BanksterCrime:

For the First Time in History, the Fed Is Reporting Billions in Losses Weekly; It’s Still Paying High Interest Income to the Mega Banks on Wall Street

By Pam Martens and Russ Martens: April 8, 2024 ~

Jerome Powell, Chairman of the Federal Reserve

As of April 3 of this year, the Federal Reserve (Fed) has racked up $161 billion in accumulated losses. We’re not talking about unrealized losses on the underwater debt securities the Fed holds on its balance sheet, which it does not mark to market. We’re talking about real cash losses it is experiencing from earning approximately 2 percent interest on the $6.97 trillion of debt securities it holds on its balance sheet from its Quantitative Easing (QE) operations while it continues to pay out 5.4 percent interest to the mega banks on Wall Street (and other Fed member banks) for the reserves they hold with the Fed; 5.3 percent interest it pays on reverse repo operations with the Fed; and a whopping 6 percent dividend to member shareholder banks with assets of $10 billion or less and the lesser of 6 percent or the yield on the 10-year Treasury note at the most recent auction prior to the dividend payment to banks with assets larger than $10 billion. (This morning the 10-year Treasury is yielding 4.41 percent.)

Operating losses of this magnitude are unprecedented at the of Fed, which was created in 1913. In a press release dated March 26, the Fed stated this: “The Reserve Banks’ 2023 sum total of expenses exceeded earnings by $114.3 billion.”

As of March 13 of this year, the Fed’s accumulated losses stood at $156.24 billion and yet on March 20 the Federal Reserve voted to sustain those high 5+ percent interest rates to its member banks – making it look like the captured regulator it is considered to be by millions of Americans.

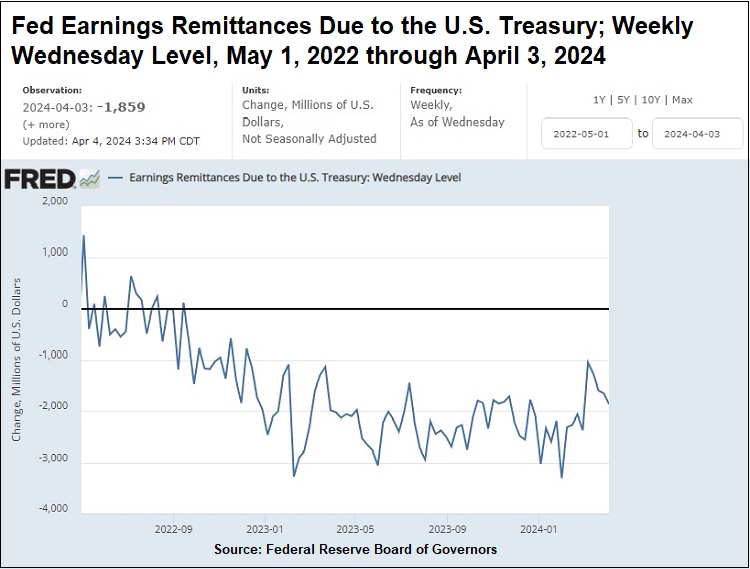

As the chart above indicates, the Fed’s ongoing weekly losses have ranged from a high of $3.3 billion for the week ending Wednesday, January 31, 2024, to $1.86 billion for the most recent week ending Wednesday, April 3, 2024.

American taxpayers have good reason to sit up and pay attention to the Fed’s giant and ongoing losses. That’s because when the Fed is operating in the green, as it was on an annual basis for 106 years from 1916 through 2022, the Fed, by law, turns over excess earnings to the U.S. Treasury – thus reducing the amount the U.S. government has to borrow by issuing Treasury debt securities. According to Fed data, between 2011 and 2021, the Fed’s excess earnings paid to the U.S. Treasury totaled more than $920 billion.

The loss of remittances from the Fed means the U.S. government will go deeper into debt, putting a heavier tax burden on the U.S. taxpayer and raising the risk of another credit rating agency downgrade of U.S. sovereign debt.

The way the Fed is accounting for these losses is straight out of Alice in Wonderland. A January 31 paper by Paul H. Kupiec and Alex J. Pollock published by the American Enterprise Institute explains why the Fed has negative capital under GAAP accounting. The researchers write:

“In 2011, the Fed unilaterally decided to adopt non-standard accounting practices that book operating losses as a ‘negative liability’ in its H.4.1 releases and as a ‘deferred asset’ in its audited financial statements. [The Fed wrote at the time:]

‘[I]n the unlikely scenario in which realized losses were sufficiently large enough to result in an overall net income loss for the Reserve Banks, the Federal Reserve would still meet its financial obligations to cover operating expenses. In that case, remittances to the Treasury would be suspended and a deferred asset would be recorded on the Federal Reserve’s balance sheet.’

