In recent weeks, there has been a lot of talk about the role of the world’s central bankers going forward. With that in mind, now seems like a good time to recap the market bailout operations during the past few years… to get some insights into how this all ends (spoiler alert – not well)!

GnSEconomics.com’s Tumoas Maalinen has written a detailed (and ominous) twitter-thread on the ‘stealth socialization’ of the financial markets by the central bankers.

How we got here…

In late November 2008, the U.S. Federal Reserve announced it would start buying the debt of Government Sponsored Enterprises and mortgage-related securities in the secondary market.

In March 2009, the Fed extended the program to include US Treasuries. QE -program was born.

The Fed ran three sequential QE -programs.

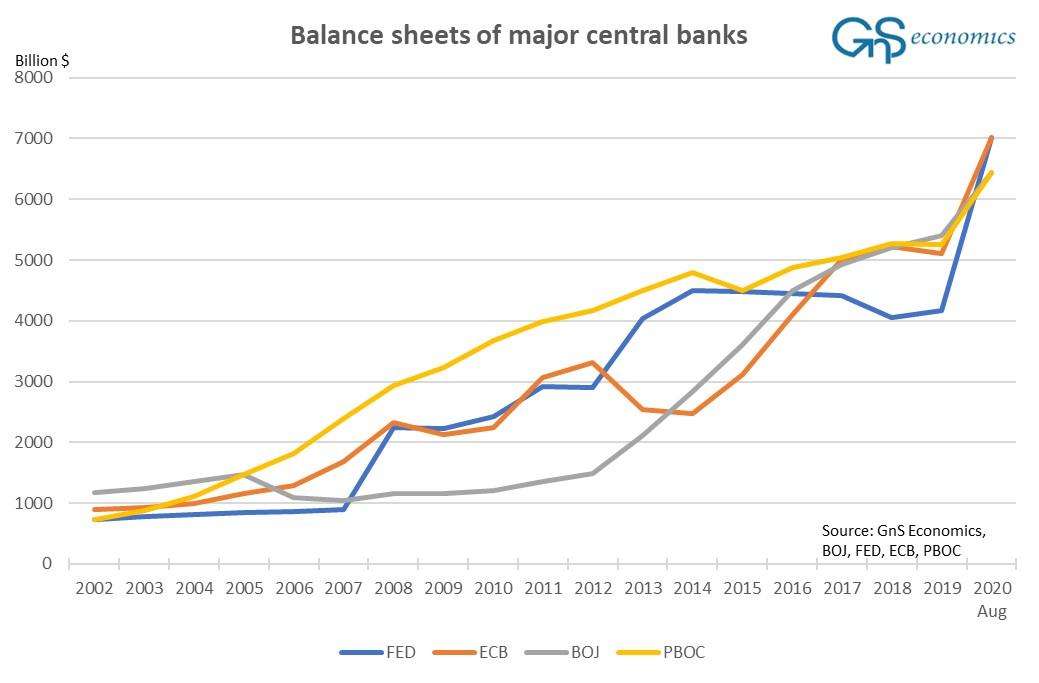

The Bank of England started its QE program in March 2009, the Bank of Japan (BoJ) in October 2010, the European Central Bank (ECB) in March 2015 and the People’s Bank of China (PBoC) in July 2015.

In October 2010, the BoJ started to buy Exchange Traded Funds (ETFs) linked to the Japanese stock market.

It became customary that the BoJ to start buying whenever the Topix stock market index fell more than a 0.2 percentage points by midday.

In August 2012, the European Central bank enacted the Outright Monetary Transactions (OMT) program to halt the rise in sovereign yields in the Eurozone (to save it).

In 2015, the Swiss National Bank started to “invest” in foreign assets, including US equities.

