BanksterCrime:

By Pam Martens and Russ Martens,

Mary Erdoes, CEO of JPMorgan Chase Asset & Wealth Management

In 2020, Netflix released a documentary series titled “Filthy Rich,” based on the book by the same name. The series examined how sex trafficker Jeffrey Epstein was able to continue to enjoy his wealth and power even after Palm Beach, Florida police had built a case that he had sexually-assaulted more than a dozen young girls – many from public schools in middle-class areas surrounding the mansions of Palm Beach.

A sweetheart deal between the Florida State Attorney and the U.S. Department of Justice allowed Epstein to serve just 13 months in jail from June 2008 to July 2009, most of it in a work release program in which he was driven to an office daily by his chauffeured limousine. Epstein was allowed to be on the loose for another decade until the Department of Justice was embarrassed into arresting Epstein on federal sex trafficking charges on July 6, 2019, following an explosive series of articles about Epstein’s victims by Julie Brown in the Miami Herald. (Epstein died in a Manhattan jail on August 10, 2019, a little more than a month after his arrest. His death was ruled a suicide by the New York City Medical Examiner.)

Despite Epstein’s earlier arrest in Florida and sensational headlines that followed, Epstein was able to continue his long-term banking relationship with the largest bank in the United States – JPMorgan Chase – until at least 2013. (JPMorgan Chase is now a five-count felon itself, able to endlessly cut sweetheart deals with the U.S. Department of Justice.)

One of Epstein’s protectors at JPMorgan Chase was Mary Erdoes – who continues to serve as CEO of the bank’s Asset & Wealth Management business that caters to the ultra-wealthy.

Erdoes may never get as “filthy rich” as Epstein, but she has sold $29 million of her JPMorgan Chase stock since just before Epstein’s arrest in 2019. That includes the following amounts: $3.9 million so far this year; $3.7 million in 2023 as headlines flew around the world over the Epstein-related allegations against the bank made by the Attorney General of the U.S. Virgin Islands in federal court in Manhattan; $3.9 million in 2022; $7.4 million in 2021; $2.4 million in 2020; and less than three months before Epstein was indicted in 2019, Erdoes sold $7.95 million. These dollar amounts do not include the millions in stock sales that Erdoes made, ostensibly to pay taxes on stock awards.

How did Erdoes come by all of this stock in the bank? The company granted it to Erdoes on the basis of good performance.

This is what the Attorney General of the U.S. Virgin Islands alleged in a federal lawsuit last year against JPMorgan Chase and Erdoes: (Epstein owned a private island and compound in the U.S. Virgin Islands.)

“In 2006, a JP Morgan Rapid Response Team noted that Epstein ‘routinely’ made cash withdrawals in amounts from $40,000 to $80,000 several times per month, totaling over $750,000 per year. In addition, Mary Erdoes admitted in her deposition that JP Morgan was aware by 2006 that Epstein was accused of paying cash to have underage girls and young women brought to his home. In the years that followed, JP Morgan employees, including senior executives, emailed internally that Epstein was under investigation or had been sued for trafficking or sexual abuse. This includes an email in 2010 between Mary Erdoes and Jes Staley regarding a federal investigation of Epstein for child trafficking; a 2011 email summarizing a few 2010 news stories connecting Epstein to human trafficking and promising to ‘monitor the accounts and cash usage closely going forward;’ and a 2011 compliance memo noting that ‘[n]umerous articles detail various law enforcement agencies investigating Jeffrey Epstein for allegedly participating in child trafficking and molesting underage girls’ and that ‘Epstein had settled a dozen civil lawsuits out of court from his victims regarding solicitation for an undisclosed amount.’ Internal emails also questioned who Epstein’s clients were, circulating an article regarding whether Epstein was running a Ponzi scheme.

“Indeed, Epstein’s behavior was so widely known at JPMorgan that senior executives joked about Epstein’s interest in young girls. In 2008, for example, Mary Erdoes received an email asking her whether Epstein was at an event ‘with miley cyrus.’ In her deposition, Mary Erdoes testified that JP Morgan terminated Epstein as a customer in 2013 after she became aware that the withdrawals were ‘actual cash.’ However, Epstein had made substantial cash withdrawals every year he banked with JP Morgan….”

