Is the death of Wall Street equity research finally at hand? Because who needs an expensive team of analysts when clients can easily reap double-digit returns by dumping their money into passive funds?

The fact that sell-side research departments have been shedding analysts this year is hardly a surprise. MiFID II regulations made it clear from the beginning that banks would soon lose a valuable revenue stream used to support research by forcing the sell-side to “unbundle” research & trading costs.

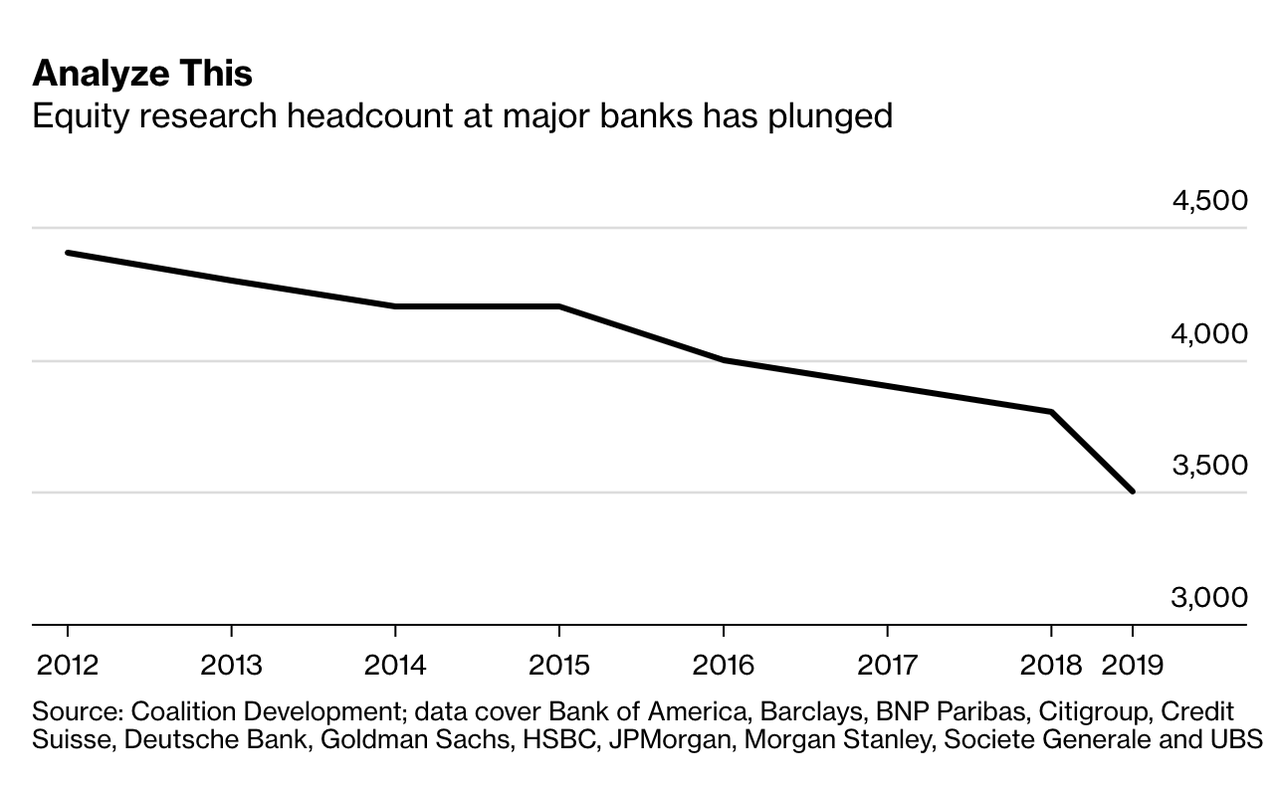

A study by McKinsey published in 2017 anticipated that the headcount at Wall Street research departments would shrink by 30% in the coming years because of MiFID.

Will Robots Take More Jobs on Wall Street?

But as Bloomberg reminds us, 2019 was the year that the heads really started to roll. Across Wall Street, equity analysts were told to clean out their desks. Even fresh all-time market highs weren’t enough to save them.

Data shared by consultant Coalition with several financial media organizations, including Bloomberg, claimed that the total headcount of sell-side equity analysts fell to roughly 3,500 this year, its lowest level in decades.

The relentless decline of brokerage research is accelerating. Its ranks shrank 8% to 3,500 across 12 major banks, data showed earlier this year, on pace for the sharpest annual decrease since research firm Coalition Development started collating the numbers in 2012.

One veteran Citigroup analyst who spoke with Bloomberg for its story said he left his job after 18 years and now works for a non-profit. Many other analysts have made similar career moves this year.

A Citigroup Inc. analyst for almost 18 years, Andrew Howell knows very well what to expect when you’re pitching a service that fewer and fewer customers need or want. So he found another line of work.

Howell now toils in a co-working space in Manhattan’s East Village doing research for a non-profit organization, part of the legion of Wall Street analysts reinventing themselves as demand for their skills fades.

MiFID isn’t the only factor impacting Wall Street analysts. Their field lies at the intersection of several trends reshaping the financial services industry, including the advent of automation and AI.

But for now, while these tools have changed things, they haven’t totally supplanted human analysts or obviated the need for real human scrutiny.

According to BBG’s data, large American asset managers are currently leading the trend of unbundling their trading business and research.

The rules that have led banks to cut down their research staff were supposed to help the buy-side by reducing the cost of research. But interestingly enough, a consulting firm teamed up with Evercore to study how research spending impacts asset-management firms’ performance.

They found that firms who skimped on the research spend routinely underperformed those that spent more.

It’s not all doom and gloom. Some banks are taking advantage of the retrenchment. Goldman Sachs Group Inc. hired new analysts this year to “get a bigger piece of what is overall a smaller pie,” said Jim Covello, Goldman’s global co-head of single-stock research.

Dwindling sell-side research may finally settle the question of its value. U.S. managers spend between three to six times more on research than their European peers, Neil Scarth at Frost Consulting estimates. An analysis by Evercore ISI and Frost argued that firms paying for analysis out of their own pockets generally underperformed last year, suggesting they’re being penny-wise and pound-foolish.

But the biggest boon for firms looking to take advantage of this trend will probably be found among boutique firms. As banks are forced to cut back there coverage, inevitably, even more, will slip through the cracks.

This should create opportunities for smaller activist firms like this one willing to think creatively and invest more in research.

On the other hand, companies who know they are facing less scrutiny from Wall Street and the media might be emboldened to try and cover up or bury information that might hurt their stock. Zero Hedge HNewsWire Bankster

StevieRay Hansen

Editor, Bankster Crime

“debtors are hostage to their creditors.”

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The Birth Pains Are Growing Stronger….

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

My name is Steve Meyers and I need to share a vision and warning that the Lord showed me back in April 2007….

Many of you will ask why I waited so long to share the warning. I didn’t. I shared the story with everyone that would listen from pastors to friends to family to colleagues. Immediately following the initial vision, I called a close friend. I told him to sit down that I had something to tell him. I needed it documented as I knew this was supernatural and from God. As I witness events unfolding today, I need to share the vision again.

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user. Steve Meyers, StevieRay Hansen

People’s hearts are troubled, their minds are in a state of confusion, the Bible tells us a time of great delusion that will come upon the people, that time has arrived, the politicians must come up with more significant and more believable lies in order to bring on the antichrist, we have entered the doorstep Tribulation.

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

Tagged Under: #Fraud #Banks #Money #Corruption #Bankers,#Powerful Politicians, #Businessmen

![]()