Greed refuses to be satisfied. More often than not, the more we get, the more we want. Material possessions will not protect us—in this life or eternally. Jesus’ parable of the rich fool in Luke 12:13–21 illustrates this point well. Again, money or wealth is not a problem. The problem is our attitude toward it. When we place our confidence in wealth or are consumed by an insatiable desire for more, we are failing to give God the glory and worship He deserves. We are to serve God, not waste our time trying to become rich (Proverbs 23:4). Our heart’s desire should be to store up riches in heaven and not worry about what we will eat or drink or wear. “But seek first [God’s] kingdom and his righteousness, and all these things will be given to you as well” (see Matthew 6:25-34). Source

Check-cashing businesses process 150 million checks a year and generate about $790 million in fees. In fact, it’s estimated that an “unbanked” worker who earns $22,000 a year spends $800 to $900 a year in check-cashing fees alone,according to research cited by PBS. If you include additional fees for money orders and bill-paying services that the unbanked rely on, that amount rises to about $1,000 annually.

According to theFDIC, just under 19 percent of U.S. households are underbanked, which means they have a checking or savings account but also use financial products and services outside the banking system, like those outlined above. Another 6.5 percent of households are unbanked, meaning they don’t have a bank account at all. Half report it’s because the fees are too expensive.

Many people turn to payday lenders for short-term bridge loans when their income isn’t enough to cover the bills since it’s also incredibly difficult for anyone with a credit score under 700 to qualify for a loan, especially at an affordable rate. In 2013, the median payday loan was $350 with a 14-day term and charged $15 per $100 borrowed ― the equivalent of a 322 percent annual percentage rate.

What’s surprising about this type of predatory lending is that it doesn’t really exist on the fringes of society at all. There are two major requirements to borrow from a payday lender, and both are considered markers of the middle class.

More than three quarters of the largest U.S. banks allow their customers to overdraw their accounts when they lack sufficient funds in order to cover the transaction for a fee of $35, on average. The Consumer Financial Protection Bureau (CFPB) found the median transaction amount of purchases that resulted in an overdraft fee was only $24. Additionally, the CFPB study revealed that 18 percent of account holders pay the vast majority of all overdraft fees triggered by debit cards, checks, and automated clearing house electronic charges.

https://www.hnewswire.com/those-that-suppress-the-truth/

The banks’ overdraft fees cause financially vulnerable consumers to leave the banking system. Thirty-one percent of consumers without a bank account reported high or unpredictable account fees as one reason for not having an account, while 13 percent cited it as the primary reason for not having a bank account. Overdraft fees are unexpected and unpredictable because most banks do not give their customers notice of an overdraft until two or three days after the incident. In the meantime, the consumer continues to overdraw his or her account, incurring more overdraft fees. The CFPB study found that more than two-thirds of consumers would prefer that the bank decline the transaction rather than assess an overdraft fee.

The Pew Charitable Trusts recently released the findings of a study conducted on “heavy overdrafters,” those who incur over $100 in overdraft and non-sufficient funds fees. Pew conducted this survey out of concern for consumers because overdraft is high risk, in that it lacks the consumer protections that accompany other credit products. It found that most heavy overdrafters are: Millennials or members of Generation X; renters rather than homeowners; and those with low incomes. See below. Furthermore, overdraft fees consumed nearly a full week’s household income of heavy overdrafters.

Half of the heavy overdrafters incur six or more overdraft fees annually and 42 percent paid seven or more overdraft fees. Heavy overdrafters tend to have lower incomes than the rest of the U.S. population, with most reporting an annual household income of under $50,000. This means that overdrafts hit those who can least afford these predatory fees. Debit cards are the most common transaction method for heavy overdrafters, with the actual value of the debit card transaction being relatively low, around $24. Seventy percent of heavy overdrafters are employed.

Younger consumers in the Millennial generation may be more affected by these overdraft fees because they are more likely to use debit cards. Additionally, they may be more vulnerable to overdraft fees because many are managing finances independently for the first time. For example, many college students are opening their first accounts for financial aid refunds, and the outside companies that distribute these funds promote their own cards. The Department of Education has adopted rules banning the charging of overdraft fees on accounts used for student aid, which will go into effect this month.

The results of the Pew survey show that overdraft now serves as a form of short-term credit for many consumers. However, overdraft lacks the requirements that financial institutions use to verify customers’ ability to repay debt before extending credit and provide a reasonable time to repay, as well as limits on late fees.

Pew urges the CFPB to write new rules to ensure that overdraft programs are safe and designed only for infrequent and accidental occurrences. This could be achieved by limiting: the size of overdraft fees, the frequency with which they can be incurred, and overall cost. A limit of six overdrafts a year would save the 42 percent of heavy overdrafters, who incurred seven or more fees in the past year, a median of $210 annually. The Federal Deposit Insurance Corporation (FDIC) published guidance suggesting that banks should give customers a reasonable opportunity to choose a less costly alternative and decide whether to continue with fee-based overdraft coverage.

