BanksterCrime:

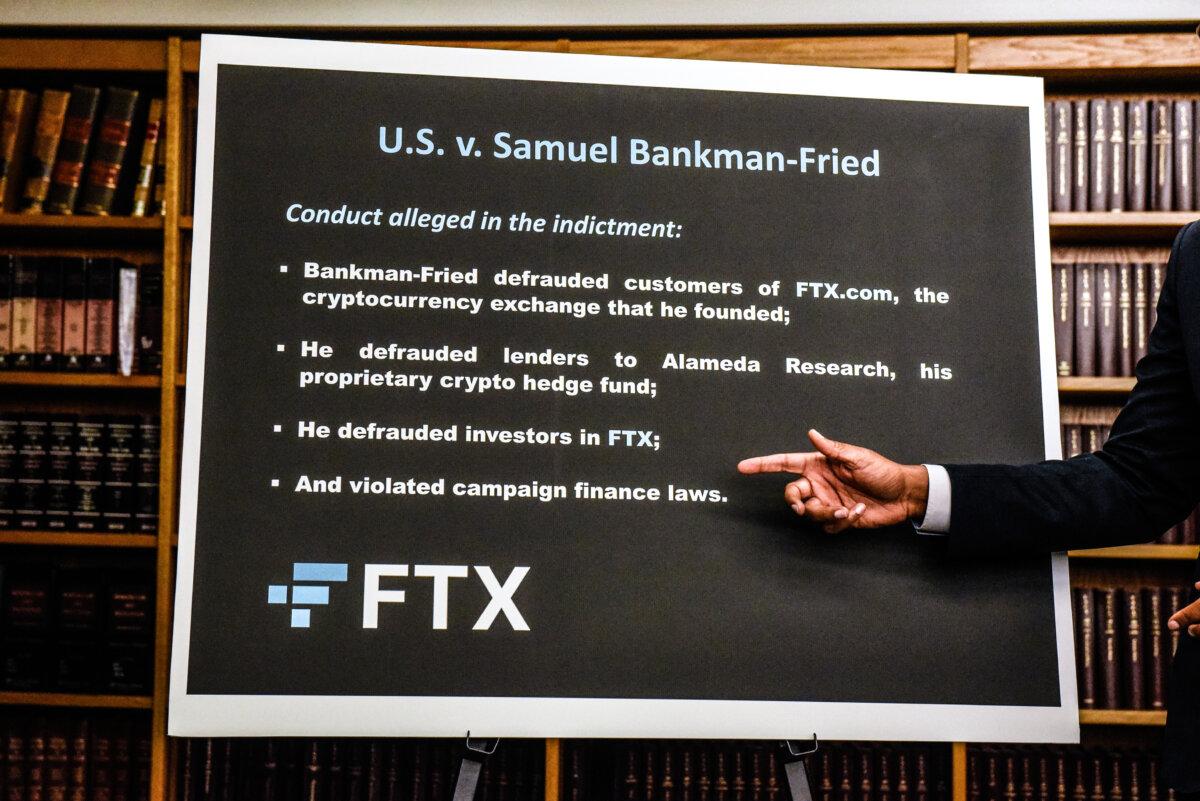

The trial of Sam Bankman-Fried has thus far strongly supported the prosecution’s charges of securities fraud, analysts say; meanwhile, any questions regarding his massive political donations have been put off for another day.

