The collapse in bond yields, exacerbated by the crash in oil prices, marks an end to the era of trust in central banks…

OPEC+: A 24-Hour View

Coronavirus. That will be the first and last time this column mentions that word. Despite the weekend’s many developments in the epidemic, there is a new issue to drive the markets. Like the dreaded disease, its effect is to take an already disquieting market trend and make it far more extreme. The breakdown of the OPEC talks in Vienna on Friday, followed by Saudi Arabia’s announcement that it would abandon attempts to limit supply, and instead aim to increase market share, has driven a historic fall in the oil price.

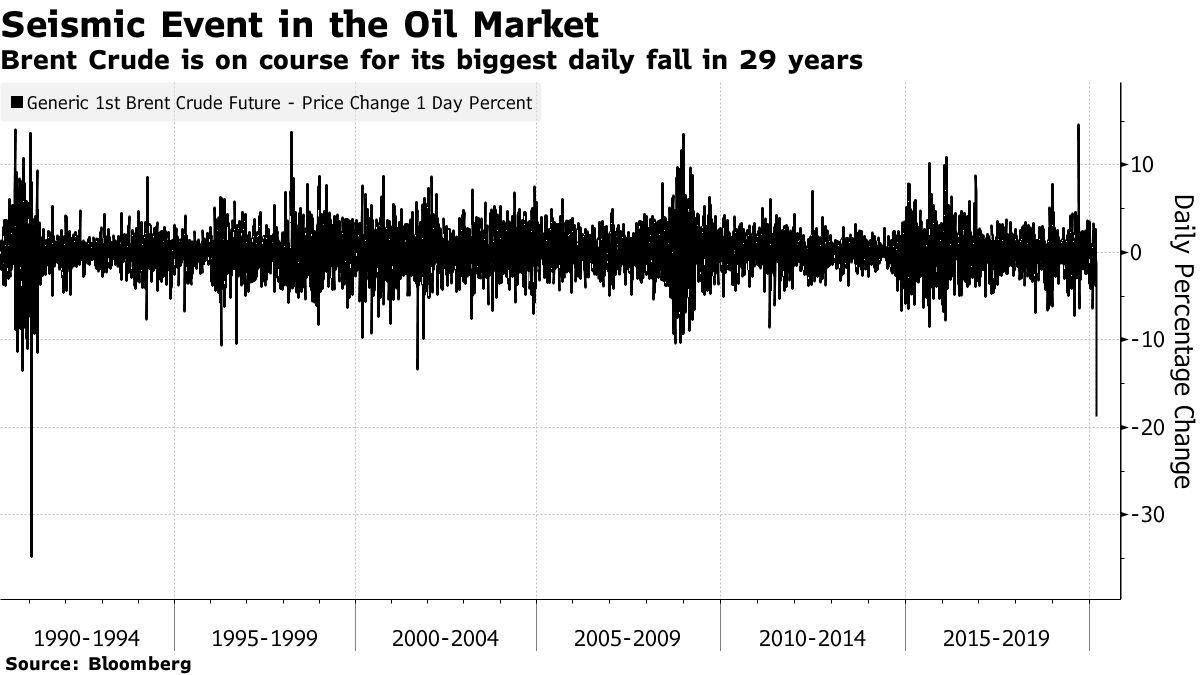

With Brent and West Texas Intermediate crude both down more than 20% when trading began in Asia, this was on course to be the worst day for the oil price since January 1991, when a coalition was fighting Iraq over its invasion of Kuwait:

Moves this dramatic can create quite a shock. This could be good news for beleaguered airlines, whose fuel will be much cheaper, and it should provide a broad economic stimulus as motorists and industrialists see fuel costs reduced. But those benefits take time to make themselves felt.

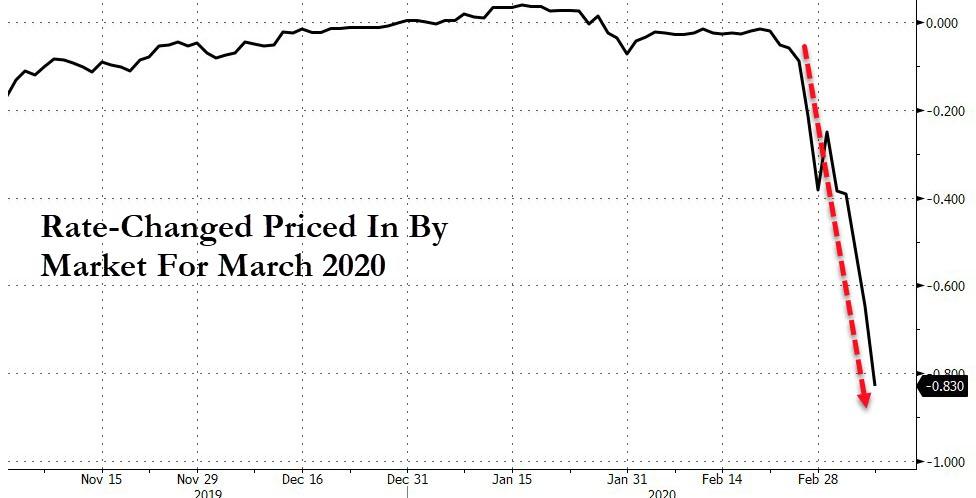

In the meantime, this will put immense pressure on anything that benefits from a high oil price. An immediate effect will be on the U.S., which has profited from the shale oil boom. The economics of that industry now come under threat — which is precisely the purpose of allowing prices to drop so far. Shale operators tend to be heavily leveraged and so now face a great risk of bankruptcy, which will hurt banks, and credit investors. That puts pressure on the Federal Reserve to cut rates further. The market now predicts the Fed will have to cut another 75 basis points off the overnight fed funds rate at its meeting this month.

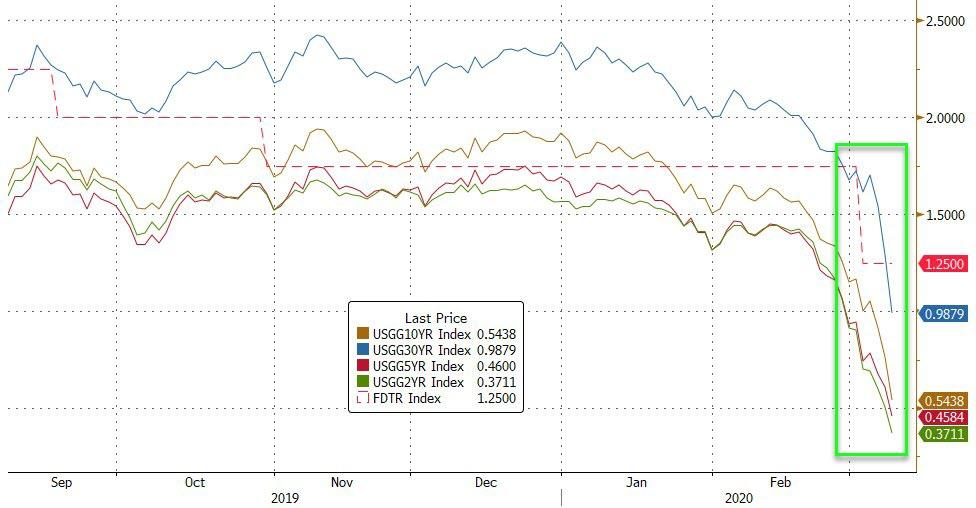

Thus the virtual collapse of OPEC has led to a further collapse in U.S. interest rates. This is what has happened to the 10-year Treasury yield since the emergency cut of 50 basis points announced last Tuesday:

