An eventful 2019 wraps up a decade of turmoil in oil markets, in which Brent Crude prices fluctuated from as high as US$125 a barrel in 2012 to as low as US$30 per barrel in January 2016.

Geopolitical turmoil, economic growth, soaring U.S. shale production, and OPEC’s various policies to try to set the trends in oil prices marked the decade which is drawing to a close.

Hong Kong Braces for Major New Year’s Day Rally

For the decade beginning in 2020, the key factors determining the price of oil are likely to be similar to those we have seen over the past decade, Andy Critchlow, Head of News, EMEA at S&P Global Platts, writes.

The state of the global economy, U.S. oil production and export growth, and the OPEC+ alliance between the cartel and a dozen non-OPEC producers led by Russia will continue to influence the price of oil through 2030.

Geopolitical flare-ups and U.S. sanctions policies toward major oil producers, including Iran and Venezuela, will also shape the supply side of the market over the next few years.

On the demand side, the growing share of renewables in the energy mix and the increased use of electric vehicles (EVs) will begin to displace meaningful volumes of fossil fuel demand in power generation and oil demand in transportation over the next decade, many analysts say. Growing climate concerns may also start impacting investment decisions in new fossil fuel production, including oil.

The fundamental supply and demand picture will likely be ‘more of the same’, but the push and policies toward greener economies could be the new factor shaping oil markets and influencing oil prices over the next decade.

According to S&P Global Platts Analytics, alternative energy—including renewables, higher EV penetration, and hydrogen use—“will limit the overall call on fossil fuels.

“As we enter a new decade, the energy complex feels like it is all cascading towards a race to the bottom,” S&P Global Platts Analytics said in a research note.

Many forecasts predict oil demand peaking at around 2030 or in the 2030s. Global oil demand will reach its peak in the mid-2020s and flatten out in the 2030s, the International Energy Agency (IEA) said in its latest annual World Energy Outlook.

“Oil demand for long-distance freight, shipping and aviation, and petrochemicals continues to grow. But its use in passenger cars peaks in the late 2020s due to fuel efficiency improvements and fuel switching, mainly to electricity. Lower battery costs are an important part of the story: electric cars in some major markets soon become cost-competitive, on a total-cost-of-ownership basis, with conventional cars,” the IEA said in its outlook to 2040.

Unsurprisingly, OPEC continues to see the oil as the fuel with the highest share in the global energy mix through 2040. The Organization of the Petroleum Exporting Countries expects EVs to hold a share of just 13 percent of the global car fleet in 2040 and sees the majority of the growth still coming for conventional internal combustion-engine vehicles.

OPEC has also been warning since the oil price crash in 2015-2016 that reduced investments in conventional oil after the price plunge will start to impact global oil supply in the 2020s. Through 2040, the world will need US$10.6 trillion in total investments in oil, OPEC said in its World Oil Outlook 2019 in November.

In the new decade, OPEC and its allies in the current OPEC+ pact will have to reckon with U.S. shale production, where growth is slowing these days as prices remain bound in a narrow range. But U.S. production will still grow in 2020, by more than 1 million bpd, according to nearly all major forecasts. U.S. shale production is expected to start declining in the middle or late 2020s, according to OPEC’s estimates.

The OPEC+ alliance will be tested as early as this coming March when the partners are meeting to discuss how to proceed with their production cuts.

The coming decade will also test how (ir)relevant OPEC is on the global oil market, considering the supply growth from countries outside the production pact, the rising share of renewables and EVs amid falling technology costs, and growing concerns about climate change.

