When a society ignores the law, lawlessness is the result, and chaos ensues. The time of the judges after Joshua’s death was marked by upheaval, oppression, and general disorder. The biblical historian puts his finger on the reason for the tumult: “In those days Israel had no king; everyone did as they saw fit” (Judges 21:25). The riot in Ephesus is a good example of lawlessness in action (Acts 19). The rioters were confused and unsure even of why they were rioting (verse 32); in their lawlessness, they were ignoring proper legal channels (verse 39) and, of course, breaking the law (verse 40).

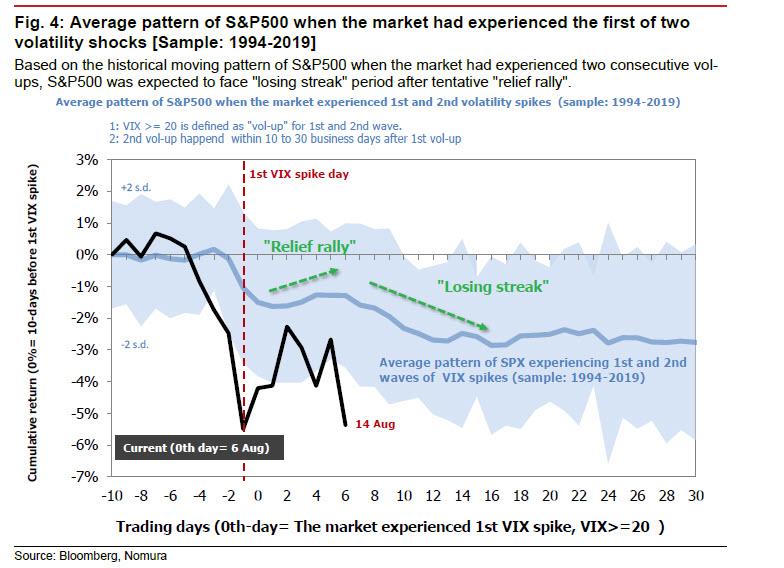

One week ago, and just days before Wednesday’s market plunge and curve inversion, Nomura’s quant team – correctly – predicted that the early August rally was a head fake, and warned that any such rally “should be best treated as an opportunity to sell in preparation for the second wave of volatility” that the bank expects will arrive in late August or early September. Worse, as Nomura quant, Masanari Takada said, “the second wave may well hit harder than the first, like an aftershock that eclipses the initial earthquake. At this point, we think it would be a mistake to dismiss the possibility of a Lehman-like shock as mere tail risk.”

Since then a lot of things happened, but none more memorable than the inversion of the 2s10s curve – the most respected leading recession indicator – for the first time since 2007 following dismal economic data from both China and Germany. And, as Nomura’s quant team points out, “the trauma in global bond markets worked its way into equity markets as well, such that stock markets in the West—and especially in the US—underwent a massive sell-off.”

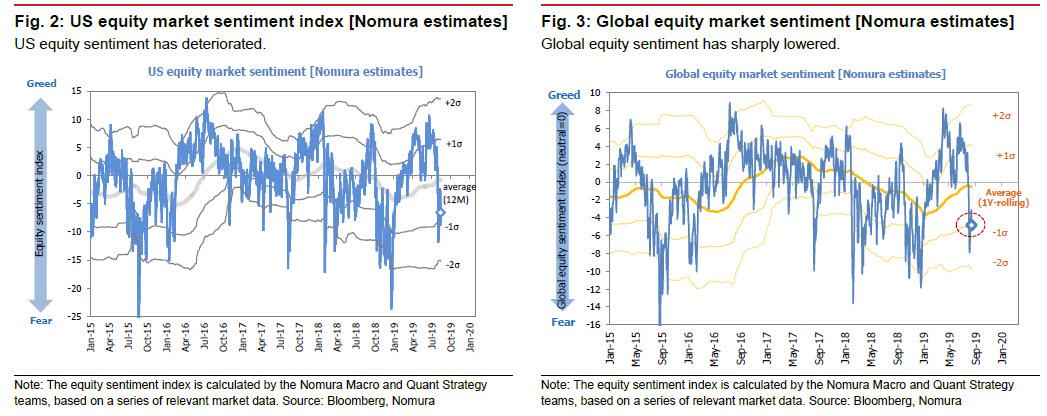

The result was that Nomura’s composite measure of US stock market sentiment swiftly dropped from -2.6 on 13 August to -6.5 on 14 August, while its measure of global stock market sentiment similarly fell from -3.1 to -4.8, both levels not seen since December’s mini bear market.

