$9 trillion in additional global liquidity (from $79 to almost $88 trillion since the March lows)…

Are we Drowning in liquidity?

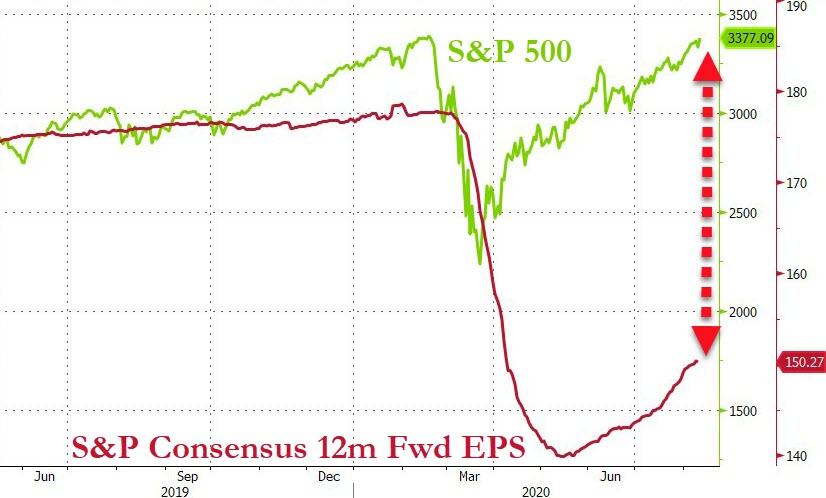

Pushed the S&P above its prior record closing high (3386.15 from 2/19/20) but could not hold it…