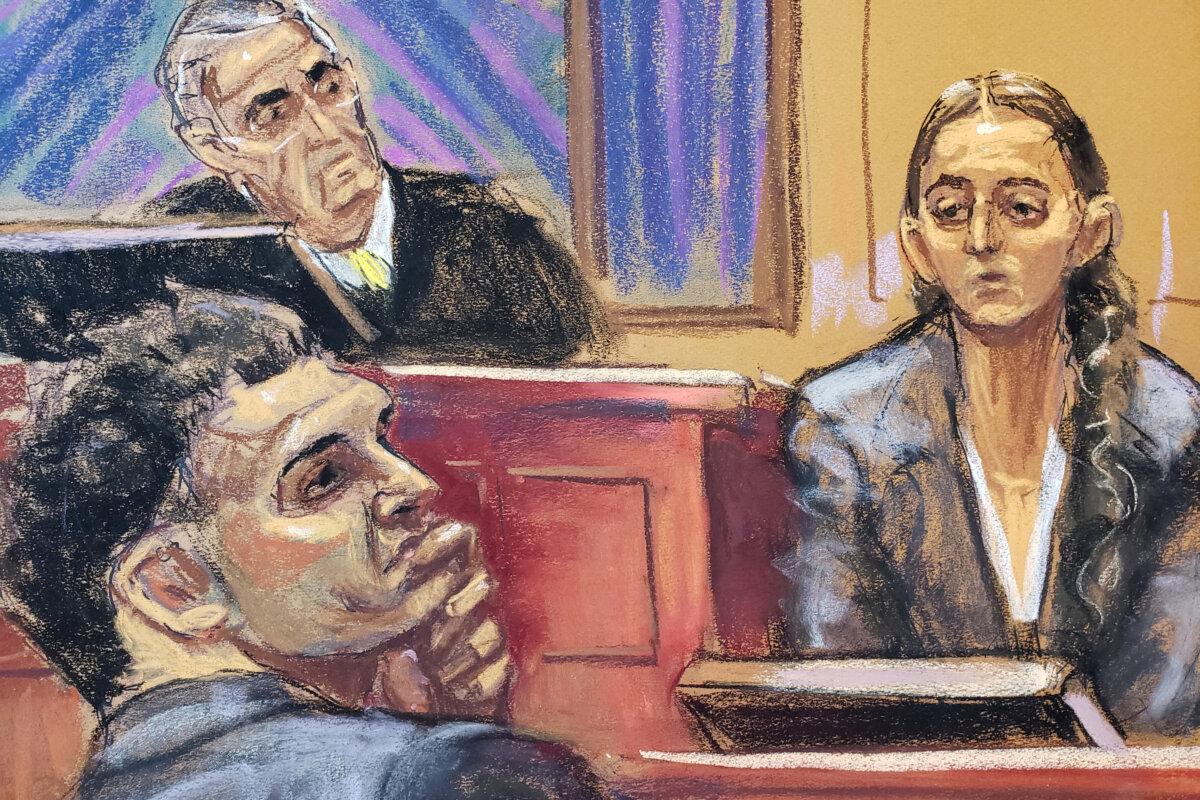

Since its start on Oct. 3, the trial has featured compelling testimony from former colleagues FTX co-founder Gary Wang and Alameda CEO Caroline Ellison, both of whom pointed the finger at Mr. Bankman-Fried—also known by his initials, SBF—as the ringmaster of one of the largest financial frauds in U.S. history. The defense has struggled to make its case, although Mr. Bankman-Fried’s attorneys may still have cards to play.

“As of now, it’s not going well for the defense,” Braden Perry, a former federal enforcement attorney who's currently a partner at Kennyhertz Perry, told The Epoch Times. “Both Ellison and Wang have testified that SBF directed them to commit the crimes.”

The prosecution has been methodically building its case, Mr. Perry said. Assistant U.S. Attorneys Nicolas Roos and Danielle Sassoon presented consistent testimony that Mr. Bankman-Fried knowingly and intentionally defrauded investors, and they also made efforts to humanize the losses suffered by FTX customers.

“The evidence that has come out over the first two weeks of trial is all to the point that SBF was involved, either directly or indirectly, in a conspiracy with people who themselves have pled guilty to committing fraud,” Daniel Silva, a former federal prosecutor who's currently a shareholder at business law firm Buchalter, told The Epoch Times.

The prosecution’s case thus far “is very strong,” he said.

And while cryptocurrencies are arcane financial instruments, the case itself is straightforward.

A Simple Tale of Theft and Deceit

“It’s a typical corporate fraud case,” Mr. Silva said. “The product may have been complex, but the fraud itself is not unique. Basically, the allegations are that [the defendants] improperly and deceptively took money from customers and investors for FTX owners’ personal use.”

The prosecution has largely avoided delving into the intricacies of cryptocurrencies, focusing instead on the simpler narrative of theft and deceit.

“What this trial boils down to is FTX’s use and Alameda’s use of customer funds,” Mr. Perry said. “The prosecution will need to prove SBF used those funds knowingly and fraudulently.”

According to the allegations, “SBF was the front of the entire enterprise, including Alameda,” he said. “Further, SBF used a massive [line of credit,] which was not disclosed to Alameda customers or investors.”

This was an “interesting start.” according to Mr. Perry.

“It shows how a typical investor was duped by the ‘safeness’ of FTX,” he said.

Mr. Wang said Alameda accounts were set up this way at the direction of Mr. Bankman-Fried but that this special arrangement between the two companies was kept secret from FTX customers. Mr. Wang pled guilty to charges of securities fraud and accepted a plea deal with prosecutors to testify against Mr. Bankman-Fried.

