For those who have received Christ as Savior from sin, the time of Jacob’s trouble is something for which we should praise the Lord, for it demonstrates that God keeps His promises. He has promised us eternal life through Christ our Lord, and He has promised land, seed, and blessing to Abraham and his physical descendants. However, before He fulfills those promises, He will lovingly but firmly discipline the nation of Israel so that they return to Him.

A Fed hint here, a Trump tweet there, and a well-timed China headline are all you need to bypass fun-Durr-metals and send stock-buying-algos into a frenzy on a low-liquidity week…”Never gonna let you down!!”

Another sideways day for Chinese stocks unable to bounce back from early weakness (closed before the China trade headlines sparked a buying panic)…

Source: Bloomberg

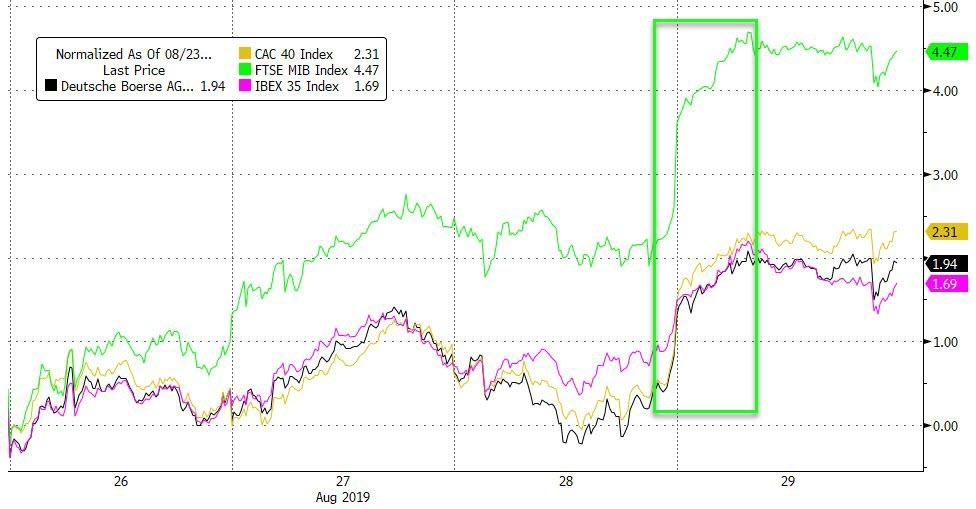

A big positive day for Europe helped by the China headlines overnight…

Source: Bloomberg

European markets did get a jolt of excitement in the afternoon as ECB’s Knot suggested no need for more QE (but that didn’t last long)…

Source: Bloomberg

US equities ripped higher again (on another trade headline overnight, this time from China saying nothing new at all), erasing all of Trump’s trade tantrum losses from last Friday…

NOTE – Nasdaq and S&P unchanged from Thursday’s close, Dow/Trans higher, Small Caps red.

Futures show the big spike overnight when the China headlines hit…

Stocks rallied all the way up to a critical Fib 61.8% retrace of the early August plunge (erasing all of last Friday’s Trump trade-tantrum losses…

