By Pam Martens and Russ Martens: February 13, 2024 ~

According to the Financial Crisis Inquiry Commission (FCIC), derivatives played a major role in the financial crash of 2007 to 2010 in the United States, the worst financial crisis in the U.S. since the Great Depression of the 1930s. The FCIC wrote in its final report: “…the existence of millions of derivatives contracts of all types between systemically important financial institutions — unseen and unknown in this unregulated market — added to uncertainty and escalated panic….”

Americans believed that the Dodd-Frank financial reform legislation of 2010 would fulfill its promise of reining in concentrated risks like derivatives. It did not. (See our report from 2015: President Has His Facts Seriously Wrong on Financial Reform.)

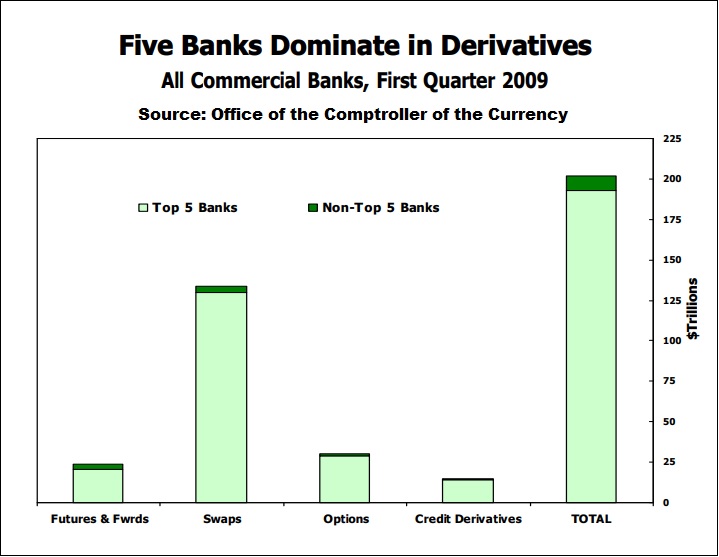

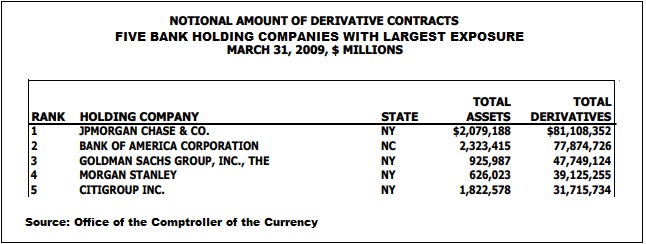

According to data from the Office of the Comptroller of the Currency (OCC), the regulator of national banks, as of March 31, 2009, five bank holding companies held $277.57 trillion in derivatives (notional/face amount). At that time, according to the FDIC, there were 8,249 federally-insured commercial banks and savings associations in the U.S. but just five bank holding companies held 95 percent of all derivatives at all U.S. banks. Those financial institutions were: JPMorgan Chase, Bank of America, Goldman Sachs Group, Morgan Stanley and Citigroup.

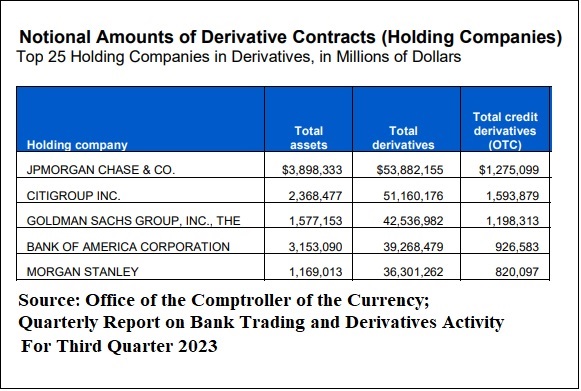

Now flash forward to the most recent report from the OCC for the quarter ending September 30, 2023. According to that report, those same five bank holding companies hold $223 trillion of the $268 trillion in derivatives held by all banks in the U.S., or 83 percent.

Equally alarming, those same five bank holding companies control 96 percent of the most dangerous form of derivatives – credit derivatives. The five bank holding companies account for $5.8 trillion in credit derivatives versus $6 trillion in credit derivatives for all banks in the U.S.

The Federal Reserve secretly funneled $16 trillion in cumulative loans at below-market interest rates to prop up the Wall Street casino banks from December 2007 through June of 2010, in no small part because of the systemic contagion that spread from their concentrated positions in derivatives.

To prevent a replay of the Wall Street mega banks blowing themselves up as they did in 2008, federal banking regulators in July of last year released a proposal that would impose higher capital rules on just 37 banks (out of the 4,600 banks in the U.S.). The proposed new capital rules would impact just those banks significantly engaged in derivatives and other high-risk trading strategies.

The backlash has been fierce from Wall Street’s mega banks, with the banks even running television ads painting a bogus and distorted picture of what the capital increases would do.

Another major area of concern is who is on the other side of these derivative trades with the mega banks – their so-called “counterparty.”

According to federal researchers, there are both mega bank counterparties as well as “non-bank financial counterparties” – which could be insurance companies, brokerage firms, asset managers or hedge funds. There are also “non-financial corporate counterparties” – which could be just about any domestic or foreign corporation. To put it another way, the American people have no idea if they own common stock in a publicly-traded company that could blow up any day from reckless dealings in derivatives with global banks.

Wall Street has a history of blowing up things with derivatives. Merrill Lynch blew up Orange County, California with derivatives. Some of the biggest trading houses on Wall Street blew up the giant insurer, AIG, with derivatives in 2008, forcing the U.S. government to take over AIG with a massive bailout.

According to documents released by the Financial Crisis Inquiry Commission, at the time of Lehman Brothers’ bankruptcy on September 15, 2008, it had more than 900,000 derivative contracts outstanding and had used the largest banks on Wall Street as its counterparties to many of these trades. The FCIC data shows that Lehman had more than 53,000 derivative contracts with JPMorgan Chase; more than 40,000 with Morgan Stanley; over 24,000 with Citigroup’s Citibank; over 23,000 with Bank of America; and almost 19,000 with Goldman Sachs.

We are asking our readers to do their part to stop Wall Street mega banks and their legions of lobbyists from gutting the proposed capital rules. Please contact your U.S. Senators today via the U.S. Capitol switchboard by dialing (202) 224-3121. Tell your Senators to demand that banking regulators hold firm on the stronger capital rules for the casino banks on Wall Street.

Be gentle with your skin. Our soaps are kind to your skin and create a creamy, silky lather that is nourishing. Small batches are made by hand. We only use the best natural ingredients. There are no chemicals, phthalates, parabens, sodium laurel sulfate, or detergents. GraniteRidgeSoapworks

To Get 20% Of Use Coupon Code Bankster20 Or HNews20

![]()