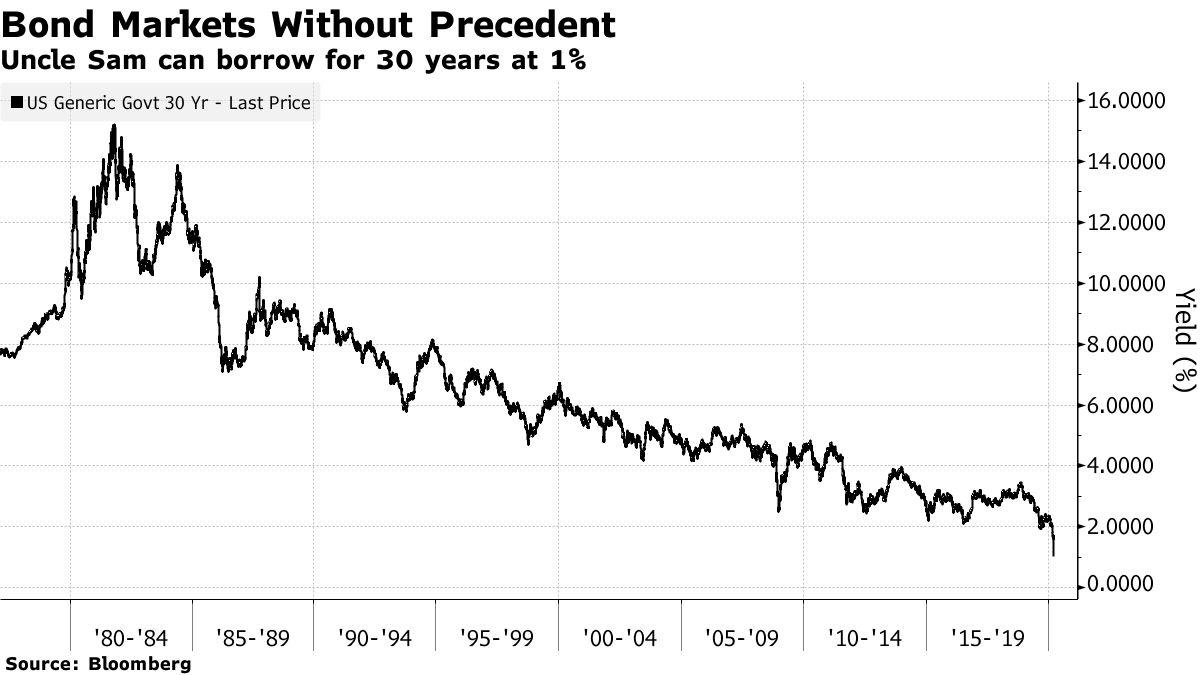

If the epidemic and the Fed’s response to it brought 10-year yields below 1% for the first time, dissension among oil producers has brought them below 0.5% less than a week later. Possibly even more remarkable is the fall in the 30-year yield, which dropped below 1% at the Asian opening, easily its lowest ever:

Central banks want to show they can raise inflation. This sudden fall in fuel costs makes that far harder, at a point when the response to the emergency cut showed that the market was already losing confidence in their ability to do so. The result has been a sharp convergence of U.S. and eurozone yields, to the narrowest in six years:

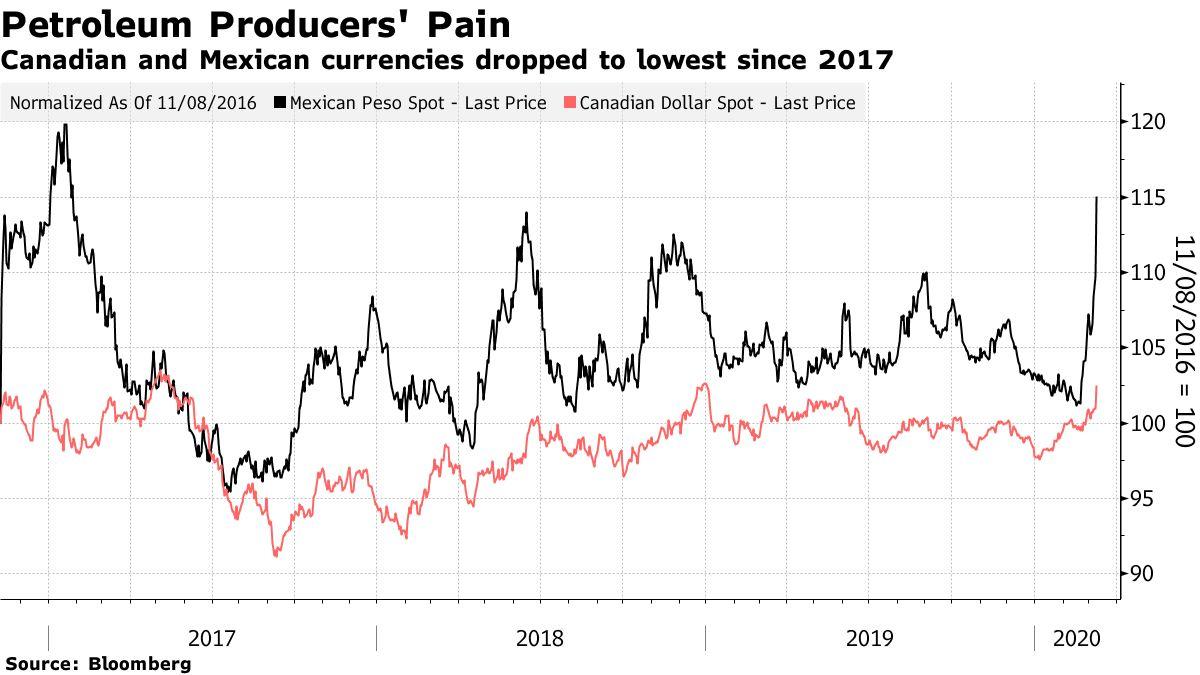

Normally when people are scared, they seek sanctuary in dollars. This is particularly true when oil falls; the dollar tends to be inversely correlated with oil, and shot up during the last major leg down for crude in late 2014. That isn’t happening this time, at least so far. The dollar has fallen to its lowest versus the Japanese yen since 2016, while gold has topped $1,700 per ounce for the first time in 12 years.

The dollar can at least enjoy some strength against petro-currencies, which benefit from higher oil prices. It strengthened sharply against the Mexican peso and Canadian dollar in Asian trading.

In the long term, there is an opportunity for everyone to benefit from cheaper fuel prices. Historically low bond yields are also effectively an invitation from the market for governments to borrow as much as they like, so if ever there was a time for fiscal expansion, this is it.

In the short term, we should expect a run on bank stocks, and energy stocks. Faced with such evidence of deflation, cyclical stocks will come under pressure. So will everything in what might be called the emerging market complex — industrial metals, as well as emerging market stocks, debt (which if denominated in dollars will be much harder to pay off), and currencies.

The Oil Standard: A 50-Year View

Having said all that, looking too closely at the drama following the OPEC breakdown might miss the point. This looks like a truly historic juncture, of the kind that comes along only every few decades, as the international financial order shifts.

