There Are Not Enough Pigs in the World to Fill China’s Pork Hole…

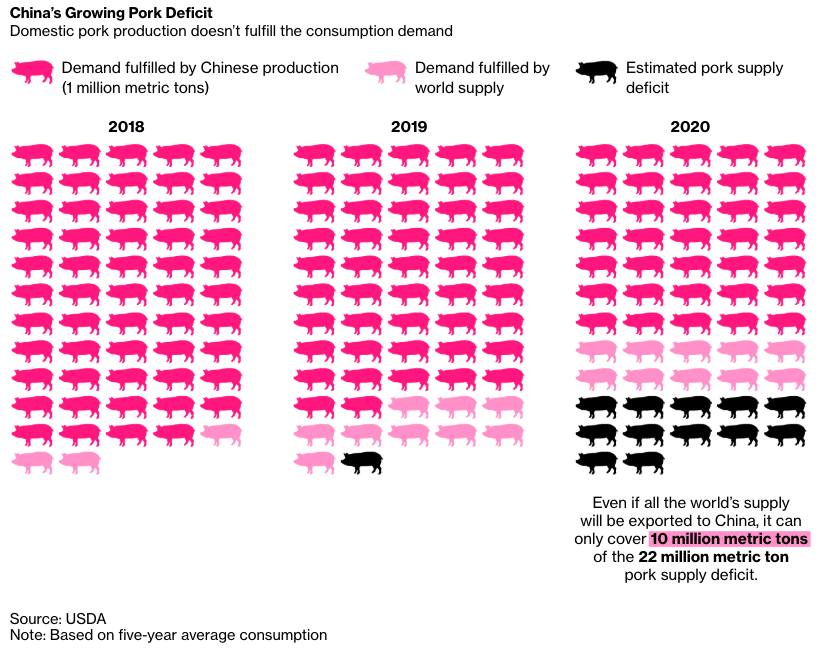

African swine fever has wiped out herds of pigs all over China – by some estimates more than half – and it now appears the global supply of pork might not be able to satisfy the country’s demand in early 2020, reported Bloomberg.

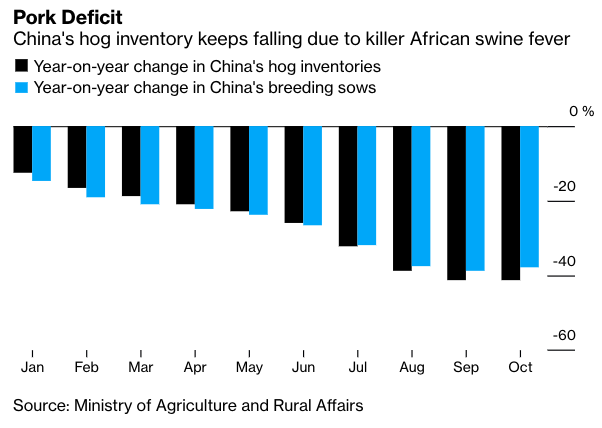

The Ministry of Agriculture and Rural Affairs published new data on Friday that shows the number of hogs in China dropped 40% in Oct. YoY. The decline is mostly due to the African swine fever and farmers culling their herds to prevent further transmission of the dangerous disease.

The disease has spread from Africa to Europe, and currently across Asia, and are fears pork supplies around the world are dwindling and might not be able to fill China’s deficit. Just this week, the Dutch government announced plans to shrink its hog industry (why? because apparently pigs smell – the government says fewer pigs means less odor nuisance and a better living environment, as well lower emissions of ammonia, in the European country with the most cows and pigs relative to land area).

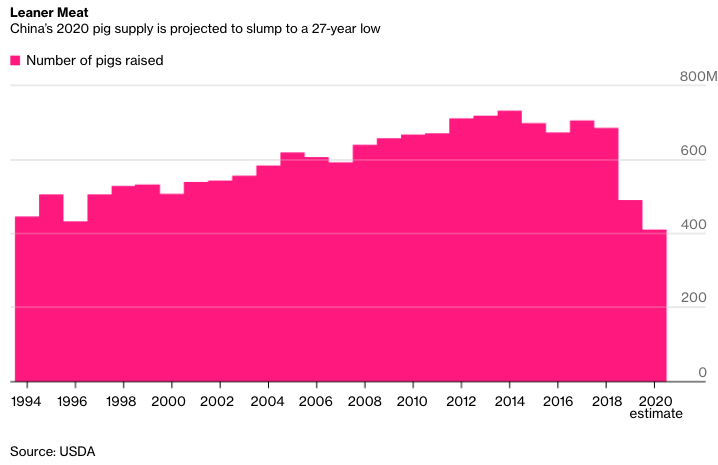

A new Rabobank report projects that domestic pork supplies could hit a three-decade low and lead to higher spot pork prices early next year.