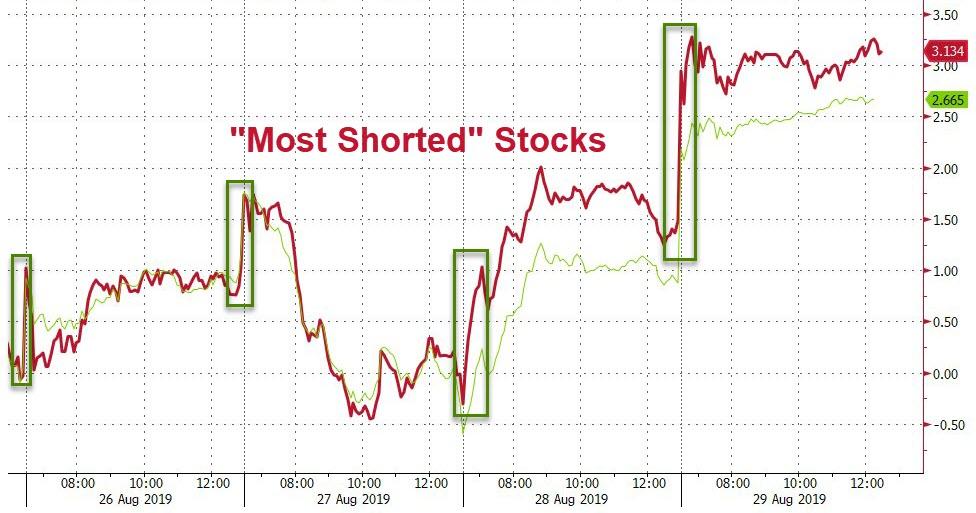

Another big short-squeeze started the day off well…

Source: Bloomberg

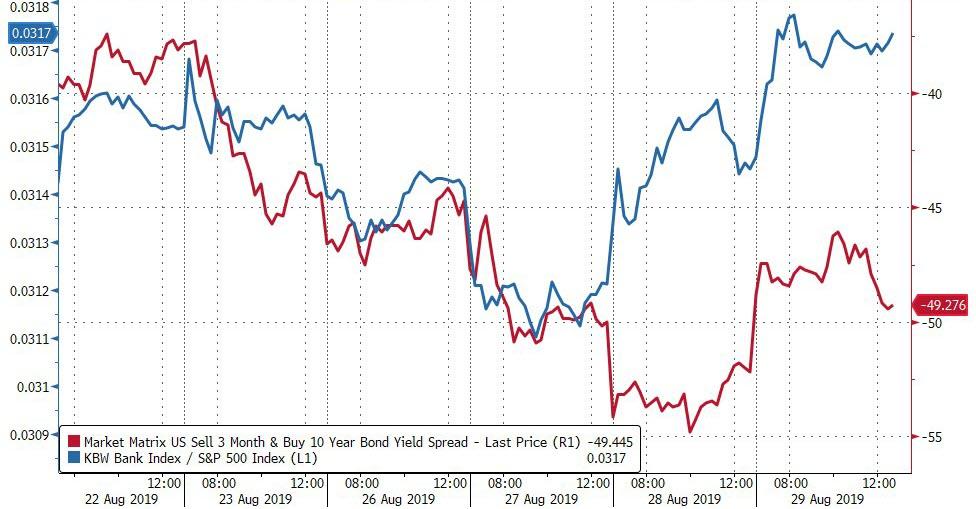

Financials outperformed the market once again, decoupling from the yield curve…

Source: Bloomberg

The timing of the China trade headlines was oddly perfectly-timed with the VIX opening, which punched lower, sparking panic-buying in the thin futures pre-market…

30Y Treasury yields are once again “more attractive” than stock dividend yields…

Source: Bloomberg

Bond yields and stocks entirely decoupled again this week (rebalancing?) as stocks shrugged off all of last week’s worries but bonds did not…

Source: Bloomberg

A really ugly 7Y auction sparked some pain in Treasuries and we suspect more rebalancing, but in the end, yields were only marginally higher (except the long bond ended unch)… A late-daye bid for bonds took them all lower for the week…

Source: Bloomberg

30Y Yields rose modestly, testing back above 2.00% intraday but each time a bid appeared…

Source: Bloomberg

And in case you wondered why the bids – look at positioning in the Ultras…

Source: Bloomberg

The yield curve steepened with 2s10s testing back toward 0 but quickly fell back in the afternoon…