After the war, the developed world was governed by the Bretton Woods accords, which tied all currencies to the dollar, which was in turn pegged to gold. It was a looser form of a gold standard and survived until 1971. That was when Richard Nixon ended the gold peg, realizing that it had become too great a burden for the U.S., and stood in the way of the expansionary fiscal policy he was hoping to adopt ahead of his re-election campaign.

The result was a huge shock to the world order. With the gold peg gone, the financial system adopted a new anchor, which was oil. In a book published 10 years ago, I tried describing the system that replaced Bretton Woods as an Oil Standard.

Effectively, producers tried to defend themselves against the declining buying power of the dollar by hiking prices, so as to keep the price of oil in gold terms effectively constant.

Receive a daily recap featuring a curated list of must-read stories.

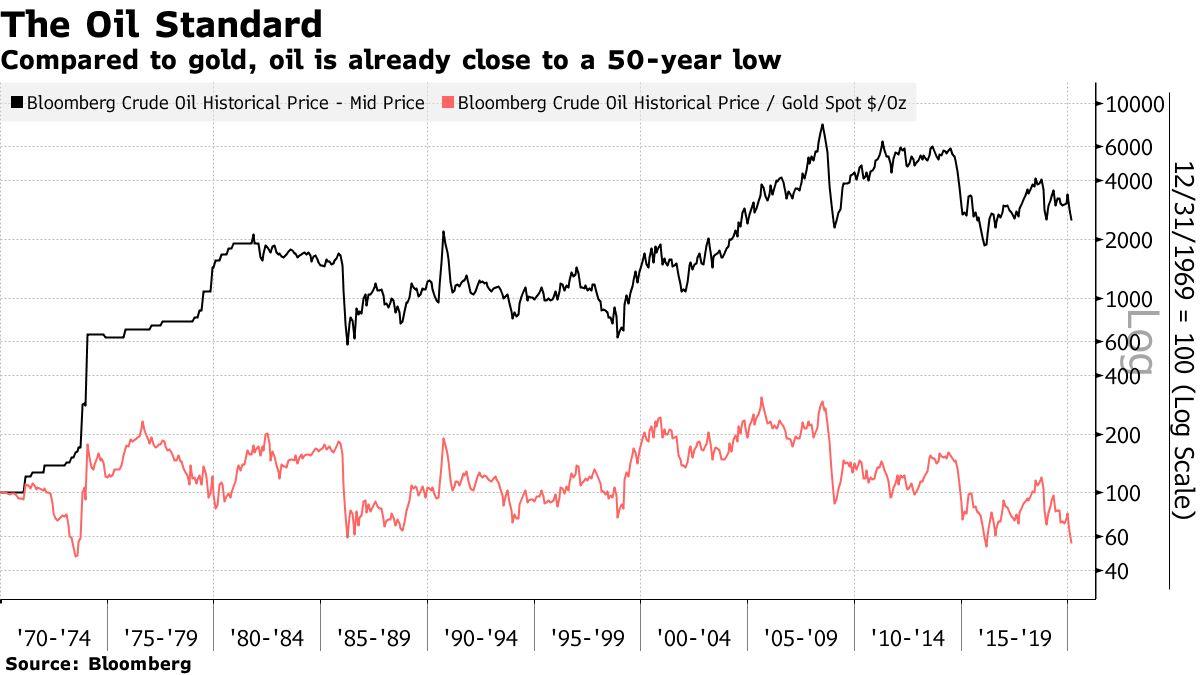

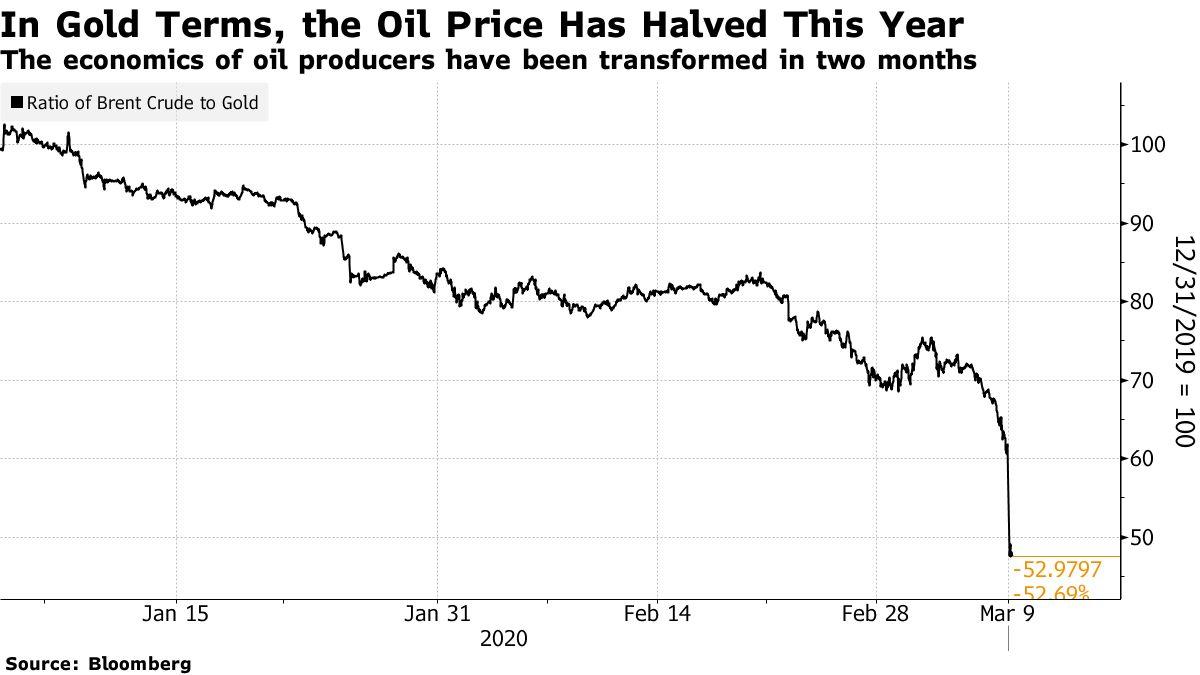

The oil/gold ratio measures how much gold you would need to pay to buy a certain amount of oil. As the chart shows, it ended the 1970s almost exactly where it had started, despite the massive increase in dollar terms.

The chart uses Bloomberg’s historic oil prices, which appear monthly, and pre-dates the latest market drama. Once updated, it will show the oil/gold ratio reached an all-time low, having already halved this year:

