The Bank of England’s Monetary Policy Committee (MPC) “voted unanimously” to keep the banking rate at 0.1% and left its bond-buying program unchanged despite the country’s worst economic slump in 300 years, caused by coronavirus lockdowns.

MPC voted 7-2 to leave its bond-buying program unchanged at £645 billion. Two of its nine policymakers (Michael Saunders and Jonathan Haskel) voted to increase the program by £100 billion.

The BoE described the economic impact of COVID-19 was “having a significant impact on the United Kingdom and many countries around the world,” adding that economic activity has stumbled since 1Q20 and unemployment “has risen markedly.”

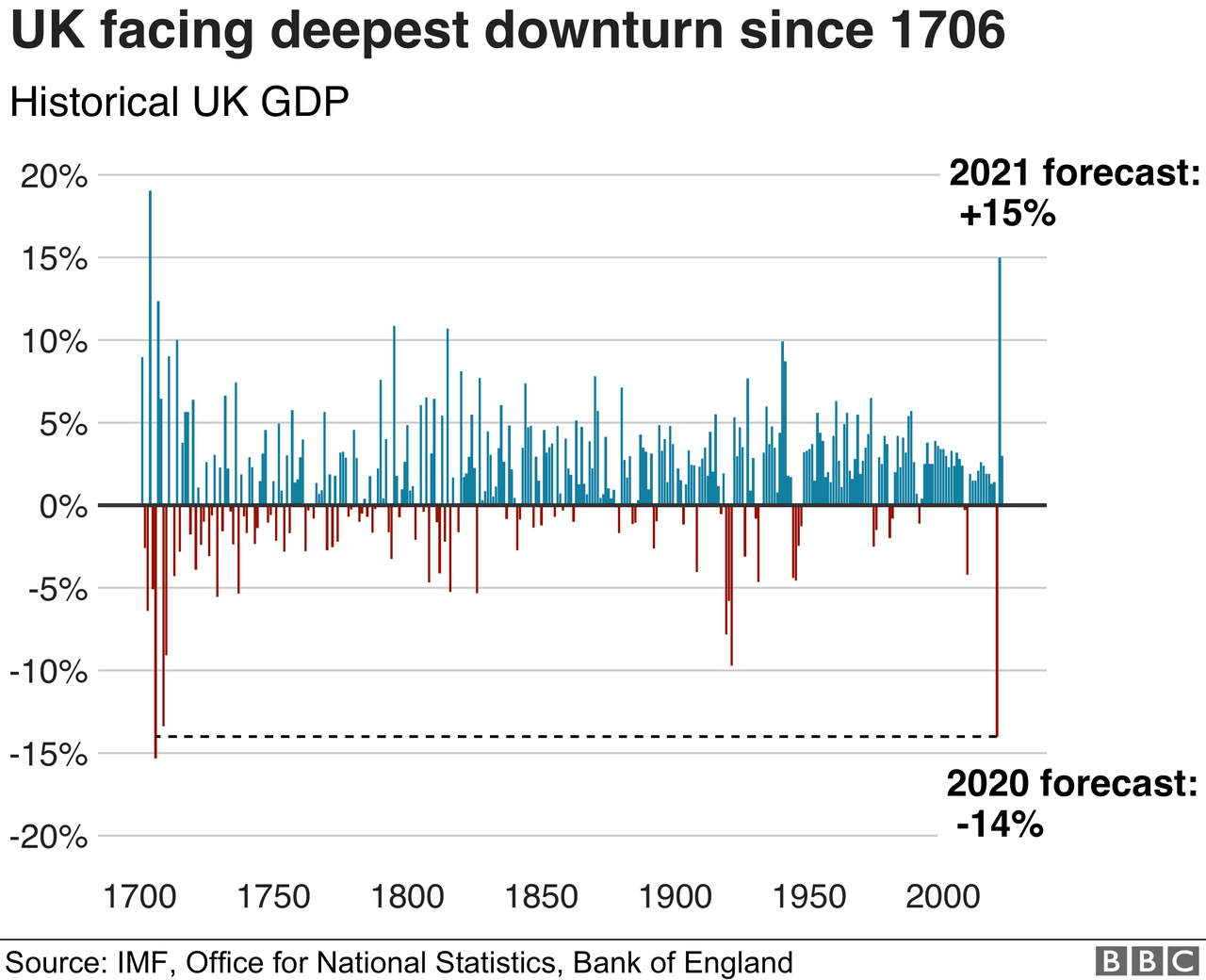

The Bank outlined an “illustrative scenario” that shows a 14% plunge in the British economy in 2020, followed by a V-shaped recovery in 2021. It said very significant monetary and fiscal stimulus is required for recovery to play out.

“However the economic outlook evolves, the Bank will act as necessary to deliver the monetary and financial stability that is essential for long-term prosperity and meet the needs of the people of this country,” Governor Andrew Bailey said.

