JPMorgan Remains the Second Largest Money Market Fund Manager, Despite Needing Billions in Money Market Bailouts from the Fed in 2020

BanksterCrime:

By Pam Martens and Russ Martens,

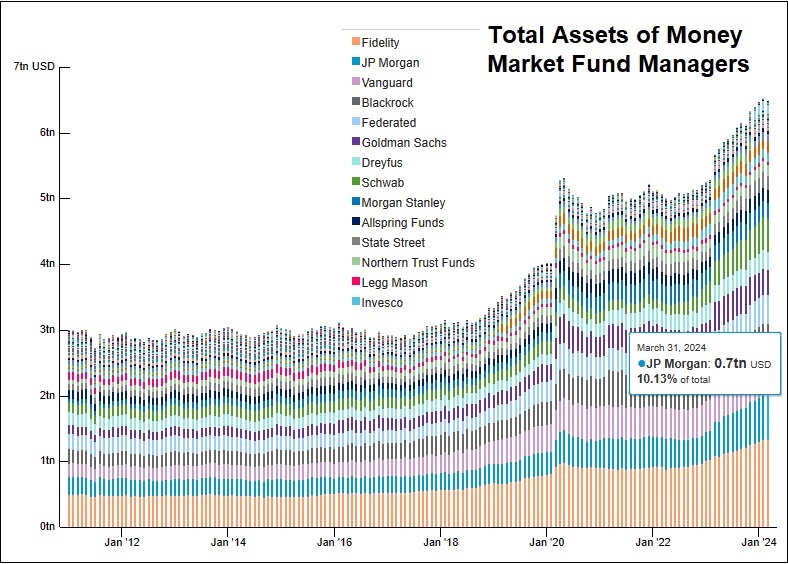

The Office of Financial Research (OFR), the federal agency created after the financial crash of 2008 to keep federal banking regulators on top of threats to financial stability, has posted an interactive chart showing the largest managers of Money Market Mutual Funds in the U.S. Alarmingly, the parent of the largest and riskiest bank in the United States – JPMorgan Chase – is also the second largest Money Market Mutual Fund manager.

According to the OFR, as of March 31, 2024, JPMorgan was managing $657.9 billion in money market funds, second only to Fidelity, which on the same date was managing $1.3 trillion in money market funds. The data comes from Securities and Exchange Commission Form N-MFP2.

JPMorgan’s federal regulators have failed to stem the bank’s growth despite the fact that JPMorgan Chase has been tapping massive bailouts from the Federal Reserve since the last quarter of 2019, as well as being charged with nonstop crimes.

During the COVID-19 pandemic in 2020, the Fed created an alphabet soup of emergency lending programs, one of which was the Money Market Mutual Fund Liquidity Facility (MMLF). When the Fed finally released the granular details two years later of which firms tapped the emergency facilities, it showed that 10 of JPMorgan’s money market funds needed to borrow a combined $8.97 billion on the MMLF’s very first day of operation. The $8.97 billion represented 32 percent of the $27.15 billion in funds loaned that day by the Fed’s MMLF.

JPMorgan money market funds’ liquidity problem on March 23, 2020 appears to have centered on JPMorgan’s tax-free money market funds holding billions of dollars in New York City’s Metropolitan Transportation Authority’s (MTA’s) short-term revenue notes. Those were prominent among the instruments submitted as collateral to the Fed for loans from the MMLF. The MTA notes apparently could not be sold by JPMorgan to meet redemption requests without causing the money market fund to break the buck. Money market mutual funds are expected to trade at a stable $1.00 per share. It is known as “breaking the buck” when money market funds trade for less than $1.00 per share. Breaking the buck occurred at several money market funds during the financial crisis of 2008 and increased the financial panic occurring at the time. To stem the run on money markets in 2008, the U.S. Treasury was forced to take the unprecedented step of guaranteeing money market mutual funds.

Why JPMorgan’s money market funds had such concentrated exposure to one municipal issuer’s notes should warrant the attention of its regulators.

