Over the past few days there has been much confusion over the repocalpyse that shook the overnight funding market, and just as much confusion over the definition of reserves which some banks were unwilling to part with, other banks were desperate for, and in the end both Powell and the former head of the NY Fed’s markets desk admitted that Quantitative Tightening had been taken too far, and the total amount of reserves in the system was too low and would have been increased.

And while the book is yet to be written on the causes for last week’s shocking move higher in repo rates, which sent general collateral as high as 10%, a record print in a time of $1.4 trillion in excess reserves, we can shed some clarity on the definition of “reserves.” While there is a universe of semantic gymnastics when it comes to explaining what reserves are, the most basic definition is quite simply “cash”, however not cash in circulation but rather cash (and deposits) held in the bank’s account with the Federal Reserve (which is where its name comes from).

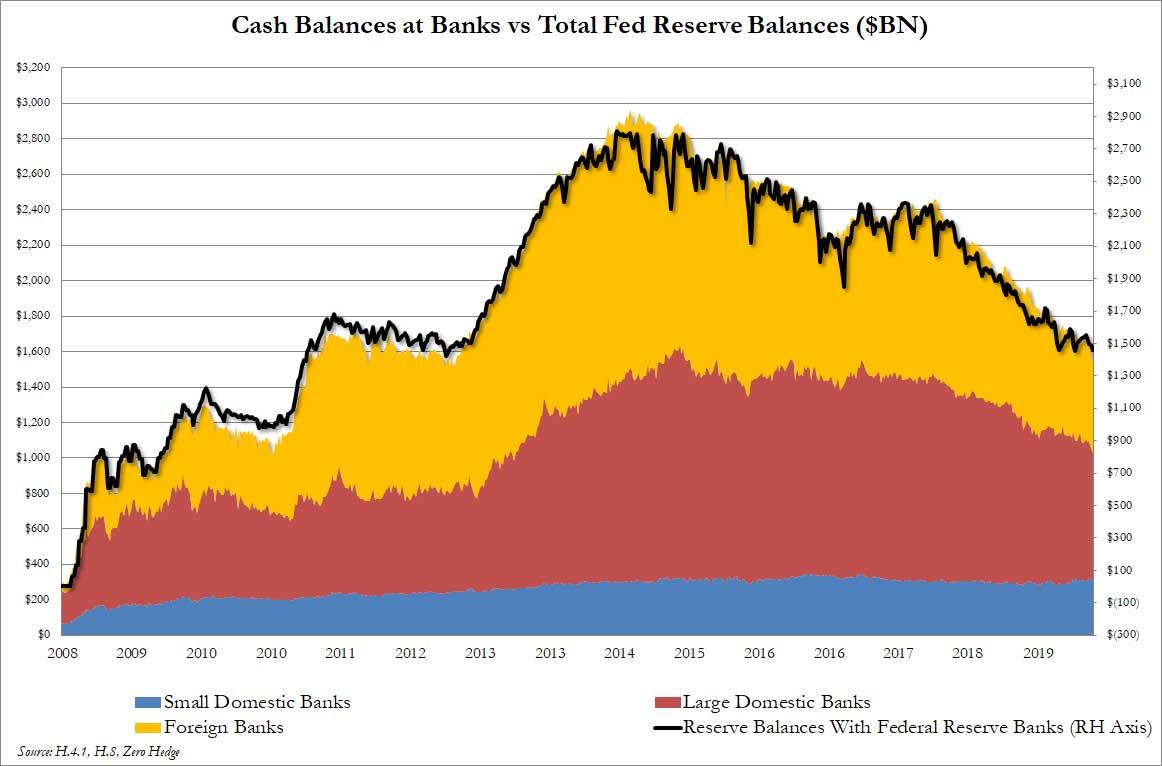

This means that there should be a de facto identity between the total amount of cash in the US banking system and the amount of total (minimum required plus excess) reserves. And sure enough, if only looks at the Fed’s weekly H.8 statement, which lists the “Assets and Liabilities of Commercial Banks in the United States“, if one adds across the various banking cash aggregates in the US, what one gets is precisely the total amount of reserves.

This is seen in the chart below, which adds across the weekly cash for both small and large domestic commercial banks operating in the US (blue and red shaded areas) as well as foreign commercial banks (yellow shaded) operating in the US. The black line, meanwhile, shows the total amount of reserve balances with Federal Reserve Banks. By definition, these two numbers have to be virtually identical, and sure enough, they are.

Why is the above information important?

Because as the FT reported on Friday as part of its interview with the NY Fed’s hapless and confused career-economist president, John Williams (who back in May inexplicably fired the man most intimately familiar with the plumbing of the US financial system, the NY Fed’s market desk head Simon Potter), the NY Fed president said that it was “looking at why cash failed to move from banks’ accounts at the Fed into the repo market, where banks and investors borrow money in exchange for Treasuries to cover short-term funding needs.“

Additionally, as Lorie Logan, senior vice-president in the markets group, told the FT, “Reserves are concentrated, the excess reserves relative to the minimum level each bank is demanding is concentrated. And the key question is how those reserves, as the level was coming down, would get redistributed, and how smooth that redistribution process would be.”

In short, the NY Fed is looking at the banks that comprise the three aggregate levels above, and is trying to figure out why they did not hand out their cash to other banks that were in desperate need for liquidity, and why said reserves were so “concentrated”, i.e., sticky, so as to precipitate a funding crisis which was only halted when the Fed stepped in.

Alas, John Williams did not elaborate, so we will do so for him: the Fed is not only trying to figure out why banks with excess cash/reserves parked at the Fed did not offer it to their more troubled peers but why they refused to do so even though any such loan would be perfectly collateralized by money-good securities such as Treasuries, MBS and Agency debt.

One possible explanation: the banks that should have lent out cash did not do so because they were afraid that i) the borrower would not be able to return the cash on the next day and ii) any potential failure in the banking system would lead to a collapse of the repo system, potentially making their ultra-safe collateral impaired, if not worthless. Hence, their desire to hold on to cash… and dear life.

In any event, if Williams really wants to find out why banks failed to step in and prevent last week’s apocalypse, he should start with the banks that are laid out in the chart above- and maybe he should focus first and foremost on the foreign banks that currently have $521 billion in cash parked at the Fed, on which they – the foreign banks – are collecting 1.80% in annual interest.

And once the NY Fed is done with this exercise, it may want to quickly found out the flip side of the equation: which banks were so desperate for liquidity last week they not only risked being seen using the Fed’s overnight repo operation, which in this day and age of $1.4 trillion in excess reserves carries the same stigma as using the Discount Window in the days before the Lehman failure, but did so by oversubscribing the Fed’s $75 billion repo facility for 3 days straight. In short, one or more banks are in dire need of just over $75 billion in liquidity, and the Fed better figure out who they are… before some financial reporter does, reveals their name and start what may soon be the biggest bank run since the financial crisis. Source

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers,#Powerful Politicians, #Businessmen

![]()