Following yesterday’s “berserk” price action in Credit Suisse’s 3x Inverse Natural Gas ETN, the Swiss banking giant has been forced to do something about it.

In recent years the price hadn’t risen above $600, but it advanced in each of the past five sessions with percentage increases of 35%, 34%, 29%, 223% and 400%, and closed on Wednesday at $15,000.

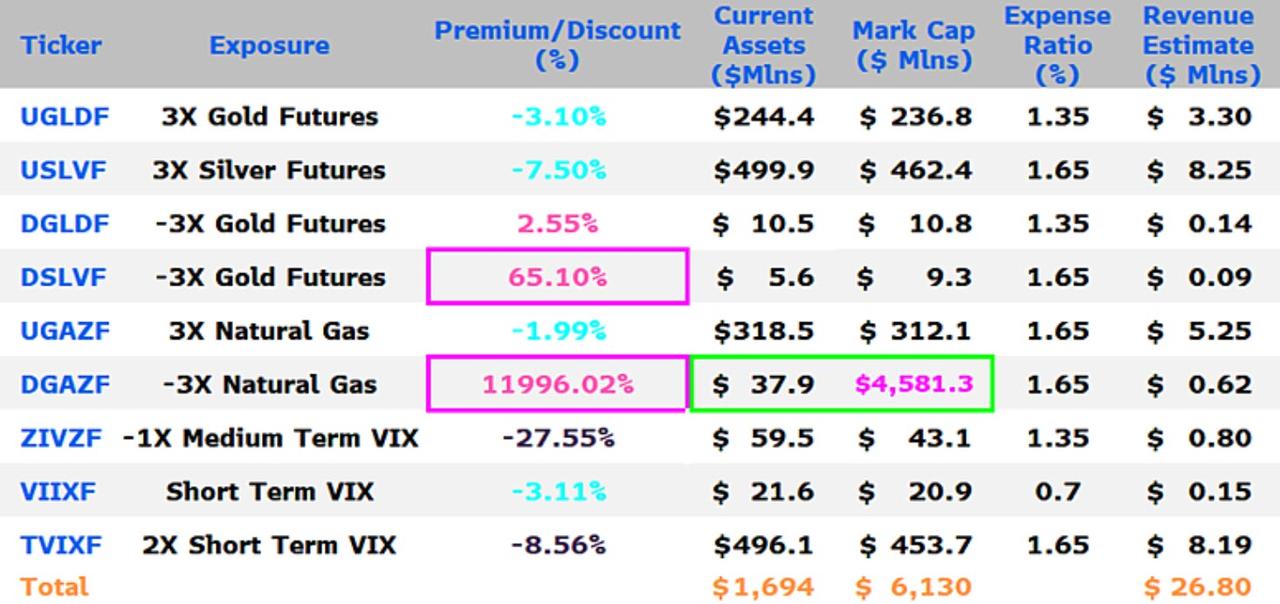

That compares with the note’s net asset value of $124.01. The market cap is $4.58 billion, versus total assets of $37.9 million.

The note had already seen securities issuance suspended on June 22 and been delisted from the NYSE Arca exchange on July 12, but after the last few days, Credit Suisse has been forced to liquidate the note as soon as possible.

Investors in the ETN will receive a cash payment per note equal to the average of the closing indicative value during a period of five consecutive business days expected to be Aug. 14-20.

And given the stock is halted, this means because Credit Suisse was completely lazy, greedy and incompetent, some traders are about to eat a 99% loss if they bought in the last few days.

Here is Credit Suisse’s full press release explaining their actions:

Credit Suisse AG (“Credit Suisse”) announced today that it will accelerate at its option its VelocityShares™ 3x Inverse Natural Gas ETNs (the “ETNs”), which were previously delisted from the NYSE Arca.

The ETNs were originally listed on the NYSE Arca, but were delisted from the NYSE Arca as of July 12, 2020. On June 22, 2020, Credit Suisse suspended further issuances of the ETNs. Following the delisting from the NYSE Arca, the ETNs traded on an over-the-counter basis.

As described in the related pricing supplement for the ETNs (the “Pricing Supplement”), Credit Suisse, as the issuer of the ETNs, may, at its option, accelerate all issued and outstanding ETNs on any business day after the inception date. Credit Suisse expects to deliver notice of the acceleration of the ETNs via the Depository Trust Company on August 12, 2020.

As described in the Pricing Supplement, investors will receive a cash payment per ETN equal to the arithmetic average of the closing indicative values of the ETNs during the accelerated valuation period. The accelerated valuation period will be a period of five consecutive index business days, which is expected to be from August 14, 2020 to August 20, 2020. The acceleration date is expected to be August 25, 2020, three business days after the last day of the accelerated valuation period. If you have questions regarding the impact of the acceleration of the ETNs on your position, please contact your broker.

Credit Suisse ends by noting specifically that “none of the other ETNs offered by Credit Suisse are affected by this announcement,” but it is quite clear that between illiquidity, leverage, and mechanics, something is very broken in any number of ETFs/ETNs across the world.

As Bloomberg Intelligence’s ETF Analysts, James Seyffart details, Credit Suisse’s decision to liquidate an exchange-traded note with outsized premiums leaves eight of the bank’s other ETNs still trading over the counter while creating no new shares — posing similar risks to investors.

The World Is In Big Trouble, for Those That Believe We Will Go Back to Some Sense of Normal Life Here on Earth, You Will Be Sadly Disappointed, Seven Years of Hell on Earth Which Began January 1, 2020

“Our courts oppose the righteous, and justice is nowhere to be found. Truth stumbles in the streets, and honesty has been outlawed” (Isa. 59:14, NLT)…We Turned Our Backs On GOD, Now We Have Been Left To Our Own Devices, Enjoy…

While Mainstream Media Continues to Push a False Narrative, Big Tech Has Keep the Truth From Coming out by Shadow Banning Conservatives, Christians, and Like-Minded People, Those Death Attributed to the Coronavirus Is a Result of Those Mentioned, They Truly Are Evil…

The ETNs hold $1.7 billion in assets, and we believe their inability to adjust to demand opens the door to price manipulation.

” Delisted active products that lack the ability to create shares should be closed, in our view, since they put investors at risk and could hurt the industry’s reputation by fueling outsized pricing gaps. “

And given that ETFs now dominate price action, that is hardly a good sign for financial stability going forward. Will The Fed start buying commodity ETFs if they crash? Who will protect the retail investor?

Source: ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

WE NOW LIVE IN A WORLD THAT IS PURE FABRICATION

![]()