This is how the New York Times reported Erdoes’ role with Epstein in August 2019: “When compliance officers at JPMorgan Chase conducted a sweep of their wealthy clients a decade ago, they recommended that the bank cut its ties to the financier Jeffrey E. Epstein because his accounts posed unacceptable legal and reputational risks.” The reason the relationship was allowed to continue, “according to six former senior executives and other bank employees familiar with the matter, was that Mary C. Erdoes, one of JPMorgan’s highest-ranking executives, intervened to keep him as a client, ” according to the New York Times article.

Any person with a criminal history of paying hard cash to underage girls for sex assaults, and who is taking large sums of hard cash from a bank, should be terminated immediately. The bank is also legally-mandated to file reports with the Financial Crimes Enforcement Network (FinCEN). But according to an expert report written by a former FBI agent of 23 years, Shaun O’Neill, and introduced into evidence last year in the U.S. Virgin Islands’ federal court case, the following massive sums of hard cash were provided to Epstein by JPMorgan Chase:

“Epstein was able to withdraw large amounts of cash from his JPMC accounts for years [Redacted]. In the year 2003, Epstein was able to withdraw highly suspicious amounts of cash totaling $175,311. In 2004, he withdrew $840,000. In 2005, he withdrew $904,337. In 2006, he withdrew $938,625. In 2007, he withdrew $526,000. In 2008, he withdrew $469,000. In 2009, he withdrew $165,011. In 2010, he withdrew $253,397. In 2011, he withdrew $260,000. In 2012, he withdrew $290,000. In 2013, he withdrew $197,152.”

O’Neill writes further in the statement filed with the court last year:

“Human trafficking under U.S. law was transformed with the enactment of the Trafficking Victims Protection Act (the TVPA) in 2000. The TVPA equipped law enforcement, prosecutors and victim advocates with new tools and resources to mount a comprehensive and coordinated strategy to combat modern forms of slavery both domestically and internationally…

“In reference to sex trafficking of a minor with great relevance to the numerous victims at the hands of Jeffrey Epstein, minors need not demonstrate force, fraud, or coercion were used against them to induce them to engage in a commercial sex act. Rather, U.S. law has firmly established that minors cannot consent to commercial sex. Additionally, there is recognition that many forms of human trafficking do not involve force but rather occur through psychological manipulation against victims.”

O’Neill indicated that “Based on the review of the 17 victim statements contained within the July 25, 2006 Palm Beach Police Department Incident Report, more than ten victims were under the age of 18. The elements of child sex trafficking were present as the allegations referenced a commercial sex act involving a minor and there is no such thing as a ‘child prostitute.’ The allegations reflected a textbook definition of human trafficking.”

O’Neill put the blame for the expansion of Epstein’s sex trafficking ring at the feet of JPMorgan Chase, writing:

“Had JPMC cooperated with federal law enforcement and [Redacted]….Epstein would have been federally charged at a much earlier date. He likely would not have received the Florida Non-Prosecution Agreement, and he would have been imprisoned for the sex trafficking and money laundering crimes that he committed at an earlier time, thereby shrinking his overall list of victims.”

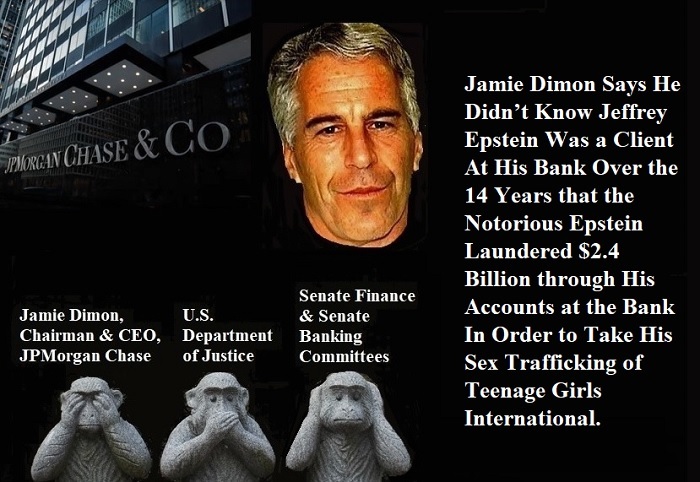

The long-tenured Chairman and CEO of JPMorgan Chase, Jamie Dimon, was deposed in the U.S. Virgin Islands court case. His narrative is that he lived a cloistered existence in a corner office on the 48th floor of 270 Park Avenue where even the top executives who directly reported to him and worked only “a couple hundred feet” away from his office, never shared with Dimon their knowledge of, and meetings over, the bank’s concerns about Epstein’s massive withdrawals of hard cash, his prior history as a jailed sex offender in Florida, or his appearance on the front page of the New York Post in 2011 with the giant, all caps bold headline: “PRINCE AND PERV,” featuring a photo of Prince Andrew and Epstein, and the commentary: “Randy Andy with NYC sex creep.”

