By Pam Martens and Russ Martens:

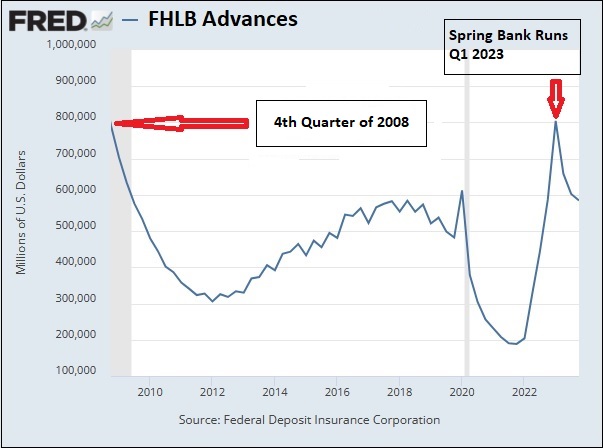

According to data from the Federal Deposit Insurance Corporation, and using a graph from the St. Louis Fed above, the liquidity crisis among banks in the spring of last year was far more dramatic than has been acknowledged by banking regulators.

According to the data, during the worst financial crisis since the Great Depression (at the end of the fourth quarter of 2008 when Wall Street was in a state of collapse), banks had borrowed a total of $790 billion in advances from Federal Home Loan Banks (FHLBs). But during the bank panic in the spring of last year, those FHLB advances topped the Q4 2008 number, registering $804 billion as of March 31, 2023.

According to data from the Congressional Budget Office, at the end of the quarter before the banking panic of 2023 (the quarter ending December 31, 2022) two of the banks that failed in the spring of 2023 were among the top 10 borrowers from the Federal Home Loan Banks. Those two banks were Silicon Valley Bank and First Republic Bank.

The CBO report explains the FHLB loan system as follows:

“The principal business activity of FHLBs is to borrow in the capital markets and issue advances to their member institutions. Advances come in two forms: traditional advances and liquidity advances. Traditional advances are intended but not required to be used by members to finance residential housing or by a community financial institution to fund loans for small businesses, small farms, or community development activities. The mortgage-related advances can be used as longer-term funding for loans that are not sold in the secondary mortgage market—such as loans retained by a member in its portfolio—or as interim funding for loans that a member ultimately sells or securitizes.

“FHLBs may also make liquidity advances to members, provided that the member is solvent, has the necessary collateral, and has reasonable prospects of returning to a satisfactory financial condition. In that capacity, the FHLBs serve as an alternative to using the Federal Reserve’s discount window, allowing members facing liquidity shocks (that is, urgent demands for cash) to access short-term funding without experiencing the regulatory and market oversight often associated with borrowing from the discount window…”

Adequate and timely regulatory oversight was exactly what was missing at the banks that failed in the spring of 2023.

According to data released by the Federal Home Loan Banks for the quarter ending December 31, 2023, it is not just small or medium size banks that are tapping advances from the FHLBs. As of that date, the top three borrowers were the following: JPMorgan Chase, the largest bank in the U.S., had outstanding FHLB advances of $41.7 billion. Wells Fargo and PNC Bank each took second place with advances of $38 billion each.

Also ranking among the largest borrowers was Flagstar Bank, the federally-insured bank of the publicly-traded New York Community Bancorp. (ticker NYCB). As of December 31, 2023, Flagstar had outstanding advances at the FHLBs of $20.25 billion. NYCB’s share price has collapsed this year; its deposit credit rating has been cut to junk; and earlier this month it accepted an emergency equity infusion from an investor group led by the former U.S. Treasury Secretary in the Trump administration, Steve Mnuchin. See our report: Steve Mnuchin, Trump’s Treasury Secretary/Foreclosure Kingpin, Joins with Hedge Fund Guys to Grab a Teetering, Federally-Insured Bank for $2 a Share.