Macri Slams Opponents for Market Rout

The other immediate result: the boost the market got on the previous day (13 August) from the postponement of a portion of the fourth round of US tariffs on Chinese goods evaporated almost immediately, putting a quick end to the relief rally in US stocks, and as Takada argued in his Wednesday note, sustaining the rally would depend on

- the S&P 500 regaining the 2,960 lines,

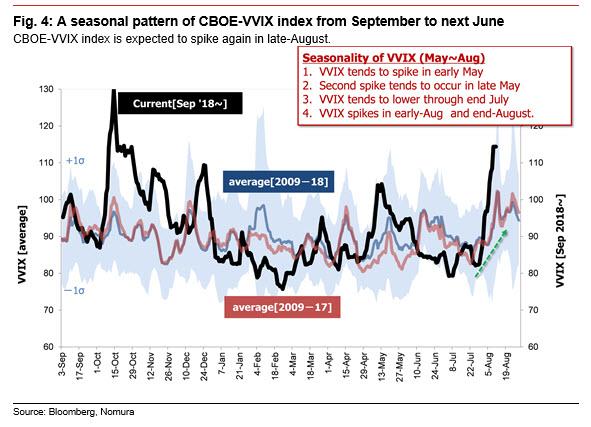

- the VVIX settling down to around 90, and

- a 10yr-2yr UST yield curve that resists becoming inverted.

By all three measures, yesterday’s developments were a complete rout, as the S&P 500 was sold down to 2,840, the VVIX rose to 113, and the 10-2 spread inverted, according to Takada. All of this is to say that the market seems to be experiencing just the sort of tense summer Nomura had anticipated, “raising the likelihood of the second “vol-up” wave that we have been warning may arrive in late August or early September.”

* * *

So if a vol explosion and/or a “Lehman shock” is indeed coming, how should one be positioned?

First of all, according to Nomura, there is little in the way of developments on the horizon that could help solidly reestablish a normal 10yr-2yr UST yield curve, so the bank thinks it makes sense, for now, to stay bearish on global equities and bullish on global bonds (sovereign debt).

Additionally, the bank’s quants see a high risk of the market unwittingly launching itself into a pattern of trades that make a recession essentially self-fulfilling, barring the emergence (by the end of August) of some positive news powerful enough to turn the tide, such as

- the withdrawal of the fourth round of tariffs on Chinese goods,

- an emergency rate cut by the Fed on the order of 50-100bp (or an implicit promise to make such a cut), or

- reports to the effect that a coordinated fiscal response is on the way.

Absent these highly unlikely events, Nomura warns investors not to be swayed by day-to-day headlines that do not add up to one of these three things and should consider strategies built around the assumption that a second “vol-up” wave is coming. In that context, Nomura has 4 key trade recommendations:

