Financial writer John Rubino says gold is at new all-time highs, silver is vaulting upward and there is no end in sight for the massive money printing around the world.

Rubino say’s if you look deeper, you can see the “real message” in the unfolding events. Rubino explains,

“It’s fun to be a gold bug and see your stacks getting more valuable, but the real message here is the world is on the verge of spinning out of control. That’s what gold and silver are signaling. We’re just a mess with no way out of this because even before the pandemic hit, we were running deficits in the U.S. of a trillion dollars a year. That is an emergency level of government borrowing, but we were doing it in the 10th year of a recovery or expansion.

Normally, everybody is back at work, paying taxes, government debt goes way down and sometimes it even turns into surpluses, but that wasn’t happening this time, which is a sign the monetary experiment that began in 1971 when we went off the gold standard and went to all fiat currencies everywhere was ending. We are no longer able to manage economies with this much debt just by printing new currency and borrowing more money. The system was going to break down anyway, but the pandemic has come along and accelerated the process.”

Rubino goes on to say, “So, now people ask: Is there a pain free way of getting out of this and getting back to normality?“

“And the answer is probably no. We have to get rid of this debt somehow. I think the global debt to GDP is in the 350% to 400% range, which is the highest ever. We have never had a society that has borrowed this much money before. Past societies have seen their monetary system breakdown before they got to this point. So, we are now an historical outlier as to how much debt we have taken on. . . . This means when all this debt gets wiped out, this might be historically worse than anything we have seen in the past.”

Rubino predicts, “We don’t have a tool to fix this if the dollar starts to fall...”

“That is the end game scenario in the financial system. When the world’s reserve currency starts to lose value and the central bank that’s managing it doesn’t have any way to stop it, then, basically, everything falls apart everywhere. . . . When it happens, the early stage of it will feel like the past few months here. I am not predicting we are heading straight to a dollar collapse or a fiat currency collapse, but when it happens, it’s going to start feeling a lot like it is now.”

In closing, Rubino says,

“The reason why so many groups are so angry right now is because the system no longer works for most people. We have an aristocracy that is harvesting the rest of us. 1% of the population gets richer and richer year after year at the expense of everybody else.”

Rubino says look for corrections in the gold and silver markets that will be “pretty scary” but adds,

Receive a daily recap featuring a curated list of must-read stories.

“This is a buy the dip market . . . . The long term trend for gold and silver are in place, and nothing is going to stop them short of their ultimate fair value.”

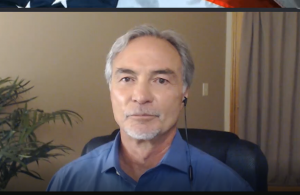

Join Greg Hunter as he goes One-on-One with John Rubino, creator of the popular website DollarCollapse.com.

To Donate to USAWatchdog.com Click Here

Source: ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()