Well that really did escalate quickly…

Today had the feeling of ‘liquidation’ (similar to March) as big-tech stocks (growth/value rotation), bitcoin, bonds, and bullion were all dumped unceremoniously.

While Nasdaq futs were bid along with everything else on Putin’s vaccine headlines overnight, it didn’t take long for the growth/value rotation pressure to kick in and send them lower as small caps (financial/energy dominant) surged… but late on things rolled over as the liquidations spread and the rest of the market tumbled lower on ‘stalled stimulus’ talks…

This 3-day losing streak for the Nasdaq is the worst in 5 months and the Dow/S&P broke its 7 day win streak.

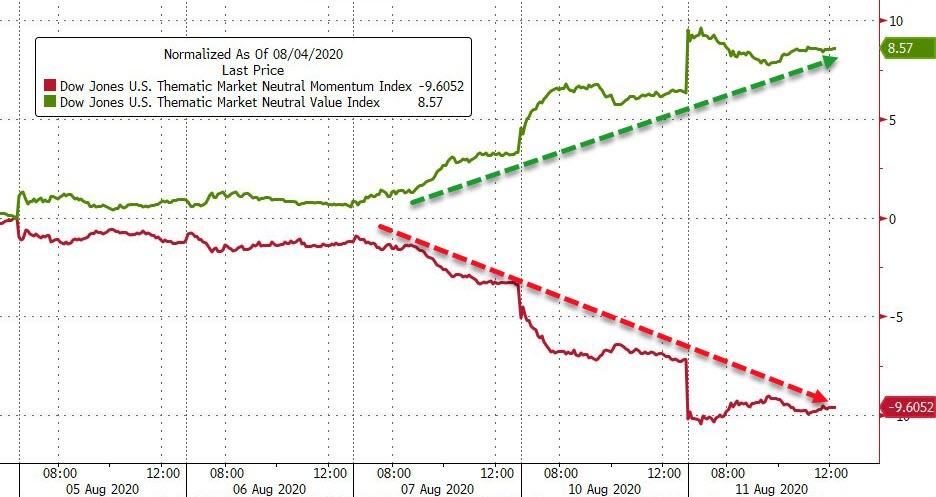

The momo/growth vs value rotation continued to pick up…

Source: Bloomberg

Another serious quant-quake…

Source: Bloomberg

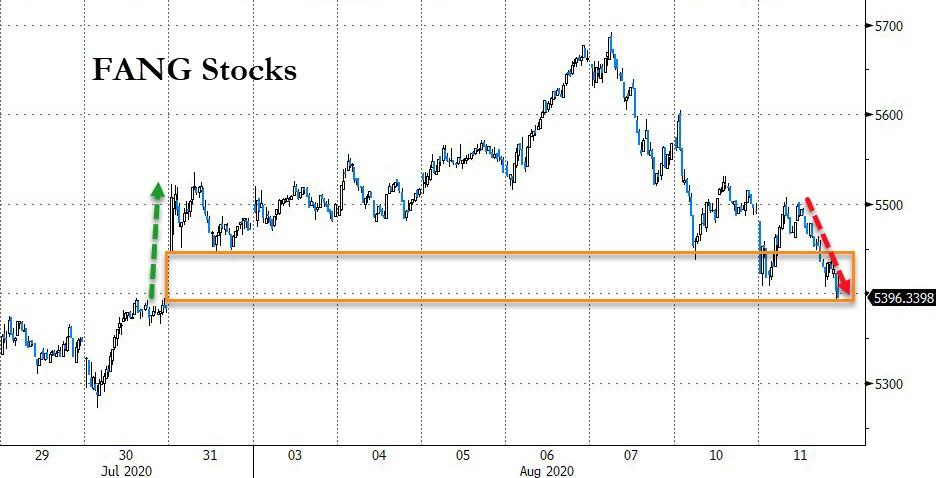

The early ‘value’ gains were erased in the last hour…

Source: Bloomberg

FANG stocks staged the typical BTFD effort after an initial tumble but accelerated lower later to foll the gap-up from July 31st…