JPMorgan was also an outsized user of the Fed’s Primary Dealer Credit Facility. The transaction data released by the Fed showed that at the end of the first 11 business days of operation of the PDCF, on April 3, 2020, the Fed had an outstanding balance in the PDCF of $49.5 billion and the trading unit of JPMorgan had borrowed $14 billion of that, or 28 percent of the total.

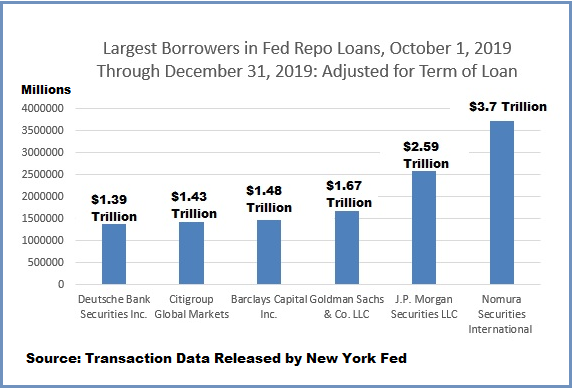

JPMorgan’s need to tap the emergency repo loans from the Fed, which began on September 17, 2019 – months before there were any reported cases of COVID-19 anywhere in the world – was also deeply alarming. According to the quarterly data releases by the Fed for its emergency repo loans (after a delay of two years), the trading unit of JPMorgan (J.P. Morgan Securities) borrowed $2.59 trillion in term-adjusted cumulative repo loans in the fourth quarter of 2019 (see chart below) and another $3.6 trillion in the first quarter of 2020.

When the Fed released the shocking details showing that a unit of the largest bank in the United States needed enormous sums of emergency cash in the fall of 2019, it should have made front page headlines in every newspaper in America. Instead, there was a complete news blackout among mainstream media and the major business press.

These bars are formulated for special skin needs. Our soaps are gentle and produce a smooth creamy lather that is nourishing to your skin. They leave your skin feeling amazing. Our bars are handmade in small batches. We use only high-quality natural ingredients that you can pronounce. No chemicals, no sodium laurel sulfate, no phthalates, no parabens, no detergents.

Our soaps are made with skin loving ingredients including olive oil, coconut oil, lard, sweet almond oil, shea butter, and castor oil. We do not use palm oil. They are only scented lightly with essential or fragrance oils.

Soaps:

Charcoal Detox Bar is made with Activated Charcoal and an essential oil blend of Tea Tree and Rosemary. All of these ingredients are know for their detoxification properties.

Lavender For Dry Skin is formulated with lots of extra moisturizers for those with dry skin. It is lightly scented with Lavender and Champagne fragrance oil.

Lavender For Oily Skin is specially designed for those with oily skin who want much less moisturizer from their soap bar. It is lightly scented with Lavender Essential Oil.

Pink Salt Bar has a smooth feel on your skin. It is made with pink sea salt and is great for all types of troubled skin. It is lightly scented with our original Honey Almond scent.

Pure Olive Castile contains only olive oil. It is made especially for those with sensitive skin. This is a simple bar with no additives and no scent added, just the natural scent of the olive oil.

Samples give you a chance to try before you buy. You will receive two random samples, unless you specify which ones you would prefer. Each sample will weigh approximately 0.3 ounces.

This listing is for 1 of our beautiful bars of soap. A bar will weigh approximately 4.5 ounces and be approximately 2.25 inches wide by 3.5 inches tall and 1.25 inch thick. Please keep in mind that our products are handmade and hand cut. Each bar is unique and might vary slightly in shape, size, design, and color from those pictured.

Please keep your handmade soap well-drained and allow to dry between uses. This will ensure a longer lasting bar.

Allergen: Our soaps contain dairy and oil from tree nuts. Please test on a small area of skin prior to use and stop using if irritation occurs. Do not use if you are pregnant. Do not use on infants under the age of 24 months. Do not get soap in your eyes as it will sting slightly. GoShopping

![]()