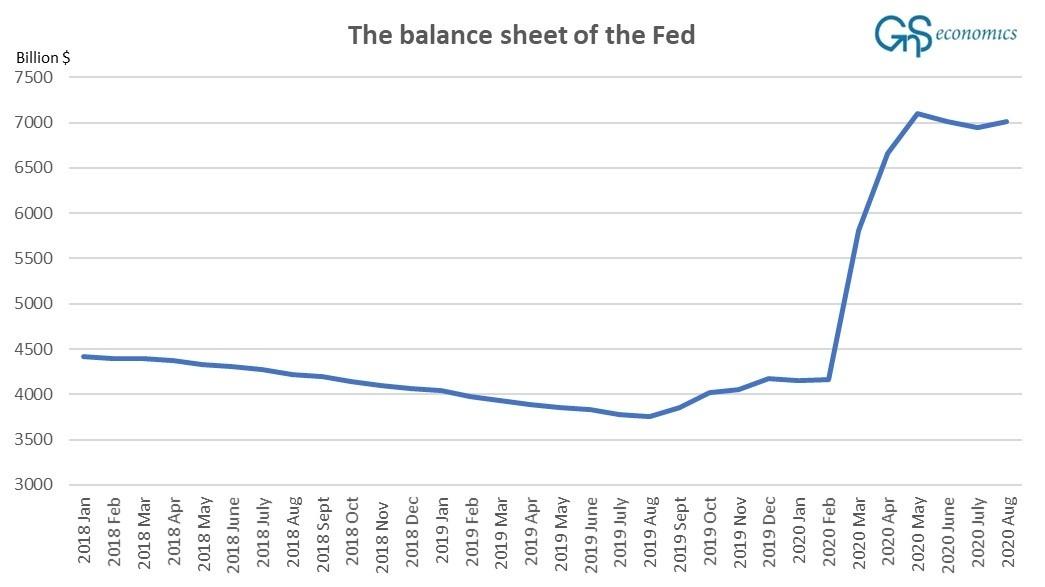

2017 set the pre-corona record for central bank stimulus.

During that year, central banks across the globe pushed over $2 trillion worth of artificial central bank liquidity into the global markets mostly through their asset purchase programs.

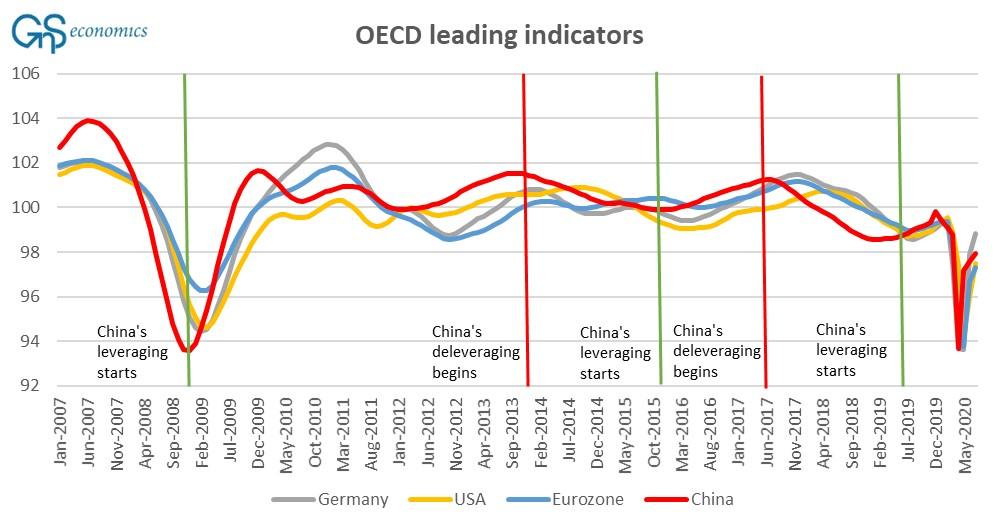

In December 2018, the People’s Bank of China started to support the domestic banking sector by injecting hundreds of US billions worth of liquidity into the system.

In January 4, 2019, the Fed pivoted from its previous statements of several interest rate rises in 2019 and automated balance sheet run-off. This was to stop the market rout which threatened to topple the US credit markets.

Between January and March 2019, the Federal Reserve made a complete U-turn. In early December 2018, Chairman Powell was still anticipating several interest rate rises for 2019, but by March they had turned to possible cuts and ending the balance sheet normalization program.