Source: Bloomberg

VIX spiked 13 handles to 25 (after tagging a 20 handle intraday)…

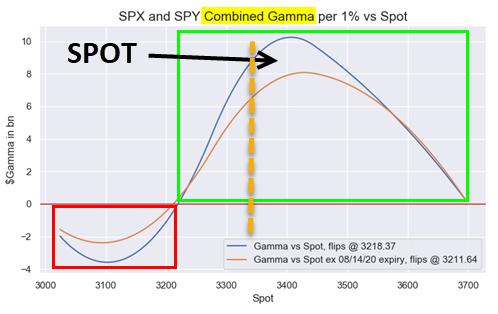

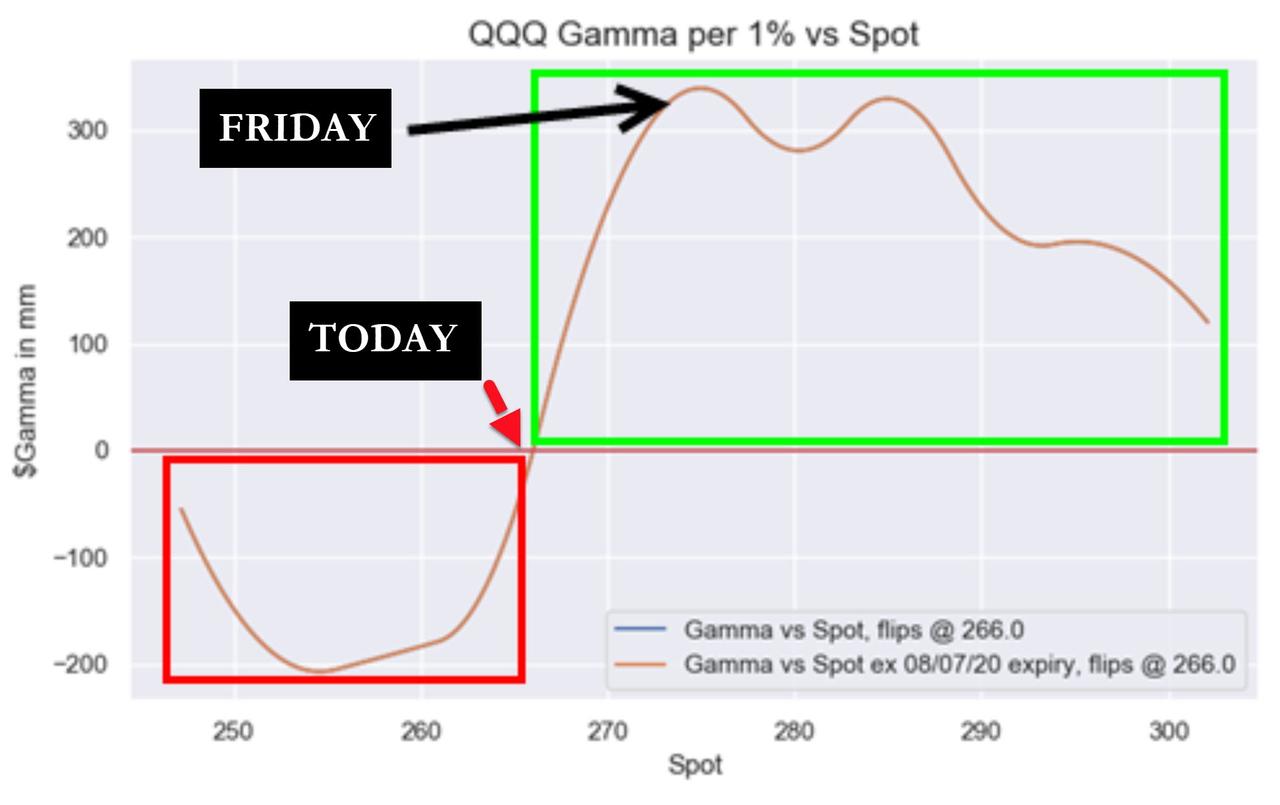

Notably the S&P has a way to go until gamma flips (3218)…

Source: Nomura

But the Nasdaq’s gamma just flipped negative…

Source: Nomura

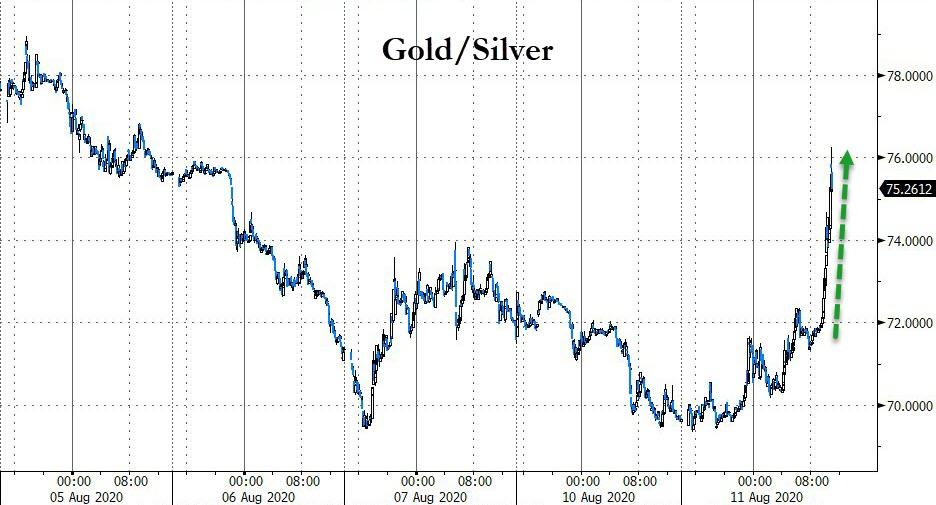

However, it was precious metals that caught the eye today as gold saw its biggest daily drop sine April 2013…

And silver crashed by its most since Lehman (Oct 2008)…

Sending the gold/silver ratio spiking…

Source: Bloomberg

Gold’s initial tumble tracked real yields perfectly but over-did as the yellow metal broke $2000 and ran stops…

Source: Bloomberg

So, Vladimir Putin (whose nation has been among the most avid buyers of gold for its reserves in recent years), announces a vaccine (which crushes the price of gold by the most since Lehman)? Does make you wonder eh?

But let’s not over-react too much eh?

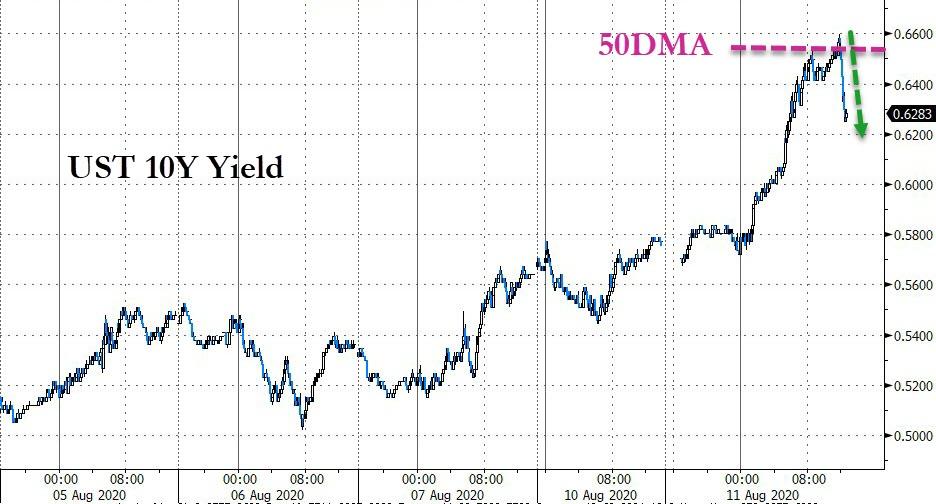

But it was not just gold and silver were clubbed like a bay seal. Bonds puked led by the long-end, but as stocks started to accelerate lower in the last hour, things turned around and bonds were suddenly bid (McConnell said ‘stimulus talks are stalled’)…

Source: Bloomberg

With 10Y exploding 9bps higher (the biggest absolute jump since March) to its highest since July 8th and tagged the 50DMA…

Source: Bloomberg

…and then reversed notably…

Source: Bloomberg

We are all in big trouble if this gap is really starting to fill – a surge in rates of that scale will kill America’s balance sheet and a purge of that scale in stocks will be worse for sentiment still…

Source: Bloomberg

Simply put, The Fed is in a corner, it can’t let rates run (debt loads) on the back of hope-filled ‘reflation’ and if the growth-to-value rotation escalates further it will create a flight to safety in bonds… which will hurt financials and thus leave the two legs of the growth/value rotation hurting.