“This is our total and unwavering commitment,” Bailey said, adding that, “the recovery of the economy to happen over time, though much more rapidly than the pull-back from the global financial crisis.”

The scenario was based on the government relaxing lockdown restrictions between June and September. However, if a second coronavirus wave is seen, it could quickly derail the recovery and possibly trigger prolonged shutdowns that would undoubtedly lead to a double-dip decline in the economy.

Bailey unleashed helicopter money last month, which was a historic move to counter the devastating effects of the lockdown.

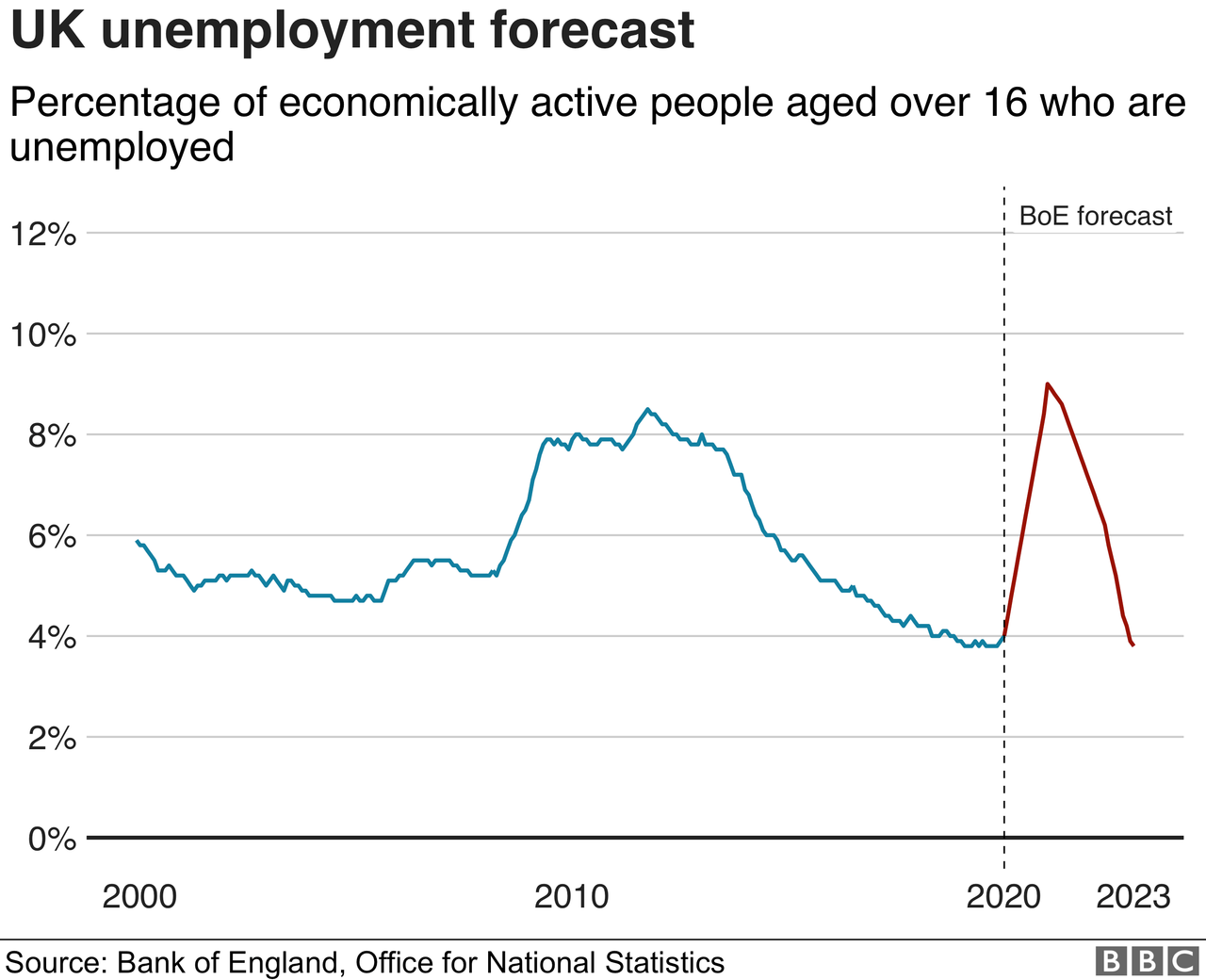

Here’s the BoE forecast for unemployment – widespread job loss is expected this year with possible recovery over the next few. However, the model is showing nearly every job will be restored, we find that highly unlikely, as some will be eliminated.

Receive a daily recap featuring a curated list of must-read stories.