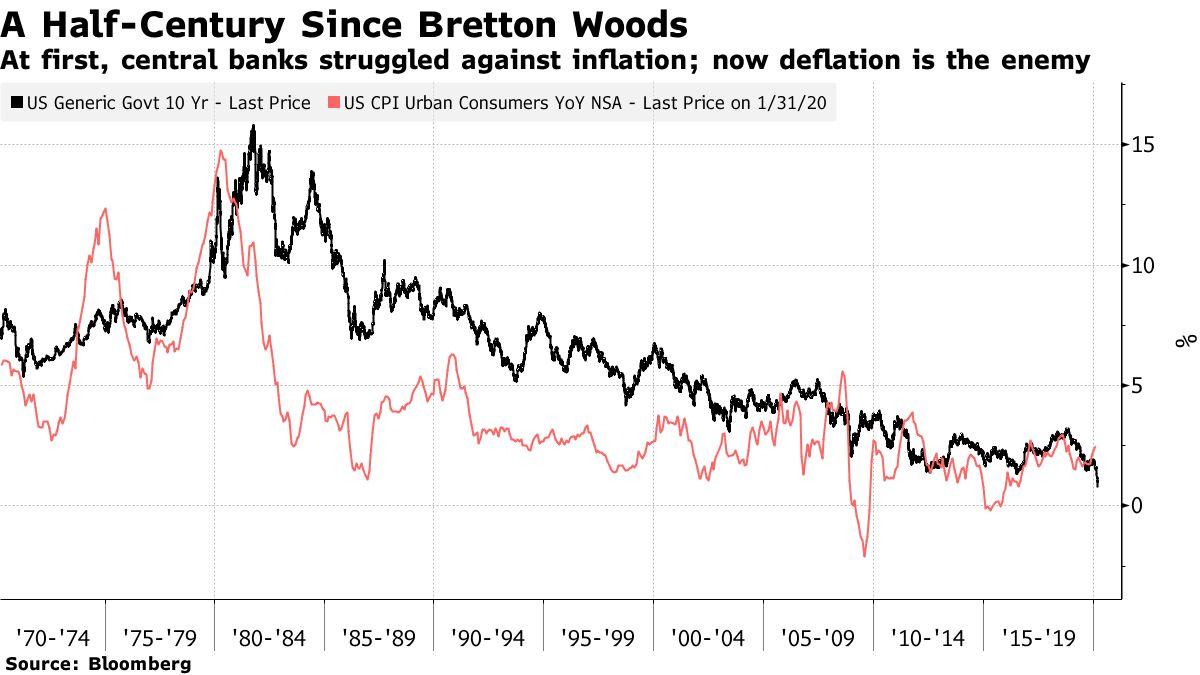

The Oil Standard era ended in the early 1980s. Markets — and everyone else — had lost faith in the ability of central banks to control inflation. Paul Volcker arrived at the Fed, raised rates more than anyone thought he would dare, provoked a recession, and convinced everyone that central banks could control inflation after all. In conjunction with the Reagan/Thatcher approach to economic management, and then the collapse of the Soviet Union and the resurgence of China, that ushered in a quarter-century of triumphalism for a new model anchored by broadly trusted central banks.

That foundered in the financial crisis of 2007-09. Now we have reached a new juncture, where the fear is that central banks cannot control deflation. For the post-crisis decade, the U.S. has managed to stay distinct, thanks in part to the privilege of the world’s reserve currency, and in part to the superior success of its corporate sector. It has done this even as Japan and Western Europe have sunk into negative interest rates, while the emerging markets have stagnated. The twin shocks of the epidemic and the oil price now appear to have wounded confidence that the U.S. can stand alone.

It certainly looks as though the world has at last arrived at a point that it appeared to have reached a decade ago. Some new financial order, to replace Bretton Woods and the system that Volcker built to replace it, is now needed. A decade of monetary expansion has delayed the issue. It is hard to see how it can be delayed much further. It would be wise to brace for disruption to match what was experienced at the end of the 1970s and the beginning of the 1980s.

Coronavirus kills the oldest and has no respect for authority

Many of the most powerful people in the world are old, and coronavirus does not discriminate based on social status. Deaths are now hitting at high levels (not of death but of status), which can change the political conflicts of our world:

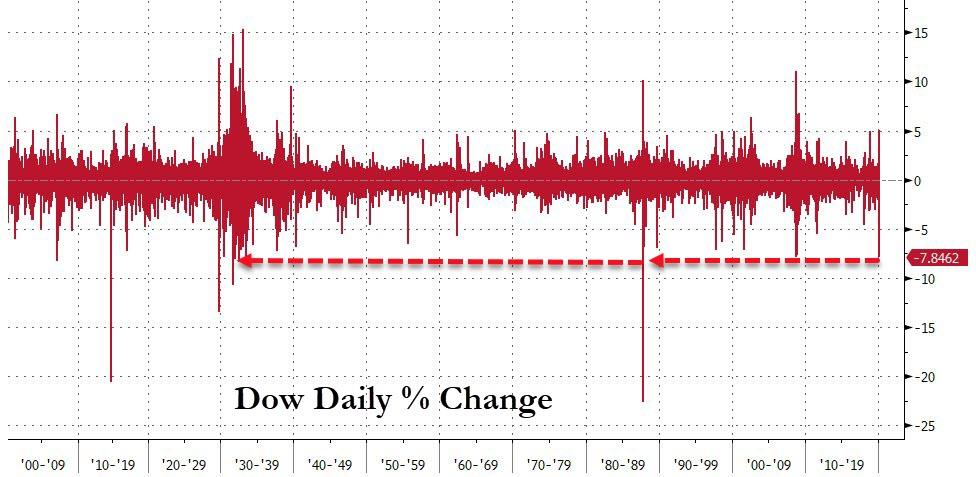

At its lows today, this was the market’s biggest down day since 1987 (by the close the biggest since Oct 2018)!

Source: Bloomberg

In a reflection of the total loss of faith policymakers among BTFDers, @Sentimentrader notes that:

This is the only day in the history of S&P 500 futures that they gapped down more than -5% and didn’t close above the open.

Did the 11-year-long, almost unstoppable bull run that started on March 9, 2009, just end on March 9, 2020?

Source: Bloomberg

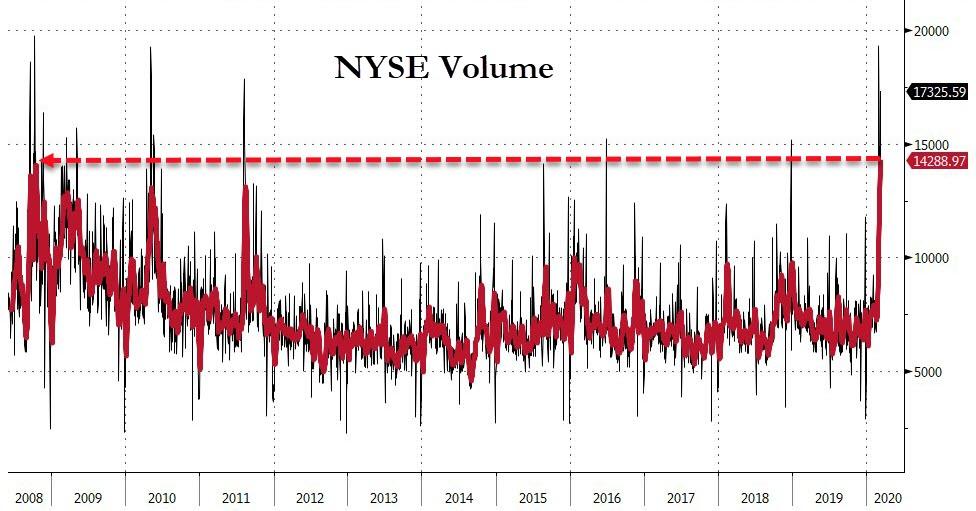

Here’s another stat for the record books. Total U.S. Trading volume, on a 10-day moving average basis, is now higher than during the meltdown in 2008. Volume is another whopper today, over 17 billion shares.

Source: Bloomberg

Thanks to the market perceiving President Trump’s response as remaining one of “denial” of the scale of the problem, and concerns that any fiscal stimulus will be underwhelming, things were already anxious as markets opened Sunday night. But the situation was worsened considerably as both Russia and Saudi Arabia stood poised to flood the market with cheap crude (supply) in an all-out price war just as the coronavirus is spurring the first contraction in demand since 2009.

