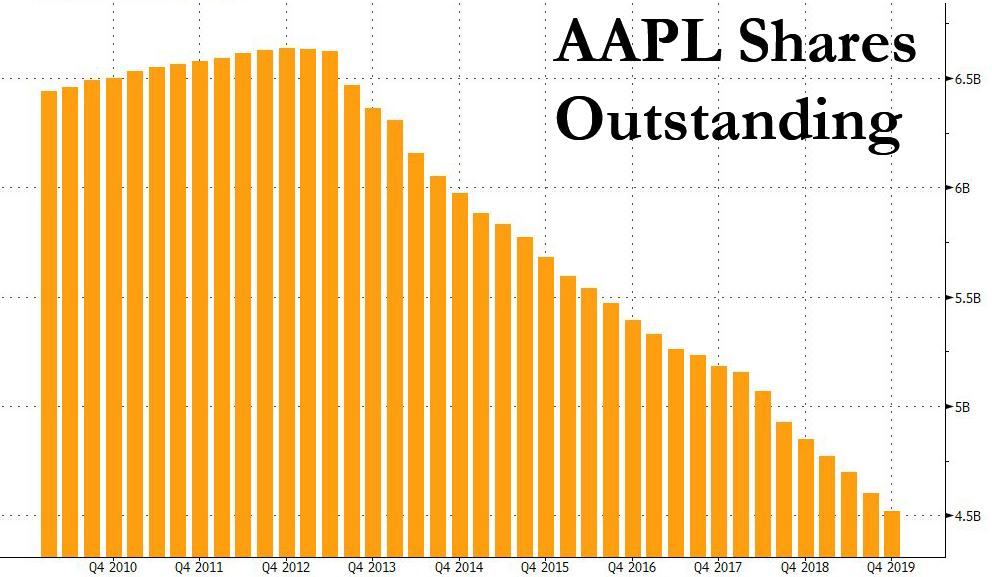

… largely as a by-product of its gargantuan stock buyback program, which started in Q3 2013, and which has seen a third of AAPL’s total stock repurchased in the past 6 years. If one extrapolates the current trend, AAPL will fully LBO itself, i.e., have no public shares outstanding some time in 2030.

Steve Wozniak on Apple Card Algorithm and the Future of Augmented Reality

And while a record buyback in an abysmally illiquid market can do miracles to give the impression that there is a natural buyer, there is only so much that Tim Cook can do to offset the inevitable selloff that will follow the collapse of the US-China trade talks which will also drag down any company that has exposure to the Chinese market, not to mention the next recession which will see consumer spending on AAPL service grind to a halt, until that moment comes, Bank of America’s Michael Hartnett has made a stunning observation: with a market cap of $1.17tn, AAPL now has a greater capitalization than the entire US energy sector.

And there is more to come: Apple this week issued a euro-denominated bond with a 0% coupon (whose proceeds AAPL will then promptly use to repurchase even more stock), which as Hartnett puts it is the “QE-induced bull market in “growth” & “yield” in a nutshell.“

There’s more. Now that Walt Disney has joined the deflation fray by trying to snatch market share from Netflix and Amazon by offering its streaming video service at roughly half the price (with remarkable success so far, adding 10 million users in just 24 hours) it too has enjoyed an amazing lift in its stock price now that it too is seen as a “growth” company, and at a market cap of $268 billion, Disney is now bigger than market cap of the 5 largest European banks – BNP, Santander, ING, Intesa and Credit Agricole.

Hartnett’s take: this is the “QE-induced bull market of “growth” over “value” in a nutshell.”

What happens next? Stock buybacks aside, as Hartnett puts it, 2019 was anything but data dependent… oh, and Bank of America once again has no qualms about calling “NOT QE” by its true name – “QE”:

Powell ’19 rate cuts & QE a success…recovery in credit market (US BBB credit 14.1% YTD), housing market (purchase & refi mortgage activity strongest since 2013 – MBAVBASC), stock market (global market cap up $12.1tn YTD), labor market still strong (unemployment 3.6%);

The punchline: “Fed now on hold but QE remains supportive for risk (Fed + ECB will buy $420bn assets next 6 months).” Here, regular readers will recall that at the start of August, this website was the first to correctly predicted that QE is coming, and just over two months later it was proven correct. And so the Fed has once again decided to reflate assets – of not the real economy – at any price, which means that until Powell stops, or more likely is forced to stop, the best trade may well be not to fight the Fed and the liquidity gusher it has again unleashed. Source

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The Birth Pains Are Growing Stronger….

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

My name is Steve Meyers and I need to share a vision and warning that the Lord showed me back in April 2007….

Many of you will ask why I waited so long to share the warning. I didn’t. I shared the story with everyone that would listen from pastors to friends to family to colleagues. Immediately following the initial vision, I called a close friend. I told him to sit down that I had something to tell him. I needed it documented as I knew this was supernatural and from God. As I witness events unfolding today, I need to share the vision again.

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user.

Tagged Under: #Fraud #Banks #Money #Corruption #Bankers,#Powerful Politicians, #Businessmen

………………………………………………………………………………..

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user.

Tagged Under: #Fraud #Banks #Money #Corruption #Bankers,#Powerful Politicians, #Businessmen

![]()