Oil prices are lower overnight after a surprisingly large crude inventory build reported by API. The energy complex was not helped by comments by President Trump that the COVID-19 outbreak in the U.S. will probably worsen before improving.

“Everything seemed to rise in the commodity world yesterday as part of the reflation trade,” said Giovanni Staunovo, an analyst at UBS Group AG in Zurich.

“But today oil fundamentals are taking control again, and a likely crude inventory build in the U.S. doesn’t fit in the story of an undersupplied market.”

And so all eyes are on the official data for signs of this reversal in recovery…

API

- Crude +7.54mm (-2.1mm exp)

- Cushing +716k (+800k exp)

- Gasoline -2.019mm (-1.4mm exp)

- Distillates -1.357mm (-600k exp)

DOE

- Crude (-2.1mm exp)

- Cushing (+800k exp)

- Gasoline (-1.4mm exp)

- Distillates (-600k exp)

After API reported a 7.54mm build in US crude stocks, oil bulls are focused intently on the official data expecting a 2.1mm draw still. However, while not as large as the API build, DOE reports a 4.892mm build in crude, another build at Cushing, a surprise build in distillates, and a slowing drawin gasoline…

Source: Bloomberg

Additionally, as Bloomberg’s Sheela Tobben reports, U.S. crude oil exports may be under downward pressure as China is now facing new troubles that might curb its interest for American. The Asian nation was struggling with bulging inventories and port jams after a recent crude binge, while battling a new wave of the Covid-19 pandemic. This month, heavy rains have resulted in severe floods, threatening run cuts at the country’s top refiner.

Total US distillates inventory has soared to its highest since 1982…

Source: Bloomberg

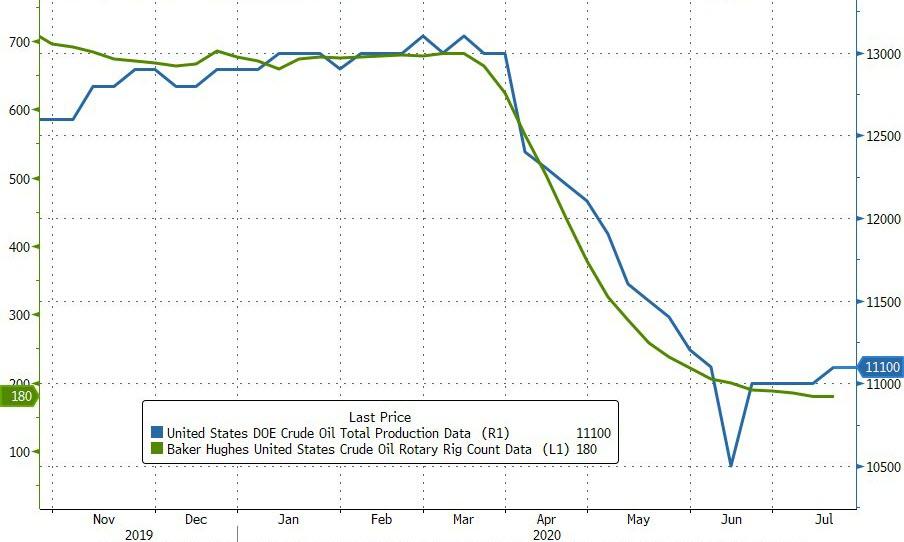

US crude production has stabilized along with the decline in rig counts for the last few weeks, and rose modestly in the last week…

Source: Bloomberg

The unexpected crude build and slowing product draws suggests that U.S. producers jumped back too fast, particularly if the recent rise in coronavirus cases further curbs demand just as the U.S. exits its peak gasoline-demand season.

WTI prices remain lower on the day, chopping lower then higher after the initial DOE print…

As a reminder, OPEC+ is due to start resuming some supplies next month, tapering the record production cutbacks implemented to offset demand losses inflicted by the coronavirus. Nonetheless, there are signs the alliance will be careful.

Source ZeroHedge

StevieRay Hansen

Editor, BankstersCrime

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

![]()