In August and September 2019, the market bailout operations continued. Fed cut its interest rates for the second time for the year in August, and the ECB pushed rates further into negative and restarted the QE -program in September.

In September 16, 2019, the repo-markets clogged up and the Fed started its emergency repo-operations for the first time since 2009.

In October 16th, 2019, the Fed started to buy US Treasury bills with the rate of $60 billion per month.

So, without the market bailout operations, the global financial crisis would have probably started no later than January 2019 by the toppling of the US credit markets.

The Fed and central bankers were able to postpone the crisis till mid-September, 2019, when the repo-markets ‘blew up’.

Since then the US financial markets have been in constant resuscitation.

In the spring 2020, things naturally went from desperate to absurd.

On the 16th, 2020, the New York Fed announced that it would add $500 billion in overnight loans to the repo market.

On Tuesday the 17th the Fed announced that it would use $1 trillion to mop-up corporate paper from issuers. 13/

On the 19th, 2020, the Fed announced that it would create a lending facility to unlock frozen money market mutual funds.

The Fed ended-up backstopping U.S. Treasury markets, corporate commercial-paper and municipal bond markets and short-term money-markets.

Thus, by June 2020, the #Fed had effectively became the financial markets of the US.

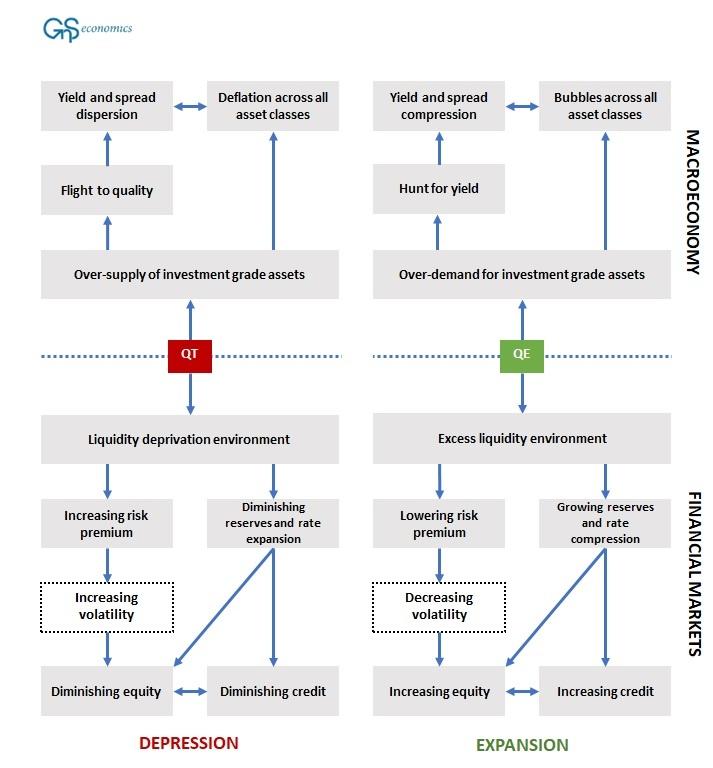

What many do not seem to get is how dangerous all this central bank meddling in the markets is.

When rates were cut to zero, it invited the use of maximal leverage. When QEs started, they started to push investors to ever-riskier financial market products.

Moreover, when one compares the similarities between the biggest stock market crash in history, many worrying similarities emerge.

Central bankers have been playing an extremely dangerous game of “extend and pretend”.

To keep the markets afloat in a darkening economic picture requires ever larger bailouts and, eventually, the full socialization of the financial markets.

Receive a daily recap featuring a curated list of must-read stories.

The balance sheets of central banks would turn into investment vehicles with no boundaries.

Central bankers would decide which countries, corporations or even households would survive. They would effectively turn into Gosbanks (former CB of the Soviet Union).

This would lead to an utter global economic dystopia.

I’ve visited the Soviet Union as a boy (two times). The horrors of socialization of the financial markets and thus the economy should not be underestimated.

I dearly hope we’ll be spared from that fate.

Source: zerohedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()