“Unfortunately for the Fed, the ‘unlikely scenario’ has become reality. Regardless of the name used, the ‘deferred asset’ account acts to hide the basic immutable fact that operating losses have consumed the Fed’s capital.

“Under the Fed’s unique accounting policy, operating losses do not reduce the Federal Reserve’s reported total capital. The accumulated losses in the ‘deferred asset’ account allow the Fed to report the same capital account balance, no matter how large its accumulated losses. Even if it lost 100 times its capital, or $4.3 trillion, the Fed would still report that it has positive $43 billion in capital. Similar creative ‘regulatory accounting’ has not been utilized by financial institutions since the 1980s when it was used to prop up failing savings and loans.”

The researchers posted a line-item chart on page 8 of their report showing how the Fed’s accounting compares with GAAP accounting. As of December 27, 2023, the Fed’s accounting produces $42.85 billion in capital. Under GAAP accounting, the Fed’s capital stands at a negative $88.7 billion.

As anyone who is a regular reader of Wall Street On Parade will easily guess, the New York Fed has the most dramatic negative capital under GAAP accounting among the Fed’s 12 regional Fed banks. The researchers write:

“Restating each of the 12 individual FRBs [Federal Reserve Banks] December 27, 2023 capital accounts using GAAP, 8 have negative GAAP capital. Exhibit 2A shows the FRBs that have GAAP capital deficits larger than $1 billion. The Federal Reserve Bank of New York, with a GAAP capital nearly negative $70 billion, has the largest capital deficit followed by the Federal Reserve Bank of Richmond with negative GAAP capital approaching $12 billion and the Federal Reserve Bank of Chicago with $7.6 billion in negative GAAP capital.”

For a deeper understanding of the New York Fed, read our reports: Is the New York Fed Too Deeply Conflicted to Regulate Wall Street? and The New York Fed Has Quietly Staffed Up a Second Trading Floor Near the S&P 500 Futures Market in Chicago.

If you agree with Wall Street On Parade that the current banking and Fed structure in the U.S. represents a threat to national security and economic stability, please contact your U.S. Senators today via the U.S. Capitol switchboard by dialing (202) 224-3121. Tell your Senators to hold immediate hearings on the financial stability implications of the Fed’s losses and its deep conflicts with Wall Street’s mega banks.

Exfoliating Soaps

These bars are for exfoliation. They leave your skin feeling refreshed and amazing. Our soaps are gentle and produce a smooth creamy lather that is nourishing to your skin. Our bars are handmade in small batches. We use only high-quality natural ingredients that you can pronounce. No chemicals, no sodium laurel sulfate, no phthalates, no parabens, no detergents.

Our soaps are made with skin loving ingredients including olive oil, coconut oil, lard, sweet almond oil, shea butter, and castor oil. We do not use palm oil.

Please select from:

French Vanilla Coffee has the aroma of fresh coffee and is mildly exfoliating from finely-ground coffee beans. The scent notes are fresh brewed coffee, cream, sugar, and warm vanilla.

Coffee Scrub has finely-ground coffee beans for strong exfoliation. Great for cleaning hard-working hands. Or use to scrub rough skin on your heals. There is no scent added.

Scented Oatmeal, Milk, and Honey contains goat milk and honey for a rich lather and is mildly exfoliating with oatmeal. It is mildly scented with the aroma of vanilla, almond, hawthorn, and milk.

Unscented Oatmeal, Milk, and Honey contains goat milk and honey for a rich lather and is mildly exfoliating from the oatmeal. There is no scent added to this bar.

Samples give you a chance to try before you buy. You will receive four random scent samples, unless you specify which ones you would prefer. Each sample will weigh approximately 0.5 ounces.

This listing is for 1 of our beautiful bars of soap. A bar will weigh approximately 4.5 ounces and be approximately 2.25 inches wide by 3.5 inches tall and 1.25 inch thick. Please keep in mind that our products are handmade and hand cut. Each bar is unique and might vary slightly in shape, size, design, and color from those pictured.

Please keep your handmade soap well-drained and allow to dry between uses. This will ensure a longer lasting bar.

Allergen: Our soaps contain dairy and oil from tree nuts. Please test on a small area of skin prior to use and stop using if irritation occurs. Do not use if you are pregnant. Do not use on infants under the age of 24 months. Do not get soap in your eyes as it will sting slightly. GoShopping

![]()