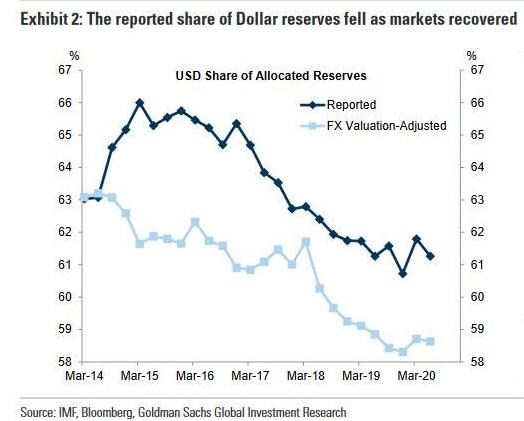

Global de-dollarization resumed in the second quarter according to data recently released by the International Monetary Fund (IMF).

While the dollar share of global reserves increased in the first quarter of 2020, it fell sharply in Q2, resuming a more than two-year trend downward.

The share of euros making up global reserves rose slightly and the share of yen dropped. The second quarter saw the largest build-up of reserves in Chinese RMB and “other currencies”

The increase in dollar reserves in Q1 was likely an anomaly triggered by increased valuation and safe-haven buying during the early stages of the COVID-19 panic.

A Bank of America report concluded, “the de-dollarization theme appears intact.” According to its data, the share of US holdings has declined to 61.3%, “slightly more than expected based on FX, bond and equity valuation changes.”

Central bank reserves globally rose significantly as they aggressively intervened in foreign exchange (FX) markets. Total FX reserves rose to over $12 trillion. According to analysis by ZeroHedge, most major countries experienced a rise in FX reserves through Q2, with the exception of Turkey. That country continues to bleed reserves in order to stabilize its currency.

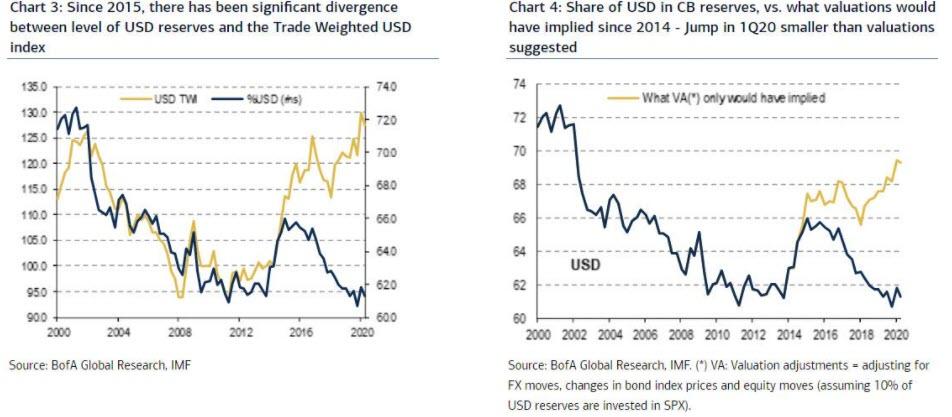

There has been a decoupling between the level of dollar reserves and the Trade Weighted USD index – a measure of currency strength weighted by the country’s amount of trade.

According to ZeroHedge, “This divergence between the level of USD reserves and that of USD TWI is expected to persist, as the world is decoupling from the USD as the notional reference peg.”

According to the BoA report, no single currency stood out as having benefited from the process so far. Instead, many central banks have turned to gold.

Central bank gold purchases have slowed somewhat this year after record buying in 2018 and 2019. But, central bank gold-buying is expected to rebound in 2021, according to analysts for both Citigroup and HSBC Securities.

Central bank demand came in at 650.3 tons last year. That was the second-highest level of annual purchases for 50 years, just slightly below the 2018 net purchases of 656.2 tons. According to the WGC, 2018 marked the highest level of annual net central bank gold purchases since the suspension of dollar convertibility into gold in 1971, and the second-highest annual total on record.

Some analysts believe both China and Russia will resume adding to their gold-holdings next year. Both countries have been aggressive in reducing their exposure to the dollar but recently put gold purchasing on hold.

Earlier this year, Russia announced it would halt gold purchases effective April. Meanwhile, the People’s Bank of China has not reported any gold purchases in 10 months. It’s not uncommon for China to go silent and then suddenly announce a large increase in reserves. The Chinese government has hinted that it might shed more US Treasuries from its reserve holdings. It would come as no shock if the Chinese replaced US debt with gold.

We’ve been watching this de-dollarization trend over the last several years, and have written extensively about a push to minimize dollar exposure by countries like Russia and China and their desire to undermine the ability of the US to weaponize the dollar as a foreign policy tool.

The dollar’s slowly shrinking share of reserves doesn’t yet threaten its status as the world’s reserve currency, but it could be a canary in the coal mine. It’s definitely a trend to keep a close eye on.

Source: ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()

Day-Traders Send US Producer Prices Soaring In July

US Producer prices were expected to rise MoM following four declines in the last five months and they did, rising 0.6% MoM (double the expected…

Read More