Global economic growth and recessions will undoubtedly also impact oil demand and oil prices over the next decade. So will the ever-restive Middle East with the Saudi-Iran antagonism and global powers vying for influence in a region home to one-fifth of the world’s daily oil supply. Source

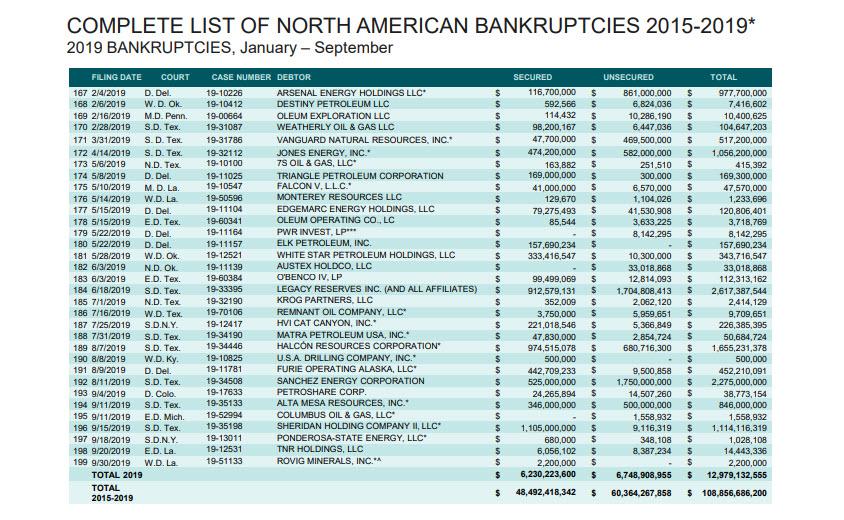

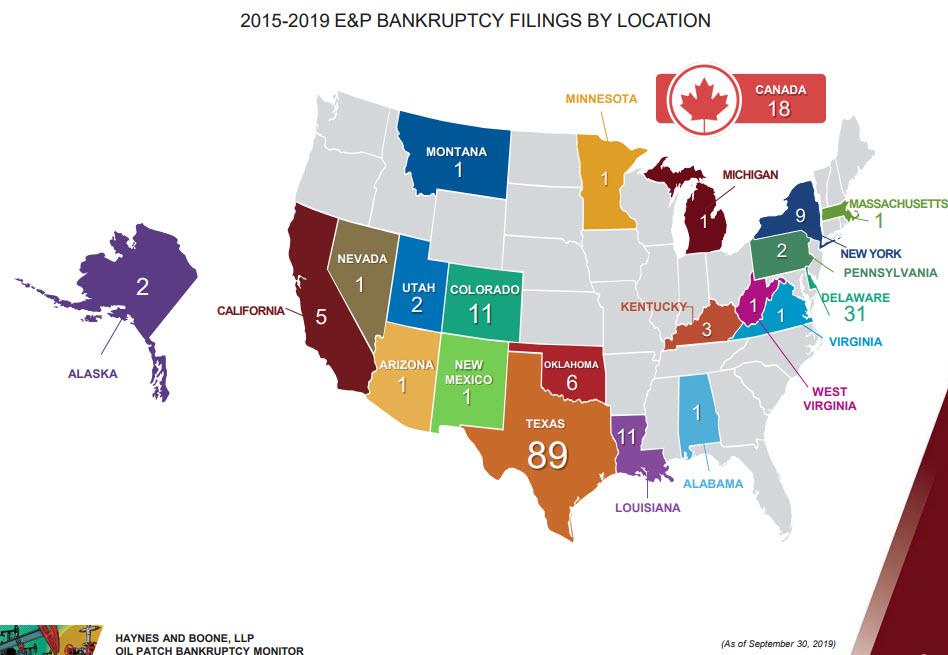

In 2019 through the third quarter, 32 oil and gas drillers have filed for bankruptcy, according to Haynes and Boone.

Since the end of September, a gaggle of other oil and gas drillers has filed for bankruptcy, including last Monday, natural gas producer Approach Resources. This pushed the total number of bankruptcy filings of oil and gas drillers from the beginning of 2015 to over 200. Other drillers, such as Chesapeake Energy, are jostling for position at the filing counter.

Chesapeake has been burning cash ever since it started fracking. To feed its cash-burn machine, it has borrowed large amounts and has been buckling under its debt for years, selling assets to raise cash and keep drilling for another day. But its debt is still nearly $10 billion. Its shares closed on Friday at 59 cents.

