These same money changers were associated with others who engaged in shady business practices in the temple courts. Some sold sacrificial animals, overcharging people who did not bring their own. Others were in charge of examining the animals to be sacrificed, and it was a simple matter to declare an animal “unapproved” and force the worshiper to buy another animal—at an inflated price—from the temple vendors. Such goings-on, exploiting the poor and the foreigner, angered the Lord Jesus and was strictly forbidden in the Mosaic Law (Exodus 22:21; Leviticus 19:34).

The money changers in the temple courts were similar to tax collectors in that they extorted money from their own people. They were more than ordinary businessmen. They were seeking to profit financially from the worship of God. Wherever passion and zeal are found, there will also be those who seek to profit from that zeal. Paul wrote to Timothy about such people, false teachers who found a way to make a fortune off the gospel (1 Timothy 6:5). Modern versions of the money changers flood the airways, promising to exchange your hard-earned dollars for blessings, healing, and God’s favor. For a suggested donation, they will supposedly pray for you or promise virtually anything you want. For another twenty bucks, they will sell you a book about how to wrangle prosperity, health, or spiritual insights from God. And, like the simony of the first-century money changers, the practices of modern religious price gougers only aid those worshipers who have enough cash to purchase their wares.

It’s not often that job cuts in the City of London make the same sort of headlines as layoffs at a car plant in Swindon or a steelworks in Scunthorpe – so you know something’s up when the 18,000 job losses at Deutsche Bank hit the front pages of all the wrong newspapers.

The decision by Deutsche Bank to finally throw in the towel on its 25-year attempt to build a global investment bank to rival the Wall Street giants is a parable of the past 25 years in global banking. You might even say it was the moment that the full impact of the financial crisis finally sunk in for the industry, albeit perhaps 10 years too late.

Deutsche Bank will cut a fifth of its global workforce over the next three years, effectively shut down some businesses altogether, and significantly reduce the giant bond and derivatives trading business on which the entire Deutsche Bank project had been built. Perhaps a few thousand of the 8,000 or so staff at Deutsche Bank in the UK could be at risk. It can sometimes be hard to feel sorry for bankers, but for every one of them, it will be a devastating personal blow.

At its most basic level, the decision to finally bite the bullet marks the end of 10 years of reluctant tinkering at the edges of a business that had grown too big and too quickly in the decade before the financial crisis. Like most banks, Deutsche Bank has been struggling since the financial crisis to adapt to a perfect storm of tougher regulation, falling revenues, and a stubbornly high-cost base. But unlike many banks – particularly its main US rivals – it has seemed strangely unwilling and unable to get to grips with these structural challenges.

It was quite a ride on the way up. I first started writing about Deutsche Bank in the mid-1990s as a cub reporter on a City trade paper and this week’s news made me feel quite nostalgic. My first interview as a reporter in 1996 was on an empty trading floor in the City with someone called Edson Mitchell – the uber-trader hired by Deutsche Bank in 1995 to spearhead its ambitious project. He patiently explained to a clueless reporter why the bank was hiring 500 traders and what they would soon be doing.

My first front page splash a few months later was that Deutsche Bank had hired the entire Latin American equities team of about 70 people from ING Barings. Why bother building a business from the bottom up when you can just buy the people from another firm that has already done so? Those early moves were repeated many times over. Do you want to build the best trading business? Hire a huge team from Merrill Lynch. Do you want the best equities and advisory business? Take the best team on the street from SG Warburg.

In the early days of the Deutsche Bank project it had the culture of an ambitious start-up: hire large teams of very good people, pay them a ton of money, focus on revenues, scale and market share – and eventually, the profits will follow. Throw in as much leverage as your balance sheet can bear, and the numbers started adding up pretty quickly. It was a simple and successful formula.

Soon Deutsche Bank graduated from hiring teams to buying entire firms: its acquisition of Bankers Trust in 1998 for $10bn – the biggest ever attempt by a European bank to break into the US market – briefly made it the biggest bank in the world in terms of assets. It snapped up Scudder Investments a few years later, and the Russian investment bank UFG a few years after that.

The danger was that this ambitious start-up culture became the de facto culture of the investment bank. As a business model, it worked when regulators around the world were more generous with how much leverage banks could have and when everyone was printing money in the years running up to the financial crisis. In 2007 the investment bank at Deutsche generated a shade under €20bn in revenues of a balance sheet that was just shy of €2 trillion. Two-thirds of that revenue came from its huge sales and trading business. Pretax profits topped €5bn and its return on equity – a measure of profitability – was just under 20%. The Deutsche Bank project had worked.

The problem with this culture and business model – or rather, collection of businesses that had been rammed together over the previous decade – was that when the music stopped in 2008 it left Deutsche Bank with a huge and unproductive balance sheet, a cost-base that was nowhere near as flexible as it should have been, and a toxic culture in which many people’s expectation of how much they should be paid had become disconnected from the reality of the day-to-day business.

To put this challenge in perspective, since May 2007, Deutsche Bank’s share price has tumbled more than 90%. Revenues in the investment bank have dropped by a third and its traditional engine room of sales and trading has virtually halved in size. Pretax profits are down by 90% and its return on equity is less than 1%. The amount of capital required by regulators has more than doubled, but it employs the same number of people in the investment bank as in 2007 and it has only managed to cut 10% of its costs. One reason for that is that nearly 650 people at group managed to earn more than €1m in 2018, and 100 of them made more than €2.5m.

For the first few years after the crisis, it had looked like Deutsche Bank had played a blinder (it’s best ever year in terms of revenues and profits was in 2010 and it wasn’t bailed out during the crisis). Its sheer scale meant it would probably weather the storm: it had after all succeeded in its quest to become the biggest investment bank in Europe and a top tier player on Wall Street.

Even as regulators around the world turned the screw on the business model and profitability of investment banks, Deutsche was a disciple of the “promised land” theory of investment banking: the fallout from the crisis would blow over, regulators would relax their grip on the industry, and smaller rivals would drop out. This would leave the field open for a handful of global giants to have the same sort of fun as in the good old days.

But the fallout hasn’t blown over, regulators are showing no signs of chilling out, and none of its main rivals have fallen by the wayside. Investment banking has changed, perhaps permanently. Deutsche Bank didn’t change with it: its culture, cost base, structure and share price have finally caught up with it.

Postscript: Many years after my first meeting at Deutsche Bank, I sat down to interview a senior executive in the investment bank at Deutsche. To break the ice we discussed our mutual love of cricket (he expressed his love for the game by buying a stake in a professional cricket team, I went to the occasional match at Lord’s when I got tickets in the ballot). “But the problem is that you can’t make any money in professional sport as a shareholder. The only people who make money are the players,” he said. Not unlike investment banking. Source

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

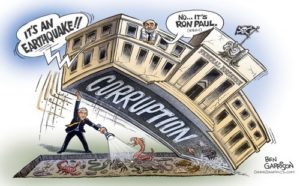

Fraud #Banks #Money #Corruption #Bankers,#Powerful Politicians, #Businessmen

![]()