Personal Finance Expert Says US Rating Downgrade Likely to Embolden BRICS Currency Supporters–Trouble Times Ahead For American’s

BanksterCrime:

The American rating agency Fitch’s recent downgrade of the United States’ credit rating from AAA to AA+ may embolden proponents of a BRICS currency, Riley Adams, a personal finance expert, has said. Adams however argues that there are certain “geopolitical issues” that must be overcome first before the BRICS currency becomes a reality.

Debt Ceiling Standoffs and the Impact on the U.S. Credit Rating

According to Riley Adams, a personal finance expert and the CEO of Young and the Invested, the credit rating agency Fitch’s recent downgrade of the United States to AA+ will likely “embolden anyone in the BRICS [Brazil, Russia, India, China, and South Africa] that supports the creation of a new currency.” Adams, also a certified public accountant (CPA), told Bitcoin.com News that Fitch’s report on the country also “relays legitimate concerns about how the budgeting process has devolved in the U.S.”

As reported by Bitcoin.com News, Fitch has tied its downgrade of the U.S. long-term foreign-currency issuer default rating from AAA to AA+ to the “repeated debt-limit political standoffs” and the last-minute resolutions which have in turn “erode[d] confidence in fiscal management.”

Meanwhile, the personal finance expert has posited that many of those opposed to the U.S. dollar’s reserve currency status will now attempt to use news of Fitch’s downgrade to further rally support for a BRICS currency.

“At the very least, it could trigger a short-term shift in sentiment that BRICS-currency supporters could use to get some traction on their ideas,” Adams, a former senior financial analyst for Google, explained.

BRICS Currency and Geopolitical Issues

In the past few years, critics of the U.S.-dominated financial system have highlighted how the country’s divided legislature has played a part in eroding confidence in America’s ability to meet its obligations on time. Also, before the latest debt ceiling agreement was struck, senior U.S. officials including Treasury Secretary Janet Yellen warned that the U.S. Congress’ constant failure to raise the debt limit on time posed a serious threat to the dollar’s dominance.

However, as has been reported by Bitcoin.com News, the same U.S. officials appear less concerned about the possibility of the Chinese yuan or the much-vaunted BRICS currency toppling the greenback. While American leaders have flaunted the dollar’s unmatched backing by United States’ “deep, liquid and open financial markets” when dismissing the prospects of rival currencies, Adams sees “geopolitical issues” as one of the reasons why people ought to be less sanguine about the BRICS currency’s chances of success.

To illustrate, the personal finance expert pointed to a report in which the governor of the South African central bank reveals that a common currency would require a banking union, a fiscal union, and macroeconomic convergence for it to succeed. According to Adams, attempting to achieve this takes “many steps farther than simply trying to decouple from the dollar individually, and [is] much more unlikely to happen.”

Adams said the fact that proponents of a BRICS currency are seemingly trying to walk back earlier comments about the launch suggests the alternative reserve currency will not start circulating in August as some proponents had predicted.

How Deutsche Bank Helped Con The Public Into Believing In Wirecard

By Tyler Durden More reporting on the Wirecard situation has emerged over the long weekend in the US, and none of it…

![]()

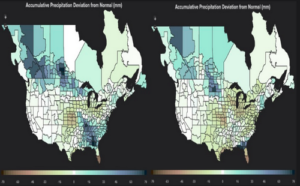

USDA Crop Report Shocker Sends Corn Futures Surging

Chicago corn futures surged 8% in the last two sessions after a massive reduction to the U.S. government’s acreage estimate reported Reuters. …

![]()

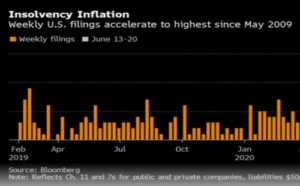

US Bankruptcies Busting Out to Match 2009 Peak Mean Trouble for Stock Market

The following article by David Haggith was published on The Great Recession Blog: Bloomberg reported this week that thirteen US companies (in the…

![]()

Who Is The Next Wirecard?

Now that the multi-year saga of German fintech megafraud Wirecard is finally over, the pain is only just starting for…

![]()

COVID-Comeback Batters Big-Tech & Black Gold, Sparks Bond Bid

Just when you thought it was safe to buy any stock – selected at random via Scrabble letters – on…

![]()

“Watershed” Moment: Is Gold Signaling Stocks Now On “Shaky Footing”?

I rarely discuss financial markets these days. Although I pay attention, it’s not in the obsessive manner I did a…

![]()

COVID-Crunch? Fed Begins Rationing Coins As Americans Horde Cash

Having closed the US Mint and halted production (blaming COVID-19) after a surge in demand for gold and silver coins, and warned of…

![]()

This Can Not Continue, “A Staggering Number”: Over $18 Trillion In Global Stimulus In 2020, 21% Of World GDP

On Friday, we relayed the latest observations from BofA chief investment officer, Michael Hartnett who concluded that there is just one bull…

![]()

HSBC Resuscitates 35,000 Job Cut Plan As Banking Troubles Persist

Back in February, HSBC, Europe’s largest bank and troubled lender, announced a plan that would slash upwards of 35,000 jobs. Shortly after, the lender put…

![]()

Sources: BitCoinNews

Revelation: A Blueprint for the Great Tribulation

A Watchman Is Awakened

Will Putin Fulfill Biblical Prophecy and Attack Israel?

Newsletter

Orphans

Editor's Bio

“Red Flags Galore”: Companies Sold A Mindblowing $113 Billion In Stock In Q2

When it comes to bearish market flow red flags, aggressive selling of stock by corporate insiders is traditionally viewed as…