“The situation we are witnessing today seems to have no equal in oil market history,” said IEA Executive Director Fatih Birol.

“A combination of a massive supply overhang and a significant demand shock at the same time.”

Oil futures fell by about one-third in New York and London on Monday, the biggest drop since the Gulf War in 1991, before pulling back to a 20% decline.

Source: Bloomberg

Crashing below $30!

Crashing US HY Energy sector bond prices…

Source: Bloomberg

US markets were a bloodbath from Sunday night future open (ETFs showed things were uglier than the 5% limit down in futs) and stocks were unable to show any real resilience…

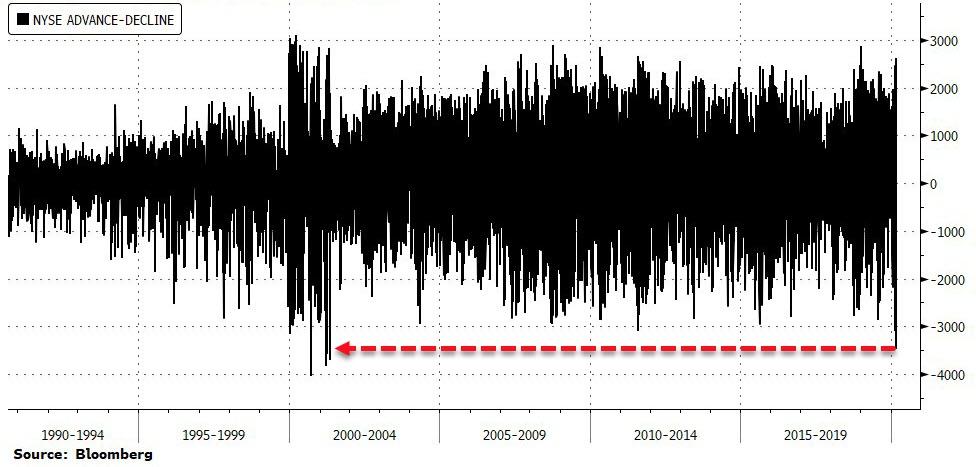

Early selling pressure today – judged by NYSE’s advance-decline line – was at its strongest since the DotCom collapse…

Source: Bloomberg

Extreme Fear has reached its extreme-est level…

The shrill cry from the asset-gatherers and commission-rakers – “TURN THE BUY-THE-DIP MACHINES BACK ON!!!!”

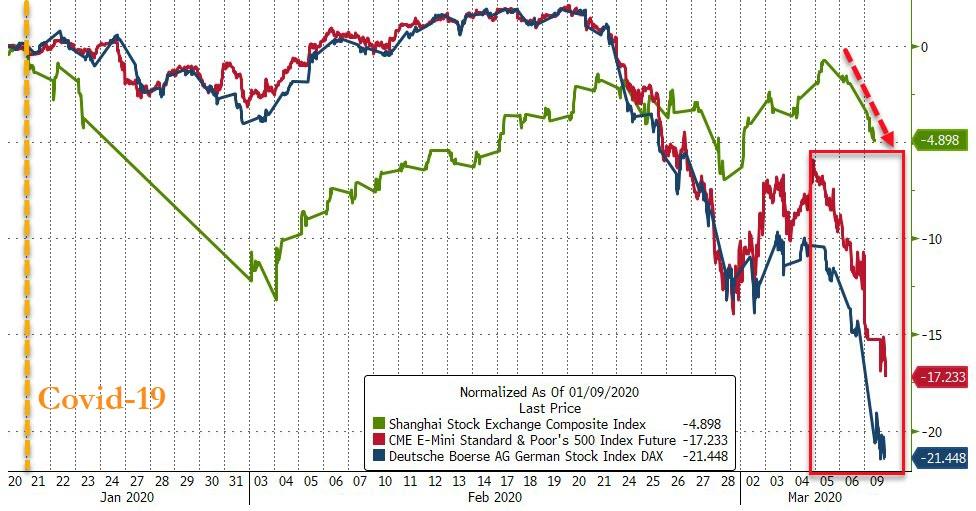

Chinese stocks – somewhat uncharacteristically – tumbled overnight… finally…

Source: Bloomberg

European stock markets just suffered their worst decline since Lehman… Oct 2008…

Europe is now down over 22.5% – a bear market – from highs just 3 weeks ago…

Source: Bloomberg

The selling was absolutely across the board…

Source: Bloomberg

European banks crashed to their lowest since March 2009… but judging by EU bank credit, there’s more to come…

Source: Bloomberg

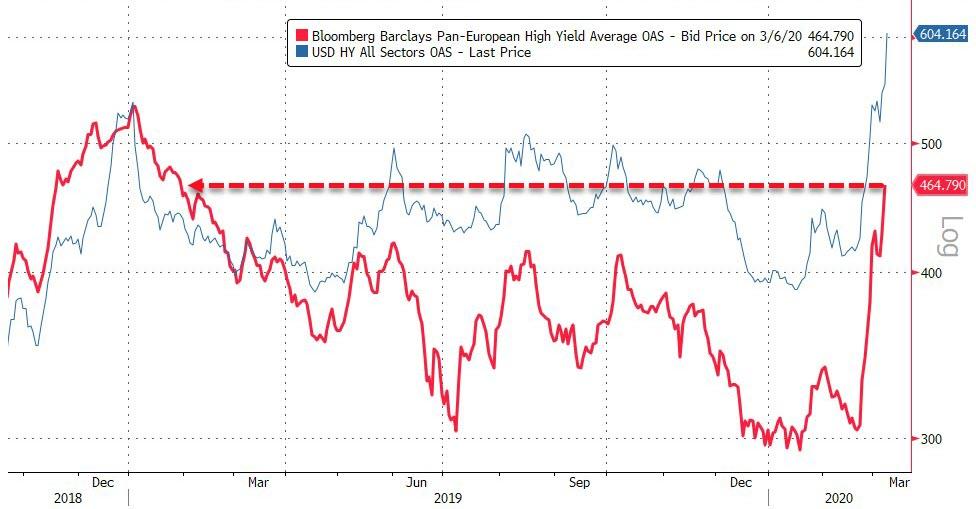

And European credit is crashing…

Source: Bloomberg

Gilt yields fall below 0% in two- and five-year segments, with BOE’s buyback seeing the institution buy at a sub-zero rate

Source: Bloomberg

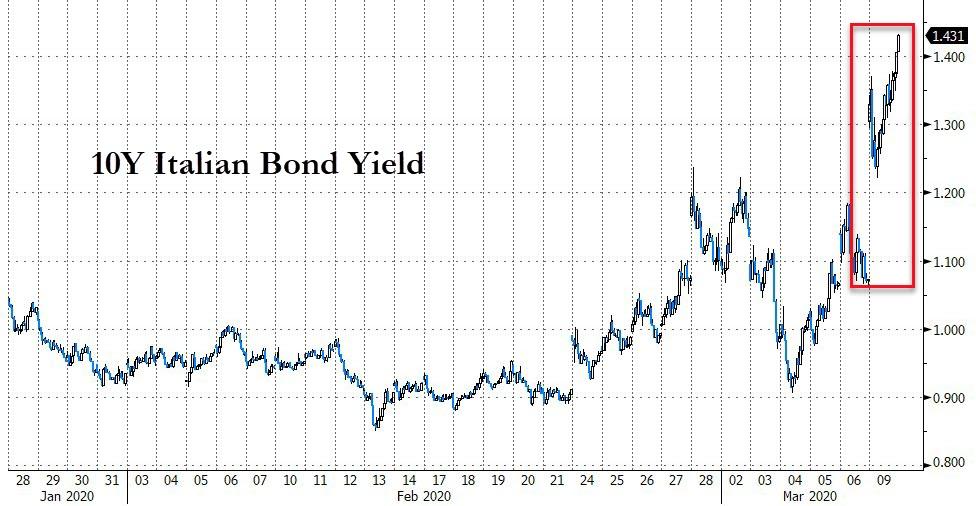

But, Italian yields surged, rising 30bps in 2-year to 10-year segments.

