Readers may recall in April that Norway’s sovereign wealth fund, the world’s biggest, posted record losses for 1Q20 as the virus pandemic wreaked havoc on global markets.

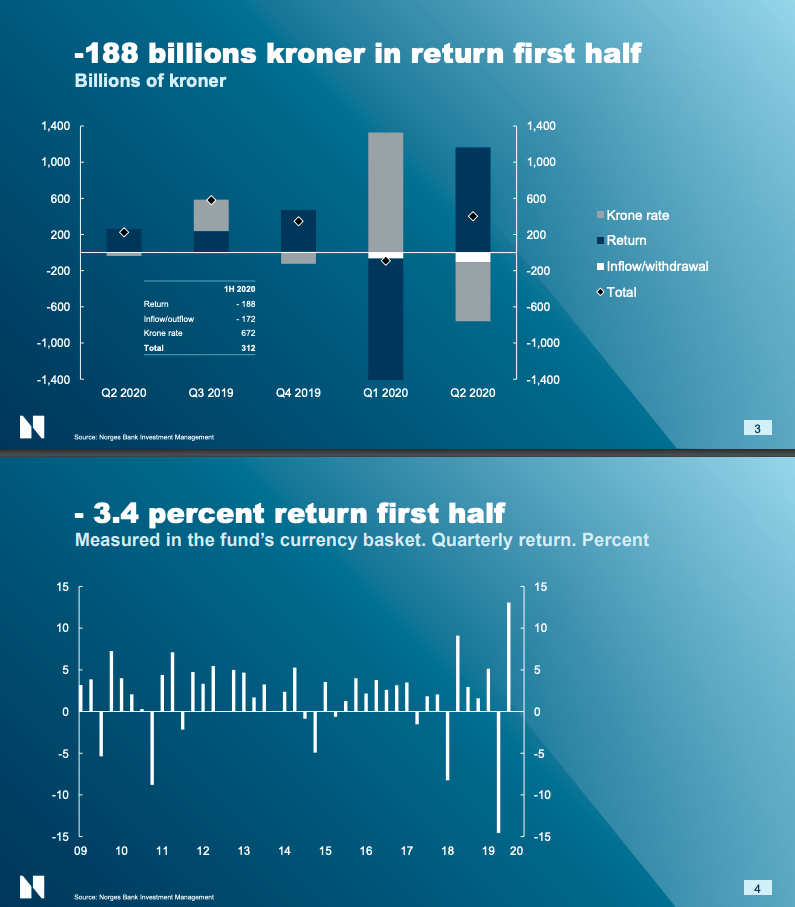

For more color on the losses, the $1.15 trillion sovereign wealth fund posted a $21.27 billion loss (-3.4%) over the first half of 2020.

Citing “major fluctuations” in equity markets, Deputy CEO of Norges Bank Investment Management Trond Grande said the year started great but quickly turned for the worse when the spread of the virus led to market meltdowns.

“There were major fluctuations in the equity market in this period. The year started with optimism, but the outlook of the equity market quickly turned when the Corona virus started to spread globally,” said Grande.

Grande said, “however, the sharp stock market decline of the first quarter was limited by a massive monetary and financial policy response.”