The prosecution’s case then shifted to how customers’ money was taken by Alameda Research.

Her testimony became emotional when during cross-examination, she broke down in tears and said she lived in "dread" that her actions to deceive investors would come to light and that when Alameda and FTX finally collapsed, it brought her an "overwhelming feeling of relief."

Defense Fights Uphill Battle

In sum, this evidence has put the defense in a particularly challenging position, analysts say.

“You can attack testimony and witnesses and their credibility and recollection, which it sounds like they’re trying to do,” Mr. Silva said. “But at the end of the day, when you have multiple people saying the same thing—basically that SBF committed fraud and directed us to commit fraud—it’s really tough to undermine those witnesses or the impact of that.

“Strategically, there’s only so much you can do.

“Even if you’re the greatest [attorney] in the world, you can’t make evidence disappear.”

The defense, indeed, appears to be floundering.

Lead defense attorney Mark Cohen had argued in his opening statement that Mr. Bankman-Fried’s associates were the actual perpetrators and that his client was either unaware of or not directly involved in their crimes. Mr. Bankman-Fried stepped down as CEO of Alameda Research in October 2021, handing the reins to Ms. Ellison.

Mr. Cohen succeeded in getting Ms. Ellison to admit to instances in which Mr. Bankman-Fried wasn't directly involved in the workings of Alameda, but he largely failed to discredit her overall testimony that Mr. Bankman-Fried was the ultimate decision-maker, legal analysts say.

Mr. Cohen’s line of questioning appeared to ramble at times, repeatedly changing topics and dates and, at one point, referencing a wrong document. Another time, he paused to say he'd lost his place.

“The judge has been very skeptical of the [defense’s] cross-examinations and has sustained multiple objections,” Mr. Perry said.

Several times, the judge stopped the proceedings to ask Mr. Cohen where he was going with his questions or what he was talking about, finally declaring after an hour of cross-examination that “maybe this is a good time for a break.”

Despite the stumbles, Mr. Bankman-Fried may not be beaten just yet.

One element that the defense may have in its favor is the fact that both Mr. Wang and Ms. Ellison admitted that, for the most part, they were the ones who acted—coding accounts, transferring money from FTX, or manipulating financial records. While they both said they did so at the direction of Mr. Bankman-Fried, there has so far been limited physical evidence of that, leaving jurors to rely on the word of those who are testifying in order to receive a lighter sentence.

The defense may also be attempting to build a counter-argument that Mr. Bankman-Fried believed that he was acting lawfully, based on advice that he had received from FTX lawyers.

“A key ruling will be the use of the advice-of-counsel defense by SBF,” Mr. Perry said, referring to decisions by Judge Kaplan about what evidence he'll allow along these lines.

“The prosecution will need to prove SBF used those funds knowingly and fraudulently. The SBF defense has asked the judge to allow SBF to argue that his acts were reviewed and approved by his FTX’s lawyers and that SBF believed that his acts were within the law based on this advice.

“This would mitigate the intent element of his crimes.”

Mr. Cohen argued that the legal advice given to Mr. Bankman-Fried by Fenwick, as well as by internal FTX lawyers, “gave him assurance that he was acting in good faith” and that “the fact that the Government now asks the Court to preclude evidence on reliance of counsel is yet another attempt by the Government ... to deprive the defense of a defense.”

Fenwick has denied that it advised Mr. Bankman-Fried that the alleged fraudulent actions were legal or that it was aware of him engaging in activity that might have violated laws.

