HNewsWire: A wave of bankruptcies and corporate defaults can be imminent as US corporations are being battered by rising loan rates. Experts caution that as high interest rates have an adverse effect on both consumers and businesses, it may increase the likelihood of a recession. As of the end of August, 459 businesses had declared bankruptcy, according to S&P Global. The entire number of bankruptcy filings reported between 2021 and 2023 is already exceeded by that figure. August saw the largest monthly total of corporate debt defaults since 2009. S&P Worldwide According to Collin Martin, a fixed income strategist at Charles Schwab and director, borrowing prices for certain companies increased by two or almost three times in 2023 compared to earlier years, which had a negative impact on company balance sheets. The ICE BofA US High Yield Index shows that…Read More

by Tyler Durden

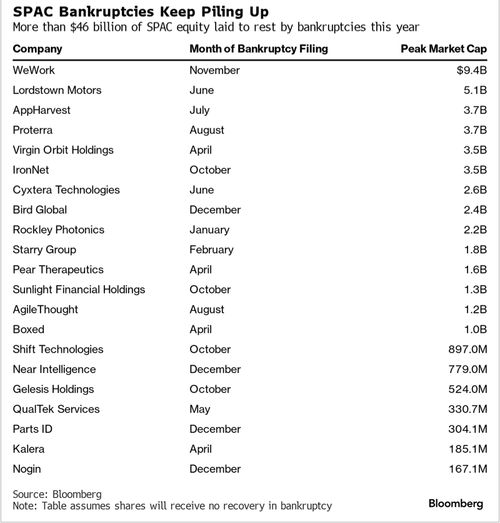

Thursday, Dec 28, 2023 – 05:55 AMAn increasing number of startups that have merged with special purpose acquisition companies, or SPACs, are running out of cash and unable to raise new funds in a deteriorating macro environment with high interest rates.

At least 21 companies that went public via SPACs filed for bankruptcy this year, wiping out $46 billion in total equity, according to Bloomberg data. Some of the largest bankruptcies were WeWork, Lordstown Motors, and Virgin Orbit.

The failures of coworking space, electric vehicle, and space launch startups exemplify that these companies were never “ready for primetime” on public markets, said Gary Broadbent, an executive guiding former SPAC AppHarvest Inc.

WeWork was the highest-profile SPAC implosion of the year. It was once valued at $9.4 billion after going public in 2021. This blow-up exemplifies the bubbles the Federal Reserve blows in a near-zero interest rate environment, with the eventual implosion when rates rise (or before, in anticipation of higher rates).

Usha Rodrigues, a law professor at the University of Georgia, said the SPAC bubble during Covid was a “ticking time bomb” of corporate failures and “Everyone should have seen this cliff coming.”

Bloomberg data shows about 140 SPACs desperately need financing in 2024 to keep operations humming. Elevated interest rates will make refinance challenging and increase the risk of more bankruptcies.

Hudson Labs shows about 44% of SPAC companies that filed annual reports in 2023 have stated going-concern warnings compared with 22% of non-SPAC companies.

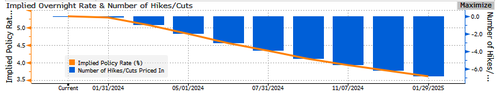

However, the Fed’s pivot this month could be the biggest lifeline for these startups as rate traders prices in 6 interest rate cuts through December 2024.

The pandemic-fueled frenzy has been over for two years, and the failures will likely accelerate in the first quarter.

![]()