Authored by Zoltan Vardai via CoinTelegraph.com,

A mysterious Bitcoin whale, nicknamed “Mr. 100,” has sparked curiosity in the cryptocurrency space after amassing over 52,996 Bitcoin, worth over $3.5 billion, on-chain data shows.

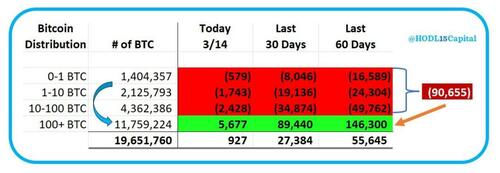

The Mr. 100 whale wallet bought at least 1,000 Bitcoin on March 15, which is 52% of the total 1,907 BTC bought by the 10 spot Bitcoin exchange-traded funds (ETFs), according to an X post by HODL15Capital.

Bitcoin accumulation sheet. Source: HODL15Capital on X

This address has been continually receiving BTC since November 2022, when the FTX exchange collapsed. The wallet has been adding at least 100 BTC nearly every day since Feb. 14.

The wallet received some larger Bitcoin transfers from a secondary wallet address, which has also been adding tranches of 100 BTC since 2019. This suggests that the mysterious whale has been stacking sats since at least 2019, according to HODL15Capital, who also noted in a March 15 X post:

“What I do know is that this is NOT one of the U.S. ETFs. I have all those mapped.”

Based on the size of the acquisitions, there’s speculation that the whale could be either a Hong Kong financial institution pre-seeding for ETFs, the Qatar Investment Authority, other Middle Eastern sovereign wealth funds, a cold wallet associated with South Korean Upbit exchange, or an unidentified address of a tech billionaire.

Mr. 100 continues accumulating regardless of Bitcoin price at near all-time highs, adding 400 BTC on March 12, when Bitcoin traded above the $72,000 mark.

Following the accumulation spree, the Mr. 100 wallet is currently the 14th-largest BTC holder, according to Bitinfocharts data.

Mr. 100 wallet data. Source: Bitinfocharts

Wallet linked to Upbit: Crystal Intelligence

The Mr. 100 wallet has been tagged as a cold wallet belonging to the Upbit cryptocurrency exchange, by blockchain intelligence firm Arkham Intelligence.

Based on blockchain data analyzed by Crystal Intelligence, the mysterious wallet belongs to Upbit, the firm told Cointelegraph:

“We have found that the number and value of transactions associated with this wallet are indicative of a VASP-type service. Additionally, we can confirm with high accuracy that the incoming transactions originate from Upbit, and these have maintained a consistent value since the collapse of FTX.”

Looking at the wallet’s outflows, Mr. 100 has only been sending Bitcoin transactions to a wallet tagged as an Upbit hot wallet by Arkahm’s platform. Most of the transactions were in tranches of at least 500 BTC, with two of the biggest transactions transferring as much as 3,000 BTC.

Upbit: Cold Wallet Outflows. Source: Arkham Intelligence

The analytics team behind Crystal Intelligence confirmed that the secondary wallets also belong to Upbit:

“Bitcoin is moved into three major clusters on the outgoing transaction side, and those clusters appear to be connected in subsequent transactions. We also found some evidence that the clusters that received funds from 1Ay8v belong to Upbit.”

Thus, the “Mr. 100” wallet likely belongs to Upbit, argued pseudonymous on-chain analyst Defioasis, who wrote in a March 12 X response:

“The regular movements of 100 BTC are not purchases but could be Upbit’s unique way of managing cold and hot wallet assets.”

HODL15Capital also noted that a South Korean entity is stacking large amounts of Bitcoin, in a March 15 X post, referencing the heatmap from below.

BTC global transfers heatmap. Source: HODL15Capital

All the 14 secondary wallet addresses associated with the main wallet of Mr. 100 have passed Know Your Customer verification on Upbit exchange, wrote pseudonymous on-chain sleuth Mai in a March 15 X response:

“Mr.100 uses a small wallet address to buy $BTC. I find it very similar to what Upbit usually does with altcoins (ETH network). If we follow Upbit’s cash flow, we will see the coincidence.”

![]()