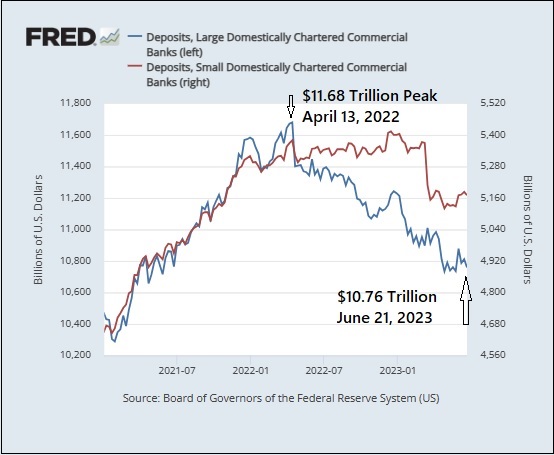

Large Banks Have Bled $921 Billion in Deposits Since April 2022 — the Fastest Pace in 40 Years — and a Much Larger Decline than Small Banks

By Pam Martens and Russ Martens: July 6, 2023 ~

You may recall reading a burst of headlines during the banking crisis in March of this year about depositors fleeing small banks for the perceived comfort of the largest banks. Unfortunately, those headlines were never put in context or updated to reflect a broader picture.

In fact, using deposit data that is updated weekly from the Federal Reserve’s own H.8 releases, it becomes crystal clear that the large banks are bleeding deposits at the fastest pace in 40 years.

As the Federal Reserve data in the chart above indicates, deposits at the largest 25 commercial banks in the U.S. peaked at $11,679,758,700,000 on April 13, 2022. The most recent H.8 release shows that the deposits of the 25 largest banks as of June 21 stood at $10,758,977,000,000. That’s a percentage decline of 7.88 percent or $920,781,700.

The Fed’s H.8 data defines small domestically-chartered banks as all other commercial banks outside of the 25 largest. As of March 31, that would be 4,071 “small” banks, although more than two dozen of those had between $40 billion to $150 billion in consolidated assets as of March 31.

Deposits at the smaller banks didn’t peak until December 14, 2022, reaching $5,413,667,700,000. The most current reading on June 21 was $5,170,296,000,000, a decline of 4.5 percent from the peak versus the 7.88 percent decline at the 25 largest banks. In actual dollar terms, those 4,071 banks shed just $243.37 billion versus the $920.78 billion at the 25 largest banks.

It should be noted that the Fed’s initial H.8 weekly releases are static. That data is not updated at the H.8 web page, whereas the St. Louis Fed’s FRED H.8 data is updated for charting purposes. We used non-seasonally adjusted numbers, which we feel are more reliable given the unprecedented nature of this year’s banking crisis where three of the four largest banking failures in U.S. history have occurred.

To make your own charts, you will find the Fed’s updated large commercial bank deposit data here and the small commercial bank deposit data here. (Place your cursor on the various points of the chart for a date and dollar level reading.)

One of the most striking examples of distorted reporting on deposits by the financial press came on April 28 when a Bloomberg column by John Authers was syndicated to the Washington Post. Authers included this misleading narrative about the four largest U.S. banks: JPMorgan Chase, Bank of America, Wells Fargo and Citigroup’s Citibank.

“This summary from the Canadian firm Palos Management explains neatly why the bigger banks are still OK:

“The first quarter’s performance of the big four was consistent with a broad consensus that the big banks have capitalized on massive depositor inflows, clearly related to the well-documented liquidity stresses facing their smaller, regionally based brethren. This should come as no surprise. The panic-fueled depositor exodus from the smaller banks to the larger ‘too big to fail’ banks is simply a rational decision. Protection of capital rules.”

As we reported on May 8, the actual reality is this: Deposits at JPMorgan Chase, Bank of America and Wells Fargo Shrank by $465 Billion Y-O-Y; More than Twice the Total of 4,000 Small Banks. Using deposit data from the banks’ own regulatory filings, we reported as follows:

“The deposit losses at JPMorgan Chase, Bank of America and Wells Fargo are more than twice what the 4,000 small banks lost in total during the same period. Their combined loss in deposits was just $210 billion…

“Bank of America and Wells Fargo not only lost those large deposit sums on a year-over-year basis, but both banks saw deposits fall during the past five quarters, including the quarter ending March 31, 2023 when headlines were declaring that they were seeing big inflows of deposits as a result of the banking crisis. JPMorgan Chase lost deposits in each of the quarters in 2022 and then saw a small increase in deposits in the first quarter of this year – likely from all of those misleading headlines. (This information is easily obtained from the financial statements the firms file publicly with the SEC.)”

On May 21, the Wall Street Journal ran a big article (paywall) on how the banking crisis has “only made JPMorgan stronger.” Reporter David Benoit writes as follows about JPMorgan Chase’s purchase of the collapsed bank, First Republic:

“Yet JPMorgan’s show of strength, for many, exposed a weakness in the U.S. financial system. The bank and its largest rivals have become so big, their reach so extensive, that the government would almost surely step in to prevent their failure. That implicit guarantee encourages people and businesses to move their money to them in times of stress creating a feedback loop that makes big banks bigger at the expense of their smaller peers.”

JPMorgan Chase’s purchase of the failed First Republic was not a “show of strength,” but a revolting demonstration of regulatory capture at its worst. Despite JPMorgan Chase having admitted to five felony counts brought by the U.S. Department of Justice since 2014; despite it signing a non-prosecution agreement and three deferred prosecution agreements over the same time span with the Justice Department; and despite it being currently scandalized around the globe for functioning as the cash conduit for Jeffrey Epstein’s sex-trafficking of school-age girls for more than a decade, this is the sweetheart deal the bank got from the FDIC to take over First Republic: the FDIC would eat 80 percent of any losses on single-family residential mortgages for 7 years and 80 percent of any losses on commercial loans, including commercial real estate, for five years. The FDIC also provided JPMorgan Chase with a $50 billion, five-year fixed-rate loan at an undisclosed interest rate.

Say hello to Granite Ridge Soap-works! Use our handmade soaps to take good care of your skin. Our premium natural ingredients work together to create a silky, creamy lather that hydrates your skin. Chemicals, such as sodium lauryl sulfate, phthalates, parabens, or detergents, are never used by us. To ensure quality, we make all of our soaps in modest quantities. Visit our Etsy store right away to give them a try and the attention your skin deserves. GraniteRidgeSoapworks: Because only the best will do for your skin.

Use the code HNEWS15 to receive 15% off your first purchase.

Revelation: A Blueprint for the Great Tribulation

A Watchman Is Awakened

Will Putin Fulfill Biblical Prophecy and Attack Israel?

Newsletter

Orphans

Editor's Bio