Frequent overdrafts are a financial burden, especially because the fees are oftentimes hidden and unpredictable. These fees cause many consumers to leave the banking system, with 13 percent of consumers without banking accounts citing overdraft fees as the primary reason, and forces them to use cash other alternatives, like payday loans with predatory interest rates.

Pew also suggests that the CFPB enact rules to limit the negative effects of overdraft fees and ensure that overdraft is not being used as short-term credit. It suggests that overdraft fees be reasonable and proportional to banks’ cost of covering overdrafts or to the overdraft amount. Financial institutions should charge no more than six small overdraft fees in any 12-month period that are proportional either to the banks’ cost of covering overdrafts or to the overdraft amount, and these fees should be limited to one per negative-balanced episode. If that limit is reached, then any further overdrafts should be covered under the rules for credit. Additionally, banks should post deposits and withdrawals in a fully disclosed, objective, and neutral manner that does not maximize overdraft fees.

NCL applauds Pew’s report and accompanying recommendations. Imposing these predatory fees on lower income Americans and Millennials who are just beginning to manage their own finances is unacceptable. We hope the CFPB takes action to minimize the impact of these odious charges. Source

the Trump administration wants to take the reins off payday lenders. Shortly after Kathy Kraninger was voted in as the new director of the Consumer Financial Protection Bureau in December ― despite having no experience in banking, finance or consumer protection ― she announced plans to reverse parts of a rule that requires payday lenders to verify whether a borrower can afford to pay back a loan before approving it. In other words, the agency responsible for protecting consumers now wants to make it easier for them to get stuck in a cycle of debt they can never repay.

According to Fergus, borrowers are actually better off if they are denied a payday loan, since they’re more likely to file for bankruptcy if they’re approved. “A good way to think about a payday loan is like financial bloodletting,” Fergus said. “You go to this bloodletter, but often, the cure is worse than the disease.”

But even those who take steps to better their financial situation often end up stunting their opportunities in the long run thanks to the high cost of financial services. College offers a prime example.

“The increasing costs of fees and tuition are really saddling generations, particularly communities of color and historically marginalized populations, in debt,” Fergus said. Prosperity Now also found that of the main expenses that financially insecure communities face, for-profit college tuition costs top the list.

Americans generally think of access to post-secondary education as a means of upward mobility; an oft-cited study “proved” that attending college is worth it overall because the average college graduate earns about $1 million more over their lifetime than someone with only a high school degree. However, what isn’t highlighted is that those who are forced to take on student loans in order to pay for college are significantly disadvantaged when it comes to accessing credit and other financial tools at a low cost in the future.

“The average borrower takes about 20 years to pay off a college student loan. And what we see over that 20-year span is that you have a lower credit score because there’s a strong correlation between higher student debt and lower credit,” Fergus said. So for the next several decades, a borrower whose credit suffered as a result of that debt will pay higher rates on everything from auto loans to credit cards to insurance premiums.

And once again, debt is held disproportionately by people of color, especially women of color. The National Center for Education Statistics estimates that 86.8 percent of black students borrow federal student loans to attend a four-year public college, compared with 59.9 percent of white students. Women hold almost two-thirds, or $900 billion, of the outstanding student debt in America.

“The way in which the system works now is that it actually exacerbates wealth inequalities,” Fergus said.

Thanks, Deregulation

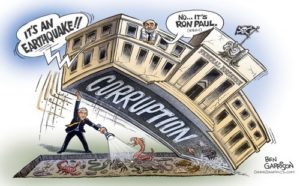

How did the banking system get to this point? There are a lot of complex reasons, but banking deregulation is a big factor.

Decades ago, federal and state governments held tight control over how banks could operate. For example, following the Great Depression, President Franklin Roosevelt implemented a number of banking reforms as part of the New Deal. One of those provisions was the Banking Act of 1933, better known as the Glass-Steagall Act, which created a separation of commercial banking from investment banking, among other important measures.

Later, the Bank Holding Company Act of 1956 was established to prevent bank holding companies from acquiring banks in states outside of where they were headquartered, unless that other state’s laws allowed it. In other words, bank mergers and acquisitions were controlled at the state level in an effort to prevent the collection of financial power among a few institutions.

And up until the 1970s, most states still followed usury laws that were established during earlier decades. These laws imposed interest rate ceilings on deposit accounts to prevent rate wars among banks and protect smaller institutions that couldn’t compete for deposits.

Beginning in the 1980s, however, many of those banking regulations were reversed. As a result, banks were able to offer many more products and became more profit-driven.

Deregulation allowed banks to become a “one-stop financial shop,” said Pamela Capalad, a certified financial planner and founder of Brunch and Budgetfinancial coaching. “They were able to offer credit cards that have their branding. They were able to sell insurance.”