Campaign Finance Charges Set Aside

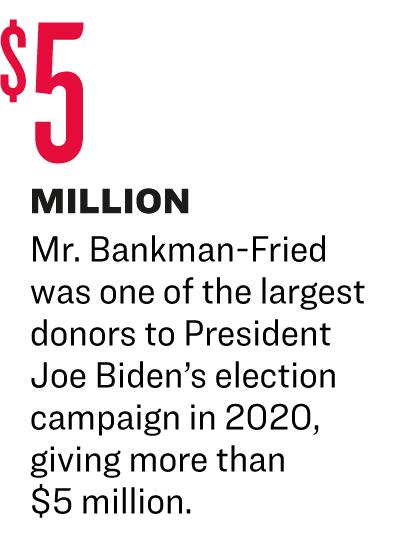

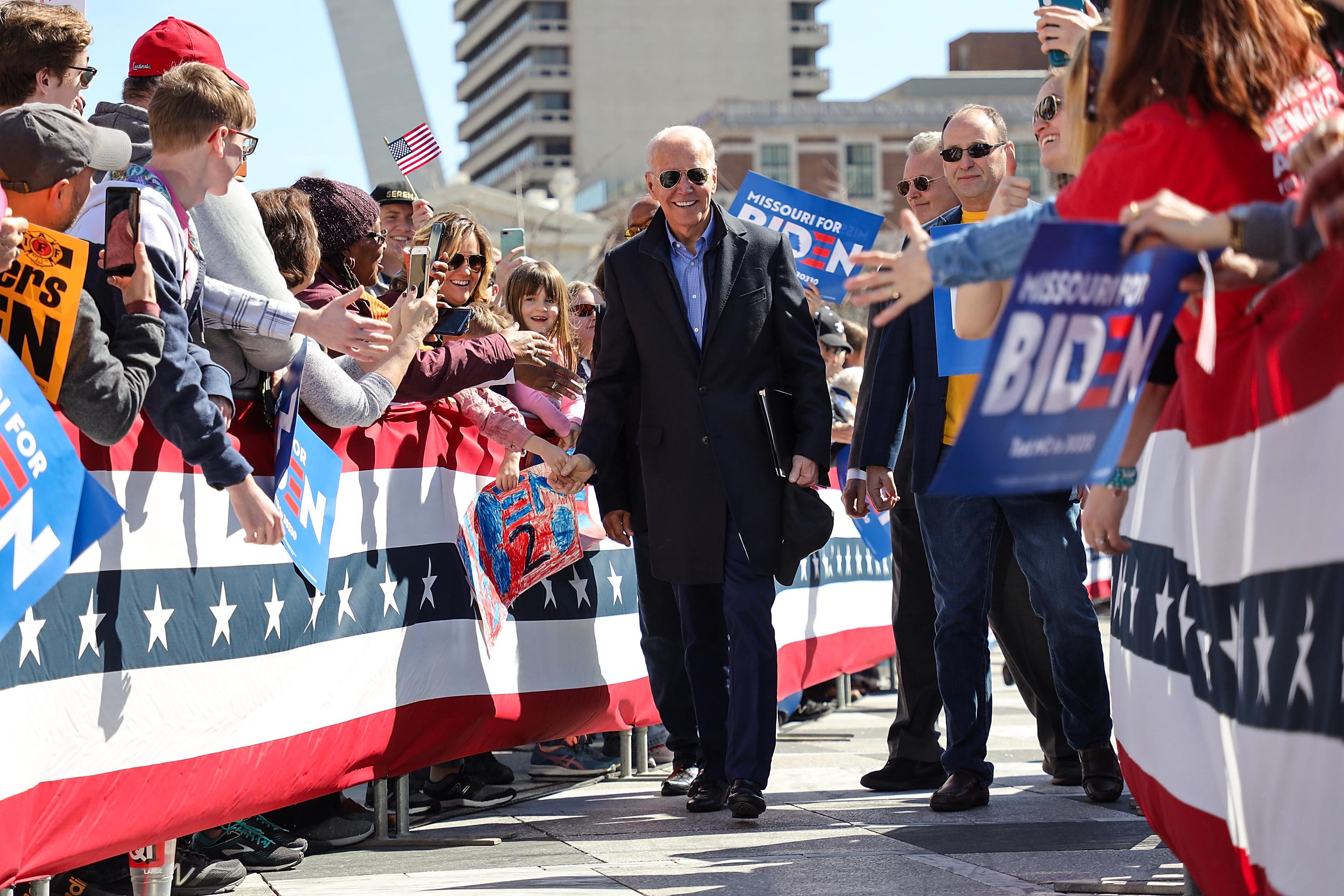

The remaining wild card in this trial is the more than $100 million of FTX money that Mr. Bankman-Fried donated to politicians prior to FTX’s collapse. He was the second-largest donor to President Joe Biden’s election campaign in 2020, giving more than $5 million, and the second-largest donor to Democrat politicians and political action committees (PACs) in the 2022 midterms.

A number of PACs, primarily those affiliated with the Democratic Party, also received large donations from Mr. Bankman-Fried.

Prosecutors may bring these charges at a later date, which could be sometime in 2024, according to legal analysts.

This is Text.

This is Text.

This is Text.

Sources:

Revelation: A Blueprint for the Great Tribulation

A Watchman Is Awakened

Will Putin Fulfill Biblical Prophecy and Attack Israel?

Newsletter

Orphans

Editor's Bio