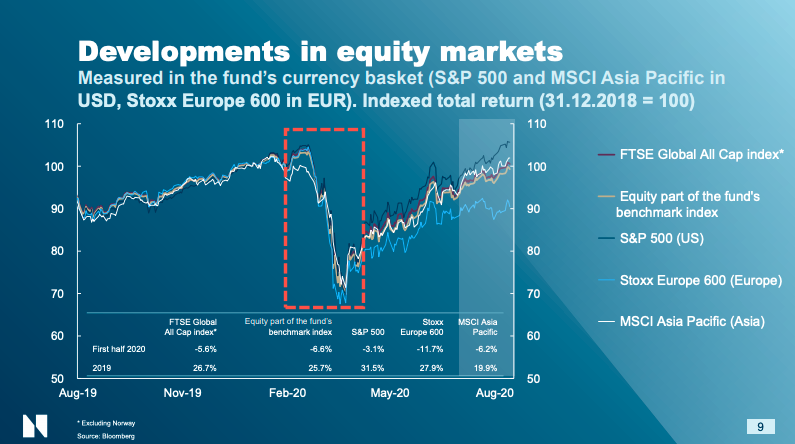

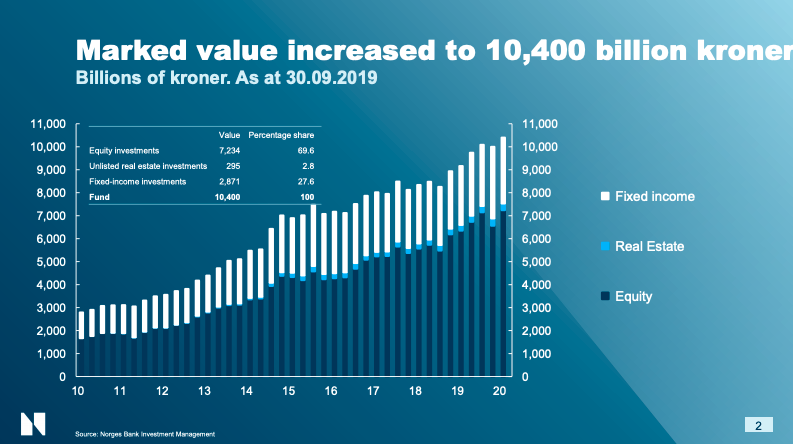

During the half, the fund was 69.6% invested in equities, 27.6% in fixed income, and 2.8% in real estate. Equity investing was by far the worst investment during the period, down 6.8%.