Somehow, the fact that Epstein was referring to JPMorgan Chase some of the richest and most politically-connected men in the world also escaped Dimon’s perch in that corner office. According to the Attorney General of the U.S. Virgin Islands, Epstein referred the following individuals to the bank as clients: the sixth richest man in the world, Microsoft co-founder and billionaire Bill Gates; the ninth richest man in the world, Google co-founder and billionaire Sergey Brin; the Sultan of Dubai, Sultan Ahmed bin Sulayem; media and real estate billionaire Mort Zuckerman; former U.S. Treasury Secretary and former Harvard President Larry Summers, and numerous others.

As chance would have it, Dimon – for the first time since taking the helm of the bank – is also selling large chunks of his stock in the bank. See Jamie Dimon Dumped $150 Million of His JPMorgan Stock in February; Now He Says His Regulators Want 25 Percent More Capital at his Bank.

For how the bank settled its Epstein-related lawsuits last year, see JPMorgan’s Settlements Reach $365 Million Over Civil Claims It Banked Jeffrey Epstein’s Sex Trafficking of Minors; Criminal Charges Could Lie Ahead.

Give the gift of great skin care. Our Soap and Shave Bars are gentle and produce a smooth creamy lather that is nourishing to your skin. They are handmade in small batches. We use only high-quality natural ingredients that you can pronounce. No chemicals, no sodium laurel sulfate, no phthalates, no parabens, no detergents. The set can include Soap Bar, Shave Bar, Shave Brush, and/or Shampoo Bar. These come in a white box and are perfect for your gift giving needs.

Our soaps are made with skin loving ingredients including olive oil, coconut oil, lard, sweet almond oil, shea butter, and castor oil. We do not use palm oil. Scented only lightly with fragrance oils.

The Shave bars give a very close and smooth shave with no razor burn. They leave your skin feeling amazing. A lather can be built up in your hands and then applied to your face, but it is best to use a shaving brush. These bars will only produce a thick foam when used with a shaving brush.

Our Shampoo Bars have a thick lather. A lather can be built up in your hands and then applied to your hair, but it is best to rub the bar gently in your hair. Rinse and repeat.

You choose a scent:

A Thousand Dreams is a whimsical blue scented in a warm mix of fruity and floral notes with peach, peony, lily, musk, sandalwood, and amber.

Bay Rum Spice is a nice masculine scent similar to Old Spice. The scent notes are clove, pine needles, cedarwood, orange, vanilla, and musk.

Birch Woods is a great outdoors-type scent. The notes are bergamot, patchouli, vetiver, and tonka bean.

Cool Clear Water is a refreshing scent. The notes are crisp water, oakmoss, pine, cedar, and musk.

Lavender Champagne has a wonderful scent of Lavender and Champagne and has a light purple color. The scent notes are lavender, sparkling Champagne, grapefruit, orange, thyme, oak, and amber.

Midnight Waters is a moody-mystical scent that opens with fruity notes of red berries, juicy tangerine, and bergamot. Then unfolds into bubbly Champagne, violet flowers, cashmere, amber, and musk.

Raspberry Vanilla is an all-time favorite fragrance for soap. It is a beautiful magenta color. The scent notes are raspberry, strawberry, lemon, coconut, peach, honeysuckle, plum, and vanilla.

Warm Sandalwood is a warm, rich, and woodsy scent. The colors are warm and rich with brown, gold, and white.

A Soap bar will weigh approximately 4 ounces and be approximately 2.25 inches wide by 3.5 inches tall and 1 inch thick. A Shave bar will weigh approximately 3 ounces and be approximately 2.5 inches across and 1.25 inches thick. A Shampoo Bar will weigh approximately 3.5 ounces and be approximately 2.5 inches across and 1.25 inches thick. Please keep in mind that our products are handmade and hand cut. Each bar is unique and might vary slightly in shape, size, design, and color from those pictured.

Please keep your Soap Bars, Shave Bars, and Shampoo Bars well-drained and allow to dry between uses. This will ensure longer lasting bars.

Allergen: Our products contain oil from tree nuts. Please test on a small area of skin prior to use and stop using if irritation occurs. Do not use if you are pregnant. Do not use on infants under the age of 24 months. Do not get in your eyes as it will sting slightly. GoShopping

![]()