Source: Bloomberg

And US markets were an ever bigger bloodbath… The Dow dropped 2019 points!!! Worst day for stocks since Oct 2008

And while China began to drop, US and Europe lead the way since the start of the Covid-19 headlines…

Source: Bloomberg

Russell 2000 entered a bear market today (down 23.5% from January highs), dropping most since Lehman…

Source: Bloomberg

Dow Transports have erased all of the post-Trump election gains…

Source: Bloomberg

S&P broke key technical support…

Source: Bloomberg

All the major US equity indices have broken below their 200DMA…

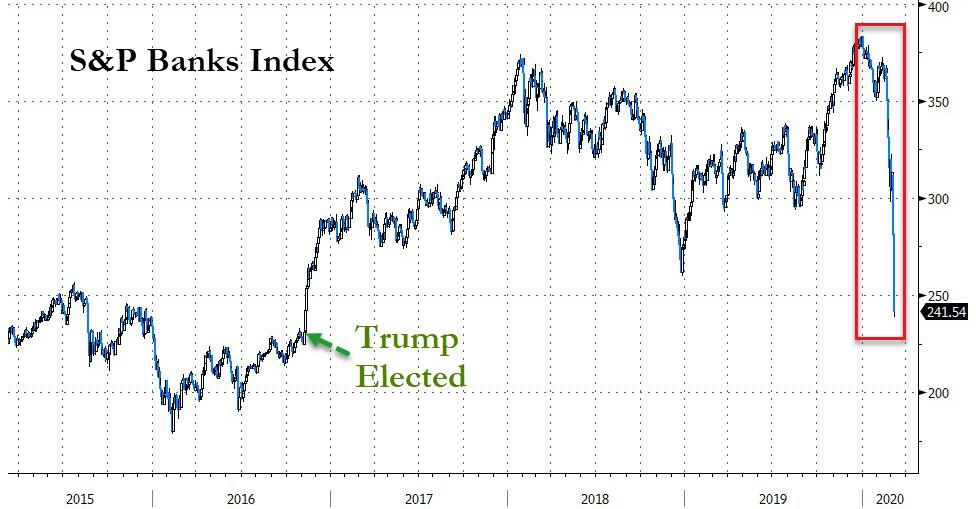

US Banks were crushed today…

Source: Bloomberg

The big banks are down a stunning 30-40% in the last 3 weeks…

Source: Bloomberg

The Energy sector suffered its biggest loss ever, crashing over 18% on the day…

Source: Bloomberg

Virus-related sectors have been destroyed…

Source: Bloomberg

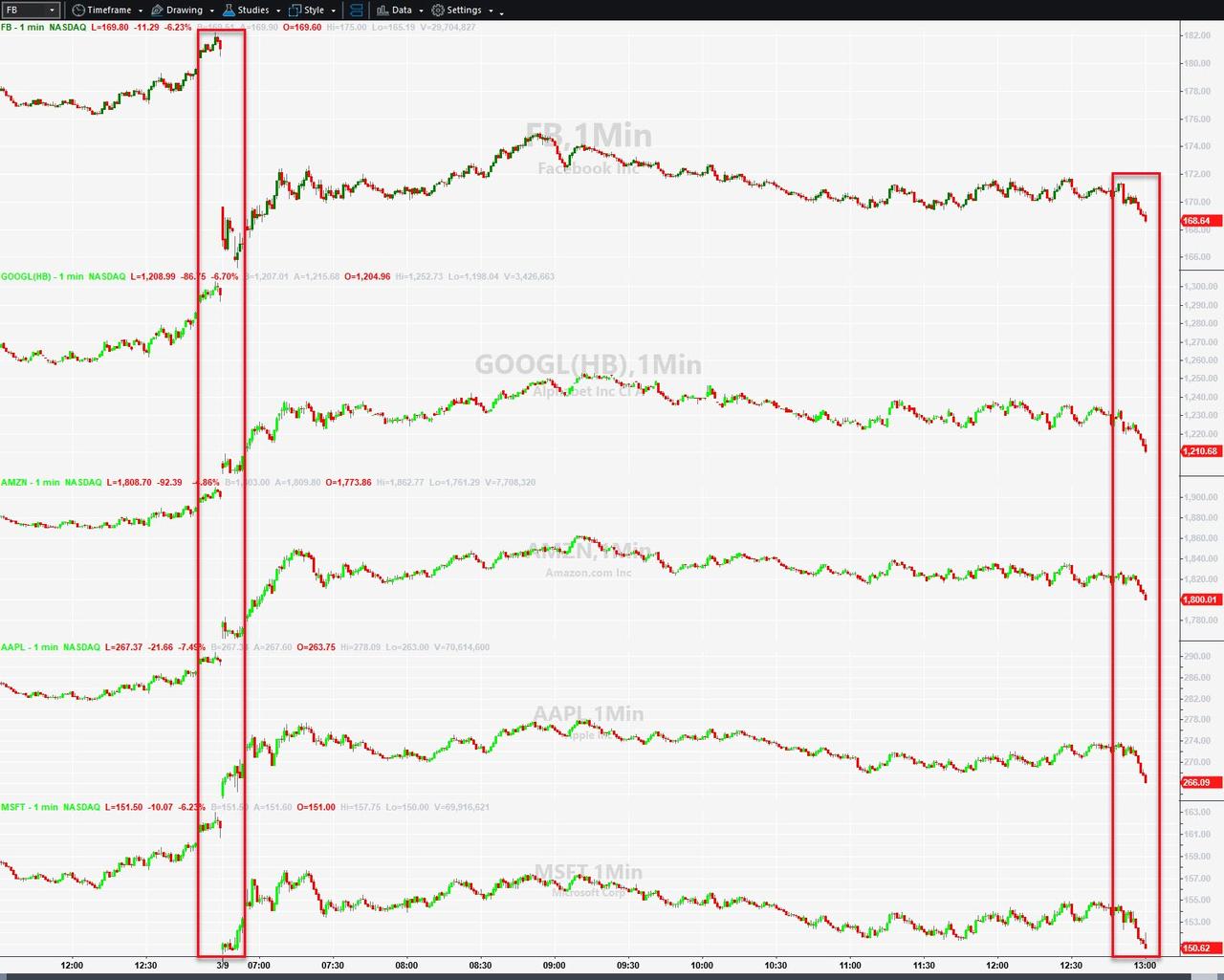

FANG stocks were slammed most since Oct 2018 (and closed ugly)…

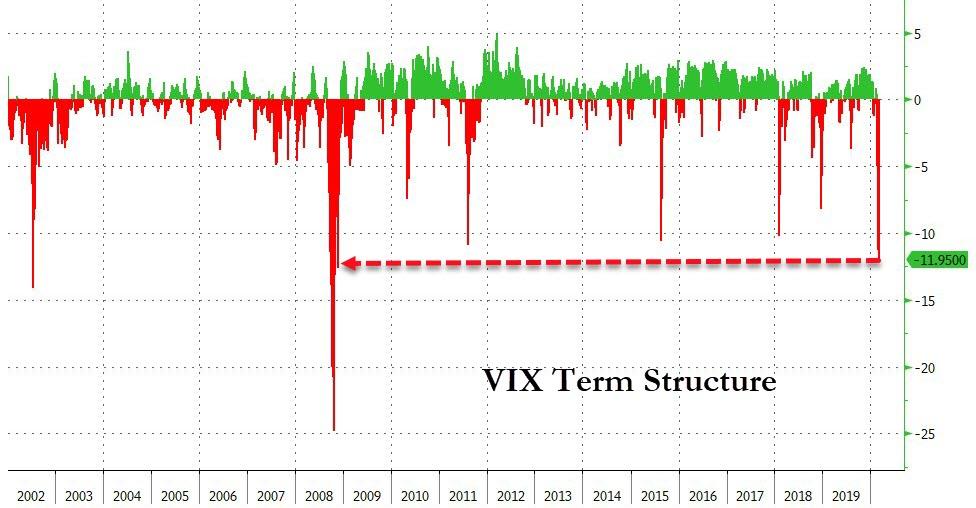

VIX exploded above 60 today – the highest since Lehman…

Source: Bloomberg

And VIX’s term structure is the most inverted since Lehman…

Source: Bloomberg