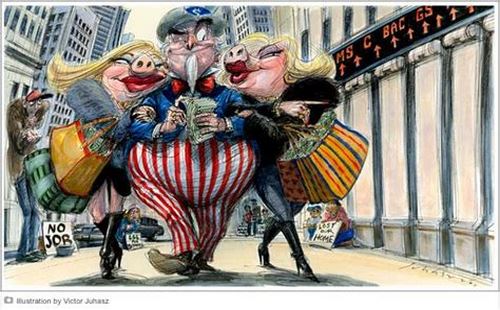

That meant anyone walking into a branch with a certain level of assets instantly became a target for multiple offers. Customers with lower incomes were less of a priority, increasingly treated as little more than a source of fee harvesting.

Deregulation also changed two major things about where and how banks could operate: It eliminated the need for approval to merge or close branches, and it spurred competition among banks so that they favored high-income communities where they could raise profitability. This helped to create what are known as “bank deserts,” where even those who can afford traditional banking services have no access to them.

Fringe institutions were eventually able ― and more than willing ― to fill that void.

The Long-Term Consequences Of High-Cost Banking

If you are one of the fortunate few able to maintain $1,200 in your checking account or qualify for a low-interest loan, this all might seem like a problem for other people. Why worry about it if it isn’t something that affects your life?

Aside from having empathy for your fellow man, of course, the unfortunate reality is that at some point, it will affect you. If things keep moving along the same trajectory, Americans will continually be pushed into one of two groups: the wealthy elite and the working poor. And as the name suggests, the 1 percent is an exclusive club with a limited number of seats.

“I think this is why the United States essentially subsidized a middle class right after the Great Depression. … Having a middle class leads to a more democratic population. People feel like they have a voice,” said Capalad, who is from the Philippines and has witnessed firsthand what can happen when the wealth divide becomes too great.

“There is virtually no middle class there,” Capalad said. In fact, 86.6 percent of adults in the country have less than $10,000 to their name. “Seeing what poverty does to people and the voice that it takes away ― I think that with a lack of a middle class, countries are more susceptible to dictators who say they’re going to fix the situation or that they’re going to clean things up,” she said.

It’s true: The more inequality that exists, the more likely it is for a nation to move away from democracy. Even so, the idea that the United States could fall into a Duterte-esque dictatorship because of our dysfunctional financial industry might seem a bit far-fetched. And maybe it is. But there are other implications that are equally as concerning.

“It’s going to have much greater implications in the future than it does today,” Fergus said. “What’s going to happen to the nation’s infrastructure? What’s going to happen to the nation’s retirement program? The population which is relied upon to fund most public entitlements and infrastructure is also that same population which is targeted historically for the extraction of wealth.”

And if you do hit hard times at any point, it’s clear that the cycle of less access to credit, more fees and higher interest rates makes it hard to pull yourself out.

Providing Access To Quality Financial Services For All

The growing U.S. wealth divide, which is exacerbated by the banking industry, almost seems like too big a problem to solve. It’s not something that can simply be regulated away.

Bringing quality financial services to consumers of all income levels will help but will require fundamental changes to how the banking industry operates. Even today, though, there are a couple of potential solutions in the works.

Postal Banking

One potential banking solution that’s been gaining traction lately is the reinstatement of postal banking. Mehrsa Baradaran, an associate dean at the University of Georgia School of Law and author of How the Other Half Banksand The Color of Money: Black Banks and the Racial Wealth Gap, has often said this could be the answer to reversing inequality within the banking industry.

And now, a handful of 2020 presidential hopefuls ― including Sens. Kirsten Gillibrand, Bernie Sanders and Elizabeth Warren ― have made postal banking a key component of their platforms.

Why postal banking? The U.S. Postal Service is backed by the government but isn’t controlled by shareholders. It actually offered banking services between 1911 and 1966; often referred to as “poor man’s banks,” post offices offered savings accounts with modest interest rates that were meant to complement ― not compete with ― commercial banks.

Though banks have fled many low-income communities, there’s a post office for almost every ZIP code in the country. Postal banking could offer services at much lower costs than commercial banks and without the commercial interests that tend to trap low-income people in cycles of fees and debt.

Community Development Credit Unions

Back in the day, credit unions were established as a low-cost alternative to banks. These financial co-ops are owned and operated by members, and therefore, are able to offer higher dividends on deposits and lower rates on loans. But thanks to increased competition within the financial industry, many credit unions have become just as expensive to bank with as, well, banks.

Enter community development credit unions, which are specifically designed to serve low- and moderate-income people and communities. They offer low-interest loans to members who have poor or no credit, financial counseling and other services that help people escape predatory financial products like payday loans.

To join a credit union, you have to fit within its field of membership. Usually, this means living, working, worshiping or going to school in a certain region. However, there are CDCUs across the country; check out this list of CDCUs by state to find one near you. Source

It remains to be seen whether any other major overhauls to the banking industry will happen. But one thing is for sure: Something has to change.

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers

“Have I therefore become your enemy by telling you the truth?”

![]()