Source: Bloomberg

Source: Bloomberg

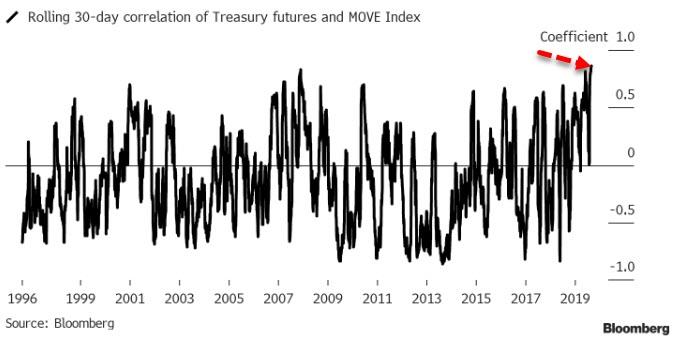

Before we leave bond-land, we note that traders looking for a reason to bet against the epic run in Treasuries might want to consider that the rolling 30-day correlation between 10-year Treasury futures and the MOVE Index, a gauge of underlying volatility, rose to a record this week. As Bloomberg’s Robert Fullem notes, market theorists say a surge in volatility may mark an end to a trend, suggesting it could be best to avoid Treasuries at these levels. The price-volatility correlation, which has generally been negative, rose above the prior peak seen in the run-up to the financial crisis of 2008.

The Dollar rallied once again…

Source: Bloomberg

The Broad trade-weighted dollar is at an all-time record high…

Source: Bloomberg

The Argentine Peso crashed to a new record low at the open (above 60/USD) but like yesterday was rescued by ARG auction bids…

Source: Bloomberg

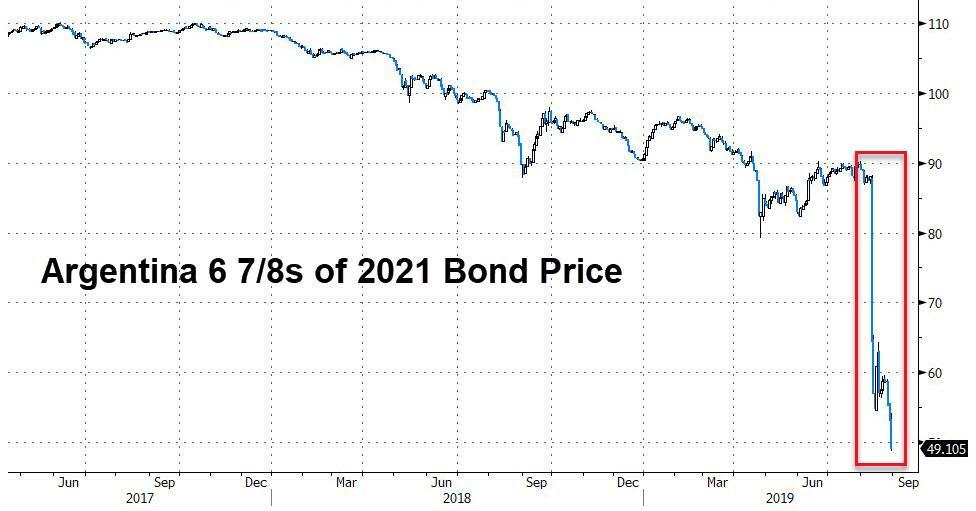

But, as the currency was rescued, traders dumped ARG bonds like a syphilitic hooker…

Source: Bloomberg

Cryptos extended losses overnight from the late-day plunge but saw a bid in the US equity market session…

Source: Bloomberg

Bitcoin extended losses below $10k…

Source: Bloomberg

Gold slipped back into the red for the week but well off the lows from before Trump’s tantrum…

While gold is the best-performing precious metal YTD, Platinum has exploded this week…

Source: Bloomberg

Big roundtrip in WTI over the last two weeks…

And finally, the big question is – Will 2019 be like 1998 or 2013?

Source: Bloomberg

StevieRay Hansen

Editor, Bankster Crime

The people spreading concrete information on the dangers of globalism are accomplishing far more than those sitting around buying bitcoin or passing around Q-cult nonsense.

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers

“Have I therefore become your enemy by telling you the truth?”

![]()