Credit markets have completely collapsed (but are slightly under-pricing relative to VIX) – today was biggest jump in IG credit since Lehman…

Source: Bloomberg

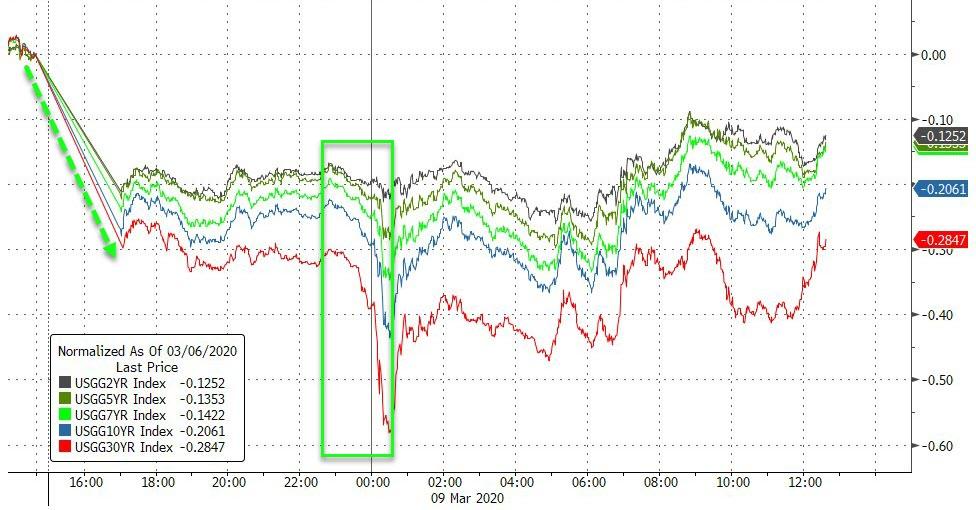

Today’s crash in Treasury yields was the biggest since Nov 2008

Source: Bloomberg

At its trough in yields overnight – it was the biggest yield drop in history…

Source: Bloomberg

10Y yields hit their lowest ever at 31.3bps…

Source: Bloomberg

The entire Treasury curve is now below Fed Funds…

Source: Bloomberg

The Yield curve crashed into inversion as yields plunged overnight but stabilized later – still flatter on the day…

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

Source: Bloomberg

Amid all this carnage, the dollar ended only modestly lower…

Source: Bloomberg

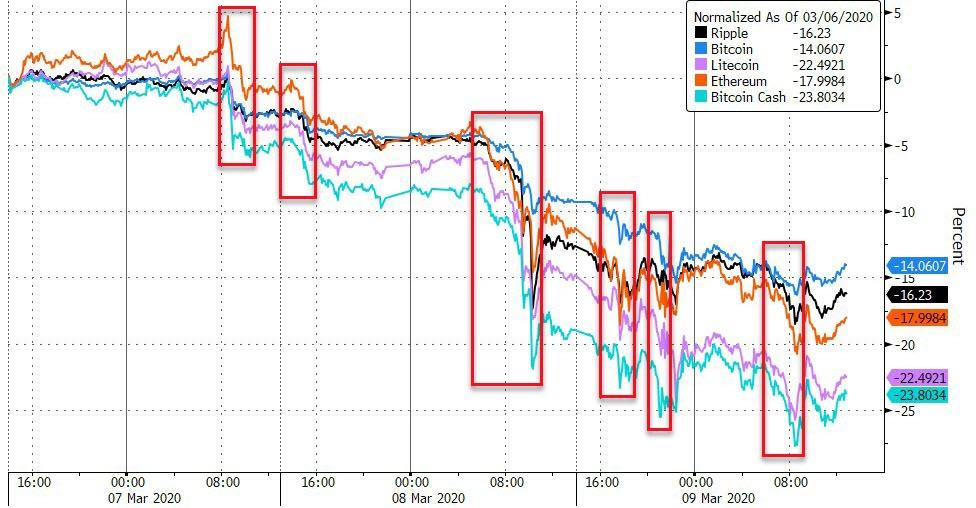

Cryptos were crushed along with almost everything else…

Source: Bloomberg

Gold managed very modest gains, copper and silver were down over 2% as crude collapsed…

Source: Bloomberg

Gold/Oil spiked to its second highest level ever today…

Source: Bloomberg

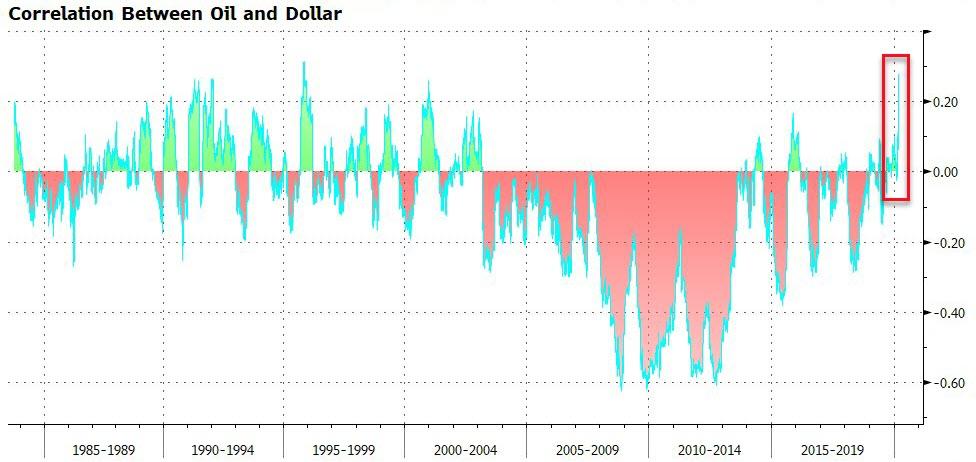

Once again oil’s drop today coincided with dollar weakness and in fact, as Bloomberg details, the relationship between oil and dollar has turned on its head: The lower the crude prices are, the weaker the U.S. currency.