On November 5, in an SEC filing, it warned of its own demise unless oil and gas prices surge into the sky asap: “If continued depressed prices persist, combined with the scheduled reductions in the leverage ratio covenant, our ability to comply with the leverage ratio covenant during the next 12 months will be adversely affected which raises substantial doubt about our ability to continue as a going concern.”

In early 2016, during Phase 1 of the oil bust — which had started in mid-2014 — Chesapeake had already used the threat of bankruptcy to push its creditors into accepting a debt restructuring. At the time, it was the second-largest natural gas producer in the US.

The debt restructuring reduced its debt burden somewhat and pushed maturities out, which then allowed it to borrow new money from new investors with a series of bond sales. This coincided with the Wall Street floodgates reopening to the oil and gas sector, when PE firms, hedge funds, and distressed-debt funds piled billions of dollars into the sector, and many of the oil and gas drillers were able to raise more cash to burn.

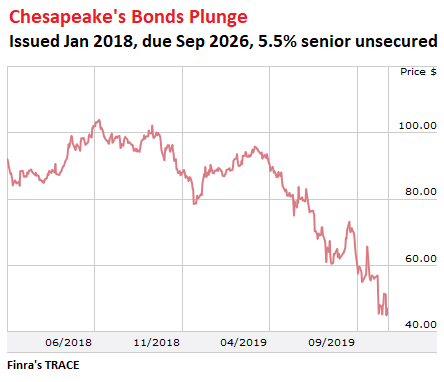

Chesapeake’s series of bond sales that it then undertook included, in January 2018, $1.25 billion of senior unsecured convertible notes with a coupon of 5.5%, due in September 2026. It issued those bonds at a discount, but by July 2018, a few months before Phase 2 of the oil bust set in, the bonds were trading at 103 cents on the dollar. On Friday, the last trade was at 45 cents on the dollar, giving these bonds yield of over 21% (via TRACE, FINRA’s Trade Reporting, and Compliance Engine):

Other exploration and production (E&P) companies have seen their shares get crushed as reality began to re-set in.

Whiting Petroleum shares [WLL] had spiked to $370 in August 2014, when the oil bust was setting in. By the trough of Phase 1 of the oil bust, in February 2016, its shares had plunged to $14. Then new money started flowing into the sector, and its shares rallied to $55 by August last year. Then Phase 2 of the oil bust set in, and after some disastrous earnings reports, its shares closed on Friday at $5.34.

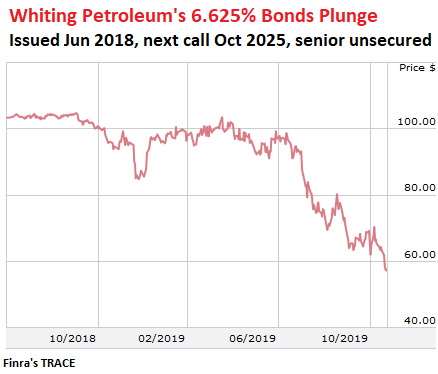

In June 2018, Whiting sold $1 billion of callable senior unsecured bonds, with a coupon of 6.625%. The next call date is in October 2025. Through September 2018, the notes were trading at 103-104 cents on the dollar. Then Phase 2 of the oil bust took its toll. On Friday, the bonds closed at 57.8 cents on the dollar, at a yield of 18.375% (via FINRA’s TRACE):

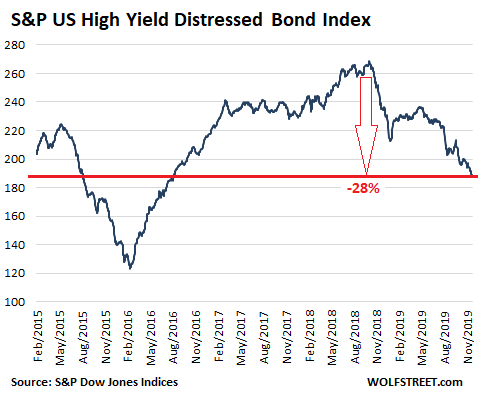

The S&P U.S. High Yield Corporate Distressed Bond Index tracks bonds that trade at a yield that is at least 10 percentage points higher than the equivalent Treasury yield (“Option Adjusted Spread” of 1,000 basis points). Chesapeake’s bond illustrated above, trading at 21%, and Whiting’s bond trading at 18.375% qualify for this index with flying colors. Of the 182 constituents in the index, many are energy bonds. Since November 2018, the index has plunged by 28%:

Now there are stories circulating of how billionaires, who in 2016 believed the hype that the fracking bust was over, have gotten tangled up and lost tons of money on their bets. Bloomberg recounts one such story, of the brothers Farris and Dan Wilks in Texas.