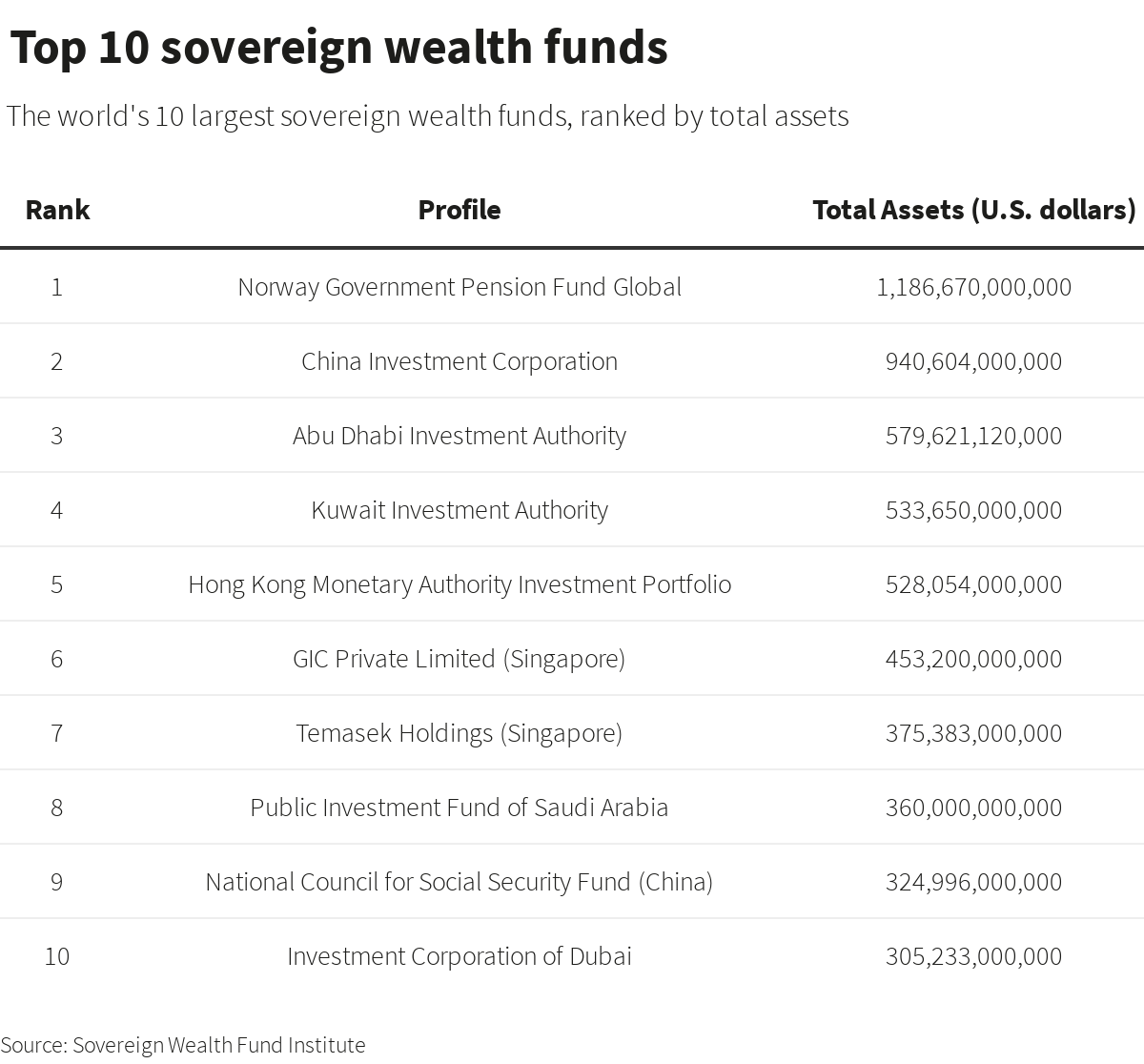

A Reuters graphic shows Norway’s sovereign wealth fund is the largest in the world.

The fund’s portfolio of energy companies were the weakest performers, with those stocks down by at least a third due to plunging oil prices. Technology stocks fared the best, soared 14.2% over the period. The fund’s largest holdings were Microsoft, Apple, Amazon, and Alphabet.

Despite a rebound, European stocks returned -11.7% for 1H20 and accounted for 31.6% of the fund’s equity holdings. Asia-Pacific made up 23% of the fund’s equity investments, returned -4.6% over the period. Emerging markets returned -7.3% and accounted for 11.5% of the equity portfolio.

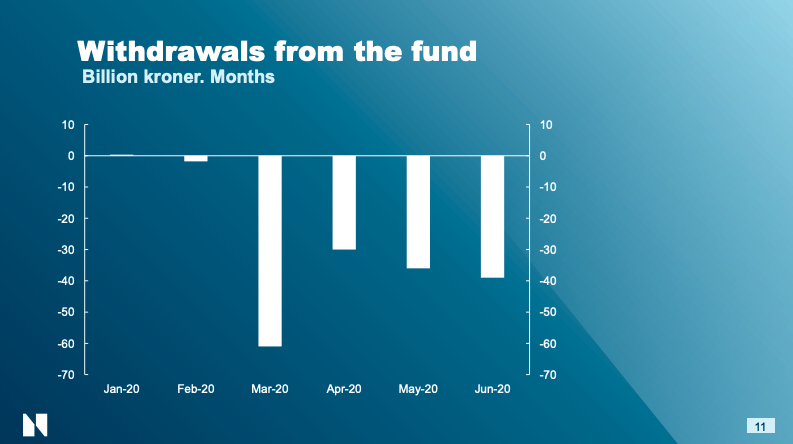

The Norwegian government has been tapping into the fund, withdrawing billions of dollars since March to pay for the pandemic-related costs.

“Even though markets recovered well in the second quarter, we are still witnessing considerable uncertainty,” Grande said.

With the tech stock rally repeating that of the 1990s Dot-Com bubble. What could possibly go wrong for the world’s largest sovereign wealth fund with some of its largest holdings in these highly overvalued stocks? Source: ZeroHedge

God often uses men who are not of the best moral character. Pharaoh, Nebuchadnezzar, Cyrus, Herod, and Trump (amongst others), to accomplish His will in events He orchestrates during human history. We either trust the sovereignty of God or we don’t. Nothing happens apart from Him…

StevieRay Hansen

Editor, BanksterCrime

The best index to a person’s character is how he treats people who can’t do him any good, and how he treats people who can’t fight back…

The Birth Pains Are Growing Stronger….

One of the signs of ruling class collapse is when they can no longer enforce the rules that maintain them as a ruling class. When the Romans started making exceptions to republican governance, it was a matter of time before someone simply decided the rules no longer applied to them. Perhaps the robot historians will consider Obama our Marius or Sulla. Maybe that person is in the near future. Either way, the rule of law is over and what comes next is the rule of men.

“Don’t piss down my back and tell me it’s raining.” Outlaw Josey Wales

![]()