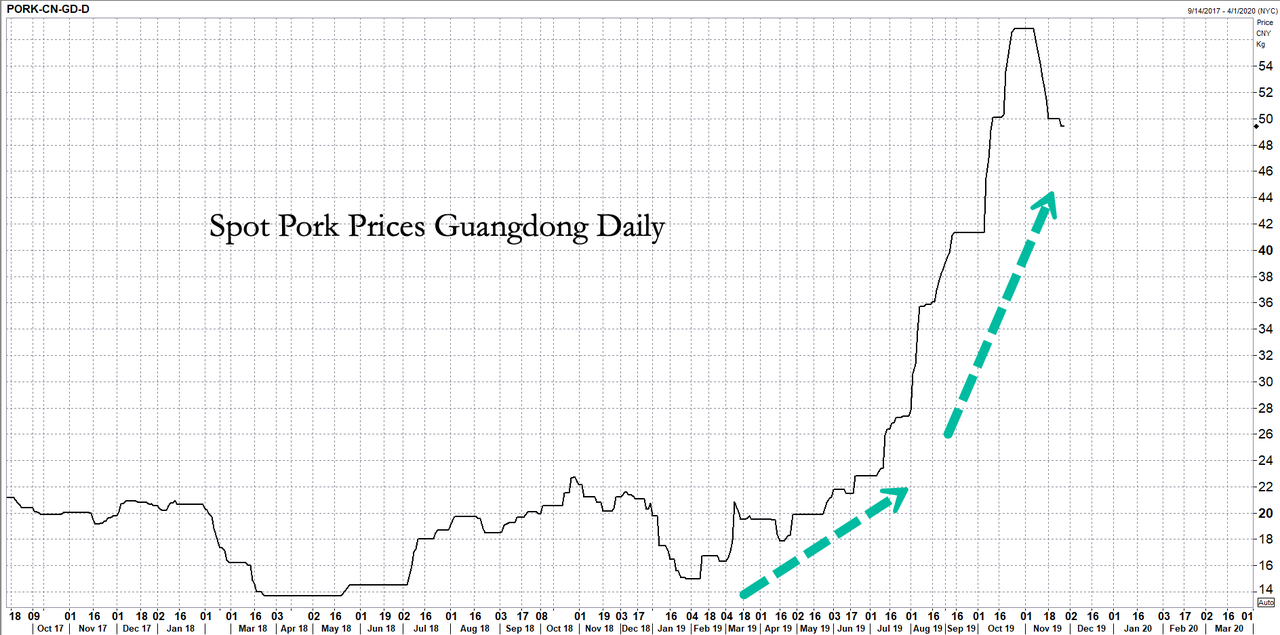

In southern China’s Guangdong province, spot prices have jumped 230% since January, with much of the gains seen in late summer as the disease gained momentum and farmers were forced by the government to cull more pigs.

The jumped in spot prices wasn’t just because domestic pork production collapsed, but the government has had difficulty sourcing products from abroad. It seems the world doesn’t have enough pork for China.

The trade war, until recently, prevented Chinese importers from souring US pork. China has found alternative sourcing in South America, signing trade deals with Argentina and Brazil for agriculture products. Though it could take months for the pork to arrive in China, the pork deficit will likely increase in early 2020, and spot prices will move higher.

Food inflation and a decelerating economy in China are a recipe for socio-economic problems in 2020. Source

China Financial Warning Signs Are Flashing Almost Everywhere

From rural bank runs to surging consumer indebtedness and an unprecedented bond restructuring, mounting signs of financial stress in China are putting the nation’s policymakers to the test.

Xi Jinping’s government faces an increasingly difficult balancing act as it tries to support the world’s second-largest economy without encouraging moral hazard and reckless spending. While authorities have so far been reluctant to rescue troubled borrowers and ramp up stimulus, the costs of maintaining that stance are rising as defaults increase and China’s slowdown deepens.

Policymakers are attempting to do the “minimum necessary to keep the economy on the rails,” Andrew Tilton, a chief Asia-Pacific economist at Goldman Sachs Group Inc., said in a Bloomberg TV interview.

Among China’s most vexing challenges is the deteriorating health of smaller lenders and regional state-owned companies, whose financial linkages risk triggering a downward spiral without support from Beijing. A landmark debt recast proposed this week by Tewoo Group, a state-owned commodities trader, has raised concerns about more financial turbulence in its home city of Tianjin.

Concerns have popped up across the country in recent months, often centered around smaller banks. Confidence in these institutions has waned since May when regulators seized control of a lender in Inner Mongolia and imposed losses on some creditors. Authorities have since intervened to quell at least two bank runs and orchestrated bailouts for two other lenders.

In its annual Financial Stability Report released this week, China’s central bank described 586 of the country’s almost 4,400 lenders as “high risk,” slightly more than last year. It also highlighted the dangers associated with rising consumer leverage, saying household debt as a percentage of disposable income jumped to 99.9% in 2018 from 93.4% a year earlier. Source

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The Birth Pains Are Growing Stronger….

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

My name is Steve Meyers and I need to share a vision and warning that the Lord showed me back in April 2007….

Many of you will ask why I waited so long to share the warning. I didn’t. I shared the story with everyone that would listen from pastors to friends to family to colleagues. Immediately following the initial vision, I called a close friend. I told him to sit down that I had something to tell him. I needed it documented as I knew this was supernatural and from God. As I witness events unfolding today, I need to share the vision again.

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user. Steve Meyers

People’s hearts are troubled, their minds are in a state of confusion, the Bible tells us a time of great delusion that will come upon the people, that time has arrived, the politicians must come up with more significant and more believable lies in order to bring on the antichrist, we have entered the doorstep Tribulation.

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

Source: HNewsWire Bankster ZeroHedge

Tagged Under: #Fraud #Banks #Money #Corruption #Bankers,#Powerful Politicians, #Businessmen

![]()