In 2002, they’d turned their stone-mason expertise into Frac Tech Holdings. Chesapeake, the fracking pioneer with the collapsed shares and bonds above, acquired a 25.8% state in 2006. They became billionaires in 2011 when they sold the remainder of the company to an investor group led by Temasek Holdings, which is owned by the Government of Singapore, for $3.5 billion. They then bought large swaths of land in five states, becoming the top property owners in Montana and Idaho.

However, not all of their wealth went into real estate. In 2016, the brothers started investing heavily in the fracking industry through their investment company, Wilks Brothers LLC, including oil and gas drillers in the Permian Basin and suppliers, such as frac sand supplier Carbo Ceramics, of which the brothers are the second-largest investors.

Back in 2015, Carob Ceramics [CRR] still traded at over $40 a share. By October 2016, shares had dropped into the $6-range. Then the Permian boom started, and early 2018, shares were trading at $12. But then the long hard decline continued, as demand for frac sand vanished as drillers were running out of cash and cut back on their drilling activity, and on Friday, shares closed at 41 cents.

The brothers also invested $110 million in the above-mentioned natural-gas driller Approach Resources, which filed for bankruptcy last Monday. They invested in Alta Mesa Resources, which filed for bankruptcy in September, and they invested in Halcon Resources, which filed for bankruptcy in August (its second filing, after having already filed in 2016).

Bloomberg notes:

“Eight of the 10 biggest holdings in a portfolio spanning more than 50 investments have dropped since June 2018, when they were worth almost $1 billion. In a filing last week, they reported stakes in just seven entities worth a total of only $35.7 million. The combined value of those remaining holdings plunged by $171.2 million, or 88%, since they were initially disclosed.”

The shale oil and gas business has turned the US first into the largest gas producer in the world, and then this year also into the largest crude oil producer in the world. It’s a huge business, with lots of high-paying jobs, not only in the oil field but in technology sectors, including software and hardware, manufacturing of heavy equipment, transportation, materials, and of course construction – ranging from pipelines and housing in the oil field to now partially empty office towers in Houston where, according to JLL, the office vacancy rate in Q3 climbed to an astounding 24%.

The shale oil and gas business, when it’s hopping, is great for the US economy. Its activities feed a significant part of US industrial production, including manufacturing. It pays well, and manufacturing for the industry pays well, and construction for the industry pays well, and the tech components of the industry pay well, and these workers are spending their income on new vehicles and houses and other things, and boost the economy. Source BanksterCrime

StevieRay Hansen

Editor, Bankster Crime

“debtors are hostage to their creditors.”

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The Birth Pains Are Growing Stronger….

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

My name is Steve Meyers and I need to share a vision and warning that the Lord showed me back in April 2007….

Many of you will ask why I waited so long to share the warning. I didn’t. I shared the story with everyone that would listen from pastors to friends to family to colleagues. Immediately following the initial vision, I called a close friend. I told him to sit down that I had something to tell him. I needed it documented as I knew this was supernatural and from God. As I witness events unfolding today, I need to share the vision again.

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user. Steve Meyers, StevieRay Hansen

People’s hearts are troubled, their minds are in a state of confusion, the Bible tells us a time of great delusion that will come upon the people, that time has arrived, the politicians must come up with more significant and more believable lies in order to bring on the antichrist, we have entered the doorstep Tribulation.

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

Tagged Under: #Fraud #Banks #Money #Corruption #Bankers,#Powerful Politicians, #Businessmen

![]()