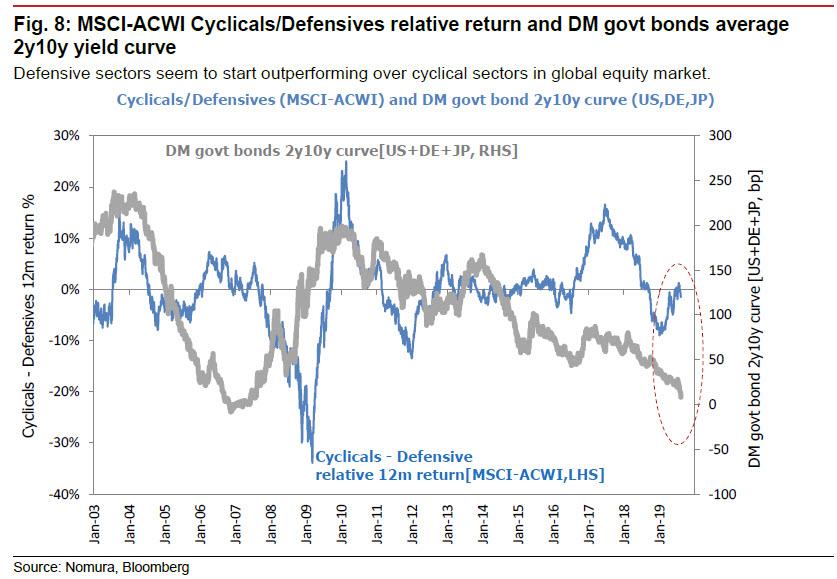

- 1. Buy low-beta & defensive stocks, sell high-beta & cyclical stocks: There is a loose correlation between the inversion of the 10-2 spread in DM bond markets and the relative performance of defensives vs. cyclical in global equity markets (MSCI ACWI). The bond market’s track record in predicting recessions is somewhat less than perfect, but it makes sense to conservatively shift into low-beta & defensive stocks on the assumption that stock market players as well will become more fearful of a recession

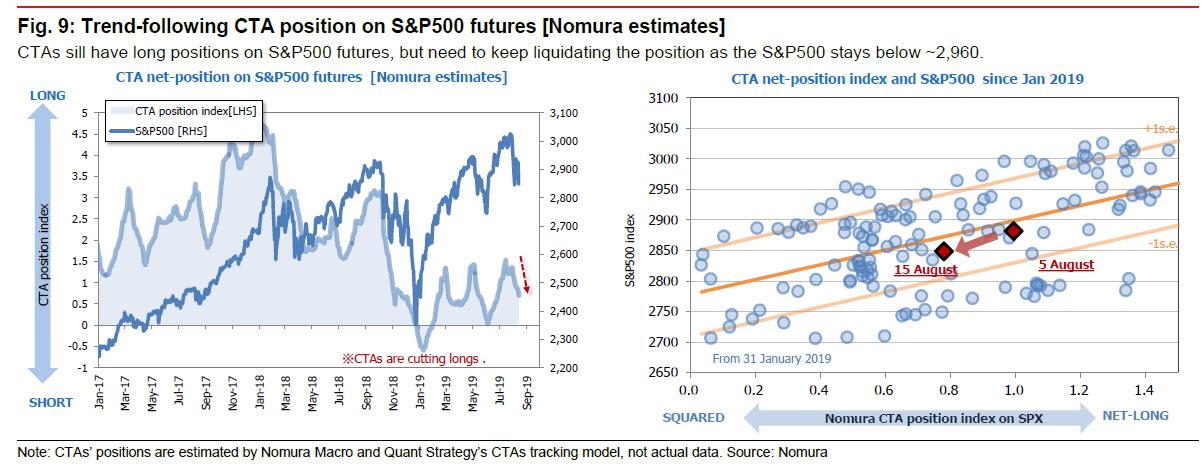

- 2. Too soon to start contrarian buying in the hope of riding a bear squeeze rally in equity futures: CTAs and other speculative players are still net long US equities. Buying in now would mean trying to catch a falling knife, according to Takada; instead, a better opportunity may come in perhaps two weeks’ time. As the Nomura quant notes, “the right time to consider taking out contrarian long positions with the aim of capturing a bear squeeze rally would be when CTAs have cleared away their outstanding longs and have started taking on shorts.”