Bitcoin was monkeyhammered…

Source: Bloomberg

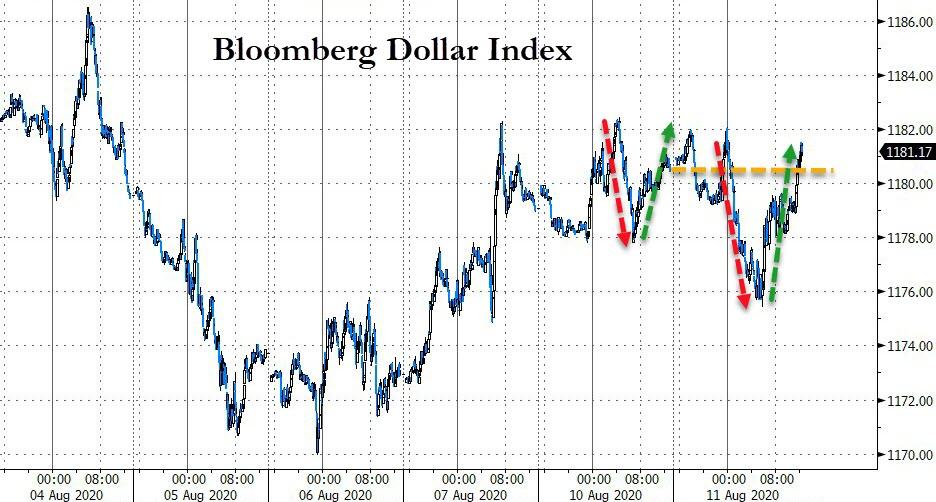

The dollar ended marginally higher after another roller-coaster today…

Source: Bloomberg

Oil prices were higher early on, excited about Putin’s vaccine but as the liquidation accelerated WTI was bashed back below $42…

And Dr.Copper also stalled and tumbled again at key resistance…

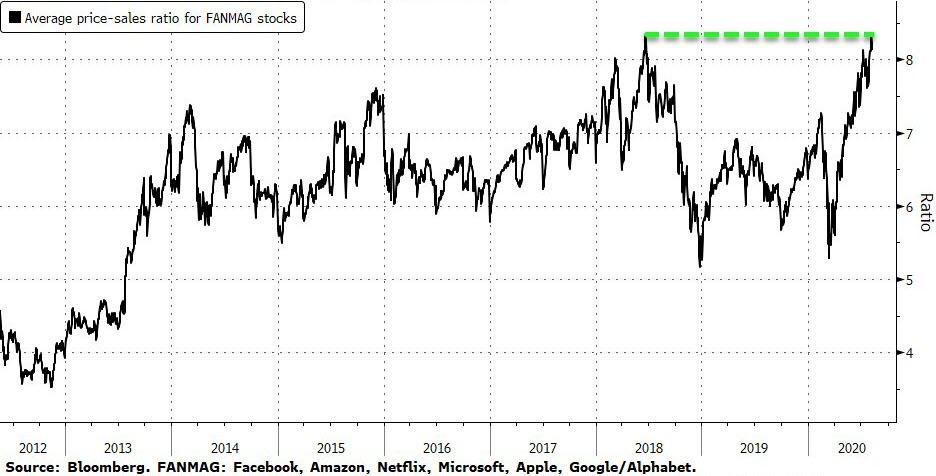

Finally, we note that today’s reversal came at an interesting moment in mega-tech valuation… Combine Apple Inc. and Microsoft Inc. with the FANG stocks, and the result is a record valuation. The average price-sales ratio among the so-called FANMAGs climbed as high as 8.33 last week, according to data compiled by Bloomberg. Their peak just surpassed the previous mark of 8.32, set in June 2018.

Source: Bloomberg

And one wonders if the ‘dead cat bounce’ is over (if nothing else, today’s reversal is interestingly timed)…

Source: Bloomberg ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()