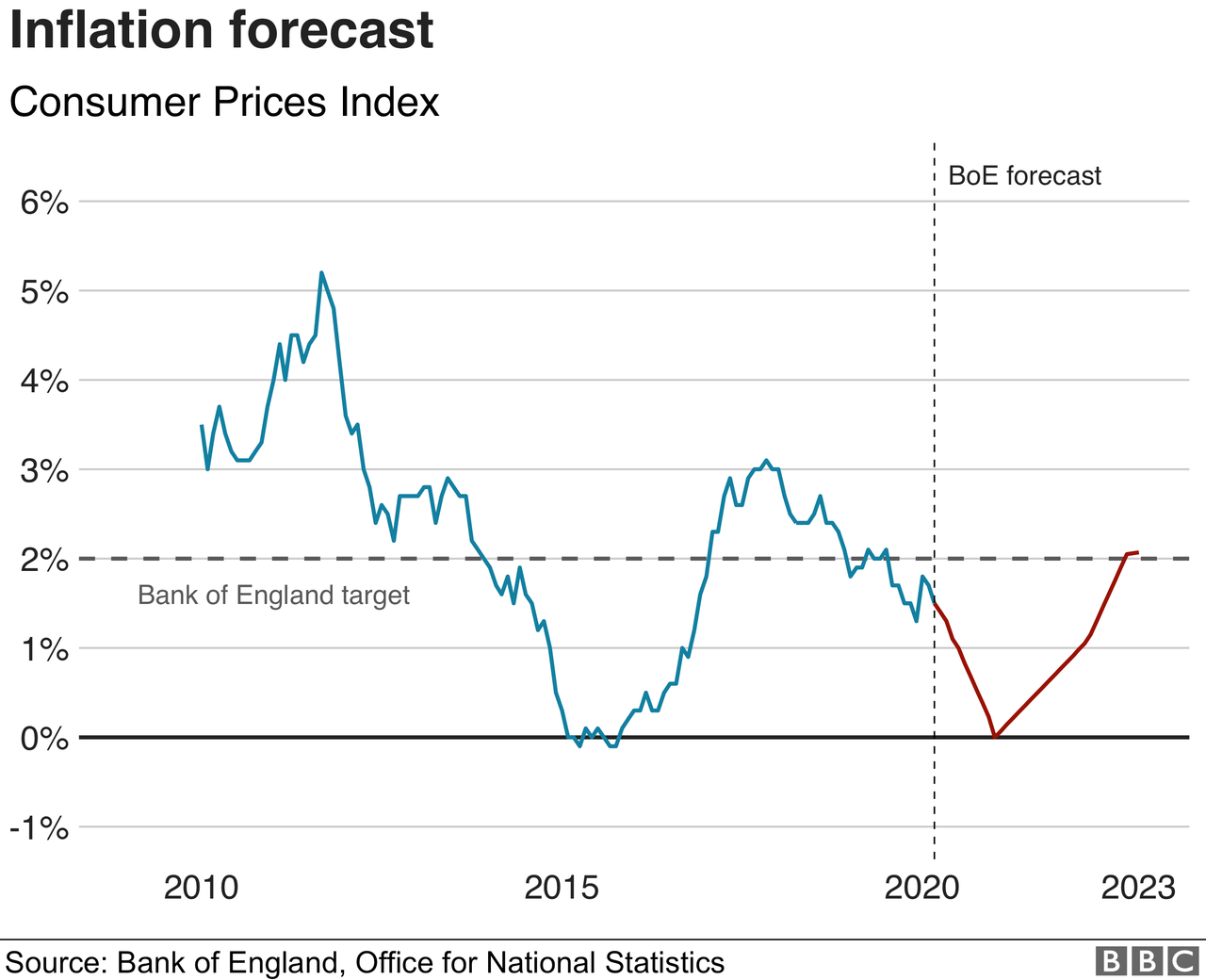

The scenario also showed consumer prices index would fall to near zero at the start of next year, mainly because of the drop in energy prices. Then the BoE expects to meet its 2% target in the next several years.

“The financial system was, however, in a much better position to support households and businesses through this period compared with the global financial crisis,” the BoE said.

Can the financial system handle a possible second wave of virus cases?

StevieRay Hansen

Editor, Bankster Crime

The 127 Faith Foundation understands the pain and sorrow associated with being a throwaway child, We push this throwaway child towards bettering their education, be it junior-college are going for a Masters’s degree. This program is about them because they determine by the grace of God if they’re going to be a pillar in the community or a burden on society. Some of the strongholds orphans deal with are: fear, resentment, bitterness, unforgiveness, apathy, unbelief, depression, anxiety, lust, anger, pride, and greed. Many of these strongholds do open the door to addiction. Please Help The127

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

“Have I therefore become your enemy by telling you the truth?”

Oil Drop, Coronavirus, Fraud,Banks,Money,Corruption,Bankers

![]()

It’s Happening Again… Investors Dump Everything ‘China’

Global stock markets plunged Friday as tensions between the US and China spiral out of control. Stocks in Hong Kong and mainland China tumbled after Beijing ordered Washington to cease all…

Read More