Because it sure isn’t being driven by fun-durr-mentals…

Source: Bloomberg

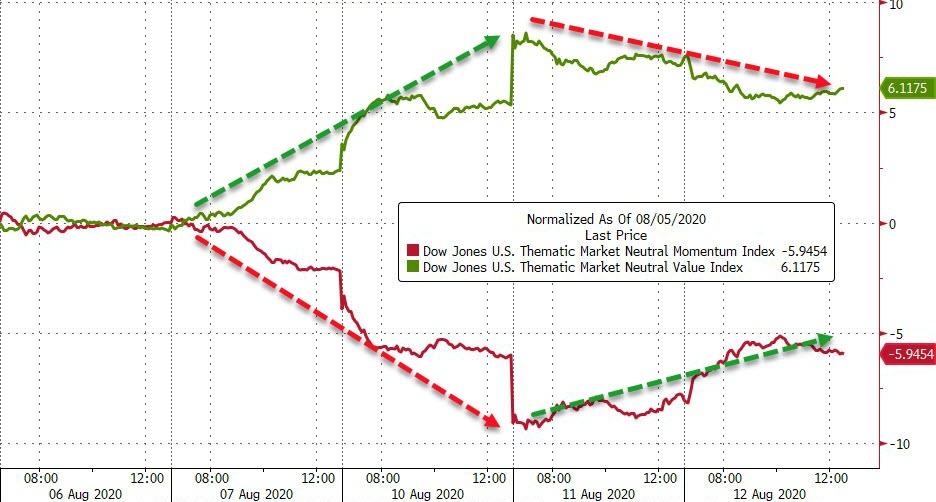

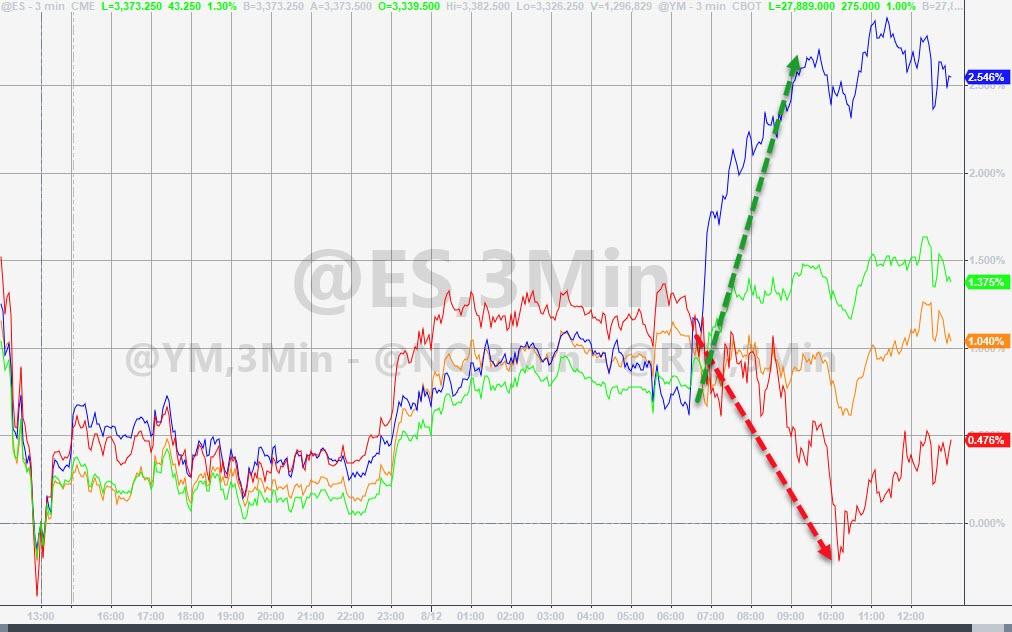

The recent Momo/Value rotation is over…

Source: Bloomberg

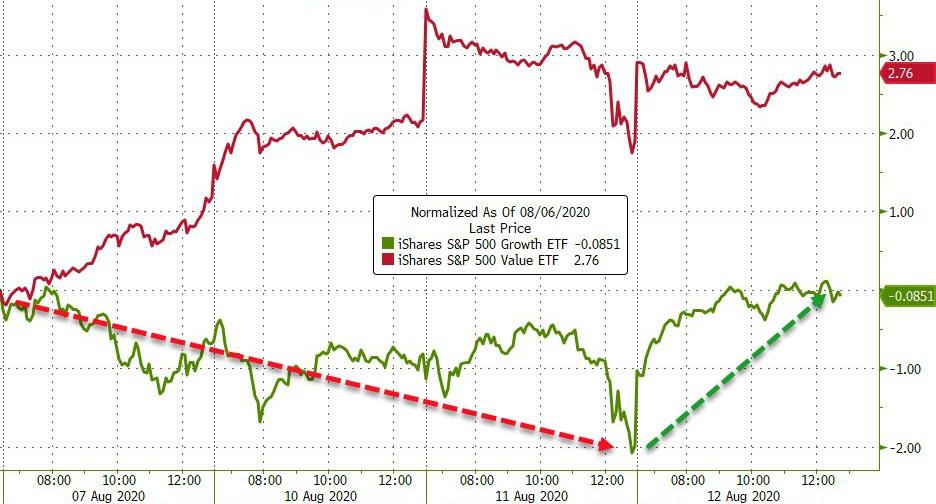

Growth surged today, erasing the losses of the last three days…

Source: Bloomberg

And that was evident in today’s rip higher in Nasdaq and big laggard Small Caps…

Small Caps weakness today in the face of tech’s resurgence sent AAPL to a new record high relative to the entire Russell 2000..

Source: Bloomberg

TSLA shares soared a ridiculous 15% after announcing a 5-for-1 stock split… just fucking idiotic!!!

Europe’s Stoxx 600 surged today, back above its 200DMA…

Source: Bloomberg

Treasury yields rose for the 4th straight day (up around 2-3bps across the curve, but notice that it chopped around in a small range for most of the day)…

Source: Bloomberg

With 10Y Yields closing above their 50- and 100-DMA

Source: Bloomberg

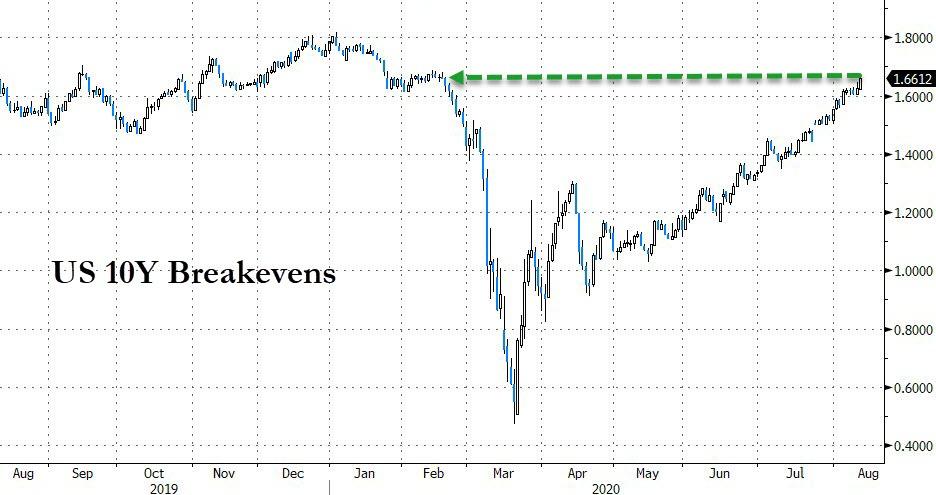

As far as inflation expectations are concerned, the pandemic is apparently over. After today’s data, the 10-year breakeven spiked to 1.67%. That’s the highest it has been since mid-February, before the March Covid-19 collapse.