Another bailout program initiated during the banking panic of 2023 is the Federal Reserve’s Bank Term Funding Program (BTFP). The BTFP was announced by the Fed on March 12, 2023 and was to provide emergency loans to banks of up to one-year in duration – an unprecedented action for the Fed as its emergency loan programs are required under statute to be short-term in nature and adequately collateralized. But instead of imposing a haircut on collateral posted by the banks as is the custom, the Fed said it would accept the collateral at par – meaning at the face amount of the collateral at maturity, rather than at the deeply depressed market value.

The Fed announced it was ceasing to make new loans under the BTFP as of March 11 of this year. But because banks may have made new loans of one year recently, loan balances for this program may not come down dramatically for some time. As of Wednesday, March 13, the BTFP had total loan balances of $167.46 billion, which was $3.4 billion more than the prior week.

For context on what is going on here, see our report: Former New York Fed Pres Bill Dudley Calls This the First Banking Crisis Since 2008; Charts Show It’s the Third.

FacebookTwitterWhatsAppLinkedIn

Give the gift of great skin care. Our Soap and Shave Bars are gentle and produce a smooth creamy lather that is nourishing to your skin. They are handmade in small batches. We use only high-quality natural ingredients that you can pronounce. No chemicals, no sodium laurel sulfate, no phthalates, no parabens, no detergents. The set can include Soap Bar, Shave Bar, Shave Brush, and/or Shampoo Bar. These come in a white box and are perfect for your gift giving needs.

Our soaps are made with skin loving ingredients including olive oil, coconut oil, lard, sweet almond oil, shea butter, and castor oil. We do not use palm oil. Scented only lightly with fragrance oils.

The Shave bars give a very close and smooth shave with no razor burn. They leave your skin feeling amazing. A lather can be built up in your hands and then applied to your face, but it is best to use a shaving brush. These bars will only produce a thick foam when used with a shaving brush.

Our Shampoo Bars have a thick lather. A lather can be built up in your hands and then applied to your hair, but it is best to rub the bar gently in your hair. Rinse and repeat.

You choose a scent:

A Thousand Dreams is a whimsical blue scented in a warm mix of fruity and floral notes with peach, peony, lily, musk, sandalwood, and amber.

Bay Rum Spice is a nice masculine scent similar to Old Spice. The scent notes are clove, pine needles, cedarwood, orange, vanilla, and musk.

Birch Woods is a great outdoors-type scent. The notes are bergamot, patchouli, vetiver, and tonka bean.

Cool Clear Water is a refreshing scent. The notes are crisp water, oakmoss, pine, cedar, and musk.

Lavender Champagne has a wonderful scent of Lavender and Champagne and has a light purple color. The scent notes are lavender, sparkling Champagne, grapefruit, orange, thyme, oak, and amber.

Midnight Waters is a moody-mystical scent that opens with fruity notes of red berries, juicy tangerine, and bergamot. Then unfolds into bubbly Champagne, violet flowers, cashmere, amber, and musk.

Raspberry Vanilla is an all-time favorite fragrance for soap. It is a beautiful magenta color. The scent notes are raspberry, strawberry, lemon, coconut, peach, honeysuckle, plum, and vanilla.

Warm Sandalwood is a warm, rich, and woodsy scent. The colors are warm and rich with brown, gold, and white.

A Soap bar will weigh approximately 4 ounces and be approximately 2.25 inches wide by 3.5 inches tall and 1 inch thick. A Shave bar will weigh approximately 3 ounces and be approximately 2.5 inches across and 1.25 inches thick. A Shampoo Bar will weigh approximately 3.5 ounces and be approximately 2.5 inches across and 1.25 inches thick. Please keep in mind that our products are handmade and hand cut. Each bar is unique and might vary slightly in shape, size, design, and color from those pictured.

Please keep your Soap Bars, Shave Bars, and Shampoo Bars well-drained and allow to dry between uses. This will ensure longer lasting bars.

Allergen: Our products contain oil from tree nuts. Please test on a small area of skin prior to use and stop using if irritation occurs. Do not use if you are pregnant. Do not use on infants under the age of 24 months. Do not get in your eyes as it will sting slightly. Go Shopping

![]()