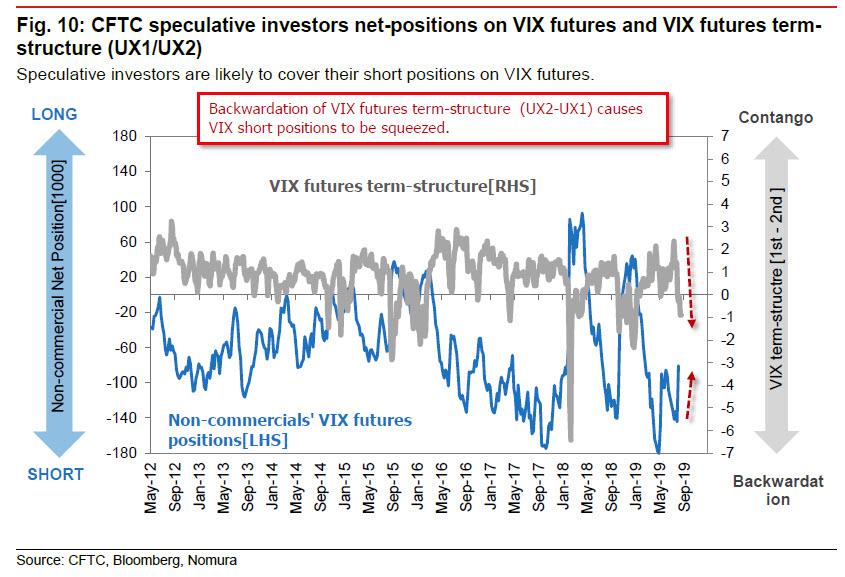

- 3. Still favoring long positions in the VIX and other measures of implied equity volatility, as the time for going short would be after the second “vol up” wave: CFTC data shows speculative players (non-commercial traders) to still have a net short position in VIX futures, to the tune of 80,000 contracts as of 6 August. Given the backwardation of the VIX futures curve between UX1 and UX2, speculators are likely to continue buying VIX futures to cover shorts.

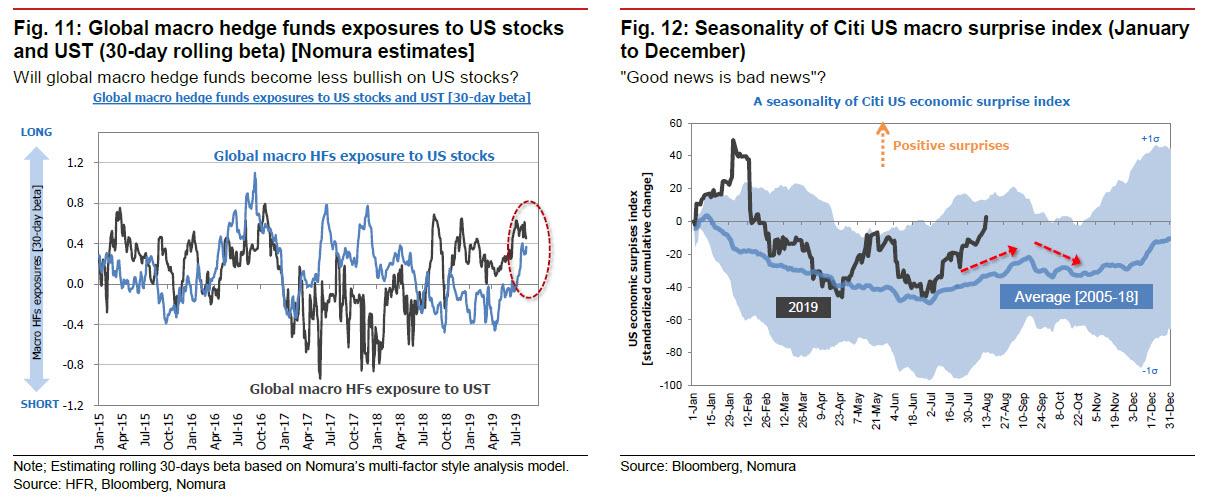

- 4. Contrarian trades on indicators of fundamentals: Global markets are likely to increasingly press the Fed to cut interest rates substantially. Therefore expect stock market players to apply the “good news is bad news” reading to incoming US macroeconomic data.

Last but not least, beware of a self-fulfilling recession.

The inversion of the 10yr-2yr UST yield curve put a quick end to the relief rally in US stocks, and thereby seems to have pushed US stock market sentiment into a pattern that suggests further, significant deterioration ahead.

As Nomura concludes, “the inauspicious pattern in US stock market sentiment could well be signaling that a self-fulfilling recession is on the way.” Source

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers

“Have I, therefore, become your enemy by telling you the truth?”

![]()