BanksterCrime:

By Pam Martens and Russ Martens: April 17, 2024 ~

According to Federal Reserve data, for the first time in its history, the Fed has been losing money on a consistent basis since September 28, 2022. As of the last reporting date of April 10, those losses came to a cumulative $162.9 billion. As the chart above from the Fed indicates, the monthly losses thus far in 2024 have ranged from a high of $13.4 billion in January to $5.5 billion in March.

We are not talking about unrealized losses on the debt securities the Fed holds on its balance sheet, which it acquired under its various Quantitative Easing programs. (The Fed does not mark to market the gains or losses on those securities on the basis that it plans to hold them to maturity.) We’re talking about real cash operating losses the Fed is experiencing from earning approximately 2 percent interest on its $6.97 trillion of mostly low-yielding debt securities while it continues to pay out 5.4 percent interest to the mega banks on Wall Street (and other Fed member banks) for the reserves they hold with the Fed; 5.3 percent interest it pays on reverse repo operations with the Fed; the eye-popping 6 percent dividend the Fed pays to member shareholder banks with assets of $10 billion or less; and the lesser of 6 percent or the yield on the 10-year Treasury note at the most recent auction prior to the dividend payment to banks with assets larger than $10 billion.

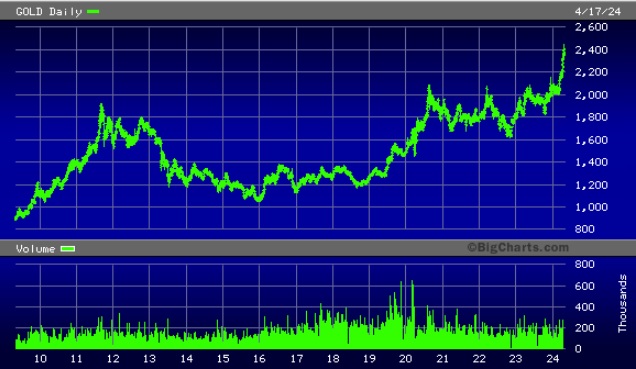

An interesting market action is happening in tandem with the Fed’s growing operating losses. The price of gold has been setting historic new highs this year. From a futures front month price of around $2050 at the beginning of March, gold has topped $2,400 in recent days – dramatically outperforming the year-to-date performance of the S&P 500.

Gold typically moves up when there is the threat of inflation, financial instability, or geopolitical threats. Russia’s war in Ukraine and the Middle East crisis are providing plenty of geopolitical threats; inflationary pressures have yet to be fully tamed. The Office of Financial Research’s Financial Stress Index, however, is showing a negative -1.6 reading, meaning it sees no major financial threat on the horizon. (It should be noted that the Index didn’t foresee the worst financial crash in 2008 since the Great Depression until it was in progress.)

In a note last week, the international investment bank, UBS, noted the following factors impacting the price of gold:

“The rally thus far has been driven by buyers who haven’t traditionally made material purchases, while the usual ETF [Exchange Traded Fund] buyers have remained net sellers. In fact, ETF holdings stand at a 4-year low. A combination of market concerns—including the sanctioning of USD-based assets, CNY [Chinese currency] devaluation fears, and renewed inflation risks—have supported solid demand from central banks and Asian investors. In January and February, preliminary data indicates central banks bought around 64 metric tons of gold and China imported 132 metric tons from Switzerland, a key gold refinery hub. We expect these buyers, who are less price sensitive, to continue accumulating gold in the months ahead.”

Is it possible that the unprecedented losses at the Fed – the central bank of the United States – are also creating a flight to safety into gold?

Wall Street’s veteran traders know that since 2007, it’s been the Fed that has rushed in with trillions of dollars in loans to bail out Wall Street mega banks when their share prices tank from their latest fiasco. A Fed crippled with its own ongoing losses and negative capital itself under GAAP accounting might have a tough time justifying more Wall Street bailouts to Congress.

In addition, when the Fed is operating in the green, as it was on an annual basis for 106 years from 1916 through 2022, the Fed, by law, turns over its excess earnings to the U.S. Treasury – thus reducing the amount the U.S. government has to borrow. According to Fed data, between 2011 and 2021, the Fed’s excess earnings paid to the U.S. Treasury totaled more than $920 billion.

The loss of remittances from the Fed means the U.S. government will go deeper into debt, adding to the risk of another credit rating agency downgrade of U.S. sovereign debt.

In testimony before the Senate Banking Committee in June 2023, Fed Chair Jerome Powell downplayed the operating losses at the Fed, stating that “these are paper losses, they have absolutely no effect on our ability to conduct monetary policy, or really on the economy, it’s just an accounting effect.”

In January, two researchers, Paul Kupiec and Alex Pollock, put the negative capital problem and cash operating losses at the Fed into sharper perspective with an insightful report published at the think tank, American Enterprise Institute (AEI). The researchers wrote:

“Notwithstanding the claims made by current and former Federal Reserve officials, the Fed’s cash operating losses and unrealized interest rate losses have already changed the way the Fed conducts monetary policy. In the past, when the Fed wanted to raise rates or shrink member bank reserve balances, it would sell SOMA [System Open Market Account] securities. But today, with the market value of its SOMA securities approximately $1 trillion less than their book value, selling these securities would immediately turn huge unrealized mark-to-market losses into actual cash losses. To avoid reporting such embarrassing losses, the Fed has committed to hold these securities until they mature to ‘avoid’ a loss, thus constraining its monetary policy options.

“The Fed’s official plan is to shrink the size of its balance sheet by letting its SOMA securities mature over time. But if interest rates stay elevated, the Fed’s unrealized market value losses will systematically turn into cash operating losses because the Fed will keep paying more to finance its securities than the yield it earns on SOMA securities. FRBs’ [Federal Reserve Banks’] operating losses could continue for a long time.”

Kupiec and Pollock further explain how the Fed is gambling on a dangerous confidence game:

“As long as the public and financial market participants retain confidence in the FRB’s unsecured deposits, FRBs [Federal Reserve Banks] can continue to pay banks billions in interest and dividend payments while operating at a loss, deeply technically insolvent, and with asset shortfalls. Aided by an implicit guarantee, taxpayers will bear the burden of accumulating Federal Reserve losses that are hidden by Federal Reserve accounting policies and not included in reported government deficit statistics.”

Editor’s Note: Nothing in this article should be construed as a recommendation from us to buy gold. Always consult with a professional financial advisor before making any investment decision.

Beef in Bulk: Half, Quarter, or Eighth Cow Shipped to Your Door Anywhere within Texas Only

We do not mRNA vaccinate our cattle, nor will we ever!

Grass Fed, Grass Finished Beef!

From Our Ranch to Your Table

![]()