Source: Bloomberg

Since the turn of the century, the two have typically had a negative correlation. A strong dollar has meant weak oil prices and vice versa, partly because oil is priced in dollars. Granted, the relationship hasn’t been stable in recent years, but a positive correlation has been rare.

There could be several explanations:

- For one, lower oil prices add deflation pressure and lower the bar for the Fed to ease monetary policies.

- Second, with the U.S. a net energy exporter now, weaker oil prices reduce investment in the shale industry.

- Third, oil prices signal weak global demand, causing unwinding of carry-trade positions funded by the euro.

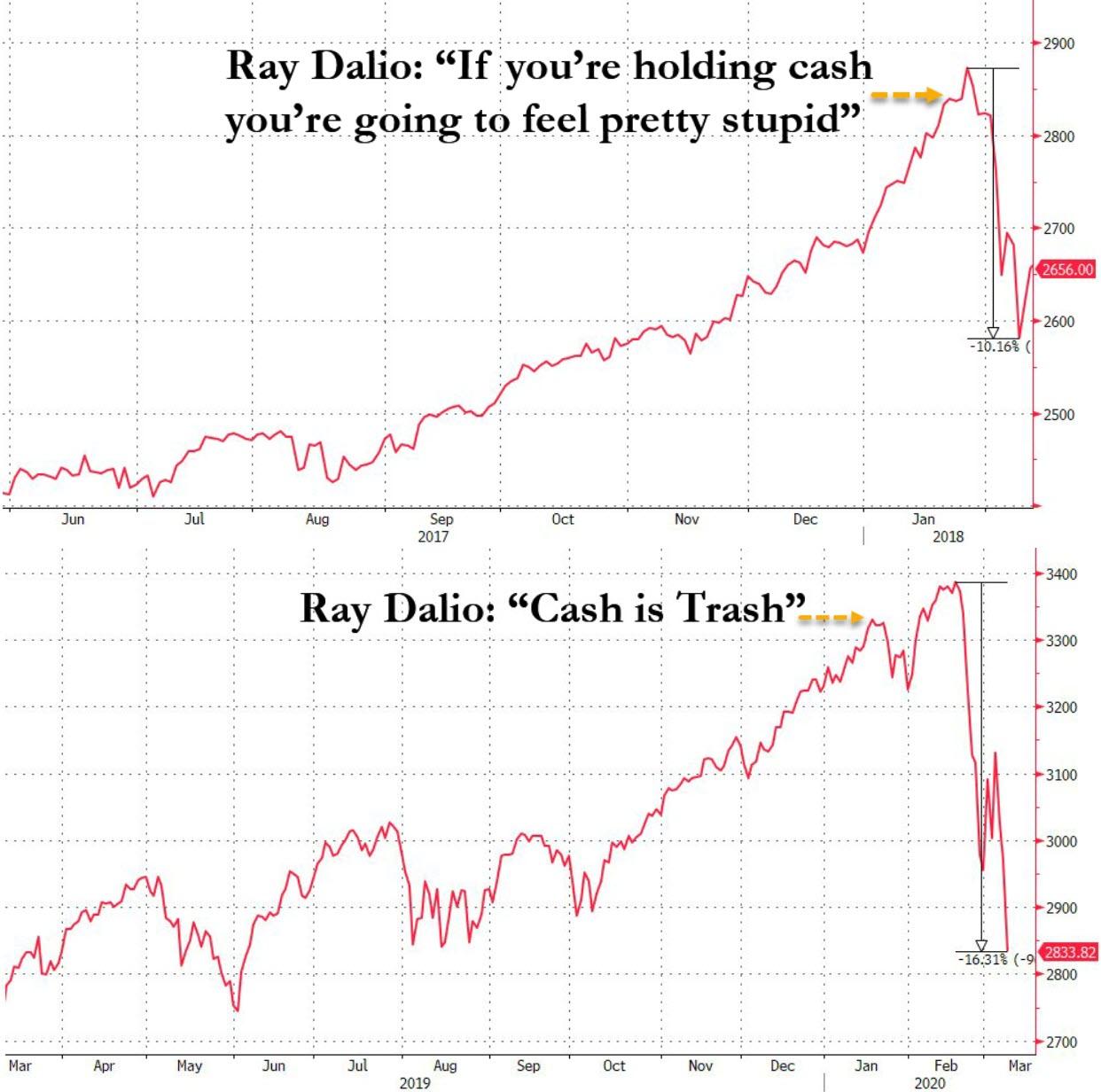

And finally, we wonder – has Ray Dalio lost his touch?

Source: Bloomberg

And don’t forget it’s also the anniversary of 1933’s Banking Crisis Holiday

And in case you’re wondering. The 2K analog is holding very well… implying we should get a decent bounce here before the finally catastrophic collapse…

Source: Bloomberg

The market is now demanding 3 rate-cuts at or before the next Fed meeting (on March 18th)…

Source: Bloomberg

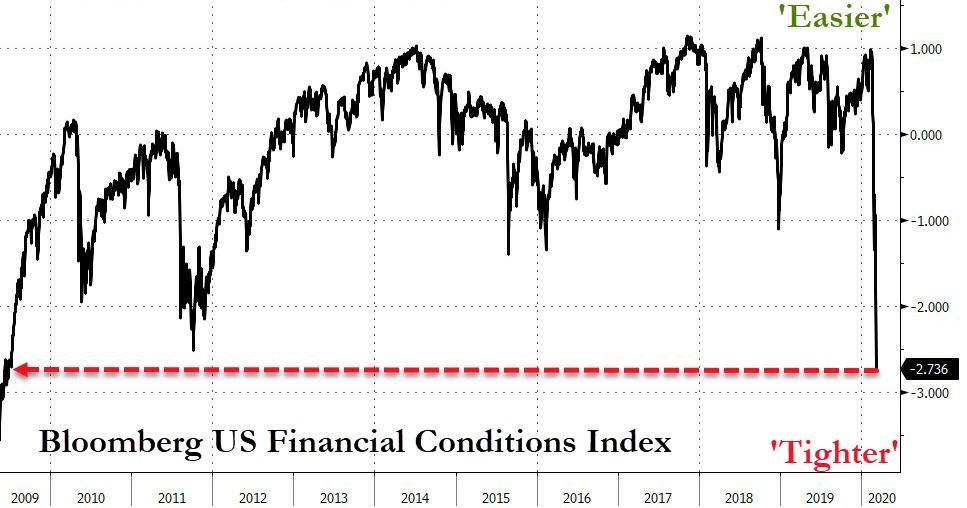

And US financial conditions are their tightest since 2009…

Source: Bloomberg

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user.

Tagged Under: Oil Prices, Fraud, Banks, Money, Corruption, Bankers, Powerful Politicians, Businessmen

The Coronavirus, Pestilence, the hospital will fail–there’s no other word for it. Docs and nurses won’t show up. It’s not their friends or family or kid’s teacher or pastor at risk. While we wouldn’t have liked it, we would’ve risked our health for our community. These professionals are not going to risk their life for a job. The senior management will try to keep it together for the sake of their careers, but the next tier will quickly bag it. Again, it’s just a job. The corporate supply chain is so fragile, and there are now so few community resources that the hospital as a care system will quickly break down.

![]()