Source: Bloomberg

The dollar ended the day lower, sold from the European open…

Source: Bloomberg

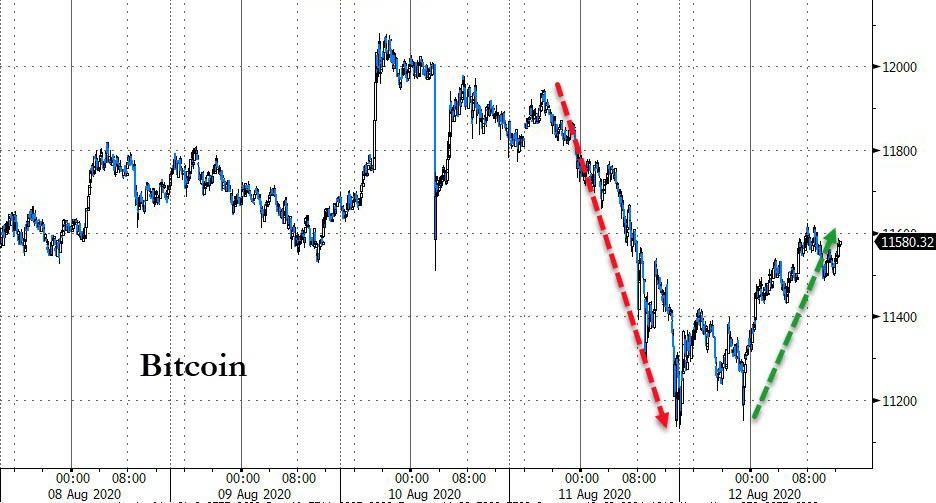

Bitcoin bounced today…

Source: Bloomberg

Real yields led gold higher…

Source: Bloomberg

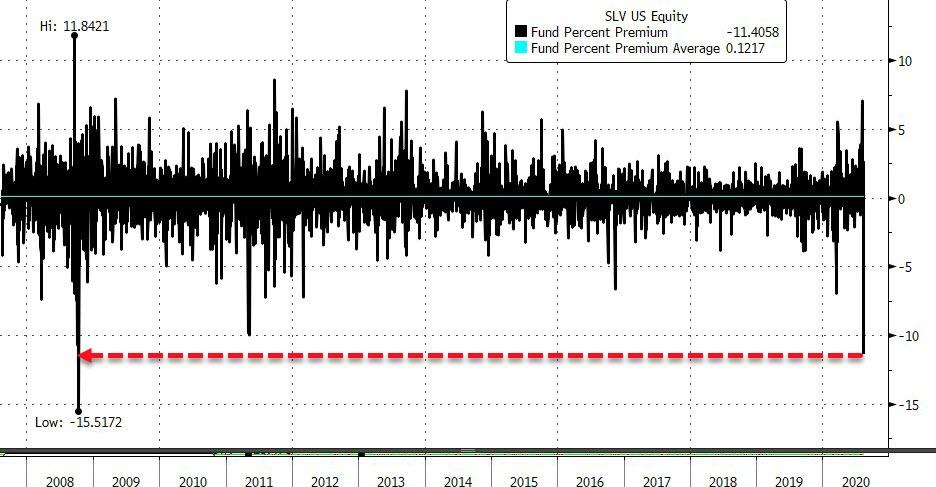

Silver rebounded from weakness in early Asia trading…

Silver’s chaos of the last couple of days sent SLV (the Silver ETF) to the steepest discount to NAV since Lehman (Oct 2008)…

Source: Bloomberg

Elsewhere in commodity-land, there was this chaos in NatGas ETNs…

And Lumber Futures soared above $700, a new record high…

“We had to pay three times the price,” Ron Woods, the owner of Firehouse Builders said.

“The explanation they had for us was that COVID-19 shut down the plants that treat the wood, and that finally caught up.”

Source: Bloomberg

Finally, just another reminder…

Source: Bloomberg

Now that fear has been fully removed…As Bloomberg detailed, concern about the prospects for U.S. stocks has dropped to a level last seen almost 20 years ago, according to one option-based indicator. The gauge is a 50-day moving average of the ratio between company-specific put and calloptions, as compiled by Cboe Global Markets, and was cited Tuesday in a Twitter post by the SentimenTrader blog. Monday’s reading was the lowest since October 2000, based on data compiled by Bloomberg.

Source: Bloomberg

“Even less extreme cases led to pullbacks/corrections” for stocks before, SentimenTrader wrote.

Source: ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()