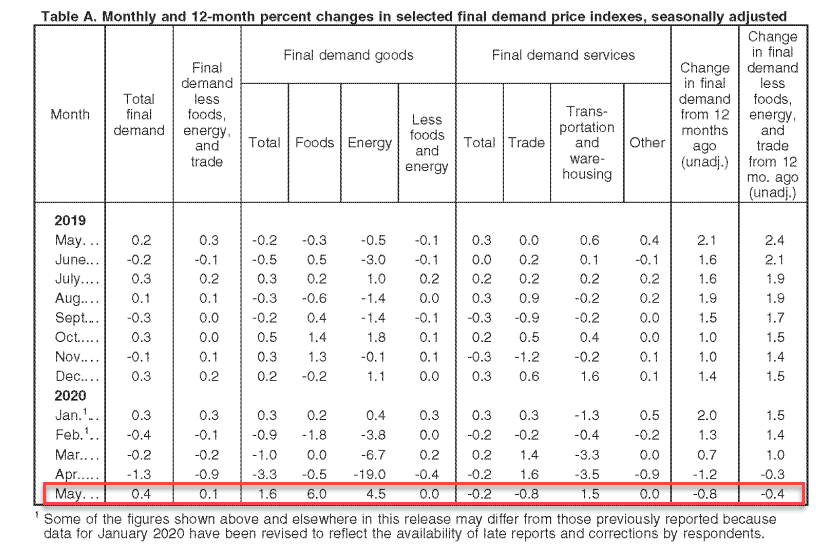

Producer Prices rebounded MoM in May with headline Final Demand PPI rising 0.4% (against +0.1% exp) but it left PPI YoY still down 0.8%…

Source: Bloomberg

Some serious dispersion in the various sector’s price swings…

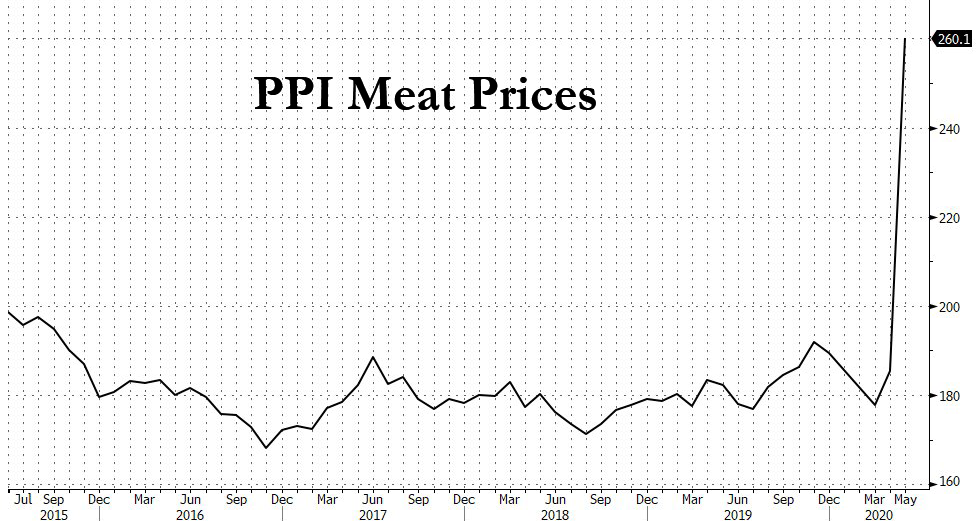

This rebound was driven by a record surge in food prices…

Source: Bloomberg

Two-thirds of the May increase in the index for final demand goods is attributable to a 40.4-percent jump in meat prices.

Source: Bloomberg

The indexes for gasoline, processed young chickens, light motor trucks, liquefied petroleum gas, and carbon steel scrap also moved higher.

Source: Bloomberg

Conversely, prices for chicken eggs fell 41.2 percent. The indexes for diesel fuel and for plastic resins and materials also decreased.

What will Jay Powell do now that average joe’s cost of living is soaring?

StevieRay Hansen

Editor, Bankster Crime

![]()